Instead of buying cryptos, you can invest in it, you just have to choose will you do it directly or indirectly. Traders-Paradise explains how to invest in cryptocurrency stocks.

Instead of buying cryptos, you can invest in it, you just have to choose will you do it directly or indirectly. Traders-Paradise explains how to invest in cryptocurrency stocks.

Cryptocurrency stocks are continuing to attract new investors in 2019. However, most beginners have problems finding the next cryptocurrency to invest in 2019 We understand how upsetting it is when you first begin looking for cryptocurrency investments. And that’s why we want to help.

We can understand your wondering “Should I be investing in Bitcoin or Ethereum or some other crypto?”

We want to explain how to invest in cryptocurrency stocks.

This is for you, beginners.

You’ll have to decide on the way how you want to invest in cryptocurrency: directly or through, for example, the stocks, which is indirectly way.

Then, if you want to invest directly, you’ll need to decide if you want to be in direct control of your cryptocurrency, or if you would like to use some custodial service.

A lot of things is already said about the future of cryptocurrencies. Some people believe that the cryptocurrency period won’t last long. On the other side, the others think they’re going to be around forever.

It is tricky to predict the future of cryptocurrencies, but what we do know is that the demand of cryptocurrencies is only increasing. One of the reasons for that is because of blockchain technology, which is the principal technology behind all cryptocurrencies.

But before you start, follow Warren Buffett’s advice “Never invest in something you don’t understand”. Start to read more about cryptocurrencies to go get a sense of information before you dive into the world of cryptocurrencies.

When you start your learning task, you will find a lot of blogs and videos online. Some of them are very ignorant, but some are too difficult.

They are either too specific or too general. The learning path isn’t always clear.

So, let’s make it easier.

To start investing in cryptocurrency stocks directly you’ll need:

- A cryptocurrency wallet. This will provide you with direct control of your cryptocurrency.

- A method of obtaining cryptocurrency. Honestly, you will need a cryptocurrency exchange or broker to buy cryptocurrency or to trade cryptocurrency.

- A method for selling cryptocurrency. Part of investing is occurring in the ability to cash out. To cash out you’ll probably need to change your cryptocurrency back to some top coin like Bitcoin, Ethereum, or Ripple. So, you’ll need access to the platform that lets you trade those for fiat currencies.

To start investing in cryptocurrency stocks indirectly through a stock, you’ll need

First, you’ll need to select between a limited set of options. They include:

- A cryptocurrency IRA.

- A stock that is related to cryptocurrency.

- A private fund which means you’ll need to be an accredited investor and meet certain capital requirements.

- Each method of investing in cryptocurrency has its own pros and cons.

If you know something about the cryptocurrency markets, you then know that 2018 wasn’t an excellent year. Bitcoin has lost 74% of its value last year. The most other major cryptocurrencies have done even worse. Last year, Ripple, Ethereum, and Litecoin are down by 80%, 81%, and 85%, each.

But, there’s still a lot of interest in blockchain technology and cryptocurrencies. So, it’s possible that we may see a flood in bitcoin or some of the other digital assets.

That’s why, instead of investing directly in cryptocurrencies, it could be a smart idea to put your money in a business that will do just nice no matter what happens in the cryptocurrency world. And that will do even better, of course, if the crypto world has a good year in 2019.

What are the best cryptocurrency stocks to buy in Traders Paradise’s opinion?

1. Bitcoin Investment Trust (GBTC)

Barry Silbert has been a figure behind many cryptocurrency trends over many years. He was best recognized for Second Market. It was a well-known system to trade stocks in private companies. His Digital Currency Group (DCG) was originally a part of Second Market, combining a cryptocurrency trading firm called Genesis Global Trading with an asset management firm, Grayscale Investments.

The Bitcoin Investment Trust (OTCMKTS: GBTC) brings digital currency investment to small investors. It is currently traded through what was called the “pink sheets.” The attempt to get a listing through the NYSEARCA platform having failed in September last year.

Some investment gurus called GBTC a joke. But they had to face it has won the race and become the first publicly traded Bitcoin fund.

