There are many ways of making money by trading stocks and numerous methods to find potential investments that match your trading strategy.

It is almost normal wishing to make a lot of money in several months but do you know how to make money by trading stocks? Yes, it is possible. Everything you have to do is to make several high-risk trades buying stocks that are paying dividends. Simple as that. But it isn’t going to happen to all of us.

Someone can make fortune trading stocks in a short time. Some people can do that. But it is too risky. Honestly, when we talk about them we are actually talking about people who know how to make money by trading stocks. Others prefer other approaches. Many of them are less risky and safer ways to participate in the stock market. But still, it is possible to make a lot of money. That’s true.

Also, the truth is that some traders and investors got lucky but it isn’t a common story. Actually, it is the opposite. Most traders fail to make money on the market. So if you want to know how to make money by trading stocks you have to understand the nature of the stock market. We are not going to tell you the sad stories but what you have to know is that the stock market is a zero-sum game. Meaning, if someone doesn’t lose, you’ll never earn. Is that all? Of course not. There are more so, let’s see how to make money by trading stocks.

Can you make money by trading stocks?

Why not? Thousands of people already did it and still do. Some are trading stocks every day or month but the others are more buy-and-hold types. They are sitting in the stocks for decades and today they are counting their millions. For example, risk-averse types will do that. They will choose some reputable company or the company with a promising outlook, good business plan, and stick it out for the long run.

Also, there are some other approaches. You’ll find plenty of outstanding traders capable of making money through several quick but risky trades. Frankly, they are a minority. Great success in trading will come if you pick a day trading or short selling the stocks but it is connected to the extremely high risks. You’ll have to trade in the high-risk and volatile market. But it is one of the most important and usual features of the stock markets: they are volatile, they are risky no matter how strong or experienced you are. Let’s call statistics as help, only 20%, or even less, of traders, are successful when trading the stock market. The others constantly fail to make money.

But this article is about how to make money by trading stocks. So, let’s go!

As we mentioned above, one way is to adopt a strategy to hold stocks for a long time. At least five years, for example. If the stock pays dividends, it’s better.

Quick ways to make money by trading stocks

Making money by trading stocks, especially with a small amount, is challenging, and honestly, riskier. Of course, if you don’t know what you’re doing. But let’s try to be more creative.

Certainly, it is ideal if you have more money to trade. But it’s not mandatory. The mandatory is to have the right strategy that works for you, to have a trading plan and trading journal. If you are a beginner in trading stocks, start modestly. Try with small amounts, test different approaches, and methods. After you did it, monitor, and examine the result you got. Don’t think about obtaining the fortune overnight. That’s not going to happen.

The smartest thing you can do is follow some of the rules and methods on how to make money by trading stocks and place a small amount, and over time raise it until you become ready to trade with larger sums.

Let’s go! Play the market and earn money!

Day trading is for traders with courage and heart. It demands to understand various forces at play in the stock market. For day trading you’ll need more experience. Well, if you are a good student and learn a lot, day trading will give you a chance to make a lot of money in several hours. The point is that you don’t need to invest a large sum, you can do it with a relatively small amount.

But be careful, you’ll need to hedge your bet. What does it mean? You have to set stop-loss limits to cut potential losses. The advanced traders know that market makers push stocks to provoke our fear of failures or our greed. They want the stock to run for their profit, not ours.

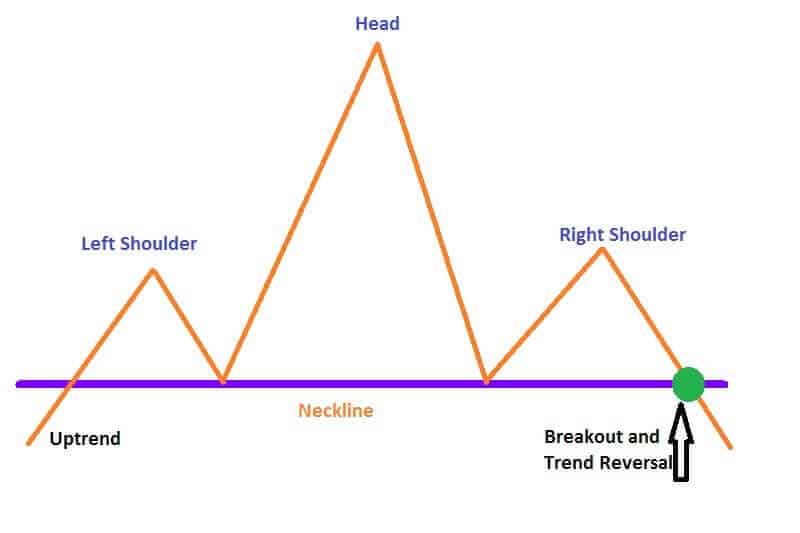

So you have to be very careful, to understand what you are doing, and to examine the market trends to be able to make important gains. For example, moving averages. Pay attention to them. If some stock breaks through the 200-day moving average that is the sign that potential upside or downside change in price is coming.

