Everyone would like to know everything about this

By Guy Avtalyon

Stock market prediction is the intention since the beginning of the stock market. The reason is clear. Every single participant in the stock market aims to gain huge or decent returns and to avoid losses. Sounds logical, indeed. In early days traders and investors were just guessing, to say it simply. Well, frankly, not just guessing. There were some estimations, judgments, listening to the rumors, asking. But today, traders and investors may employ different tools, machine learnings, and AIs to help them in stock market predictions.

Is the stock market prediction possible or not?

We already learn that past performances can’t show future trends. But is this truth 100%?

Of course not.

Watching past performances can help you with a high level of certainty to predict how some stock will act in the future. This is very important because based on that data you will determine and decide what to do with some stocks. Would you buy or sell, would you stay on position or leave.

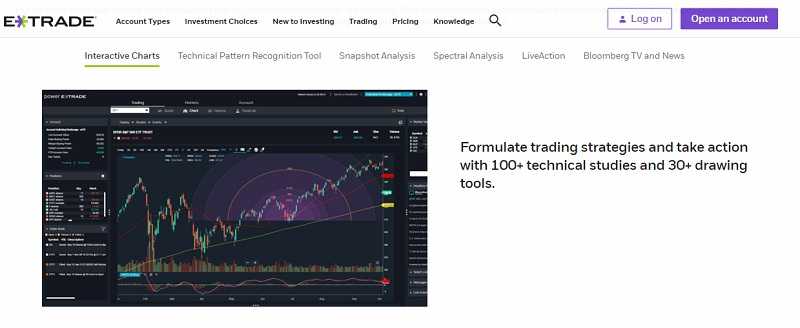

The modern stock market prediction is often based on machine learnings and AI technologies varying from very simple to complex ones. Those stock market prediction tools or techniques, whatever would you like to call them may help you a lot to secure your investments. Even the simplest can give you an insight into the future stock market trends.

Using robust algorithms has benefits, of course. But not every trader or investor can afford them. Some are very expensive and the result is very often almost the same if you use the simple version or some simple tool.

The crucial thing about stock market prediction is to have quite enough historical data to be able to make a conclusion, to have a basic sense of some stock’s nature.

How to predict the stock market movements?

The relationship between supply and demand is what dictates the stock price. And this works very simply. If there is in the market more sellers, that means the supply is greater than demand, so the price will decrease. And vice versa. That is the easy part of the stock market. Things become more complicated when you try to understand why some investors like one stock more than the other. But that is another question. We want to know is the stock market prediction possible or not.

The algos, tools, learning machines deliver their predictions based on historical data. This means that all of them show the prior values of some stock and based on that give the future estimation of stock price action.

And that is exactly what you need as an investor. To get some info with the highest level of possibility on how some stock will perform in the future. To have that kind of info you don’t need to spend a fortune. Some simple tools may benefit you too. Such a tool must have historical data about prior performances, for some limited time, for example during one year. Based on that info you will be able to check your trading or investing strategy. And that is crucial. The possibility to check your strategy on your own and not to put all in the “hands” of some algorithm, because we want to be honest with you, algos can make fails. Algos, as like your trading strategy, depends on inputs that some other implemented in it. To say simpler, it is based on other people’s knowledge about the stock market prediction and investor expectations.

Le’s check one example. Let’s say you have a strategy and you want to check how it works on a particular stock.

How efficient your strategy is?

If it shows your strategy isn’t good you can easily change the strategy or test it on some other stock. Moreover, the possibility to test different strategies on numerous stocks is extremely important when it comes to choosing the stock to invest in or strategy to employ. What is the main point of trading? To gain a nice return. And how to provide that? You have to find the best possible to take a profit point and stop-loss point.

Based on the info you can obtain from such a tool you can easily decide about your future trading.

Very simple and very helpful, don’t you think?

What Traders-Paradise wants to say is just stay tuned.

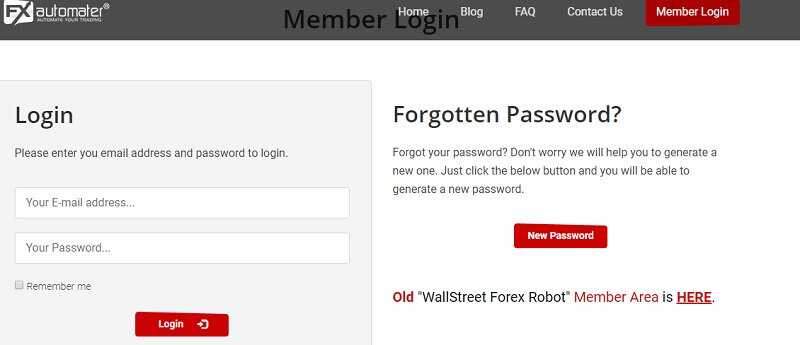

Here are Traders-Paradise’s suggestions for the automated trading software we examined.

Here are Traders-Paradise’s suggestions for the automated trading software we examined.

This is not something you can do over the weekend and let run happily ever after.

This is not something you can do over the weekend and let run happily ever after.