2 min read

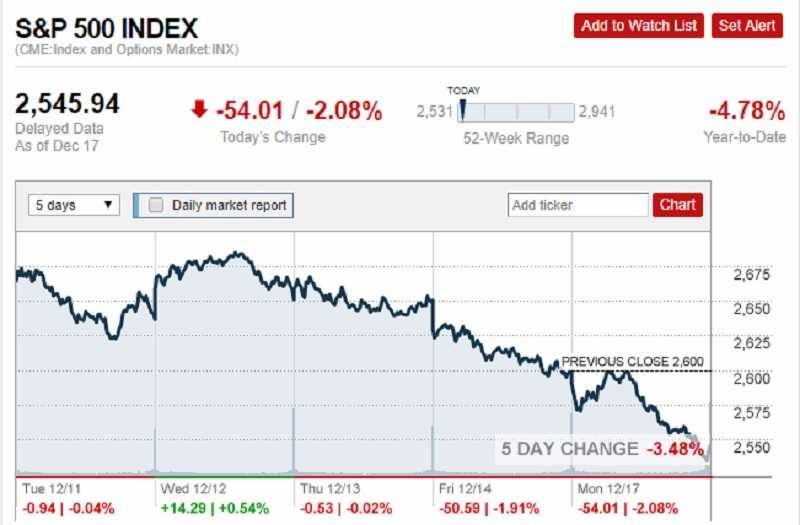

The bear market is here. Now is the time to focus on how bad this bear market can be. But also, how can you make a profit during the Bear market period. The questions exploded, and negative consequences are extensive and serious. But it isn’t impossible to make the profit over the bear market.

The investors and advisers are still focused on holding stocks. That means they are not prepared for the destructive emotions that come from this panic-crash.

How they could be when is the time of the bear market and their goal is to make the profit?

Hopefully, the market does not drop.

But there is a considerable risk now. Maybe the best philosophy is to be prepared for a disaster than to count that the worst will not happen.

Yes, we know. The Bear markets are brutal when they hit. That know any stock investor who was invested in stocks during 1973–1975, 2000–2002, or 2008.

The very first fact is that fortunately, bear markets tend to be much shorter than bull markets. If you’re properly diversified your portfolio, you can get through this period. And not to have much damage.

How?

If you are an agile investor, bear markets can provide opportunities to boost your portfolio. It can lay the base for long-term wealth.

Here are some ways to make bear markets very profitable.

First of all, don’t let yourself down, even when the market is down. Stay calm and focused.

The big truth is that in the bear market, the stocks of all companies tend to go down. Where is the catch? How to make some profit from this?

Bad stocks tend to stay down. Yes?

But good stocks tend to recover and back on the growth path.

So, the strategy is clear.

If the stock of a profitable company goes down, that is a buying opportunity.

Remember this!

Let’s say a few words about the second opportunity during the Bear market.

You have to look at the dividends! A dividend comes from a company’s net income. It is an important fact. Contrary, the stock’s price is determined by buying and selling in the stock market.

Say the some company’s stock price goes down but the company is strong yet, still earning a profit, and still paying a dividend.

It is a good opportunity for those seeking dividend income.

If you are one of them, you have to buy.

A bear market comes in tough economic times. It reveals who has too much debt to deal with. But also, who is doing a good job of managing their debt.

We are talking about the bond rating.

In this circumstance, the bond rating becomes valuable. The bond rating is a picture of a company’s creditworthiness.

The ratings of AAA, AA, and A are considered kind of investment-grade. The lower ratings are Bs or Cs.

A rating of AAA is the highest rating. This mark signifies that the agency believes that the company has achieved the highest level of creditworthiness. Therefore, it is the least risky to invest in.

If you find a stock whose company has a bond rating of AAA, that is good to buy!

Using ETFs with your stocks can be a good way to add diversification and use a sector rotation approach. Different sectors perform well during different times of the slump and flow of the economic or business cycle.

Do you remember the rule: Never put all eggs in one basket.

So, rotate your sector.

Bear markets are tough for good stocks. But they’re brutal to bad stocks.

When a bad stock goes down, it often goes into a more critical decline. Because more and more investors look into it and discover the company’s shaky finances.

What you have to do?

Short it?

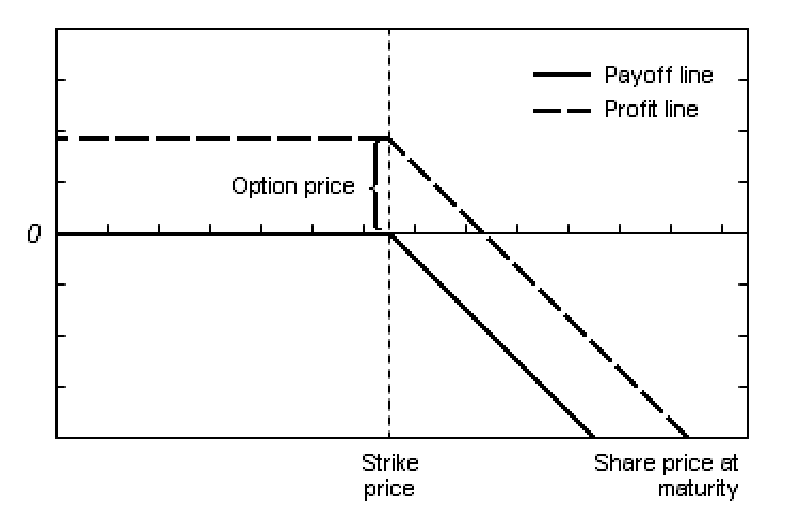

Going short is a risky way to bet on a stock going down. If you’re wrong and the stock goes up, you have the potential for unlimited losses.

A better way to speculate on a stock falling is to buy long-dated put options. That gives you the potential to profit if you’re right but limits your losses if you’re wrong.

During the bear market, you can make the profit by using the margin. It can be useful. Using the margin is wisely, it can be a powerful tool. The great tactic is o acquire dividend-paying stocks after they’ve corrected.

A margin is using borrowed funds from your broker to buy securities.

Keep in mind, you don’t like to use margin before the stock corrected or declined.

Using margin when the stock is high and it subsequently falls, can be dangerous. But using margin to buy the stock after a notable fall is less risky.

Buy call option if you want to make the profit during the bear market!

Well, it is about speculating, not investing. Remember, a call option is a derivative, and it has a finite shelf life; it can expire worthless if you’re not careful.

The good side of a call option is that it can be low-cost to buy. And it tends to be a very cheap vehicle at the bottom, when is a bear market. This is your chance!

If the stock price sink, but the company is in good condition, betting on a rebound can be profitable.

How can you still make the profit?

For example, you can write a covered call option. Also, you can write a put option to generate income.

But the most important is to stay calm when the bear market starts. That will provide you with more chances to make the profit.

If you don’t plan to retire ten years from now or even more, a bear market shouldn’t make you nervous.

Good stocks will survive bear markets. After that period, they’re ready for the next bull market.

So, try not to get quickly out of stock. If you want to make the profit on the bear market territory.

Just keep monitoring the company performance for growing sales and profits. If the company looks fine, then hang on. Keep collecting your dividend and hold the stock.

This bear market had a fairly recognizable trading picture. We had the opportunity to see it before.

So, be patient and take your advantages!

Risk Disclosure (read carefully!)

Leave a Reply