2 min read

Image from shutterstock.com

Image from shutterstock.com

What caused a chaotic December? A chaotic December in equity markets is closing. But, at the end of the year, these were not usual circumstances.

It’s “completely bizarre,” says Stephen Innes, head of trading for the Asia Pacific at Oanda Corp. “It’s incredible just how harmful markets veer when sentiment slides.”

Innes mostly is keeping his money on the sidelines. But he has been taking profit on some winning investments. And, also, from blue-chip stocks whose valuations have dropped in the December sell-off.

Like many other traders in Asia, he’s been watching events play out in the U.S. from a distance, astonished at what he sees.

So, what he did see?

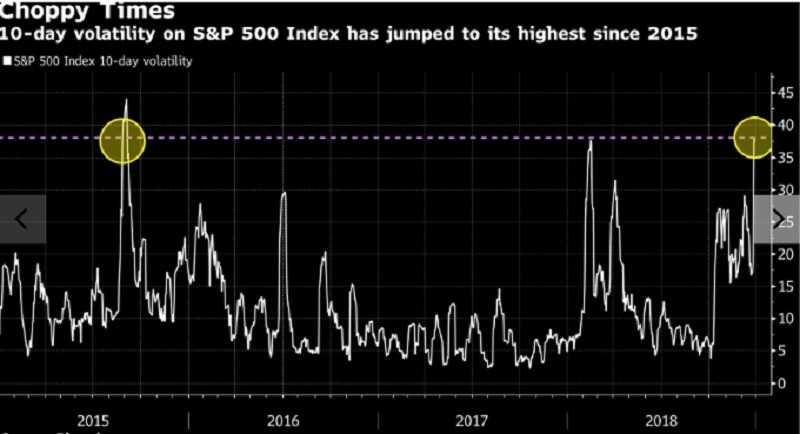

Source: Bloomberg

Source: Bloomberg

The S&P 500 Index posted its biggest upward reversal since 2010 on Thursday. Just a day after the largest advance since 2009. Despite this two-day gain, the measure is still down almost 10 percent in December alone.

That’s the largest drop for each key market barometer since 1931, according to data from LPL Research. But those Depression-era losses were much bigger: the S&P 500 plunged 14.5% while the Dow plunged 17%.

Two golden rules have been broken.

First, since 1945, December has produced the highest average gains of any month. But December is the worst month of the year. Second, since the 1970s, the S&P 500 has never slumped when earnings growth was more than 10 percent.

Mark Matthews, head of Asia research at Bank Julius Baer & Co. in Singapore, is planning to ride it out. “I remain invested through good times and bad,” he says. “Not being invested, over the long term, is like betting against the house in a casino.” He is a long-only investor.

The December 2018 chaos is making investors nervous.

This chaotic December in 2018 could have an impact in the future. The investors are worried that the economy could slow in 2019 because of continued trade tensions with China and rate hikes by the Federal Reserve.

The Dow and S&P 500 are both in the red for the year, their worst annual loss since the 2008 Great Recession, and first annual loss since 2015. Last year, the S&P 500 returned 22%.

For the past, eight to nine years never happened the U.S. market dropping at this magnitude and speed.

Maybe the solution is to go overweight cash for the time being. The volatility will continue until year-end until investors get a clearer picture from the holiday earnings season, say experts.

But longer-term, it is unknown if this will prove a “healthy correction”. The investors may find the S&P 500’s low valuations are attractive and earnings come in above expectations. Or it will mark the end of the bull run. Either way, one thing’s for certain, this movement is definitely unusual.

This market turbulence isn’t normal.

Maybe investors should keep away from new trades and tend to the existing investments. Anyway, investors opinion is very bad.

Yes, most of them don’t think that this huge volatility will continue. But also, they are thinking that it is not a quite good idea to trade stock while the market is like this.

The investors can’t hope that the markets will turn around in the year’s final days. They are here and it is obvious that nothing will change.

In the past years, December was usually a very solid month for the market. Professional money managers used to buy top-performing stocks. That made their portfolios look good. This phenomenon is known as window dressing.

There was also the somewhat mysterious Santa Claus rally effect. The market was very well in the final week of the years.

There was some chalk up to light trading volume with so many people off for the Christmas holiday.

But volatility remained this year. Stocks are down.

It is, as we can see, unusual for this time of year. But the people take holidays. They have hope that the U.S. economy is robust and the sell-off will bottom out.

For this time of year, some people are probably a little more focused on the market.

But trying to explain short-term movements in the markets is an exercise in futility because generally, it is pretty random.

Not only stocks, but Bitcoin has also had a brutal 2018.

This chaotic December in 2018 had an impact on cryptos too.

The world’s largest cryptocurrency by market cap is nearly 84% since its meteoric rise topped out at an all-time high of $19,870 in December 2017.

But just after bitcoin (BTC-USD) peaked, technical trader Peter Brandt made a fantastically prescient call. This has recently resurfaced in crypto circles. In January, he called for an 80% retrace of bitcoin’s parabolic advance, predicting a $3,933 price target. Bitcoin is currently trading around $3,600. It was very close.

But as ever, there were different opinions.

The dominant Bitcoin price prediction was that Bitcoin would reach the $14,000 mark by the end of 2018.

However, that prediction is blown out.

Despite some optimists who were hoping that Bitcoin will break through the $100,000 barrier till the end of this year. In fact, Jim Cramer was predicting that Bitcoin will go as far as shattering the million dollar threshold one day.

To do so, market capitalization should surpass 1 trillion USD just on BTC to reach $66,000 per coin, a 10x increase. Well, the entire market cap is at $212 billion. The BTC market cap was $170 billion almost a year ago. Now it is $115 billion and it was at $800 billion in January 2018.

So, who knows what can happen.

Today’s price of BTC you can see here

One thing is certain. After this chaotic December in 2018, next year will be difficult and uncertain. Markets will be full of volatility. Permanent ups and downs.

Anyway, it will be interesting.