3 min read

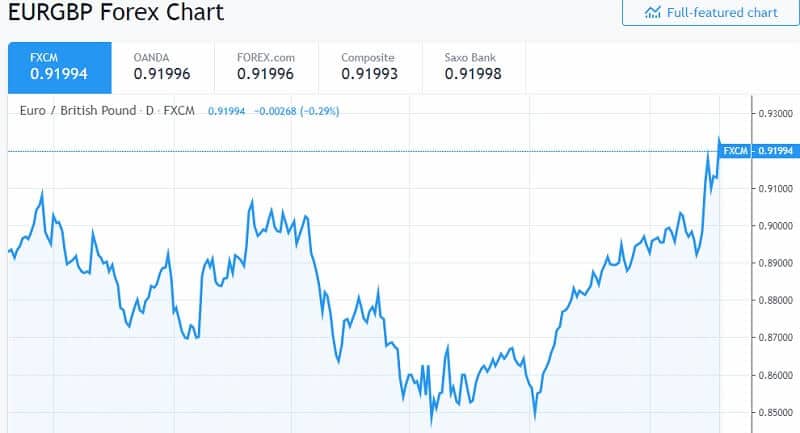

- GBP reached a record low against the Euro.

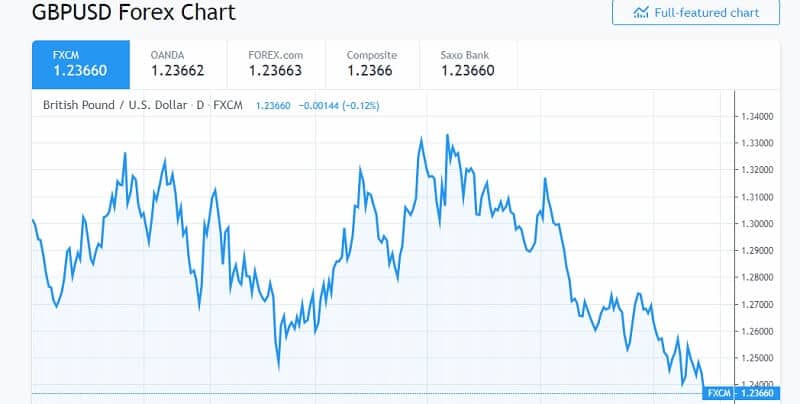

- Pond falls against the US dollar too.

Boris Johnson, the new UK Prime minister refused to reconsider his threat to leave the European Union with “no-deal Brexit”. This decision already has a negative influence on the pound and pound falls.

GBP reached a record low against the Euro.

But the pound falls and GBP is under great pressure according to latest reports. It fell against the US dollar too.

The pound-to-euro exchange rate is quoted at 1.0853, the pound-to-dollar exchange rate at 1.2161. This level wasn’t noticed since October 2016. The date when former Prime Minister Theresa May declared her plan to trigger divorce from the EU. It is a clear sign that sterling fell to an almost-three-year low as no-deal Brexit worries rise. And now, pound falls more.

Johnson “isn’t bluffing”

The ‘no deal’ Brexit will happen on October 31. The reports came after a meeting on Monday between European Commission officials and Brexit diplomats.

The Guardian and The Telegraph cited unnamed EU diplomat who said that “no deal’ Brexit appears to be the UK government’s “central scenario”. Both media reported the EU is taking this situation as “[their] working hypothesis is ‘no deal’.”

The investors are worried about Johnson’s stance. His “no-deal Brexit” thinking isn’t a good signal for them. Rehan Ansari, the currency expert at Caxton FX, commented for Express.co.uk the current exchange rate developments.

“The data, however, was not enough to get the Pound off the back foot. GBPEUR printed a new low at 1.0819, a level not seen since August 2017,” pointing out that “any volatility will likely be influenced by politics”.

The market expectations

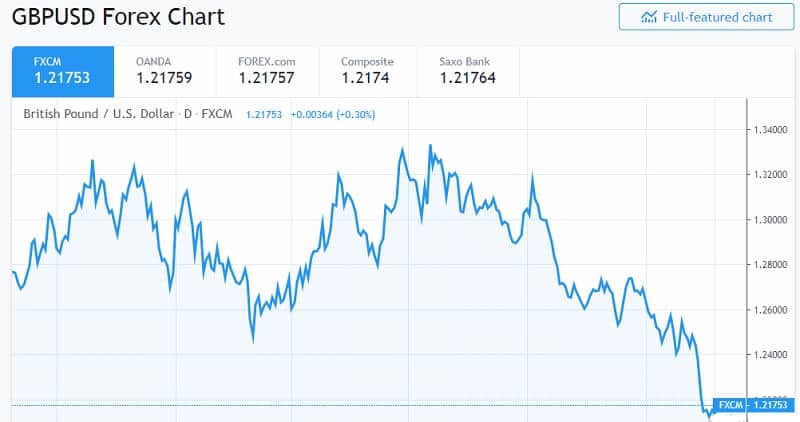

The market expects a ‘no deal’ Brexit scenario, it is obvious. The forex strategists are seeking to set the levels that the British pound might be aiming. Some of them gave some numbers and found an alternative answer. Forex strategist Jordan Rochester said the GBP will settle at “hard Brexit equilibrium”. This is recognized as the level where the UK’s accounts would begin to balance themselves.

The main issue for the UK is that it is reaching a historically high deficit. In the first quarter of this year, it was at -5.6% of GDP. The consequence is that the UK imports goods and services more than it exports. That is an outflow of currency.

But there are some optimistic opinions. For example, Robert Halfon, a conservative politician, has faith that the drop of the pound will give more profit to exporters and boost British tourism.

“Hopefully holidaymakers will choose GB as a holiday destination,” he stated. Britons think it would be nice if it would be the truth. The truth is that leaving the EU may have a bad influence on the UK economy and national currency. But there is almost no chance for that to happen, as it is evident from Bank of England’s predictions of 1-in-3 chances for post-Brexit recession.

Clearly Departing

Johnson said many times that he’ll lead the UK out of the EU on Oct. 31. With or without a deal. Moreover, he has directed government departments to develop the plans for this divorce from the EU until the Halloween deadline. Johnson personally is going all over the country searching for wider support for his plans.

“If they can’t compromise, if they really can’t do it, then clearly we have to get ready for a no-deal exit, and I think we’ll do it,” Johnson said. “It’s up to the EU, it’s their call.”

The investors’ concerns

If the UK leaves the EU with a ‘no deal’ the country could be faced with dry-out of investment capital. The investors are cautious, and they could leave the pound ‘high and dry’.

The UK internal capital depends on outside capital. But the balance may be established. If pound drops more that would decrease the incentives to import. At the same time, it would increase the incentives for export. Hence, achieving a balance.

The pound falls as markets raise expectations of the new political risks and a ‘no deal’ Brexit on October 31.