2 min read

A body advising ECB has warned the European Central Bank to be prepared to end Eonia interest rate benchmark. Eonia is currently used to price more than €24tn of derivatives, loans, and bonds, a body advising the European Central Bank has warned.

To prevent markets to become more confusing and legal conflicting, it is necessary to shift away from the Eonia interest rate benchmark. That stated the head of the ECB’s working group supervising the transition for the Financial Times.

Eonia involved in scandals

Current interest rate benchmark Eonia caused plenty of scandals and market manipulations. The consequence is ruined confidence in how the current benchmark is calculated.

Instead of Eonia, the €STR (ester) benchmark will be placed from the beginning of October.

“I am worried about complacency among market participants, especially as regards the change in the timing of the publication of Eonia, which takes place already on October 2 and creates very significant operational challenges,” said Steven van Rijswijk, the chief risk officer at Dutch bank ING.

In July ECB Banking Supervision announced a letter to CEOs of important financial organizations about the global benchmark changes. That is mandated by FSB. The letter seeks insurance that companies’ senior managers and boards recognize the risks connected with the global benchmark changes. Also, it was asking them to take relevant steps to secure a stable change to alternative or reformed benchmark rates. All that before the deadline, previously settled for the end of 2021.

The ECB letter also pointed out that some modifications in the methodology for relevant benchmark rates will be added in October 2019.

In the financial crisis peaks, banks were punished billions of dollars.

Some bankers were sentenced for manipulating interest rate benchmarks like Libor, Euribor and Eonia. The majority of the benchmarks are replaced or completely restored.

Europe has already hesitated the Eonia replacement for several years. That’s why slowdowns in other countries like the US and UK in securing the shift. Along with switching to the new €STR standard, market participants would have to adapt to a timing change. The new transition rate will be published by the ECB at 9:15 am UK time not the prior evening as it was since now.

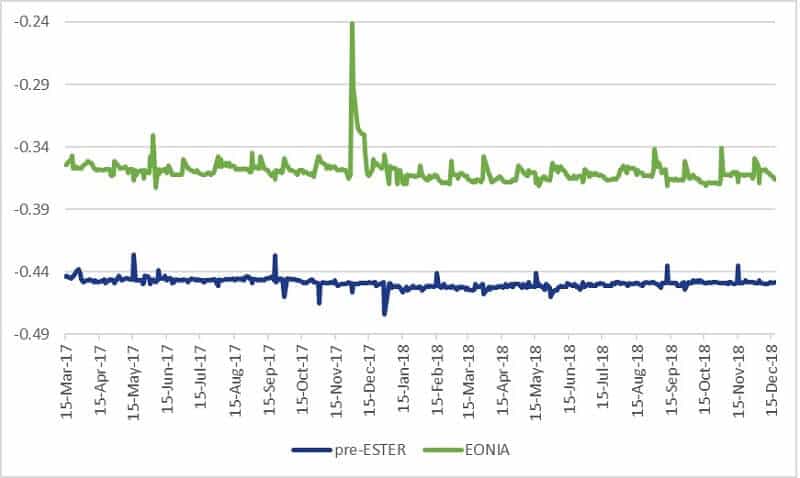

For the next two years, both €STR and the transition Eonia rate will be published alongside. Eonia will be totally removed at the start of 2022. The transition rate will be priced at an 8.5 basis point discount to Eonia.

The transition could influence the financial organizations for the value of derivatives and other products. The working group had written to the International Accounting Standards Board, which is supposed to decide on the case in the upcoming months.

“Millions of contracts need to be changed,” said Mr van Rijswijk. “That will cost quite a bit of money.” He calculated that institutions need to adjust their IT systems and correct data, procedures, and structures.

Leave a Reply