2 min read

by Gorica Gligorijevic

After assuming the office of UK Prime Minister, Boris Johnson is pushing with preparations for eventual no-deal divorce from EU on October 31. The news caused a negative impact on the British pound.

Some people would say that it was the writing on the wall, but actual writing in the Sunday Times brings confirmation that things are afoot. Things and plans which previous UK PM, Theresa May, not only avoided but actively suppressed and fought against. The UK is getting prepared for the potential no-deal Brexit.

After a reshuffle of his Cabinet, in which Leavers have remained and Remainers have left, PM Johnson has appointed Michael Gove to mistrial position of the Chancellor of the Duchy of Lancaster and charged him with preparations for the no-deal exit from the EU. Gove has laid out his intentions in the op-ed in the Sunday Times July 28 edition.

“With a new prime minister, a new government, and a new clarity of mission, we will exit the EU on October 31st. No ifs. No buts. No more delay. Brexit is happening,” he wrote. With the leaders of EU determined to keep to their current approach to the Brexit, Gove is certain that “no-deal is a very real prospect” and that the UK government is now operating under such assumption.

Chancellor of the Exchequer, Sajid Javid, in his op-ed in the Sunday Telegraph has announced additional funding in excess of £1 billion pounds, on top of the £4.2 promised by the previous PM after the 2016 Referendum.

“Yes, we want to leave with a good deal – one that abolishes the undemocratic backstop,” Javid wrote in The Sunday Telegraph. “That would be better for the UK, and better for the EU, and work is already underway to achieve this.”

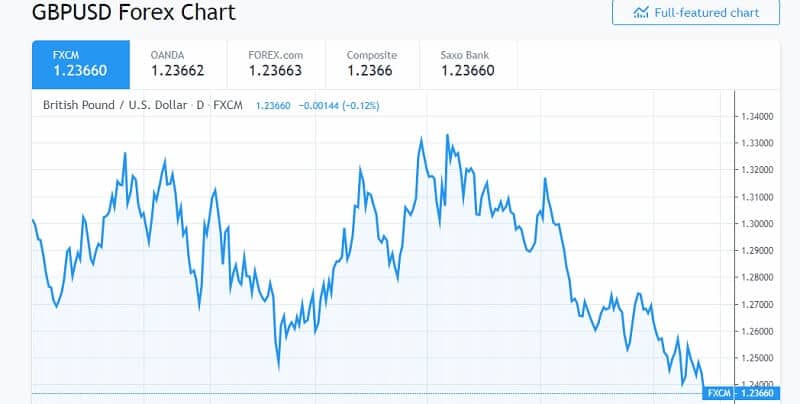

The British pound continues the slide

Despite this news, the British pound is taking the hit against the US dollar. Having fallen to the 1.2375 parity, lowest since April 2017, the pound has slid almost 17% against the USD.

And despite all the sterling effort, the UK government might put in staving off the worst outcome of Brexit, the outlook for the pound is not promising. With the Office of Budget Responsibility fiscal stress test predicting a year-long recession after Brexit, the pound is looking to continue the slide.

Downturn which may easily reach the 25% drop versus the dollar since 2016 Referendum, as predicted by the Bank of England in the worst-case scenario of no-deal Brexit.

The GBP/USD pair erased more than 100 pips for the week. It is very possible to start this week with gaping lower.

Support levels: 1.2375 1.2330 1.2290

Resistance levels: 1.2420 1.2460 1.2505

Leave a Reply