By Guy Avtalyon

The dividend yields are metric. For every single investor, the most important question is ‘How much money can I make’. At least, the reason to buy a stock or bond or ETF is to make money. It is important to understand what people mean when they talk about yield, return, and types of both. Investors have several ways to measure the money they expect to get, Depending on their investment strategies, investors have several ways to measure the money they expect to get. Managing risk is important.

What produces the dividend yields?

Yield is the earnings you can make with an investment in a period of time. It’s the cash you get from making the loan. For example, you loan a friend $1,000 for a year. And your friend agrees to pay you back that $1,000 in twelve months, as well as $10 a month. For that loan, you’ll get back the principal as well as an extra $120.

That means you’ll end up with 12% more money at the end of the year than you started with. This is easy to understand with loans and it’s similar to bonds, where the bond rate and payout periods determine what kind of money you get back and how often you’re paid.

Do bonds give yields?

But bonds are a little bit more complicated than loans because you can buy them from other investors. But the yield falls as the price rises because the yield depends on both the interest rate and the price you paid.

Let’s say someone else bought the loan to your friend for $1100 and the 12% interest rate stayed the same, they’d only get $20 for the year, or 1.82% interest. That’s a different yield from 12%, don’t you think.

What determines the yields?

The yield depends on both the interest rate and the price you paid. If you want a higher yield, you either need to earn more money from your investment every month or pay a lower price for the investment.

Hence, there are different types of yield you can measure. But, you must know how stocks produce yield, for this to make sense.

Do stocks give yields?

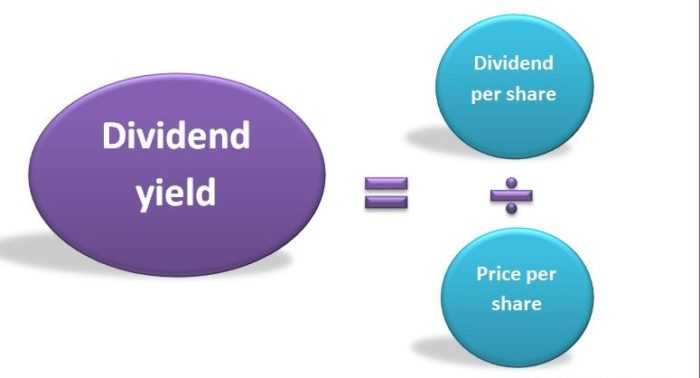

Stocks don’t pay interest, but stocks may pay dividends. The dividend yield is easy to compare to other investments if you know what you paid for a stock. The problem is you can’t measure what everyone else paid for it. There are more possible to see the current yield of a stock, which divides the annual dividend payout with the current price of the stock.

How to find dividend yields?

If you want a regular cash income from your stock portfolio, you’ll have to understand dividend yield. The dividend yield is a pivotal metric that enables investors to analyze stocks. According to stock capability to generate dividends traders are trading them at many higher prices. To define dividend yield, you’ll need to know the total of a stock’s dividend payments per year and the current stock price.

To calculate dividend yield you’ll have to add all the dividends paid per common share over the last year. Further, divide this amount by the current price. Then, multiply this result by 100 to discover the yield.

For example, if the stock trades at $10 per share, the dividend yield is $0.70 divided by $10 and times 100, which is 7%.

That would mean that for every $100 you invest in this stock, you receive income of $7 per year. Compare dividend yields of different stocks, and you’ll find the best investment choice.

What is the difference between dividend yields and returns?

But, not all stocks pay dividends. You might earn a great return that never pays you a penny. But it is possible you’ll get money from selling a share for more than you paid for it. The same goes for bonds.

Slowly, that combination of the profit you made from the sale plus any dividends you’ve received makes up your total return. Exactly as with yield, the price you paid is the most important factor in your return.

But notice that there is one more essential difference between yield and return.

The yield looks to the future.

What can you earn in a year, what dividends will you receive, what interest payments will you get? These are predictable, depending on the risk of the investment of course.

Return looks to the past.

It includes interest or dividend payments, but it also depends on the price at which you sold your investment.

What to maximize yield or return?

The real goal of understanding yield and return is to compare how similar investments meet your investing goals. Any investment that returns money to you, produce regular income. If you can live from the incomes of your investments, that can be a great modus operandi.

But if you want to build real wealth and you have enough for a long-term investment, total return is more important. But never ignore yield because it can be a great way to make better your returns. Pay attention to yield but look for good returns from share price realization as well.

Whatever, being careful about the price you pay for investment will help you improve your yields and total returns.

Leave a Reply