Value investing is profitable and could generate huge returns if done well.

By Guy Avtalyon

Value investing is an investment strategy where stocks selected that trade for less than their intrinsic values. But that explanation packs a lot of nuance in a few words.

Value investors usually seek stocks they believe the market has undervalued. Investors believe the market overreacts to good and bad news. And that stock price movements do not match with a company’s long-term fundamentals. That gives to investors an opportunity to profit when the price is deflated.

With these types of investments, you don’t make fast money, but if the investment is right it will eventually blow up and early investors may get their reward.

When this style arose?

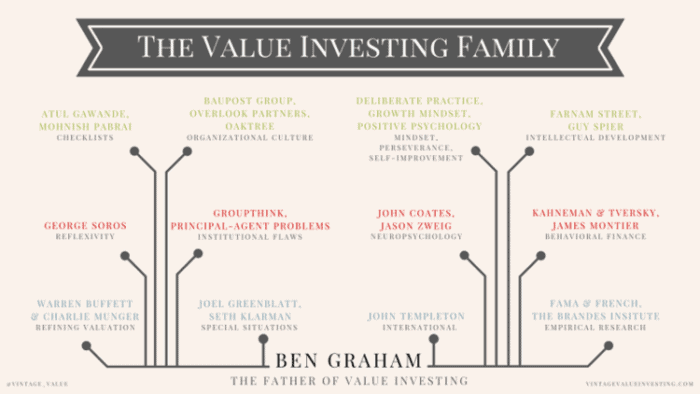

In the early 1930s, Ben Graham at Columbia University developed this style of investing. He is the author of “The Intelligent Investor” from 1947.

Graham thought it is difficult for the average investor to beat the market. So he developed the concept of intrinsic value.

But he never fully defined it. Later, he admitted that the value was ultimately determined by the investor’s beliefs.

What is value investing?

This strategy involves the three-step process. But most people believe the process has only the first step.

So, let’s see.

The very First step. – Screen stocks based on price-to-earnings (P/E), price-to-book (P/B), or other valuation-related metrics. In order to identify possibly undervalued stocks.

The second step. – You have to evaluate the low P/E or P/B stocks to determine their intrinsic value.

And the third step. – Make an investment decision. Buy only if the stock price is below the intrinsic value by a predetermined margin of safety (normally around 30%).

Value investors are very careful of valuation risk.

They are bottom-up stock pickers, with a long-term perspective. Value investing is all about concentrating a portfolio on a few, selected, undervalued stocks. Diversification does not matter much. The margin of safety helps identify a stock as truly undervalued. But also, protects the downside and controls for risk.

What is important for value investing?

Before deciding if this investing strategy suitable for you not, you have to find the answers to several questions. They are very important when estimating is some stock suitable as value investing.

What does the underlying business do?

What type of return are you looking for?

Does it have competitive advantages and which?

How much money can it generate over the next several years?

Which the underlying business is actually worth?

What’s the current price of the business relative to your aspired return on investment?

How likely are you to be wrong evaluating the business?

That seems like a lot of questions. But they’re fundamentally liable like the other investment strategies are not. It isn’t necessary to predict what other investors are doing or thinking in the short term.

For value investors, it is important to realize the stock is currently underpriced. Some people believe the stock market is financial mumbo-jumbo, where success is a kind of lottery. People very often ask this one single question: “Isn’t the average investor set to fail?”

I believe the contrary, I believe that you can succeed.

Value investing has to find great and successful businesses, the ones that bring a chance to purchasers. So they can make fair profits. They earn solid incomes. These are companies anyone would want to own because they produce real money for their owners. When some investor buys shares of these companies, she or he owns a small part of their business. Value investors buy shares in companies that have demonstrated that they can and will continue to succeed.

What is the value investing strategies?

The most popular value-investing method is the discounted cash flow analysis.

That’s how investors try to determine a company’s financial future. The next step is to discount the future cash flows based on a preferred discount rate. The rate is determined by the weighted average cost of capital or short WACC. Also, the weighted average between the cost of equity and the cost of debt is one of the measures.

There are comparable versions of this analysis that tries to determine intrinsic value from other cash flow. It is the dividend discount model. Its focus is on dividend payouts as one of the reliable cash flows, free cash flow isn’t so important to these analysts.

The point of all these methods is to find the net current value of a stock. In other words, they want to find what the company is worth when all future cash flows are discounted at a determined rate.

Also, there are other methods for finding undervalued stocks, for example, so-called asset play. Investors try to find out companies that have valuable assets, for example, land or intellectual property that isn’t accurately visible on its balance sheet or in its market price. Sometimes assets like patents are considered very valuable.

These value investing strategies have clearly been successful for famous investors. But there are drawbacks to value investing.

Probably the biggest one is that it creates a blind spot for fast-growing startups. That may not yet be profitable but sometimes it turns into blockbuster investments.

Is this strategy right for you?

Value investing can be very profitable and could generate huge returns if done adequately.

Your decision to invest for value may depend most on your investing goals and your time horizon.

Value investing is an intelligent choice for some middle-age investor that looking for wealth safety and low-risk returns

Always keep in your mind, dividends-paying investment, and, at the same time, profitable and high in value will provide you better profits. So, it’s almost impossible to experience great losses.

By finding undervalued stocks with the potential to grow you’ll have better chances to outperform the market.

Value investing is a smart component to include in any diversified portfolio as a mix of value and growth stocks. It can help investors get access to big winners.

Anyway, diversification is one of the best ways to reduce the overall portfolio risk but without losing out on returns.

Also, there is the compound interest. With its power, value stocks will generate income over the long term. Add dividend payments since many of these companies offer regular dividends.

But if you’re a younger investor, growth stocks could be a better pick for your investment portfolio.

But for any investor, choosing undervalued stocks is a proven way to beat the market.

Leave a Reply