Square, the fintech company has the same chief executive as Twitter, Jack Dorsey. Does SQ stock have another big run in store for investors?

By Guy Avtalyon

The Square stock had a big drop back in August and it isn’t recovered yet. And as always it happened, traders who panicked started to sell, that caused individual investors to sell too. Since the drop in August and also, after the Q2 announcement the Square stock price held steady.

This was a rocky year for Square stock. At the beginning of this year, the price grew, but the last quarter was disappointing for investors. The Square stock fell 25% during the past 3 months. But as far as we know, it could be a great opportunity to buy them.

That decision depends on personal estimation on whether the stock is a chance today or it is at the risk of further dropping.

The quarterly result expected to be released in November could be very important. The expectations among investors are lower this time but Square is still under pressure to reach its corrected estimates. If the company show increasing earnings that would be helpful for stock to rise. Analysts are expecting $597.5 million in Q3 revenue. Could they be wrong?

Square’s revenue in the second quarter was higher by 46%. The company was generating $1.17 billion in revenue. So, we can say that this company is making money.

Surprisingly low guidance is what pulled the Square stock price down in the last quarter. So, the Q3 report could be a nice surprise in a positive meaning. Well, you have to know that sometimes the companies depress expectations to provide a space for recovery.

Why to by Square stock

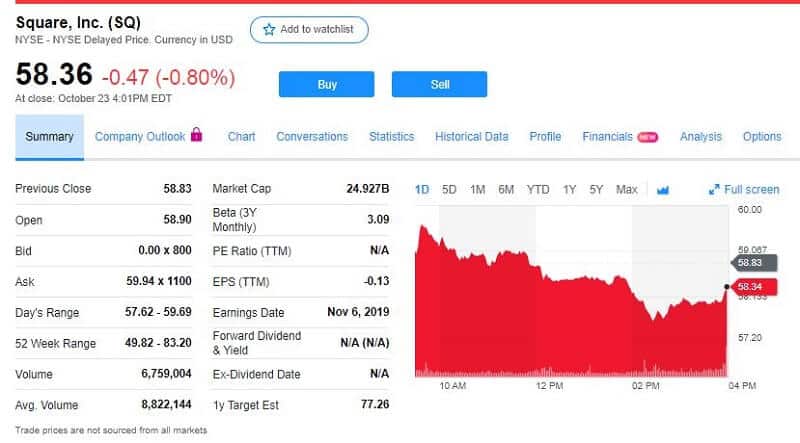

Square shares are currently traded at $58.36 (the closing price on Wednesday, October, 23) which is a depressed price. The coming earnings announcement easily could put the stock price higher.

So, what we know from the past is – buy low, sell high. Having this in mind, this is the right time to buy Square stocks.

The field in which Square could happen future extension is in the cannabis industry. Square’s service is open for companies selling hemp-derived CBD products legalized under the Farm Bill. As we know the cannabis industry will grow more and more. So, that is a great potential for the company and investors too.

Only the U.S. market is worth as much as $6 billion by 2025.

Also, there is the company’s Cash App. Over the past 3 months, they had a great increase in users and activities. So big that the company had sales growth of 44%. This phone Cash App is a great potential for getting more customers and gain more profit.

Someone may say that the stock is too expensive. Yes, $58.36 isn’t cheap but it is lower than previously. But this is a fast-growing high-tech company. Keep in mind that Square’s extension isn’t done. There is still a lot of potential for developing. For long-term investors, it is a good choice. At least, it is always better to buy now before its recovery and watch how it is growing in the future. Square stock ranks among the top 10 fintech companies. It’s not unusual for big winners like SQ stock to improve more than 50% after scoring a huge run

Leave a Reply