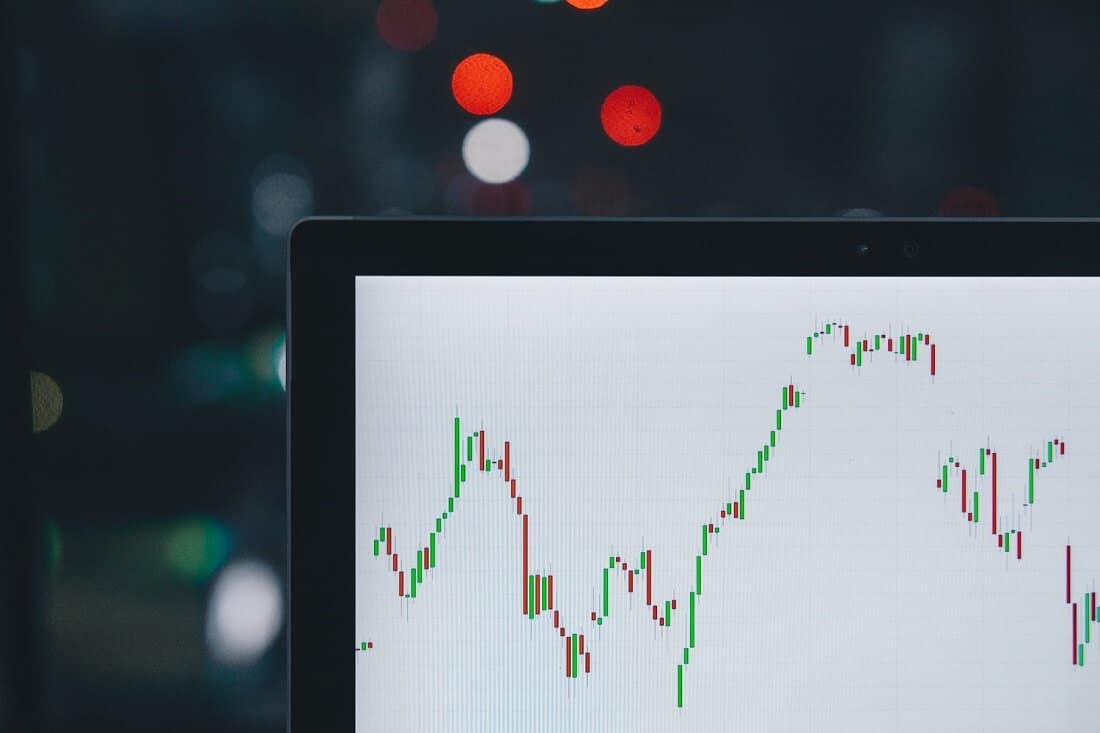

In index trading, you are betting on the movement of the stock market as a whole.

In the stock markets, you don’t need to trade individual stock only, instead, you can choose index trading. Index trading is actually very popular in stock trading.

Let’s make clear what an index is. In short, it is a mix of tradable assets. The most popular indexes are the S&P 500, NASDAQ, Dow Jones Industrial Average (DJIA), etc. They are so-called benchmark indices. In the stock market, these indexes include the shares of individual companies.

Besides the opportunity to use the index as an indicator of the market condition, you can use it for real trading. But there is some characteristic of the index that you have to be aware of. An index doesn’t have real value, it is just a measure of the value of a part of the stock market.

How is possible index trading?

We know that trading, in most people’s minds means buying and selling a single stock, currency pair, or some other asset. Well, trading isn’t just buying or selling securities, you can trade indexes also. Yes, an index is a financial instrument that consists of numerous assets with their average value. As for the index meaning, they are a financial instrument that combines individual assets and represents their average value.

Index trading means speculating on price changes in a stock index benchmark, for example, the S&P 500, FTSE 100, the Dow Jones, etc.

In index trading, perhaps the most beneficial part is that you don’t need a huge capital. You don’t need to buy the whole index, meaning you don’t need to pay it at full price, you can pay, for example, 20% of its value. How is this possible? If you want to buy stocks you have to pay 100% of the value. Well, index trading is a derivative vehicle. The main difference between stocks and index trading is that you can hold stocks for years but in index trading, you don’t have such a possibility. Actually, you have but only if you enter the same position every month, for example. This means you can hold indexes for a specified period.

The other characteristic is that you are actually trading indexes options. Further, index options are settled in cash. It is common for index traders to use index options to hedge stock portfolios. Index options are also excellent when it comes to speculating the market. Index trading is basically the traders’ attempt to profit from the price changes of indices.

