1 min read

Russell 2000 – That is going to say, we’re about the way to a bear market.

Russell 2000 is pushed into the Bear territory by growth fears!

Looks like the Bear Market is already here.

What happened?

Small American stocks have tumbled into a big hole, reflecting mounting slowdown fears on Wall Street, reported CNN.

The Russell 2000 fell into the hole, in the middle of a wave of selling. The major market indexes are in red.

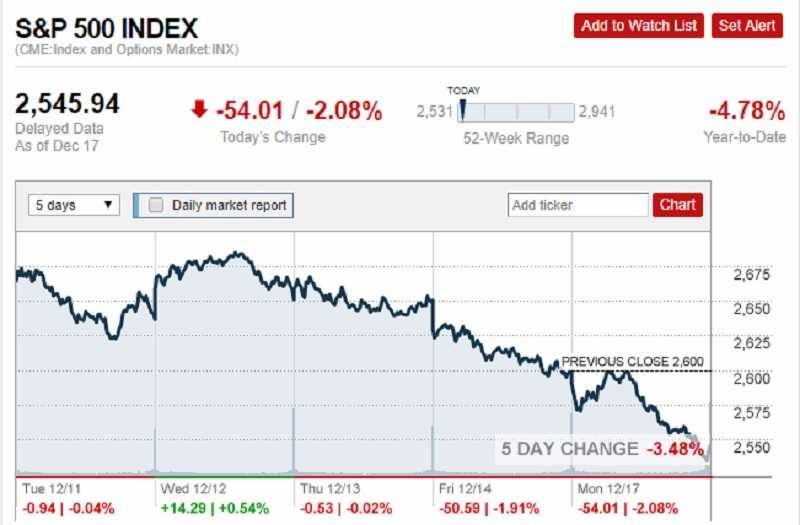

The DJIA, S&P 500 and Nasdaq are all well into correction territory. They are down more than ten percent from their previous highs.

Russell 2000 – Market indexes are red!

The Russell 2000 index of small-cap stocks dived into a bear market on Monday. It happened after a 20% decline since hitting a record high in late August.

That marks the first bear market for the index since the downturn that spanned June 2015 to February 2016, according to Bespoke Investment Group.

The media’s conclude that investors are scared by the Federal Reserve rate hike.

“Investors are showing real caution about the pace of economic growth for the US next year,” said Nicholas Colas, co-founder of DataTrek Research. “Confidence is falling,” added he for CNN.

The index contains 2,000 smaller companies that do little business overseas. As such making them highly exposed to swings in the domestic economy.

The index is viewed as a barometer for confidence in American growth.

Small-cap stocks sometimes lead the broader market. That’s the reason for making a Russell 2000 bear market a potentially ominous event.

It’s the fear of a recession and that is very real.

How the Fed made this situation as real?

The Fed’s job is monetary policy. They have to keep unemployment low and inflation under control.

Trade war worries

About 40% of the debt held by Russell 2000 companies is floating-rate, according to Peter Boockvar, chief investment officer at Bleakley Advisory Group. The cost to service that debt has climbed in tandem with the Fed’s two-year of raising interest rates.

“That’s potential stress if growth is slowing in the United States, which the markets are betting on,” said Boockvar.

Moreover, about one-third of Russell 2000 companies are unprofitable.

That number could rise if the US economy gets stuck.

It looks that the odds of a US recession over the next 12 months have climbed to about 30%. That would be the highest level during the nine-year economic expansion.

The Russell 2000 climbed 13% last year. The investors bet that US-focused companies would avoid getting caught in the middle of trade wars. Multinational companies like Nike (NKE), Apple (AAPL) and Boeing (BA) dominate the S&P 500 and Dow.

This was a safe haven. But it ended up being a very crowded trade. And everyone knows what happens to a crowded trade when the tide goes out.

The idea that smaller companies would avoid the fallout of the crackdown on trade was flawed. Now it is obvious.

The reason is that Small-cap stocks do business with big-cap stocks.

Markets were in the midst of the longest bull market in American history. This began in March 2009. But the bull has been stumbling pretty badly of late, leading some analysts to investors to wonder whether this is the start of a bear market.

It is commonly measured by a 20% fall from a previous peak.

After a brutal decline in US stocks in October, both the S&P 500 and Dow Jones Industrial Average slipped into the red for the year. That caused erasing all the gains made in 2018.

The benchmark S&P 500 has fallen more than 9% from it’s the all-time peak at the same time. So, stocks continue to slide.

That is going to say, we’re about the way to a bear market.

Risk Disclosure (read carefully!)

Leave a Reply