(Updated October 2021)

Falling knife stocks represent a high opportunity to make a lot of money, but they have a tremendous potential to hurt the traders’ portfolio.

The falling knife stocks represent the stocks that have felt a speedy decline in the price and it happened in a short time. A ‘falling knife’ is a metaphor for the quickly sinking in the price of stocks. Also, it could happen with other assets too. We are sure you have heard numerous times “don’t try to catch a falling knife,” but what does that really mean?

That means be prepared but wait for the price to bottom out before you buy it. Why is this so important, why to wait for the stock price to bottom out? Well, the falling knife can rebound quickly. That is called a whipsaw. But also, the stocks may fail totally, for example, if the company goes bankrupt.

Even if you know nothing about investing, you know the phrase “buy low sell high.” But it is good in theory. In practice…

Okay, let’s see! Suppose we have a stock with price drops. Firstly it was just 10%. No problem, we could survive that, we can cover that loss in our portfolio with gains on other assets. Oh, wait! Our stock continues to fall more and more, by 30%, an additional 40%, 60% even 90%. All this happened in a few months, for instance. That is the so-called “falling knife.”

The falling knife definition

Falling knife quotes to a sharp fall, but no one can tell what is the precise magnitude or how long this dropping will last until it becomes a falling knife. But certainly, there is some data we can use to determine if there is a falling knife at all. So let’s say that the stock that dropped 50% in one month or 70% in five months are both recognized as a falling knife. They are both falling knife stocks.

The general advice from experts is “don’t try to catch the falling knife” and it is even more valuable for the beginners. In any case, anyone who wants to continue to invest in that stocks or wants to trade them should be extremely cautious. This kind of stock could be very dangerous since you may end up in a sharp loss if you enter your position at the wrong time. So try not to jump into stock during a drop. Of course, traders trade on this dropping. But traders don’t want to stay in position for a long time, they want to be in a short position, so they will examine all indicators to time the trades. For beginners, this is still dangerous.

How do these stocks work?

They work very simply. At first, you will read or hear some bad news about the company. When bad news appears the stock price can drop. And it isn’t something unusual in the stock market. Yet, if this degradation continues we can see investors selling in a panic. That can decrease the price further. So we have two possible scenarios. For example, after bad news, some good news may appear. Let’s say the company’s management is trained for damage control and we are sure that the stock will rebound. This situation is greatly profitable for the investors who purchased this stock at a cheaper price before it bounced back.

But what is a possible scenario if the company continues to weaken?

Even bankruptcy is possible. Well, in such a case the investors could have enormous losses.