The examples of index trading

There are many indexes available that you can trade. Index traders can either focus on a single index or trade various indexes as a component of a more extensive strategy.

For example, stock indexes are the most attractive because they mix some of the most important companies. If the companies are strong with permanent growth, the index value will increase.

The stock indexes are the most popular types of index trading. A stock index is a collection of stocks that presents, let’s say, a summary of how a particular section of the stock market is doing. For example, a biotech stock index will track biotech stocks.

Index trading occurs when you don’t want to buy individual stocks Because you would like to have exposure to a whole section of the market.

There are numerous indexes, for example, FTSE100 (London), S&P/ASX 200 (Australia), AEX index (Amsterdam), CAC 40 (France), DAX (Germany), besides already mentioned above.

Why index trading?

Index trading is a comparatively protected form of trading with combined risk management. The risks of index trading are lower than the risks of trading individual stocks.

An index isn’t a manipulative financial instrument or it is at least. The price of an index will change along with the price changes of the constituent stock that make up a particular index.

The other reason is that you have an embedded money management system. Index trading simply means you don’t “put all your eggs into one basket.” Also, the risk is lower in this type of trading. It’s true that indexes can be volatile due to political events, economic predictions, or similar. But when an index is getting or losing 15% in value, the headlines will be full of that, trust us.

By index trading, you’ll be protected against the risk of bankruptcy. An index can not go insolvent. If an index’s part goes bankrupt, it will be replaced by the next company on the list. That is great protection of your capital because if you own a stock of the same company you could lose everything you invested in it. Also, you’ll benefit from the global financial condition. By index trading, you benefit from the index’s possibility of permanent rise.

For example, you invest $10.000 for a period of 2 months. At the end of that time, your gains will be 10% of the initial investment, or $1.000. Similarly, index trading permits you to profit from any kind of stock market changes. It doesn’t matter if the market grows or drops in value during these 2 months. Basically, you can profit in any market conditions.

How to trade indexes?

Position trading and trading with the trends are very effective strategies in index trading. A powerful approach could be to open the position and hold as long as possible. That is, in short, position trading. Major indexes have almost the same problems, reactions, so this could be a good approach.

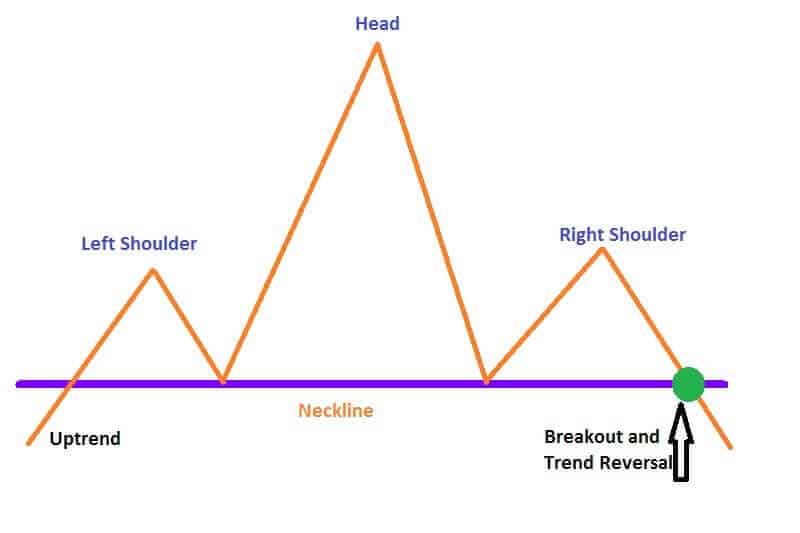

Also, one of the strategies in this type of trading could be trading with the trends. It is suggested to use long-term charts with other technical tools. For example, pattern analysis or indicators are useful to develop your position trading strategy.

This kind of trading isn’t without risks. It is with the lower risks but still, some quantity of volatility is present. This is particularly true if you trade the stock indexes. So, you’ll need some risk management strategy. You can use some of the very powerful tools like stop-loss orders, trailing stop orders, or limit orders. Basically, in index trading, if you want to lock in profit, you’ll need everything possible that may help you to manage the trade according to your risk tolerance.

Bottom line

Traders know the names of the main global stock indexes. These indexes can also be traded through stock index CFDs. In fact, you can also buy and sell them in an alike way to how you trade stocks. Everything is almost the same, except the risk is much lower.