Moreover, the GBTC value is 85% greater than the value of the bitcoin it has. There are reasons for this. For one, you can buy GBTC in a tax-advantaged account like a retirement account. GBTC is publicly traded, which means you can get out any time you want, and the coins are being kept safely.

One of the primary media for cryptocurrency news, Coindesk, is a subsidiary of Digital Currency Group (DCG).

If you are a small investor or investing in a retirement account, GBTC may be the best bet you have for profiting on the future of Bitcoin Nvidia Corporation (NVDA).

2. Nvidia Corporation (NVDA) cryptocurrency stocks

Even if you’re not excited in cryptocurrencies, Nvidia Corporation (NASDAQ:NVDA) is a stock worth owning. The stocks increased by nearly 70% during 2017, revenue was growing almost 40% during the same fiscal year. This company is currently possible to reach over $8 billion in revenue and take 25% of that revenue as the net income.

Nvidia is also a very valuable cryptocurrency stock, with a market cap of $111 billion. It is almost 14 times bigger revenue estimated for this year and a tremendous 53 times earnings. High-performance graphics processors, originally designed for video games, appeared as great for the serious work of finding decryption keys that symbolize crypto-coins. But that is not the only reason to buy it.

The best reason to buy Nvidia stock is its cloud. Data centers are now going through their first upgrade cycle, to support Artificial Intelligence (AI) applications like voice interfaces, self-driving cars, and the Internet of Things (IoT).

Instant response is the key here. The low-end processor clouds like those of Amazon.com, Inc. (NASDAQ:AMZN), and Alphabet Inc (NASDAQ:GOOG, NASDAQ:GOOGL), just don’t have the processing power needed for the next decade’s growth markets.

Graphics chip leader NVIDIA has done greatly well in recent years thanks to booming sales for PC gaming and data center applications.

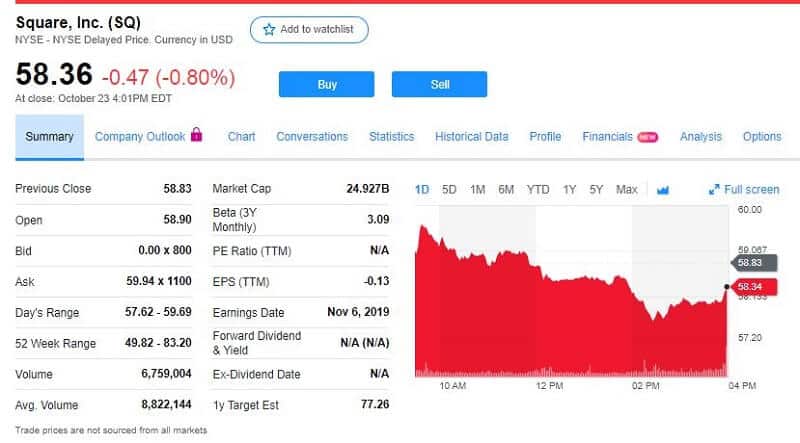

3. Square (NYSE:SQ)

Cryptocurrency stocks Square has developed quite a bit over the past few years. At first, it was a niche manufacturer of payment processing hardware for small businesses into a lender.

Its growth isn’t only impressive. It continues to rise. The company’s revenue increased by 68% year over year in the most recent quarter. Also, the payment processing volume continues to rise, the services-based revenue is 155% higher than a year ago. Also, there is the Cash App, a great source of potential income.

Square allowed its Cash App customers to begin buying and selling Bitcoin last year. When cryptocurrencies start to experience a recovery, it could evolve into a significant part of the market.

This is our opinion based on personal experience, paste performances, and data analysis. You may have some other feeling about where to invest. And it is alright. That hunch you have could lead you to the incredible gains. But, our suggestion is to read and examine.

Instead of buying cryptos, you can invest in it, you just have to choose will you do it directly or indirectly. Traders-Paradise explains how to invest in cryptocurrency stocks.

Instead of buying cryptos, you can invest in it, you just have to choose will you do it directly or indirectly. Traders-Paradise explains how to invest in cryptocurrency stocks.