These tips are kind of a guide to new investors for building a good stock portfolio. Selecting stocks needs analysis, time, and the ability to estimate different parameters for the stock, industry, and overall market.

By Guy Avtalyon

We are going to show you how a beginner investment portfolio should look like. Of course, if you think the stock market is getting crazy, you couldn’t be more right. DJIA is going up, going down, S&P 500 Index also. The graphs are looking like ECG of some very vulnerable hearts. Maybe you don’t believe it, but this is the right time to enter the stock market. A stock market is truly a wealth-building tool. Moreover, entering the stock market is easier than ever. But, as you are new in this field, you would like to know what to buy or, in other words, how a beginner investment portfolio should look like.

There are so many ways to invest the money and can pick the level of risk you’re willing to take. So, it is obvious the first thing you have to decide – the level of risk you can tolerate.

High-risk investments mean greater chances for high rewards. Wait, that also means bigger chances for losses. As a beginner investor, you should avoid high-risk investments if you don’t want your capital to throw through the window. Later, when you become more experienced and earn more cash, you’ll understand how to handle the risk, for now, here are some tips of how a beginner investment portfolio should look like

We know that a lot of beginners think of investing as attempting to get a short-term gain in the stock market. But if you want to build wealth, you have to think about long-term investing.

Beginner investment portfolio in 2020

ETFs

The world of the stock market and investing can be confused for beginners. There are individual stocks, mutual funds, bonds, mutual funds, etc.

Our first suggestion for you is some low-cost ETF. But there is a question: is it worth it? You’ll need time to build an individual stock portfolio.

Exchange-traded funds (ETFs) can be an excellent investment way for small investors. You can trade these funds like stocks. They can give you to expand the diversity of your portfolio and to do that without spending too much time on it.

Here is how an ETF works. A fund provider holds the underlying assets. Such creates a fund to follow the performance of underlying assets. At some point, such a provider decides to sell shares in that fund to other investors. As a shareholder, you’ll own a part of an ETF, but you will not own the underlying assets in the fund.

ETF tracks a stock index. So, as a shareholder of the ETF, you’ll get dividends, which you can reinvest, for the stocks included to the index.

ETFs are a passive approach to investing. Brokers will not charge you trading costs for ETFs. It is zero. Just make an automatic investment each week or month, it’s up to you.

Include the gold

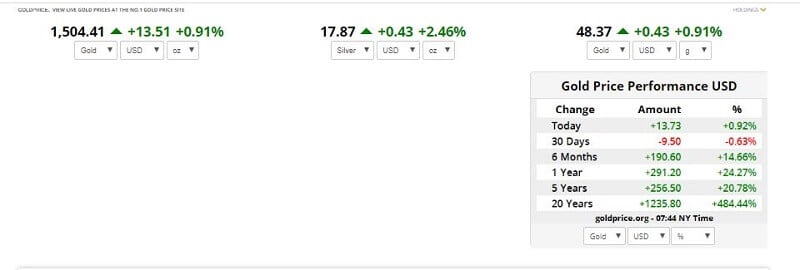

Due to the coronavirus pandemic, the global economy is suffering. In the first quarter, only five main asset classes posted gains. Among them, apart from the US dollar and yen which are currencies, the list includes gold. Gold always was a great way to protect the portfolio and historically it was known as a safe-haven investment. It is the same nowadays. You can add some gold into your portfolio while you are waiting to come into stocks because today they can be too volatile for beginner investors. So, you should grow the exposure to gold. Gold works great when the dollar is flat-to-down. Also, gold can be a great hedge against inflation.

Moreover, it performs best when investors are worried about low growth on other assets. Basically, if we take a look at its historical performances, we’ll notice that gold played best and rose fastest when other economic measures were falling quickly. We have such a situation today.

We have negative interest rates, bond yields are almost zero, so gold could be a very good opportunity to hold it. Add it as very good protection to your portfolios.

A beginner investment portfolio should include mutual funds

Mutual funds are still amazingly popular. Especially target-date mutual funds in retirement plans, so add them in your beginner investment portfolio. Mutual funds are basically a basket of investments. When you buy a share in some mutual fund you are actually investing in all holdings included to the fund with just one step.

A target-date mutual fund usually is a mix of stocks and bonds.

How to invest in target-date mutual funds?

For example, you plan to retire in 20 years and everything you have to do is to pick the fund with 2045 in the name. But you have to know, so don’t be surprised, the fund you choose will hold stocks essentially. How is that possible? Your retirement is far away, and stocks have higher returns in the long run, higher than any other asset. As time goes by, the fund manager will shift part of your investment toward bonds because they are less risky. You wouldn’t like to take too much risk while you are approaching the date of your retirement.

Add Index funds to the beginner investment portfolio

If you don’t want to employ a manager to create and manage your beginner investment portfolio, index funds are a good choice for you since they track a market index. What is the market index? It is a collection of different investments that represent a part of the market. For example the S&P 500 Index. It is a market index that covers the stocks of about 500 biggest companies in the US. So, an S&P 500 index fund will reflect the performance of the S&P 500, by purchasing the stocks in that index.

Index funds represent another passive approach to invest just like ETFs. They carry lower fees charged based on the sum you have invested. The advantage of these funds is that some brokerages offer a range of index funds without an established minimum. So you can start investing in some index fund at $100 or less.

Help to create the portfolio

For example a robo-advisor. Let’s assume you would like to invest but you’re not the DIY type. Well, we have some good news for you. You have a lot of robo-advisors out there. They will handle your investment by using very complex algorithms. But don’t be worried. It will cost you less than a human advisor, usually, it will be from 0.25% to 0.50% of your account per year. Also, robo-advisers will let you open an account without the minimum required.

Robo-advisors are an excellent way for beginners to get started investing. Look, you are a beginner and you don’t have good knowledge about investing yet. So, robo-advisors will do all that hard work for you and you’ll need a little money for them. All you have to do is to check your portfolio from time to time. So to say, it’s your money invested. Also, they will give you a chance to learn more about investing since they’ll provide you tools and educational material.

Investment apps are also extremely helpful. You can easily find some aimed at beginners.

Traders-Paradise recommends

For example, M1 Finance is excellent if you want to build a free portfolio for long-term investments. This app offers commission-free investing, automated deposit, buying fractional shares, and has many other features like free maintenance of a portfolio, diversified portfolio, etc.

Fidelity is another great app that offers full service at zero trade prices. It allows you to invest for free, a variety of ETFs that it offers can help you to build a well-balanced portfolio, stocks, or options trades and all for free.

TD Ameritrade offers free options trading. If you want to become a trader rather than an investor, it’s a really good pick for you. We already wrote about this app but we would like to point again how excellent it is. For example, its platform “Thinkorswim” is one of the best. It will not charge you a commission for trading stocks, options or ETFs.

After deeper investigation, you might choose to invest in the companies that offer the chance for growth. Just keep in mind, your portfolio has to be diversified. Never expect that each stock can generate great returns. That is the reason for diversification. It appears especially when we are talking about a beginner investment portfolio. But that doesn’t mean you’ll need a large collection of investments. You’ll need just a few stocks but they have to run together in your favor.

Today’s volatile stock market offers discounts on great stocks. So, this is a great time to start investing and create your beginner investment portfolio that will generate you amazing gains in the future.