How to Forex investing? It isn’t a get-rich-quick scheme but it is full of potential to become wealthy

How to Forex investing? It isn’t a get-rich-quick scheme but it is full of potential to become wealthy

By Guy Avtalyon

Investing in the Forex market is growing and people from all around the world, especially from, India, are choosing to invest in Foreign Exchange markets, after the regulation of brokers’ work and their massive presence on the market.

In this regard, investing in the Forex market can be a good alternative for all those who want to make a high return on invested money.

Nevertheless, regardless of the many advantages of Forex, many investors are quite skeptical when it comes to investing large amounts of money. The reason lies in numerous myths, rumors, and misinformation that can often be found on the Internet, and they are referring to the Forex market.

In the shortest, it can often be heard or read that the Forex market is a dead end, an ideal place for losing money, a fata morgana in the desert, and so on.

For this reason, investors instead of developing the right trading strategies, are often subject to rumors. Hence, they do not make the right decisions or completely abandon or omit to invest in the Forex market.

On the other hand, there are completely different myths.

There are people who believe or have heard the myth that they can get rich overnight without one day of financial education. So they believe that Forex is the right place for that.

What is investing in the Forex market?

Someone would say, instant win with minimal or almost no investment. But this couldn’t be more wrong. It is true that behind any desire for quick rich is the lack of experience, the uncertainty, and the lack of a properly defined strategy. Success on the Forex market comes slowly, step by step, through education, practice, and only if it is based on realistic expectations.

Often another myth can be heard. The is investing in stock markets is nothing more than a pure game of happiness. This is certainly far from the truth and such myths are the result of a lack of financial education. Forex is not gambling. Anyone who has read something about the Forex market, if they really wanted, could easily understand the mechanisms of price formation on the market.

Here’s one myth more about investing in the Forex market. Money can be earned on Forex, but that means a lot of nights without sleep with a computer in front. And many hours of night trading on a trading platform.

That’s another untruth about investing in the Forex.

Any standardized financial education or course in this area will teach you to invest in a minimum amount of time. Practically, from the computer, you will only read the latest news. Making a strategy and making decisions is not something that is done every hour. It has a longer-term character. Not to mention mid-term and long-term investments, where you can almost neglect any day-to-day operations.

In the case of unforeseen news, whether good or bad, you certainly can make a change in the investment portfolio. But this is not something that happens every hour or every day.

Is Forex worth investing in?

Discipline is the basis of every success and it comes in combination with solid knowledge. It comes with a great role in patience and significant experience.

Successful investing in the Forex market is only a consequence of well-planned and executed trading operations.

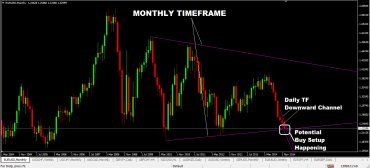

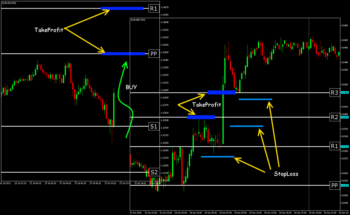

That involves taking into account all important economic events, permanent informing, and essential understanding of price graphs.

Finally, for all those who do not have adequate education in this field and recognize Forex as a good place to invest, the first thing they need to do is find the right provider of financial education. They have to choose mentors and plan personal development goals. The mentor is one who will propose to you the appropriate type of training, course, etc. And that one will be your guide through the first practical operations.

The Forex market is a very complex mechanism. The undeniable fact is that it generates various controversies.

However, the main cause of these controversies is ignorance. If you want to take advantage of the opportunities for earning in this field, you must break all the prejudices, myths, and misconceptions surrounding it.

If you are dealing with a trader’s job, you will probably be interested in the so-called “Robo-forex” ie robotic/automated business on the forex market.

How to Forex investing?

In other words, can you actively trade without moving a small finger?

It’s possible but you’ll have to do something. You’re the one who has to give instruction, you’ll have to specify inputs. Then, how is it automated, you may ask?

It’s about a program called “The Forex Expert Advisor” (Forex Expert Advisor) and can be used within the Trading Platform.

This program works independently, although based on the instructions you specify. But it does not require your direct participation in the execution of trade orders or any other market activity.

So, robo-forex executes all tasks independently, meaning automatic.

All you have to do is set the target through an online trading platform that is linked to a broker server. Then the Forex Expert Advisor will start trading according to the given instructions. It is important to note that forex market experts are necessary as advisors especially if you’re a beginner. In this way, you don’t have any responsibility for decision making and, practically, you’ll trade without stress.

What’s more, in that case, you don’t have to be an expert or have a deep knowledge of technical and fundamental analysis. These jobs are contained in the Forex Expert Advisor Add-on – Trading Program.

So, this means that you can practically be away from the computer because your “advisor” will monitor and process all trade signals in case of your absence.

So, it’s possible to invest in Forex and trade this market with a little effort and engagement.

Forex as investment

You have often had the opportunity to hear that investing is not a sprint but a marathon.

This means that if you want to succeed in a tough business such as trade in financial markets, you will have to, among other things, spend a lot of time on it.

To run in the long run, you do not need the 500-euro sneakers. You can run in the old one. The point is that you can start investing in Forex even with a little money but you’ll have to do so in a way that is suitable for you.

The price is not the most important issue when you investing in the Forex market. The most important is to feel comfortable as much as you can. Because it increases the chances that your race will end successfully. So, take advantage of this growing market. And stay tuned, follow Traders-Paradise. You’ll find plenty of valuable suggestions and examples from real investing and trading.