Finding the best UK investors all the time was a quite difficult job. There are so many incredible investors in the UK. but also some of them even the best made unbelievable failures.

Traders Paradise decided to write about the best UK investors from the second part of the XX century.

Some of them are still active, fortunately.

The other reason why writing about the best UK investors was a tricky job is that not all of them are widely present in the public. Moreover, the majority of the best UK investors avoid that.

Anyway, Traders Paradise went all across the internet, examined all articles about them and there is our presentation of the best UK investors. Right in front of you.

Maybe some of them could be an inspiration for you. Moreover, you can mirror their investing performances or just get a clue on how to start or improve your investing style.

Enjoy the reading!

Wild markets are like a boomerang.

If investors have fear or panic there will be a lot of ups and downs in the markets. Or, when the market is volatile investors are frightened and panicked.

But some investors are different. They can see opportunity where every other see disaster. So, we can say that great and famous investors always have self-discipline and patience. That’s why they are successful.

Who are the best UK investors?

And our story will start with the economist that developed his own economic school of thought thanks to his followers.

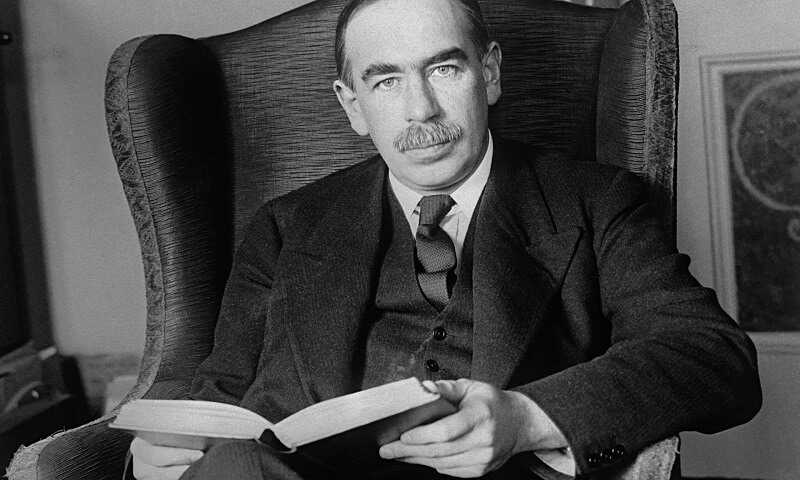

John Maynard Keynes

John Maynard Keynes

John Maynard Keynes

He was born on 5 June 1883 in Cambridge into an erudite family. They were open-minded family. His mother was the first female mayor and father was a philosopher and economist.

Keynes studied mathematics at Cambridge University.

After finishing, he found a job in the India Office. At the same time, he worked on a dissertation. That secured him a membership at King’s College. He stayed at Indian position till 1908 after which he came back to Cambridge. He joined the treasury at the beginning of World War One. When the war was ended, he issued ‘The Economic Consequences of the Peace’ which became a best-seller.

Between two World Wars, he earned a very steady amount of money by investing in the financial markets. Also, he continued his theoretical work. His most famous piece ‘The General Theory of Employment, Interest, and Money’ was issued in 1936. Even today, it is the caliber for economic theory all over the world. After that book, it was so easy for Keynes to become a famous economist in the UK and with the most influence. With the beginning of World War Two, he continued to work for the treasury again and became a member of the house of lords.

John Maynard Keynes built macroeconomics in the 1930s.

He is largely disregarded now.

The central idea of this economic school of thought is that government intervention can secure the economy.

During the Great Depression of the 1930s, economic theory was incapable to explain the circumstances of the dangerous economic collapse.

Keynes produced a revolution in economic thinking for that time.

The stand of Keynes’s theory is the idea that aggregate demand (a theory of total spending in the economy) is driving power in the economy.

Aggregate demand is the total of spending by households, businesses, and the government.

Further, Keynes asserted that free markets have no ability to balance mechanisms that direct to full employment.

Keynesian economists support government intervention through public policies. Governmental intervention can lead to price stability and full employment, state Keynesians.

During the war, Keynes had a crucial position in the consultations. He is one of the most important figures that developed the post-war global economic order. He had an important role in the devising of the World Bank and the International Monetary Fund.

Famous John Maynard Keynes died on 21 April 1946.

Neil Woodford

Neil Woodford is one of the best UK investors

Neil Woodford is one of the best UK investors

He was one of the most honored and best-known fund managers in the UK. He was born in March 1960. In 1981 he has a degree from Economics and Agricultural Economics from the University of Exeter.

