Take a big breath and a pencil.

2 min read

Everyone has dreams about how the good life should look like. But it, besides earning enough money, it is necessary to build an investment or trading portfolio. Especially if you want to invest or trade cryptos.

Before you begin building your complete financial portfolio you have to be calm and reasonable.

Take a big breath and a pencil.

The whole process of building a trading portfolio should be done in SEVERAL STEPS:

STEP 1: Define why do you want to invest or trade. Your purpose is very personal. If you thought saving and investing meant the same thing, you were wrong. Savings are the unutilized part of your income. Only when you put your savings partially or entirely into an investment instrument, it qualifies as an investment.

STEP 2: Be realistic about your appetite for risk. Most of us know how much we have saved to date but very few of us have a realistic understanding of how much risk we’re willing to take on to achieve our financial goals. Your risk appetite will depend on your age and financial responsibilities.

Young investors are under enormous stress! READ MORE

STEP 3: Understand the relationship between risk and return. Risk and return are directly proportional to each other. Higher the risk involved, higher is the return and vice versa. For example, you have promises higher returns compared to fixed deposits, but it also comes with a relatively higher risk.

Step by step to the trading portfolio

STEP 4: Create a contingency fund. Honestly speaking, this has to be the first. Before you invest or trade anywhere, you must create a contingency fund for those rainy days. A contingency fund worth six months of your current income is good enough to keep you from dipping into your investment funds.

STEP 5: “If you don’t know where you’re going, you’ll miss it every time.” – baseball philosopher, Yogi Berra. That means, you know your purpose for investing, but do you know what it will cost to achieve that purpose.

STEP 6: Invest with a plan. The most successful portfolios are assembled based on a solid understanding of the fundamentals of the individual securities that comprise the portfolio. The trading portfolio should also factor risk tolerance into the balancing discussion.

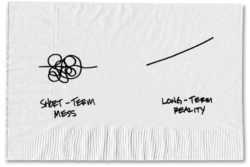

STEP 7: Give it time. While there may be some investment choices that you hold for shorter periods of time than others, overall, maintaining the long view should deliver consistently positive returns.

And general advice while building a trading portfolio: TRY NOT TO BE OBSESSED!

Markets can be volatile from day to day, even month-to-month, never mind hour-to-hour especially the market of cryptocurrencies. But over longer periods of time, volatility subsides. Build your portfolio and let it run.

Checking the market every 15 minutes or so won’t affect your portfolio, but it will affect your sanity.

When a lot of people think of investing or trading, they imagine painstakingly picking individual stocks, tracking their daily performance and constantly buying and selling. This may be good and interesting for TV shows or movies. But in real life it is agony.

All you need to do is pick a couple of funds that attempt to mimic the total market’s behavior, and, for the most part, leave them alone for 5 or 10 years. It’s very simple, and it’s something everyone can and should do. In fact, it’s one of the best ways to effortlessly build wealth in the long term.

There are more cryptos to the market and a good portfolio will usually include a few different types of investments.

Are there any differences among trading portfolios for different assets?

But when we are speaking about the trading portfolio, the principle is the same for cryptos and stocks: suitability, balancing different sectors and fund/crypto types.

You can build a cryptocurrency portfolio using a risk-reward formula if that is acceptable to you. You are that one who has to decide how much risk you want to take on and that should influence which coins you invest in.

Recommendation is keeping at least 50% of your portfolio in safe-ish coins like Bitcoin, Ethereum, Litecoin, Icoin.

When building your own cryptocurrency portfolio you should not simply copy mine, always do your own research and decide which coins you can be excited about. Crucially, the entry point is very important and I entered many of these coins months ago when they were cheaper, there may be better buys out there right now. Buying more coins to expand your cryptocurrency portfolio is a smart idea.

Diversify trading portfolio

The more you diversify, the better your chance of hitting a coin that flies to the moon.

To properly expand your portfolio, you will need to join a trading platform, some of the largest and most trusted trading platforms which list a wide selection of decent coins.

Once you have your BTC in place on a cryptocurrency exchange, you can then expand your portfolio and buy other coins.

How to structure your stock portfolio? HERE IS THE ANSWER

Leave a Reply