1 min read

What is a market signal and how to use it?

The market signal is an unintentional or passive passage of information or indication between participants of a market.

For example, If a firm issues bonds it indirectly shows that it needs capital and also desires to retain control. Thus instead of equity capital, it prefers loan capital.

It is based on the technical indicators and usually is the sign for when to sell or buy a particular product.

It also brings the attention of users to the other options available, abnormal growth and short-term interests.

Using signals in volatile markets can help to point out opportunities to the investors and also will signal them if they disappear.

The market signal is indication or information passed passively or unintentionally between participants in a market.

For example, a firm issuing bond indirectly indicates that it needs capital. And that there are reasons for which it prefers loan capital over equity capital.

The reason can be the desire to retain control of the firm.

Every company doesn’t market in a static environment. The competitor and member of the outlet will make prediction and reaction to enterprises.

Their decisions process is a dynamic market mechanism. And based on rival actions or reactions.

The market signal is any activity of rival.

We want to understand rivals motive, intention and direct and indirect target news and competitive signals such as reduced price.

So, we have to understand the new product introduction and adopting new engineering technology.

The information delivers to the market mainly through the market signal.

If we identify, search, study and analyze the market signal, we take the strategic decision and contribute to analytical behavior trend. We also improve enterprise results.

For example, a well-reputed company can be judged by its income i.e. if its sales increases then its reputation in the market also increases.

Let’s take a look at the experts’ definition market signal.

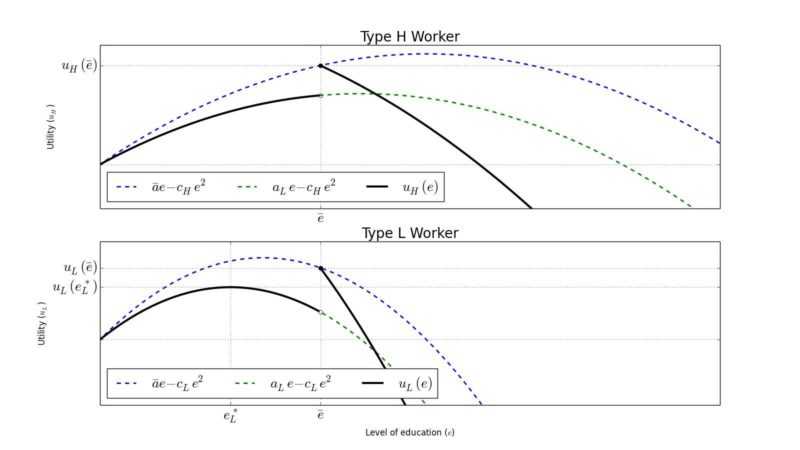

In contract theory, signaling is the idea that one party (termed the agent) credibly conveys some information about itself to another party (the principal).

For example, examine Michael Spence’s job-market signaling model.

Potential employees send a signal about their ability level to the employer by acquiring education credentials.

The informational value of the credential comes from the fact that the employer believes the credential is positively correlated with having greater ability and difficult for low ability employees to obtain.

Thus the credential enables the employer to reliably distinguish low ability workers from high ability workers.

Signaling took root in the idea of asymmetric information, meaning a deviation from perfect information.

That says that in some economic transactions, inequalities in access to information upset the normal market for the exchange of goods and services.

Let’s suppose that two parties could get around the problem of asymmetric information.

How?

By having one party send a signal that would reveal some piece of relevant information to the other party.

That party would then interpret the signal and adjust her purchasing behavior accordingly. Usually by offering a higher price than if she had not received the signal.

There are, of course, many problems that these parties would immediately run into.

So we can say, the market signal is any action by a competitor that provides a direct or indirect indication of its intentions. Also, motives, goals, or internal situation.

A short note about George Lane (1921 – 2004).

He was a securities trader, author, educator, speaker, and technical analyst. Lane was part of a group of futures traders in Chicago.

He developed the stochastic oscillator (also known as “Lane’s stochastics”), which is one of the core indicators used today among technical analysts.

A March 2007 article quoted George Lane’s description of his famous indicator: “Stochastics measures the momentum of price.

If you visualize a rocket going up in the air – before it can turn down, it must slow down.

That’s the essence.

The market signal is developed by George Lane.

Momentum always changes direction before price.

This means as prices move down, the close of the day has a tendency to crowd the lower portion of the daily range.

Just before you get to the absolute price low, the market does not have as much push as it did. The closes no longer crowd the bottom of the daily range.

Therefore, Stochastics turns up at or before the final price low.

Lane was also President of Investment Educators Inc. in Watseka, Illinois. There he taught investors and financial professionals basic and advanced technical analysis methods.

He popularized the stochastic oscillator, a momentum indicator that uses support and resistance levels.

The term stochastic refers to the point of a current price in relation to its price range over a period of time.

This method attempts to predict price turning points by comparing the closing price of a security to its price range.

The 5-period stochastic oscillator in a daily timeframe is defined as follows:

%K = 100 * (Price – L5) / (H5 – L5)

%D = ((K1 + K2 + K3) / 3)

The H5 and L5 are the highest and lowest prices in the last 5 days respectively. While %D represents the 3-day moving average of %K (the last 3 values of %K).

Usually, this is a simple moving average, but can be an exponential moving average for a less standardized weighting for more recent values.

There is only one valid signal in working with %D alone — a divergence between %D and the analyzed security.

The market signal is an indicator that measures the relationship between an issue’s closing price and its price range over a predetermined period of time.

Risk Disclosure (read carefully!)

Leave a Reply