More than 26 years he was a central member of the UK equities team at Invesco Perpetual. He was named a Commander of the Order of the British Empire (CBE) in 2013 for services to the economy.

As a leader of investments at Invesco Perpetual Woodford managed over £15 billion of assets. In 2014 Neil founded his own fund management firm, Woodford Investment Management LLP.

Prior to this, he was the head of UK Equities at Invesco Asset Management Limited and had been its fund manager since 1998. Woodford had worked as a fund manager at Eagle Star since 1987. He was also employed at Woodford Asset Management LLP.

Early days

Woodford began his investment career at the Dominion Insurance Company in 198. He has experience in both corporate finance and fund management.

He doesn’t like to be a public figure so we can find a little bit of information about his life. In a rare interview, he said his £10.6bn Woodford Investment Management business now. If you ask anyone in the UK to identify an investment manager they will point one name: ‘Neil Woodford’.

The audience in the UK likes to believe that Woodford is their response to US investor Warren Buffet. There is a legend connected to Woodford’s work as an investor. Britains believe that he is one of only several fund managers in the world who are able to cheat the market and producing long-term returns for investors.

The truth is that thanks to his knowledge, his investors avoided the dangers of the bursting of the “dotcom” stock market bubble in early 2000. And then proceeded to make money for them.

Woodford is the private investor’s champion in the UK. Britains like to say he is the man who made Middle England rich.

‘I’m not an investment genius,’ he said once. ‘I am just someone who follows a disciplined and rigorous investment approach. If you want to talk investment geniuses, think Anthony Bolton. And, of course, the epitome of genius, Warren Buffett.

‘Yes, people have heaped praise on me in the past but they have also not spared me opprobrium. Everybody likes to build people up in this country and then smash them down.’

In March 2000, financial advisers accused him of ‘intransigence’ over his refusal to acknowledge the potential of technology stocks. Today, it looks like bad luck is following him. But Woodford is street-fighter. He will know how to deal with it.

UPDATE 12/07/20:

In October 2019, one of the best UK’s stockpickers ended his multi-billion-pound empire.

He is known as “Oracle of Oxford” “and was dismissed from his troubled £3.1bn Equity Income fund by its administrators,” wrote BBC.

But last news tells that Neil Woodford is back in business.

Woodford announced several days ago he would leave the last two funds he is managing, Income Focus and Woodford Patient Capital. Also, he said he will close all investment management business.

John Templeton

John Marks Templeton one of the best UK investor

John Marks Templeton one of the best UK investor

Sir John Marks Templeton was a UK investor, banker, and fund manager. In 1954, he entered the mutual fund market and created the Templeton Growth Fund. In 1999, Money magazine named him “arguably the greatest global stock picker of the century.”

He was born on November 29, 1912, in Winchester, Tennessee, United States. Died on July 8, 2008, in Doctor’s Hospital, Nassau, The Bahamas.

As a pioneer in both financial investment and philanthropy, John Templeton spent a lifetime encouraging open-mindedness. He created the motto for his Foundation, “How little we know, how eager to learn.” Maybe that the best represents his philosophy both in the financial markets and in his methods of philanthropy.

He attended Yale University and graduating in 1934 near the top of his class. Also, he graduated with a degree in law in 1936.

Templeton began his Wall Street career in 1938.

We can say he created some of the globe’s greatest international investment funds.

He took the strategy of “buy low, sell high” to a maximum. Templeton was picking nations, industries, and companies popping the bottom. He called it “points of maximum pessimism.”

In 1939, he borrowed money to buy 100 shares each in 104 companies selling at one dollar per share or less. Among them were 34 companies that were in bankruptcy.

He turned huge profits from them. Among his chosen 104 companies only 4 were wasted, actually worthless.

In 1954 he founded the Templeton Growth Fund. With dividends reinvested, each $10,000 invested in the Templeton Growth Fund Class A at its inception would have grown to $2 million.

In 1992, he sold the Templeton Funds to the Franklin Group. In 1999, Money magazine called him “arguably the greatest global stock picker of the century.”

Templeton became a billionaire by globally diversifying mutual funds. His Templeton Growth Fund, Ltd. was among the first to invest in Japan in the middle of the 1960s. Templeton also created funds in nuclear energy, chemicals, and electronics. By 1959, Templeton went public, with five funds and more than $66 million under management.

He refused technical analysis for stock trading, favoring instead to use fundamental analysis.

‘You can’t outperform the market if you buy the market’ was one of his favorite sayings. How did he manage to beat it so spectacularly himself?

Templeton was one of the most generous philanthropists in history. He gave away over $1 billion to charitable causes.

In 1972 he established the Templeton Prize, which, according to the charitable foundation that he started, is the world’s largest annual award given to an individual. The prize, which rewards those who have “made an exceptional contribution to affirming life’s spiritual dimension”. It is currently £1m and always beats the value of the Nobel Prizes. Winners have included Desmond Tutu, Dalai Lama, Chiara Lubich, Mother Teresa, Lord Jakobovits, King Abdullah of Jordan, Arthur Peacocke, etc.

Templeton renounced his US citizenship in 1964. He held dual naturalized Bahamian and British citizenship and lived in the Bahamas.

Richard Branson

Richard Branson

Richard Branson

Sir Richard Charles Nicholas Branson was born on July 18, 1950, in Surrey, England. He is a UK business magnate, investor, author, and philanthropist. Also, He founded the Virgin Group, which controls more than 400 companies.

He launched Virgin Records in the early 1970s. It is now the multinational Virgin Group. His early life story is a bit out of the standard. Richard Branson dropped out the school at age 16.

Branson has dyslexia and had poor academic performance. On his last day at school, his headmaster, Robert Drayson, told him he would either end up in prison or become a millionaire. In London, Branson started off squatting between 1967 and 1968. He launched his first successful business, a magazine named Student, in 1966.

The first issue of Student appeared in January 1968, and a year later, Branson’s net worth was estimated at £50,000. Branson started his record business from the church where he ran Student magazine. He interviewed several popular figures of the late 1960s including Mick Jagger and R. D. Laing.

Branson advertised popular records in Student, and it was an overnight success.

Once Branson said, “There is no point in starting your own business unless you do it out of a sense of frustration.”

Branson eventually started a record shop in Oxford Street in London. In 1971, he was questioned in connection with the selling of records that had been declared export stock. The matter was never brought before a court because Branson agreed to repay any unpaid VAT of 33% and a £70,000 fine.

His parents re-mortgaged the family home in order to help pay the settlement.

His entrepreneurial projects started in the music industry and expanded into other sectors, including the space-tourism venture Virgin Galactic, making him a billionaire.

The Virgin Group reached 35 countries around the world, with nearly 70,000 employees handling affairs in the United Kingdom, the United States, Australia, Canada, Asia, Europe, South Africa, and beyond.

Branson is also known for his adventurous spirit and sporting achievements.

Richard Branson ranks eighth among the wealthiest British billionaires by net worth.

Mike Ashley

Mike Ashley

Mike Ashley

A famous investor Wallace Ashley is a British billionaire and investor in the sporting goods market and one of the best UK investors.

He entered the field store industry following the acquisition of House of Fraser. He is also the owner of Newcastle United after paying around £135 million to buy the club.

Ashley turned whistleblower on industry rivals in 2000, handing the Office of Fair Trading evidence of business meetings held by sports retailers to fix the price of football shirts. Ashley attended a meeting at the Cheshire home of David Hughes, the chairman of now-bankrupt rival Allsports. At the meeting, Dave Whelan, the founder of JJB Sports, reportedly told Ashley: “There’s a club in the north, son, and you’re not part of it.”

On 23 May 2007, Ashley bought Sir John Hall’s 41.6% stake in Newcastle United at one pound per share, for a total cost of £55,342,223 via his company St James Holdings Ltd.

Under the terms of UK takeover law, having purchased more than 30% of a listed company. And he was obliged to make an offer to buy the remaining shares at the same or a greater price.

On 31 May, it was announced that the Newcastle board were considering Ashley’s offer.

On 7 June, it was confirmed that chairman Freddy Shepherd had agreed to sell his 28% share to Ashley, which left Ashley free to take control of the club.

As of 15 June 2007, Ashley owned a 77.06% stake in Newcastle United, on course to withdraw the club from the stock exchange having surpassed the 75% threshold required.

The hundred percent acquisition was done in July. Ashley paid around £134 million. He also paid off large sums of debt obtained from the previous administration.

On 11 May 2016, Newcastle United were relegated for the second time under the ownership of Ashley, after local rivals, Sunderland beat Everton 3–0.

As of October 2014, Ashley owned an 8.92% stake in Rangers International Football Club (RIFC), the parent company of Scottish football club Rangers. The Scottish Football Association has rejected Ashley’s request to raise his shareholding in RIFC to 29.9%, due to the fact he already owns a large amount of Newcastle United shares, which was seen as a conflict of interest.