Can you make money quickly by trading stocks?

Yes, it’s quite possible. Just find companies in very volatile sectors. The other possibility is to find high-value or low-value stock with high risk but with the potential for an enormous reward. Also, you’ll have to be a short-term trader for that. That is the only way to make money quickly by trading stocks.

For example, you’ll have to look for a high-value company that stock recently fell but you must have some clue that the stock price will rebound soon. When it happens, you’ll sell them for a higher price.

Also, one of the possibilities is to buy a stock of some startup with the potential to produce tremendous returns. This is risky, also but can generate a great reward. The point is to hold it shortly, wait for a significant increase in price, and sell quickly. The risk here is that startups, in general, could be risky investments. A very small number of them succeed to survive a few years. They are like comets, light the sky for a while, and boom – disappear. But while they are here, in the markets, they are a great opportunity for traders to make money by trading their stocks.

Trading stocks for a living

People are trading stocks for a living which means they are making enough money for everyday life and over. Trading stocks can be a full-time job but also, a part-time job. What you choose depends on you. You have to find out how to make money by trading stocks from your home. Also, you may try day trading as a regular job.

How much money you’ll make depends on your trading strategy, your skills, knowledge, etc. But not all is in your hands. You’ll have to know how the markets are doing and be familiar with many other things. Professional traders can make above $5,000 per month but that varies depending on the amount of money you put in play.

For example, beginner traders can make several hundred or a few thousand monthly. Once, when you become more experienced with developed skills, your gain will be much higher.

Buy low, sell high to profit from your trades

This approach is easy to master. It is a tested and proven formula for making a profit as a trader. But you don’t want to jump in the trade always when a stock price rises or falls. Sometimes you’ll need to stay aside and wait for your moment. It’s incredibly important not to panic when a stock falls below the price you paid. That’s the point with stock prices, they may rebound and if you exit the position too early you might miss the greater profit.

When deciding whether the stock price is high or low enough to guarantee a trade, you should examine just a few things: the company’s earnings per share, do employees buy its stock, take a look at the company’s profit history, strength in different circumstances.

The point is to buy low, that’s true. However, it is important to recognize the company that is able to recover and its stock will rise in price. That is exactly what would you like and as fast as possible, best right after you bought the stock.

The same is with the second part of the saying – sell high.

When selling stock to reinvest the profit, you would like to ride the trend of the stock price rising as long as possible. The keywords “as long as possible.” That’s why you’ll have to learn how to recognize when the price stagnates and in which direction will go after that. In other words, you’ll have to know how to track the trends.

In day trading or short selling, buying low, and selling high is essential to your profits. In these kinds of trading, you are dealing with highly volatile markets. The stock prices will fluctuate frequently and literally any change in stock price could end in a profitable trade. Yes, there are lots of risks but rewards might be magnificent.

Diversification is important

You must have a good trading plan and a diversified portfolio but not over diversified.

Diversifying will protect you against unpredictable changes. For example, all your stocks were in biotech, but new products have a bad influence on your stock’s prices. So, your whole portfolio could be crashed. If you have a well-diversified portfolio the influence will be protected against such trends. Also, this strategy is proper for balancing high-risk and conventional investments.

We have one suggestion if you really want to know how to make money by trading stocks – never walk away from trading after you made a profit. If your goal is to trade in a long time, it is smart to reinvest part of your profits or all of them.

Bottom line

Trading isn’t easy but practicing will help you a lot. At first glance, it may look so easy and simple. What you have to do? Just to pick a good stock and trade it. We all would like it to be that simple. The truth is that traders are carrying their knowledge to the market every single day. They can make a difference between good trades from bad trades, they are able to catch the trends, they know when to enter the position and, which is more important when to exit. Moreover, they know how long they should stick to their rules but also when it is time to break them and profit.

Some do get lucky in the stock trading, that’s true. But it is very rare. Behind any successful trade lies great knowledge. Armed with that, you’ll make money in the stock market.