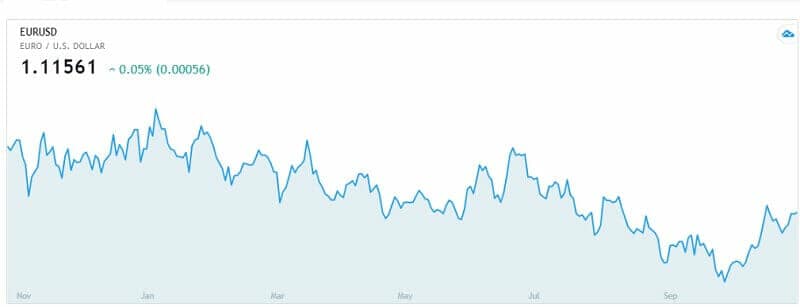

EUR/USD is by far the most important and liquid pair

The dollar index closed yesterday’s trading session in the red zone. The Fed cut its main interest rate range by 25 basis points. The central banks of Canada and Japan held the essential marks of monetary policy at the same level. The release of important economic reports is expected.

Sterling stays good this week and it is possible to have another run at 1.3000 against the US dollar.

The EUR/USD pair is sitting moderately higher on the day at around 1.1160 levels. It is similar to where it was traded on Thursday during the European morning.

Prev Open: 1.11528

Open: 1.11517

Day’s range: 1.11487 – 1.11688

52 wk range: 1.0884 – 1.1623

While buyers are looking to place more upside control with near-term resistance, closer to 1.1179, the important level to look out for will be the 200-day MA 1.1196 and also the offers holding near 1.1200.

Traders are currently 51% net-short GBPUSD.

But wait for the US jobs report later at 1230 GMT.

Buyers are keeping near-term control since the FOMC meeting concluded but unless they can break the resistance levels above, sellers will look to drive the price back lower in the future sessions.

For now, large expiries are seen resting at 1.1150 and 1.1200 so that may factor into keeping the price within a more stingy range before they roll off later today.

The dollar was lower this morning but now losses are seen.

Sterling is good, majors have stabilized. Investors are waiting to see the publication of the US labor market report for October. That could have an important influence on the rate of adjustment of the Fed’s monetary policy. Current economic statements from the United States have been combined. Experts expect a decline in key indicators of the labor market. Presently, the local support and resistance levels on the EUR/USD currency pair are 1.11400 and 1.11750. We suggest opening positions from these marks.

Leave a Reply