The main difference between a microcap stock and other stocks is the amount of reliable publicly-available data about the company but potential growth can be great in the long run.

The microcap stocks can be riskier, sometimes significantly than other assets. A lot of them are traded over the counter. They are not in the investors’ focus so, due to the lower demand, the prices of microcap stocks are cheaper. Since they are OTC traded they do not have to match the listing standards created to protect investors. Microcap stocks are relatively anonymous and whoever wants to invest in them has to follow very closely.

Microcap stocks are viewed as risky investments for a reason. They often belong to the corpus of new companies in the beginning stage, so it can be difficult to gauge how successful they can be in the market. Firstly due to the fact they don’t have historical data for investors to examine. Moreover, this lack of data may increase the risk of fraud.

But the favorite Wall Street maxim is: “The higher the risk, the greater the reward.”

That is true, especially for the microcap stocks. Because these companies are small and their stock prices are low, they can be a great potential for growth and great returns.

The risks of investing in microcap stocks

Investing in microcap stocks is connected to numerous difficulties. Finding some to research is the last in the list of many challenges. First of all, there is a lack of historical data and you have to be prepared for more hands-on methods and additional work. For large and midcap stocks you can find a lot of valuable data, even for the smallcap stocks. Well, investing in microcap stocks requires deeper digging. But if you do your homework well you can expect a handsome reward.

The additional risks come with a lack of liquidity.

How to deal with it when buying the stock?

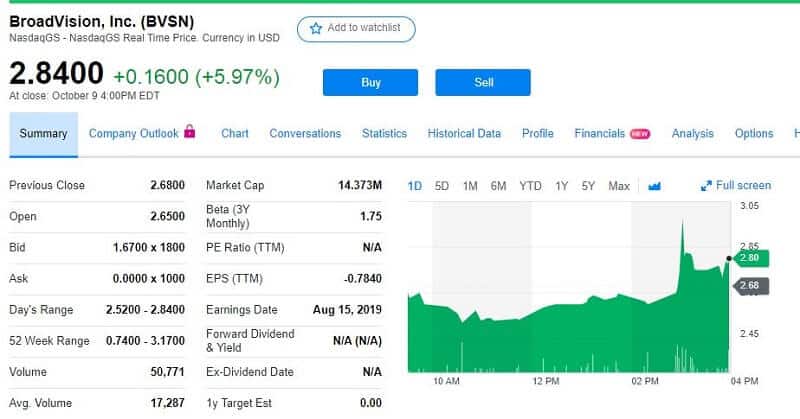

Let’s examine the following situation.

For microcap stocks, the price is low, the volume is small. So, when most of the sellers sold their microcap holdings, liquidity will dry up. So, the interest of buyers becomes smaller. But this is the right time to buy them.

Management of microcap companies often meets tremendous challenges in bringing liquidity to the company’s stock.

Generally, microcap stocks have a liquidity problem.

And everyone in the company would like trading volumes to increase. The question is how to reach the investors and increase liquidity. Maybe the main problem for those companies is that Wall Street isn’t interested in them. Let’s be honest. Microcap companies are under their radar.

This could be one of the reasons why most investors don’t invest in microcap stocks. Well, when you invest in stocks with high liquidity you expect they are highly efficient. Your transactions will be executed in seconds and your returns will be at best average.

That’s the problem, where is the possibility?

Microcap stocks are companies whose market value is usually between $50 million to $300 million. If you are looking for additional long-term investment they could be the right choice. Even if you are building your wealth by investing in large-cap stocks microcap stocks could provide you a good mix in your portfolios.

Microcap stocks are less followed but offer benefits. They offer higher returns over the long run. Microcap stocks have the high-returning quality combined with greater alpha potential.

Let’s say, small companies tend to outperform large companies over the long-term. For example, in the past several decades, from the 1970s, they have outperformed large-cap stocks by more than 1% annually. Speaking about higher alpha, you must know that less investor attention leads to greater chances to recognize quality, growing companies before they have been identified by the market.

Microcap stocks can have powerful roles in asset allocation.

They offer many of the benefits such as access to early-stage, high-growth companies. Moreover, they do that with higher liquidity and transparency than private equity, for instance. Also, microcaps don’t have a problem with valuations and a lack of deal flow.

Furthermore, a microcap can be a complete strategy that fills out the rest of an investor’s equity allocation.

In comparison with larger companies, microcap stocks have a better spot when it comes to growth. Hey, you are investing in microcap stocks because of a chance to get in the market before a company bounces and skyrockets. The only way to go with them is up. We suppose you will pick a successful company, though. When the company you invested in growing, you will profit.

Diversification is important because it provides to spread out the risk. A diversified portfolio will give you some protection from market volatility. Never miss out on the chance to invest in different kinds of assets. By investing in microcap stocks, you can create balance in your investment portfolio.

Benefits of microcap stocks investing

If you are seeking market outperformance you will have it by investing in microcap stocks.

First of all, they may give unlimited growth potential. Well, some of the famous companies, started as microcaps. And, honestly, that is the pure beauty of investing. Finding a small company and watch how it is growing over time. That is the privilege. Your stocks were almost worthless when you bought them but look at them now! You were smart enough to recognize the potential. Great! Small companies have more space to grow. Find the one like this and you will have great returns.

Further, follow the example of Warren Buffett. As a young investor (everyone knows this story) he was buying by the market undervalued stocks. If you are familiar with the efficient market hypothesis, you may think that stocks are fairly valued by the market. Well, they are, theoretically.

But this is not the case in micro-cap investing. Because micro-cap companies are almost unknown and generally below the radar of big investors, you can buy them at a discount. What do you think about this advantage against other investors?

The additional advantage appears here with investing in microcap stocks. Micro-cap companies are very often (when they are successful) acquisition targets. The truth is, the majority of small companies never become corporations because some big sharks bought them. For investors, it is a jackpot.

On the other hand, micro-cap companies are really focused on their long-term outlooks. Their businesses are efficient and sustainable with great growth potential. This feature can serve as a winning acquisition target.

Bottom line

The downside of holding microcap stocks is their selling.

Selling a microcap stock can make you feel like you are doing something illegal. You can meet discrimination and refusals and sometimes it’s so hard for holders to find a buyer.

Microcap stocks, sometimes called penny stocks, trade below $1 per share or in the best scenario up to $5. Their market cap is less than $100 million. But, if you really want to start investing and enter the stock market but don’t have a lot of money, microcap stocks are a great opportunity.

As you can see, microcap stocks offer the potential for a notable upside. It can be a fuel for charging your portfolio. But before you jump in microcap investing, it is important to realize the risks of microcap stock investing.

For the first time, they should be a smaller part of your portfolio due to the risks and volatility.