For investors, company valuation is a crucial part of determining the potential return on investment. Start by looking at the value of the company’s assets.

One of the most confusing questions for all beginners in the market is how to value a company. The worth of the companies is important for every investor. And the question of how to value a company has a sense for any investor, entrepreneur, employee, and for any size company. Thus, you have to find the best way to determine the worth of the company. Do you need to ask to see the company’s books or you can value a company based on the existing customers or news? How much time will it take to learn how to value a company? When you notice some interesting companies where to go first? Yes, you can ask in many ways how to value a company.

The first comes first.

For every investor, the value of a company is a crucial part of determining the potential returns on investment. Every investor should know if the company is fair valued, undervalued, or overvalued because it has a great impact on a company’s stock or stock options.

For example, a higher valuation might indicate the options will grow in value.

So, if you want to know how to value a company, be prepared to take into consideration a lot of the company’s attributes. This includes revenue and profitability growth, stage of growth, operating experience, technology, commodity, business plans. Yes, but the list isn’t full without market sentiment, growth rate, overall economic circumstances, etc.

To understand how to value a company in a simple way, you can take a few factors into account.

What metrics to use to value the companies?

Here is how to value a company and basic metrics you can use for that. You can use the P/B ratio and P/E ratio. These two metrics are important when you want to evaluate the company’s stock. These basic metrics you can apply to almost all types of companies. But it is important to know the other and often unique factors that can affect the process of how to value a company.

One of the variables in the valuation of a company’s health is debt. But a company’s debt is not continually easy to measure or define. So this metric can make the company’s value difficult to value.

When you want to value a company or stock, it is smart to use the market approach that includes a comparative analysis of precedent transactions and the discounted cash flow which is a form of intrinsic valuation since it is a detailed approach, and also uses an income approach.

How to value a company’s stock?

There are several methods that may give you insight into the value of companies’ stocks.

They are the market approach, the cost approach, and the income approach. The cost approach means that a buyer will buy a share of stock for no more than a stock of equal value. The market approach is based on the belief that in free markets, supply and demand will push the price of a stock to a point where the number of buyers and sellers match. The income approach defines value as the net current value of a company’s future free cash flows.

Market value as a method on how to value a company

The market value is simple. It represents the shares trade for but tells us nothing about stock’s intrinsic value. Thus, we have to know the stock’s true worth. This is a key part of value investing.

The stock value is shown in stock price. The P/E ratio is helpful to understand this value. To calculate the P/E ratio just divide the price of a stock by its earnings per share

When the P/E ratio is high it is a signal for higher earnings for investors. This ratio is helpful to use if you want to know how to value a company. The P/E ratio shows the company’s possible future growth rate. But you should be careful when using the P/E ratio to compare similar companies in the same sector.

Investors connect value to stocks with P/E ratios. If the average P/E ratio is, for example, 20 – 23 times any P/E ratio above 23 times earnings is classified as a company that investors keep in high

Investors and traders use the P/B ratio to compare the book value of a stock to stock’s market value. To calculate the P/B ratio use the most recent book value per share and divide the current closing price of a stock by it. If the P/B ratio is low you can be sure the company is undervalued. This metric is very useful if you want to have accurate data on the intrinsic value of the company.

But be aware, there are several P/E ratios and numerous variations, thus you have to know which one is in play. For more about this READ HERE

Cost approach or book value

Book value is the amount of all of a company’s tangible assets (for example equipment) after you deduct depreciation. So, when we are talking about the company’s “net capital value” it means the book value, estimated by the company’s book of net tangible assets over its book of liabilities. To calculate the book value you have to divide the net capital value by the number of outstanding shares. The result is a per-share value. The book value never takes into account the brand, keep that in mind.

Income as a method on how to value a company

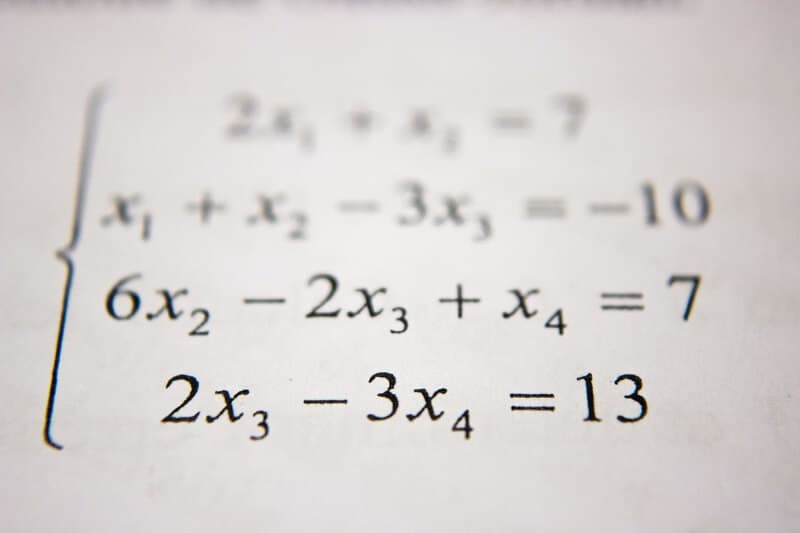

Use the capitalized cash flow to calculate a company’s worth when future income is expected to stay the same as it was in the past. But if you expect the income is going to vary, use the discounted cash flow method.

Calculations are simple, divide the result from capitalized cash flow or discounted cash flow by the number of shares outstanding and the figure you get is the price per share.

Bottom line

By understanding how to value a company you’ll be able to understand the essence of making investment decisions. No matter if you want to sell, or buy, or hold the shares of stock in some company. Warren Buffett, for example, uses a discounted cash-flow analysis.

Sometimes, the company valuation is held as the market capitalization. So, to know the value of the company you have to multiply all shares outstanding by the price per share. For instance, a company’s price per share is $10 and the number of outstanding shares is 4 million. If we multiply the price per share by the number of shares outstanding we will find this company is 40 million worth.

To be honest, it isn’t too hard to value the public company. But when it comes to private companies it can be a bit harder. You can be faced with a lack of information. For example startups. They don’t have a financial track record and you have to value these companies based on the expectation of future growth. To value an early-stage company can be a great challenge.

Before you invest in any company, you’ll need to determine its value. This is important because you need to know if it is worth your time and money. Think about the company’s value as its selling price. Maybe it is the simplest way.