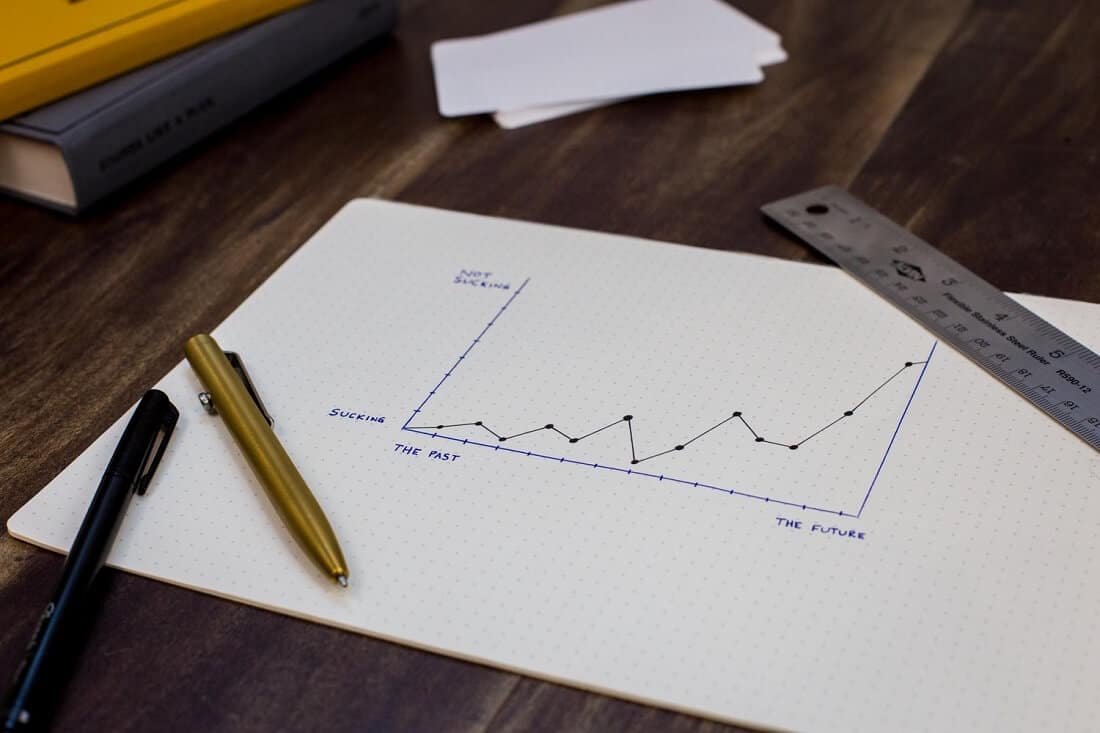

So, the precise conclusion is that falling knife stocks can generate huge gains but also, a great loss. That depends on when you enter the position. Well, you know, some stocks never rebound. Even more, they didn’t reach the original price for years since they began to drop.

To have a real chance to make a profit from falling knife stocks you must have a firm plan. What do you want to achieve? If you want a short trade, maybe it is better to wait until the stock ends its dropping.

Falling knife as an opportunity

But you might think this “falling knife situation” is a great opportunity to buy the cheap stocks that will grow in the future. That’s legitimate, of course. But instead of investing all the money you have at once, try to buy that stock in portions. One bunch this week, the same can be bought in the next week, etc. There is another way too. Let’s assume you want to invest in this stock $10.000. The original price before dropping was $500 per share, now it is $200, so buy that $500 for $200 and wait for a while until the price drops more, to $100, for example. Then you can buy another $500 for $100, etc.

The point here is that you have a plan in place and stick to it since you will not have time to make a proper decision during the regular market hours because this kind of dropping in stock price is moving too fast. For your plan to be successful, it is MUST have an exit strategy. That is particularly important for traders that are waiting for the quick bounce. The exit strategy will provide you to protect your trade to not become an investment. The essence of knife catching isn’t to buy low and sell lower.

Make big money when the stock prices go down

There are some rules if you want to profit from a falling knife and traders should follow them.

Buying a stock that is falling sharply is a bad idea for beginners, to make this clear. Picking the bottom can generate massive gains, that’s true but only if you buy at the right time. If you miss it, it is more likely you will end up in huge losses. And that happens remarkably frequently.

But at some point, when the falling knife is so close to the bottom and when the risk of additional loss is at a minimum. So the potential gains can be enormous. So, reach it out and take it. Yes, we know it is easy to say but how to do that?

The first rule for profiting from the falling knife is: Don’t buy a stock on the first drop. You see, when the first bad news comes, it is more likely that there will be more bad news that will cause the stock price to drop further. Even if there is some good news for a short time, the more bad news will come in most cases. So, wait for that and after that happens, you can start to buy but be sure that technical requirements support the bottom. That is extremely important if you want to generate massive gains.

Use MACD

The moving average convergence divergence momentum indicator is helpful to reveal where a stock is going to head next. For example, if the stock is hitting the new lows and the MACD indicator also hits the new lows, you have a strong downtrend that is very possible to continue. But if the MACD is rising the trend is going to reverse. That means that the risk of catching a falling knife is reduced. So, we have a stock that dropped at least twice but the rising MACD shows the trend is going to reverse. Don’t wait anymore, buy it! This is a low-risk point, so traders should buy that stock since its price will rise.

That’s how you can make money from a falling knife and with low risk.

Bottom line

The falling knife stocks can be a great opportunity, but they can hurt your portfolio, also. For experienced traders, yes. But if you are a beginner, it is better to stay away from these stocks until you learn more. Even not all experienced traders are not able to handle the “falling knife” stocks and catch the falling knife and recognize the whipsaw. Sometimes, you’ll have to wait for a long time until you make any gains from this trade. Don’t expect the stocks can bounce back over the next day or week. It is more possible to wait for months after you enter the trade to see the gains. But it can be worth it. Anyway, it is worth knowing how this thing works.

The adjusted closing price for dividends

The adjusted closing price for dividends