If the trade is going in your favor or for the trade that is going against you – don’t wait until expiration to see what happens. Sell before.

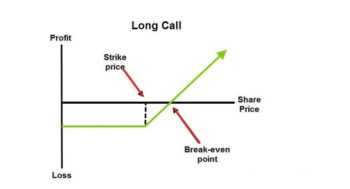

Fresh traders, particularly those with a little amount on the account, like to buy options. But do they understand all the rules? The vast of them somehow skip selling prior to the expiration date. The truth is that the call option could be sold at any time. Call options give you the right to buy some assets, you already know that. To know when to sell the option call, pay attention to several situations.

Let’s say you own calls and you decide to let them expire worthlessly. That’s okay. Your decision. But if you forgot and the stock closes on the expiration date the options will automatically be exercised whenever it is “in-the-money” when the market closes.

And it will be a problem when the next day comes. The next day, the day after the expiration date, the margin call will come. Where is the problem? When you buy an option call, you are buying the right to buy a stock. Did you know that? If you are new in the options trading it is likely you didn’t. And what happens? When margin call comes you have to pay for shares and you’ll be forced to sell your call options. So, it is better for you to sell your options calls before the expiration date.

So, you have to close your trade before the expiration date.

When you opened your position your aim was to make a profit, right? So, don’t wait for options to get too close to the expiration date because they will lose the value. As the expiry date is closer, the value is going down. To make a profit it is better to sell your options and close the trade. Of course, you may take a loss too but if you wait longer and as you are approaching the expiration date, the chances to avoid loss are almost zero.

Avoid margin call

Lett’s say you bought one call option. How to know when to sell option call? Don’t forget that one option controls 100 shares of stock. And let’s say the strike price is $30. If the stock closes at $30,03 your options will be automatically exercised and you’ll be the owner of 100 shares of stock. Further, your broker will send you a margin call if you don’t have a sufficient amount on your account to pay that stock. And what you have to do? You will be forced to sell the stock to close out your trade. More often, you will sell it below the exercise price. But it isn’t necessary to be your case. You can avoid this unpleasant situation. Just close out your open position before the expiration day. Before the market closes, of course.

For a strike price, you can calculate the cost to buy a call option and the cost to use it. You can find plenty of websites with options quotes. All you have to do is to type a stock’s ticker symbol and get a quote. You will see a column with months arranged and with the options expiring that particular month. Remember, you can trade the option until the third Friday of the expiration month.

Calculate options for a strike price

Find your wanted strike price in the “strike” column. Strike prices are ordered from cheaper than the stock price to higher than the stock price. Suppose the stock’s price is $50 and the strike prices ranging from $20 to $70 in a $2 increase. And you want to calculate an option with a $60 strike price. And suppose you want to buy a call option with a $2 “ask” price.

To calculate the whole price to buy one option contract you have to multiply the ask price by 100. In our example, it is $2 x 100 which is $200. No, it doesn’t amount to buying the stock, this amount of money you have to pay for the right to buy the stock.

Let’s go further. The next thing to do is to multiply the strike price by 100. That is an added amount you have to pay to use the option.

$60 x 100 = $6,000

This means you can buy 100 shares of stock for $6,000 before the expiration date.

Use volatility forecast

In general, volatility is extremely important when buying or selling options. Since “returning towards the mean” is especially noticeable on volatility, you can somehow easily forecast the volatility as it goes above a certain point or less than a certain point – it will, most likely, return towards the average volatility.

You can check the VIX to measure market volatility. Learn here how to do it.

Bottom line

Don’t buy call options with the aim to own the stock when the options expire. Your goal has to be to buy a call option and profit when the stock price grows. If call options expire in the money, you will end up paying a bigger amount to buy the stock. Much bigger than what you would have paid if you had bought the stock. If you want to hold the stock, buy it. Don’t play games with options.

And finally, one important note when it comes to questioning when to sell option call.

The European-style options expire on the third Thursday of the month. The American options expire on the third Friday. Don’t forget about this time difference. This could result in huge financial losses for you.

Forecast volatility, that’s a key ingredient in profiting from option trading.

There are many differences between European and American styles in trading call options. Here are all.

There are many differences between European and American styles in trading call options. Here are all.

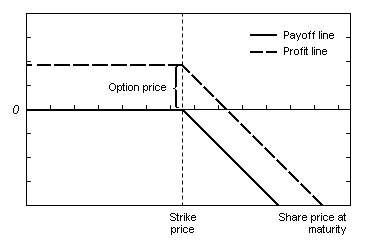

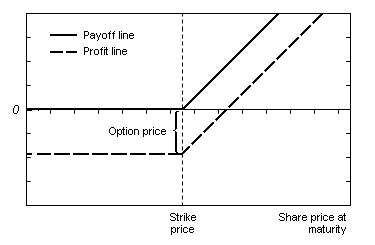

Writing or selling a call option

Writing or selling a call option P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid

P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid