Just like any other metric, CAGR is helpful but is more valuable as part of a larger analysis. Investors would need to look further.

When new investors ask what is CAGR they have in mind some complicated formulas and Excel. Well, yes it is but it isn’t so complicated and Traders-Paradise will explain all about CAGR.

As first, if you want to build wealth, you have to hold an investment that provides you compounding. That could double your investment.

CAGR reveals how much your investment increased over time. It represents the average returns you have earned after some period. That period must be longer than one year. But here we come to the main point of compounding. If you count that only one stock could provide you a steady rate of return every year, forget it. The rate is changing. You will need to add more investments to your portfolio. And when you do that you would like to know how big is the profit you earned for your investments as a whole. Especially if you reinvest. Let’s say you invested in some company and your plan is to reinvest your gains over 5 years. Compound Annual Growth Rate will show you how much return earned you for each year during the holding period. Remember, you have to reinvest your gains every year.

CAGR is one of the most accurate methods to calculate returns for your investments, for each separately and for the whole portfolio. Basically, it is the best way to calculate returns for everything that can grow or drop in value.

You will find that investment advisors like to use this word CAGR when they want to promote their offers. But we would like you to understand what Compound Annual Growth Rate really means and what represents.

Compound Annual Growth Rate explained

CAGR or compound annual growth rate stands for the growth rate that your initial investment will need to grow to an established level over a given period of time. It is similar to compound interest.

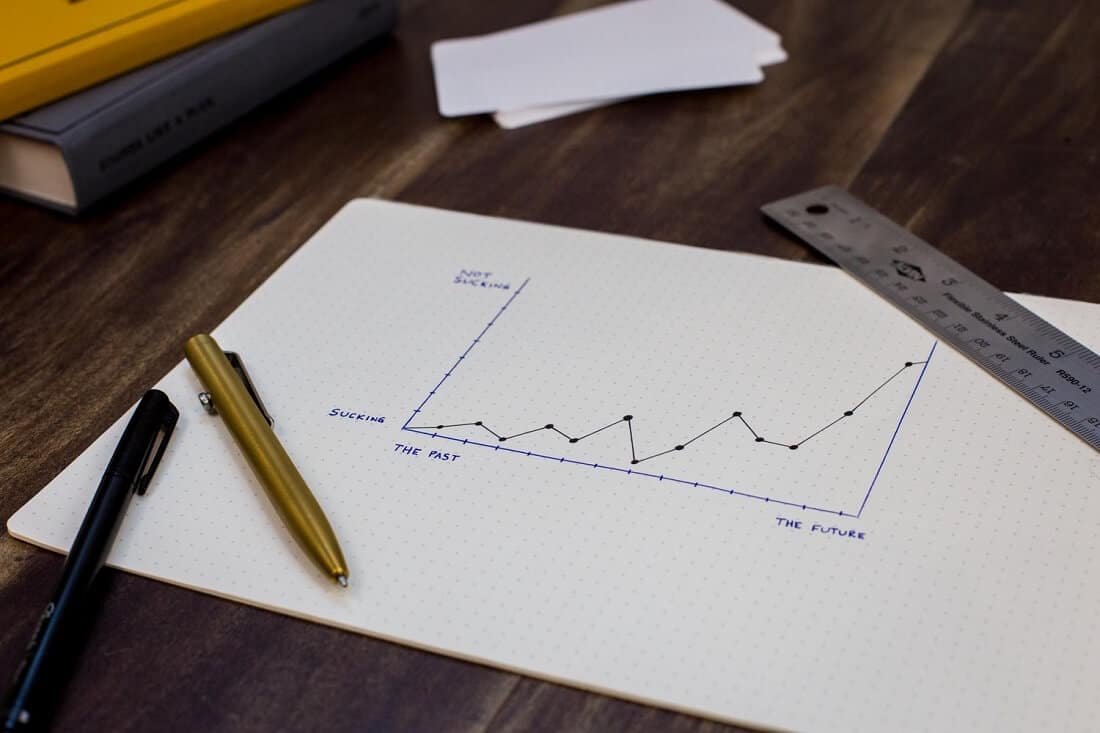

Your investment portfolio will have different rates of return over different times. Let’s say you might have huge gains one year, but the next year wasn’t so good, you made some losses.

CAGR enables you to calculate returns of your whole portfolio over several years. That period can be 3, 5, 10 years and you can easily figure out how your investments have performed over that given period. That can help you to compare your investments to others.

CAGR is a mathematical formula

For example, you invested $10.000 at the beginning of 2018. By the end of that year, your investment grew to $20.000, a 100% return. But the next year you lost 40% and you end up with $12.000.

So, how to calculate the return for these two years? If you try that by using annual return you will not have an accurate result. It will show you the average annual return of 30% on your investments (100% gain and 40% loss). Which is a misleading number, because you have ended up with $12.000 and not $16.900.

The average annual return doesn’t work and you’ll need to calculate the CAGR. So let’s do it.

We have to divide the ending value of the investment by the beginning value of the investment for a given period, in our case, it is 2 years.

Raise this result to the power of 1 divided by the number of years we are doing calculations for, which is actually square root in our case.

And finally, we have to subtract 1 from the last result and multiply the result with 100 to get a percentage.

((ending value /beginning value) ^ (1/2) – 1) x 100

That’s it.

Compound Annual Growth Rate, in this case, is 9.54%

Over the 2-years period, your investment grew from $10,000.00 to $12,000.00, and its overall return is 9.54%.

CAGR actually provides a more precise view of your annual return. Our investment started at $10,000.00 and ended with $12,000.00. In the first year, it grew 100%, in the second we lost 40%. But despite this fluctuation, our investment shows a positive return through its lifetime.

Why use the Compound Annual Growth Rate calculation?

It is a helpful tool to compare different investments over a similar investment range. One of the most important advantages of using CAGR is that it, as a difference from the average annualized rate of return, doesn’t let the influence of percentage changes over the investment’s life.

Our example shows that the investment produced a 100% return in the first year, boosting the value from $10,.000 to $20.000. When you reinvested (our potential scenario) the whole capital you lose 40% and the value of investment fell. But it generated a positive return over the lifetime of two years.

Also, you can use this calculation as help to determine what type of annual returns you maybe need to reach your investing goals. For example, take some imaginary sum into the account and calculate is it good for your goals like retirement or buying a house, for instance.

Disadvantages

The disadvantage of CAGR is that it expects growth to be constant and may produce results different from the real situation when it comes to high volatile investment. Investors use this calculation for periods of 3 to 7 years. Over the longer periods, CAGR could lose some sub-trends, simply it can hide them.

CAGR doesn’t consider investment risk and volatility. It will always show a smooth yield. So, you may think you have a stable growth rate even when the value of your investment is varying a lot.

So, remember this, the volatility and investment risk, are essential to examine when making investment decisions. But CAGR will tell you nothing about them. It does not estimate the non-performance associated circumstances in the change of value.

Bottom line

CAGR or compound annual growth rate is a helpful tool for measuring the growth over various periods. Imagine it as a jump from your beginning investment value to the ending value while you reinvest all the capital all the time.

Using it you’re able to evaluate different investment options. But it will not tell you the whole truth. Analyze investment options by comparing their CAGRs from the same periods’, compare the one investment’s annual return to some other investment’s annual return. To evaluate the relative investment risk you will need a different measure.

CAGR neglects the cash flows or volatility. But in combination with other metrics, it can give you a good view of investments or portfolio.

The adjusted closing price for dividends

The adjusted closing price for dividends