2 min read

This currency pair is becoming more and more popular in the so-called exotic pair group and trading the USD/INR pair has developed as an attractive investment chance for forex traders.

The Indian rupee on Tuesday lost by another 41 paise to close at a new six-month low of 71.59 against the US dollar. The reason is in economic risks that proceeded to rise.

Investors are still risk-averse, they are unwilling to take risks yet. They have to consider multiple factors such as foreign fund outflow, the gap in most developing currencies’ markets, and there is also Indian economic slowdown.

The main expectation is on the Indian government. Investors think that it will come out with incentive actions to refresh the development of the economy. The main problem is slowing in consumers demand in different sectors.

The higher crude oil price also influenced rupee’s trading. The global oil benchmark, increased by 0.07%, and now is trading at USD 59.78 per barrel.

The new rupee’s value of 71,58 is the lowest level for the Indian currency since February 4. On that day it was closed at 71.80 per US dollar. At the same time, the dollar index, which measures the USD strength against a basket of six currencies, increased 0.06% to 98.40.

But, Indian 10-year government bond yield was regular at 6.58% on August, 20.

“Indian rupee declined for a second day as importers and foreign banks rush for the dollar amid a recovery in crude oil prices. The market is also expecting fund outflows of around USD 102 million on the back of Shell selling stake in Mahanagar gas,” said VK Sharma, Head PCG & Capital Markets Strategy, HDFC Securities.

This expert in the capital markets with over 30 years of experience, rides the fundamental, derivative and technical fields with equal ease. VK Sharma has been associated with Canbank Financial Services and Anagram Finance.

VK Sharma believes that the next support for the rupee is at 72.5 level.

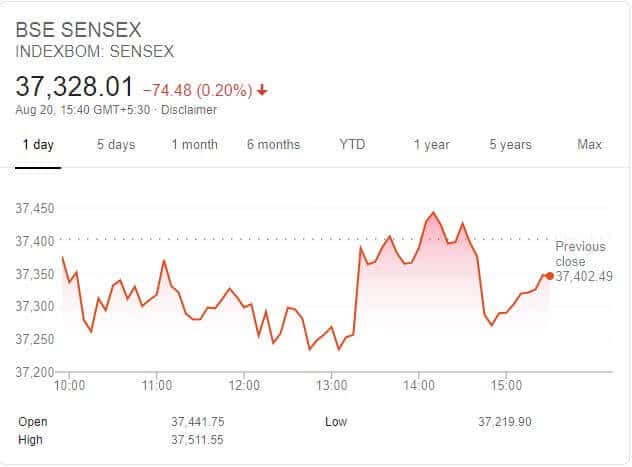

In the equities market, the BSE Sensex sank 0.20%, lower at 37,328.01

And also the NSE Nifty sank, it ended for 0.33% lower at 11,017.

Financial Benchmark India Private Ltd (FBIL) fixed the reference rate for the rupee/dollar at 71.3419 and for rupee/euro at 79.1386. The reference rate for rupee/British pound was set at 86.8026 and for rupee/100 Japanese yen at 67.05.

The Indian rupee’s outperformance against more export-oriented currencies like the Korean won has possible come to the end. JPMorgan sees risks moving to the downside.

JPMorgan had promoted the rupee since the U.S.- China trade war hit the climax in May. It now awaits the currency to display higher beta to moves in yuan, which keep falling this year. JPMorgan thinks it will be continued in the first half of the next year. The lower price of the rupee is connected to declining internal and external growth. The rupee is decreased by 3.9% during the past month which is the worst player in Asia that month.

JPMorgan sees it weakening to 73-74 to the US dollar in the following months, from 71.59 on Tuesday.

Leave a Reply