Why invest in stocks online for free, where to find broker, is it really free? Read this post to the end.

Why invest in stocks online for free, where to find broker, is it really free? Read this post to the end.

By Guy Avtalyon

Technology is making it easier than ever to invest in stocks online for free. However, some places still are charging outrageous fees and commissions to buy stocks and ETFs online when it’s possible to invest in stocks online for free.

Some of the firms that advertise “get started with just $5” can charge you huge fees as a percentage of what you invest. Truth is, we saw some really dishonest financial advisors charging thousands!

We can offer this: everything held equal, the less you pay in fees, the better your returns.

Where to find stocks online for free

Gratefully, we live in the 21st century, and there’s never been a better time to be a small investor.

For 95% of people, that’s fine. For those who want to buy individual stocks, there are still places that allow you to buy stocks online for free.

You have only a few ways to buy stocks online for free.

Thanks to developing technology investing is cheaper. More and more companies are lowering their fees and commissions.

It is possible that they will continue with costs reducing in the coming years due to competition. So, it’s reasonable to expect the cost will drop more.

Fees don’t have to stop you from making wise and lucrative investments.

And now, in today’s mobile world, investing is becoming easier and cheaper than ever. Buying and selling stock investments is not as easy as watching TV series but don’t worry it is not rocket science either.

Today you can enter your stock trades from stockbrokers websites for stock trading apps. It’s very convenient. Just read reviews of the best trading apps and you can find the best selection for you.

Some of them you can find on Traders Paradise’s Wall of fame, like E-trade, TD Ameritrade or Fidelity.

We can suggest you these 3 the best stock trading apps for beginners.

-

TD Ameritrade

It is the best for ETF trades. You’ve probably discovered Exchange Traded Funds (ETFs) and you want to cut fees, but you want to maintain a well-diversified portfolio.

ETFs maintain a tax-advantaged structure. They usually offer lower fees than comparable mutual funds. But, most brokerages charge you to buy and sell ETFs. Well, this broker, TD Ameritrade, don’t do so.

TD Ameritrade offers over 100 commission-free ETFs from industry giants iShares, Vanguard, and even more. Because of the diversity of no-load ETF funds, TD Ameritrade is, in Traders Paradise’s opinion, top broker for the people who want to consider tax-loss harvesting on their own.

Moreover, TD Ameritrade also has no minimum and no maintenance fee IRAs.

TD Ameritrade’s mobile app also offers research, information, and portfolio analysis that makes free investing that easier. But we have to say, TD Ameritrade charges for some ETFs, mutual funds, and equity trades. Our suggestion is, filter for no-load ETFs before you buy.

TD Ameritrade has about 4,120 no-fee funds.

-

E-trade

This broker offers thousands of mutual funds with no transaction costs.

Mutual funds are the old-school ETF similar principle from the diversification angle. Like ETFs, they hold many individual investments. Hence, investors get some level of diversification in a single fund.

Unlike ETFs, they are priced, they aren’t traded with a commission but with a transaction fee charged by the broker. That’s because they are bought and sold at the end of each trading day.

That fee can be pretty big, sometimes almost $50. But many brokers have a list of no-transaction-fee funds.

Of those that do, E-Trade put up the best showing, with about 4,440 and 4,350, respectively. This is why this broker tops our list of best mutual fund providers. That means you can buy funds on those lists with no charge. Though as with ETFs, investors in these funds will pay expense ratios.

-

Fidelity

It is the best for Free ETF Trades & No Minimum IRA. Fidelity allows you to invest for free. This is surprising for most people because most people don’t connect Fidelity with “free”. But, Fidelity offers a range of commission-free ETFs. That allows the majority of investors to build a balanced portfolio.

Fidelity IRAs have no minimum to open, and no account maintenance fees. Let’s say, you could deposit just $5, and invest it for free. That makes this a much better deal compared to some other companies. Furthermore, Fidelity just announced that it now has two 0.00% expense ratio funds. And yes, they are free.

So, you can not only invest commission-free, but these funds don’t charge any management fees. This is truly free investing. But to make it a prime app, it has to have a great app, and Fidelity has it. Fidelity has a great app, so that makes them the top broker.

Fidelity’s app is the easiest to use out of all of the investing apps we’ve tested. All their features work brilliantly together, and they have tones of them. Plus, they are the all-in-one option. With them, you have a full service investing broker. And that is more than just free.

Why invest in stocks online for free

Investing in stocks is supposed to be about building wealth. Well, paying trading commissions can slow your progress..Small fees on stock trades might not seem like a big deal. Most online brokers charge $10 or less for each transaction. But keep in mind that’s per transaction. If you are just starting out as an investor, or if you have only small amounts to invest, even a small fee can take a big bite out of your profits.

But now, you know how you can invest in stocks online for free.

Is it possible to buy stocks without a broker? Why shouldn’t be? Here is how to do that.

Is it possible to buy stocks without a broker? Why shouldn’t be? Here is how to do that.

Blue-chip stocks are popular because they can provide a safer position during economic downturns.

Blue-chip stocks are popular because they can provide a safer position during economic downturns.

How to Forex investing? It isn’t a get-rich-quick scheme but it is full of potential to become wealthy

How to Forex investing? It isn’t a get-rich-quick scheme but it is full of potential to become wealthy

Image from shutterstock.com

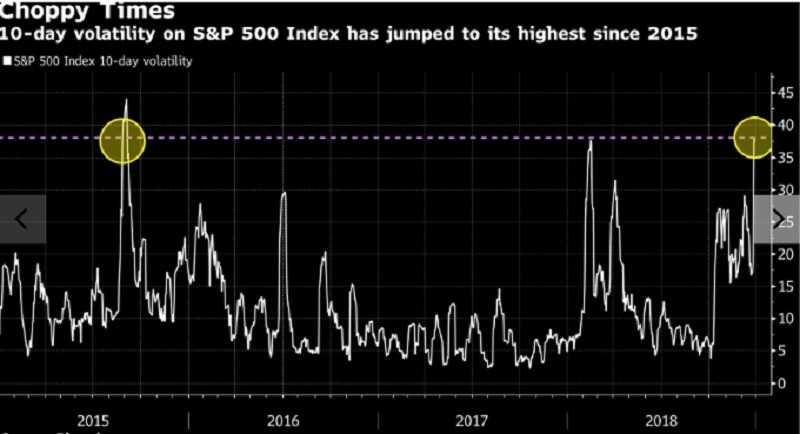

Image from shutterstock.com Source: Bloomberg

Source: Bloomberg

How can we apply artificial intelligence to the financial markets

How can we apply artificial intelligence to the financial markets