You don’t need to be an excellent asset picker to build your wealth. Just avoid get-rich-quickly schemes.

By Guy Avtalyon

How to choose an asset? Don’t pick only one, or form the same asset class, mix them.

The main asset classes are:

- a) Shares/stocks (also known as equities).

- b) Bonds (also known as fixed-interest stocks or debt).

- c) Property.

- d) Commodities.

- e) Cash and cash equivalents.

What are the best assets to invest in?

(the return criteria is based off trying to generate $10,000 a year in passive income)

1) Certificates of Deposit (CDs).

2) Fixed Income / Bonds.

3) Physical Real Estate.

4) Peer-to-Peer Lending (P2P)

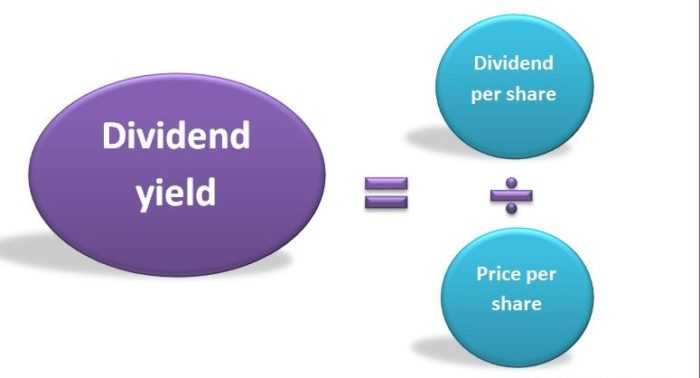

5) Dividend Investing.

6) Private Equity Investing.

7) Creating Your Own Products.

8) Real Estate Crowdsourcing.

Decide which asset to invest among these

Let’s say like this, investing is about laying out money today expecting to get more money back in the future. This is best achieved by acquiring productive assets. Productive assets are investments that internally throw off surplus money from some sort of activity. To be clear, if you buy a painting, it isn’t a productive asset. After 200 years you’ll still own the painting, which may or may not be worth more or less money. But, if you buy an apartment building you’ll not only have the building but all of the cash it produced from rent over that century.

How to choose an asset suitable for you?

First of all, never invest all your money into one asset. You should mix them. The right asset mix should help balance risk with your expected rate of return on your investments, fit your tolerance for risk, let you get your money when you need it, help provide the growth you need to reach your goals, and change as your needs and goals change over time. When you know all of these you’ll know how to choose an asset to invest in.

- Shares (also known as equities) – Shares are bought through a stockbroker. The easiest way to buy or sell shares is through an online broker. Some execution-only is maybe the best choice. Execution-only indicates the broker will take your order and execute it without giving you any advice. Many execution-only brokers provide lots of information and research about shares but this does not include advice. So, if you want to use some service like this one you’ll have to take full responsibility for your investment. If you do need advice you’ll have to find a stockbroker offering either an advisory or discretionary service. With a discretionary service, you authorize the broker to buy and sell shares on your behalf, but you’ll have to pre-arrange the limits. If you choose an advisory service, the broker will need your permission before taking any action regarding your trade.

- Bonds (also known as fixed-interest stocks). These represent a form of IOU issued by governments and companies when they want to borrow money from investors. They pay a fixed level of interest, with higher-risk borrowers paying more in interest than lower-risk borrowers.

- Property. The property has a good record in providing a financial return that beats inflation, no matter residential or commercial it is. As an investor, you can buy shares in property development or real estate investment companies. Also, you can buy real ‘bricks and mortar’. Funds generally focus on commercial property, but some buy into the residential property as well.

- Commodities. You can find a huge variety of commodities traded on global markets: oil and gas; precious metals such as gold and silver; industrial metals such as copper and iron; and ‘soft’ agricultural commodities such as wheat, rice, and soya. It is almost the same as shares and bonds. Commodity prices can rise and fall in answer to supply and demand

- Cash. It may be a bit strange that cash is considered to be an asset class because the whole reason for investing in the first place is to grow your money faster than if it was left in the bank. But you must have in your mind that cash provides a useful benchmark for all the investment. Finally, investments that don’t beat cash have failed. Cash also provides a safe shelter for funds when markets are bumpy or overvalued. For example, some funds trade in currencies to increase their returns from cash in periods the interest rates are low.

Being a skillful asset picker isn’t actually necessary to grow your capital. Many people get in trouble particularly when they think of investing as a way to get rich quickly.

Your path to success as an investor or trader is not likely to hinge on whatever hot stock your friend thinks you should buy ASAP. Your success depends more on how smart a portfolio you put together, as well as how you progressively modify or rebalance it over time. And also, knowing how to choose an asset that will generate you nice returns.

Well, how do you invest intelligently, if slowly? You have to respect some basic principles.

Why do you want to start investing?

The main argument for putting your money in anything is to avoid losing your wealth during inflation. In your checking account, cash will still be there in 40 years, if you don’t touch any of it. But you won’t be able to buy anything.

Other crucial reasons might include growing substantial enough savings for retirement and earn enough cash for buying a home. For those kinds of goals, you might want assets with higher returns and therefore you’ll have to take on higher risk.

Also, the very important question is when should you begin investing?

You might already know, but you need to be investing in old age. If you start investing in your early ages you will have many advantages as an investor. Just to name a two: you have more time for your money to grow and more time for market downturns to correct themselves.

How to choose an asset?

Each type of productive asset has its own characteristics and pros and cons. Here is a quick rundown of some of the potential investments you might make as you start your journey:

Business Equity – If you own equity in a business, you are qualified to a share of the profit or losses caused by a company’s activity. Whether you are acquiring a small business completely or buying shares through the purchase of stock on the stock market. Business equity has historically been the most rewarding asset class for investors. It is wise to observe that a good business is a gift that keeps on giving.

Fixed Income Securities – When you buy fixed-income security, you are really lending money to the bond issuer in exchange for interest income. There are billions of ways you can do it, from buying certificates of deposit and money markets to corporate bonds, tax-free municipal bonds, etc.

Real Estate – This is maybe the oldest and most easily understood asset class that you as investors may think about. There are several ways to make money investing in real estate but it typically comes with developing a property and selling it for a profit or owning something and letting others use it in exchange for rent.

Intangible Property and Rights – When it is done properly you can create things out of the air that goes on to print money for you. Adorable! Intangible property includes everything from trademarks and patents to music royalties and copyrights.

Farmland or Other Commodity-Producing Goods – It often involves real estate. Investments in commodity-producing activities are fundamentally different in that you are either producing or extracting something from the ground or nature for what you hope is a profit. For instance, if oil is discovered on your land, you can extract it and earn money from the sales. If you grow wheat, you can sell it and earn cash under any weather. But the risks are remarkable: hail, flood, drought can and have caused folks to go bankrupt by investing in this asset class. But also it can make big rewards.

That is exactly how to choose an asset to invest in.