Trading indicators are a component of every technical trading strategy. They help traders to get full insight into price trends.

After you learn the basics of technical analysis, it’s time to learn how to use technical indicators to analyze stocks. This will be something very concrete because we’ll discuss their real implementation. After we debunk all myths about technical analysis it’s time to go forward. Everyone who wants to trade stocks should know how to use technical indicators to analyze stocks.

Traders use technical analysis to examine past market data in the hope to determine future price movements. They use indicators, charts, and other tools to recognize price patterns and trends for that purpose. Future performance of the stock price is maybe the biggest mystery in the stock market, and there is no such a trader or investor that wouldn’t like to unveil where the price will go. By using tools, the chances are bigger, without them we are just guessing, and instead of trading, we are simply betting. So it is very important to know how to use technical indicators to analyze stocks.

Technical analysis is based on the belief that price movement would repeat, so the patterns can be recognized and used to determine a market’s trend.

Technical analysis of stocks

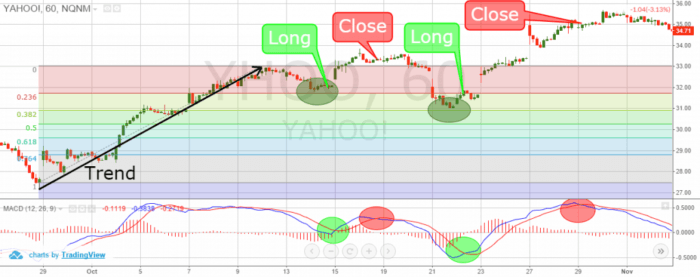

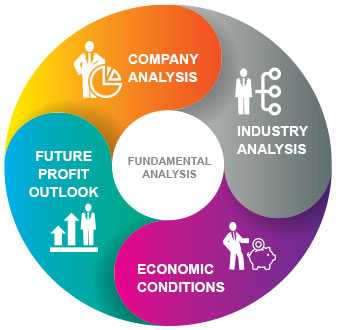

To put it simply, when analyzing stocks you have to look for patterns that appear in the chart. Patterns could be similar or exact as some previous one and based on this similarity you might have some clues of how the stock’s price will act in the future. But to have a clear picture of that you’ll need to use qualitative and quantitative techniques commonly named as technical indicators. Both techniques or types of indicators have their specific purposes. You’ll use qualitative indicators to find support and resistance levels, changes in polarity, or chart patterns but quantitative indicators will tell you if the stock is in an upward or downward trend. Quantitative indicators which are market trends, moving averages, and momentum indicators will show you the pattern in stock price actions. Based on this info you’ll decide if you will buy the stock.

Let’s break down each of these techniques separately.

How to use qualitative indicators

Important qualitative indicators are

Support and Resistance

The technical analysis method assumes that stock charts will show you the bottom and top levels. In most cases, the stock price is moving between these two levels. We said “in most cases” because when there is a breakout the price could break one of these levels.

The resistance level is also seen as a ceiling. When this level is reached the stock will not rise further, and you should consider selling the stock you own and to do so as soon as possible. You will not get a better price for it. So, that is the highest price, and you’ll profit.

The support level represents the lowest price. To explain this, when the stock price is going down, demand for the stock will increase and form the support line below which the stock price will not fall. This means the stock will bounce back and rise in price after this level is reached. That is a great time to buy a stock at that lower price.

This is how to use technical indicators when you want to buy or sell the stock you own. To tell that briefly, buy the stock when it is near to its support level and sell when it is nearing its resistance level.

But there is one thing you have to keep in mind.

These levels are not fixed.

They are changing during the long term. These levels can be higher or lower. That depends on how investors look at the stock. If they think the stock is a great player they will massively buy it but if they think the stock isn’t good they’ll start to sell it.

You should find support and resistance levels in the stock chart. Also, an important point is where prices have paused or reversed after rising or falling. That might show you what will happen in the future, once when these price points are touched.

When a zone of support or resistance is known, use those levels as potential entry or exit points. That could be a smart decision. When the price hits one of those levels it has only two possibilities – to bounce back from the levels or to break the levels and proceed in its direction. If that direction isn’t in your favor you can close your position with a minimum loss, of course, if you do it immediately.

Change in the polarity principle

So, what happens when the price breaks support and resistance? Investors are very active at these levels. But a break indicates that they are not interested in buying and selling stock further. That causes the price to move violently to find new support and resistance levels.

When the support level is broken, the stock could enter a freefall area and form new support. It is the same when the resistance level is broken, the stock will increase in price and find a new resistance level.

The polarity principle means that whenever the stock price breaks through the support level that point becomes new resistance.

Hence, the resistance is broken, it becomes a support level.

It is very important to know how to use technical indicators and notice when the price is near support or resistance levels. That will give you a chance to react in your favor to protect your investment.

How to use patterns as technical indicators?

You have to watch out the other relevant chart patterns that show where the stock price will go next. These chart patterns are grouped as reversal and continuation patterns. Reversal patterns show that a trend that was leading the stock price has expired. The stock will run in the opposite direction. This means if the stock was greatly valued, it would drop. If the stocks were undervalued, they would rise in price.

Major reversal patterns are head and shoulders, inverse head and shoulders and, double bottoms and double tops.

Continuation patterns represent confirmation that the current trend will stay. So, the suggestion is to hold your stock if the price is rising, or to sell it if the price is dropping.

Significant continuation patterns are rectangle pattern and flags, triangle pattern, and pennants.

How to use quantitative indicators

Quantitative indicators are used in combination with other indicators for predicting the stock price movements. They can be trend-following indicators, for example, moving average will give you an insight into the current trend by smoothing out price movement.

The other quantitative indicator is the oscillator as a momentum indicator. It measures the speed of how the stock price is changing. The oscillator will signal you when the stock is overbought or oversold. Overbought stock means that the stock price is probably dropping, and oversold means that the stock price is low.

How to use technical indicators – Moving averages

Moving averages are a popular indicator, especially simple moving average or SMA and exponential moving average or EMA. Calculating SMA is quite simple but the calculation is more complicated. If you draft a 50-day SMA and a 50-day EMA on the same chart, you’ll see that the EMA acts promptly to price changes than the SMA does. But there is no need to calculate them manually since you can find charting software or trading platforms that can do that for you.

How to use technical indicators – Oscillators

Oscillators are extremely helpful when the stock is overbought or oversold.

When using oscillators you can see when the stock is going upside. That is the level at which the stock turns into the overbought status. This indicates that the buying volume has been decreasing and traders will begin to sell their stocks. And vice versa, when the stock is oversold that means a great number of traders are selling their stocks consistently.

Use oscillators when your charts are not displaying a clear trend no matter in which direction.

Bottom line

The way of how to use technical indicators to analyze stocks and predict market trends could determine how successful an investor you are. Technical indicators will help you to decide when is the right time to buy or sell the stocks you hold. Some will aid traders to identify and confirm a trend direction. For example, trend lines are helpful to predict support and resistance levels. Oscillators will measure the strength and speed of a price movement and help you to recognize overbought or oversold zones, potential entry, and exit points.

By knowing how to use technical indicators you’ll be able to make more profits and reduce your losses.