In January 2015, Rangers fans protested against Mike Ashley’s plans to secure a £10 million loan using the club’s stadium as security. All the main Rangers supporter groups have heavily criticized Ashley and expressed major concern and distrust about his nature and purpose of his intentions.

On 23 June 2017 Ashley sold his entire Rangers shareholding to Club 1872 and Julian Wolhardt.

Ashley is protective of his private life. He is known to prefer casual dress rather than a suit. He often carries his fundamental business tool of a mobile phone in a plastic carrier bag rather than a briefcase.

Ashley is a private person, he never attended industry functions or gave interviews.

He left school at 16.

Anthony Bolton

Anthony Bolton

Anthony Bolton

He was born on 7 March 1950.

Anthony Bolton is one of the UK’s best-known investment fund managers and most successful investors. He had managed the Fidelity Special Situations fund from December 1979 to December 2007.

Over this 28-year period, the fund achieved annualized growth of 19.5%, far in excess of the 13.5% growth of the wider stock exchange, turning a £1,000 investment into £147,000. Until April 2014 he managed Fidelity China Special Situations PLC, a London Stock Exchange-listed investment trust.

He started a career at the age of 29, he was recruited by Fidelity as one of their first London based investment managers. In surveys of professional investors, he is regularly voted the fund manager most respected by his peers.

Bolton began managing Special Situations (a UK equity OEIC) when he joined Fidelity in 1979 and continued until 2007.

He managed other funds alongside Special Situations during this time. From November 1985 to December 2002, he managed the Fidelity European Fund (a European equity OEIC). He managed the Fidelity European Growth fund (a European equity SICAV) from 1990 to 2003, Fidelity European Values PLC (a UK-listed investment trust) from 1991 to 2001, and Fidelity Special Values PLC (also a UK-listed investment trust) from 1994 to 2007.

In 2006 his Special Situations Fund was split.

The success of the fund had brought in so much money from investors, it had become the UK’s largest open-ended fund (OEIC) and it was feared that the fund was becoming too big to manage successfully.

The fund was split into the UK and Global Special Situations funds. The Global Fund and the UK fund continuing under Bolton’s stewardship until the end of 2007. With Bolton’s step back from fund management, many questioned whether the fund could continue to outperform the market in the future. And not without the reason.

Bolton’s former funds suffered amongst the worst redemptions in 2007.

Investors withdrew £335m from the Special Situations fund and £508m from Global Special Situations. However, redemptions in both funds slowed significantly in 2008, and in March 2010, at £3 billion, the UK fund is almost back to the same size as when Bolton stepped down.

When he stopped managing funds in 2007, he took a full-time role in mentoring and developing newer investment managers.

He still works with Fidelity.

Nick Leslau

Nick Leslau

Nick Leslau

This famous UK investor was born on 18 August 1959. He is a UK commercial property investor. His wealth is estimated at £350 million.

Leslau is chairman of Prestbury Investments.

He is a 30% shareholder in Prestbury‘s Secure Income REIT which owns properties such as Thorpe Park, Warwick Castle, and Alton Towers. Secure Income REIT also owns 20 private hospitals and 55 Travelodge hotels in the UK.

Early days

Leslau left the University of Warwick where he was studying German, studying surveying, and become one of the best UK investors.

Leslau joined the ground rent company of commodities traders Burford Group. He had completed a degree in estate management at South Bank University and became a chartered surveyor with Burford. At age 23, he became CEO of Burford Estate & Property.

Wanting to move further into the property, contacted Nigel Wray to engineer a reverse takeover of Wray’s listed company Chartsearch in 1986 for £8 million. They expanded the company into a £1 billion enterprise, buying large parts of Oxford Street and the Trocadero center.

In 1997, Leslau and Wray set up their own small property company MAYBEAT Limited, which they merged into one of Michael Edelson’s Alternative Investment Market-listed shell companies called Prestbury Group Plc.

The board consisted of Leslau, Wray, Viscount Astor, John Hodson (the then chief executive of private bank Singer & Friedlander), and Edelson. Over the next two years, it produced a return of 150% on net asset value. Leslau grew its total value to several hundreds of millions of pounds before taking it private in 2004.

In 1999, Leslau founded an investment vehicle, Edenhawk, collectively with Wray, Archie Norman, and Julian Richer. And once again, they merged the company into an Edelson shell company, Knutsford Plc. The plan was to acquire a retail business to take advantage of the retailing skills of Norman, a former Chairman of Asda, and Richer, who had built up the retail group Richer Sounds.

Within weeks the value of Knutsford had soared to £1 billion.

They attracted attention from financial media around the world as potential acquisition targets were touted by the media such as Marks & Spencers and Sainsbury’s. Knutsford concluded a deal with WI Link (which continues to trade successfully). No one could hope to achieve the dizzy expectations generated by the media in the weeks after flotation.

Knutsford announced the end of the dot com boom in the UK.

In February 2001 Leslau set up a private company, Prestbury Investment Holdings, funded by HBOS and Sir Tom Hunter.

Leslau is now chairman of Prestbury Investments.

He has sat on many quoted and unquoted company boards including, most recently, Max Property Group Plc, and is a Member of the Bank of England Property Forum.

Jim Slater

Jim Slater is one of the best UK investors all the time

Jim Slater is one of the best UK investors all the time

James Derrick Slater was born on 13 March 1929 and died on 18 November 2015). He was a British accountant, investor, and business writer. Slater rose to prominence in the 1970s as a businessman and financier. And one of the best UK investors.

In 1964, investor Jim Slater acquired control of H Lottery & Co Ltd, a £1.5m public company, which with his business partner Peter Walker they renamed Slater Walker Securities.

In the 1960s and 1970s, James Slater was one of the top players in the City. He was active in business and investing until his death in 2015.

Slater was, at the beginning of his career, a chartered accountant and writer. He had a column in the Sunday Telegraph and he was writing under the nickname ‘Capitalist’.

Slater Walker Securities was a huge success in the 1960s and early 1970s. But it crashed in the banking crisis of 1974.

The firm was in connection with acquiring businesses and selling off anything that was considered to be surplus to demands.

During the secondary banking crisis in 1975, Slater Walker faced financial difficulties and received support from the Bank of England. Slater resigned as chairman in October 1975, because the Singapore Government began to try to extradite him from the UK for alleged offenses by the company in Singapore referring to the alleged misuse of more than £4 million of company funds in share deals. The Singapore government’s attempt to extradite Slater was dismissed by the Chief Metropolitan Magistrate at Horseferry Road Magistrates’ Court in 1977.

In separate proceedings, following the takeover of the company by the Bank of England, a prosecution was brought against Slater by the Department of Trade alleging 15 counts of offenses under the Companies Act.

Slater was guilty of the Companies Act offenses and fined £15 per count.

Fortunately, the court accepted that the offenses were purely technical. Also that Slater didn’t act dishonestly and that there was no question of him having made any personal gain through committing them.

Finding himself technically bankrupt after the collapse of Slater Walker, Jim Slater invested his residual funds and repaid all of his personal creditors within a few years. And paid with interest.

Slate came to publicity again as the author of The Zulu Principle.

That book, and his subsequent Beyond the Zulu Principle in 1996, Slate spread the idea of investing in small-cap stocks, and the use of the PEG ratio to help identify targets.

Slater did not create the PEG. But he was absolutely responsible for its popularity as a stock-picking tool.

In order to find a way to help investors to filter the full market to find out which shares are worth looking at, Slater developed the Company Really Essential Financial Statistics products — REFS.

Be focused on small caps was Slater’s investment style. His famous statement was “Elephants don’t gallop.”

That explains the idea that big companies cannot double in size, but small ones can. He has also devoted himself to knowledge.

The website The Motley Fool wrote about Slater:

“He doesn’t want to know a little about everything, he wants to know everything about a few things. If those few things include a handful of neglected companies, the chances of his making money should be greatly increased.”

His hobby was chess. Amongst other sponsorships he donated $125,000 to make possible the 1972 World Chess Championship between Bobby Fischer and Boris Spassky in Reykjavík, Iceland, doubling the total prize fund.

Why these UK investors?

This is our choice of the best UK investors. Maybe some others have different. Our criteria while we were trying to pick the best UK investors were how do they influence the market, the companies they hold, and moreover, how they were acting when everything gets apart.

Yes, they show strength, power, but more than anything, they are fighters. They are the best UK investors because they have self-discipline and patience to achieve their goals even when markets play against them.

They are the winners and hence, they are the best UK investors.

Who are modern german investors? Why are they popular? How do they differ from others?

Who are modern german investors? Why are they popular? How do they differ from others?

The survey “War on Stress” showed young investors feel stressed and insecure while investing.

The survey “War on Stress” showed young investors feel stressed and insecure while investing.

There is no such thing – worst investors. Yes? No? Read to the end.

There is no such thing – worst investors. Yes? No? Read to the end.

Who was John Bogle?

Who was John Bogle?