Improving risk management in trading could be a life-changing factor.

By Guy Avtalyon

I’ll start straight to the point on how to improve risk management in trading. Risk management in trading very often stands very low on the priority list for many traders. The main concern is the entry signal or other indicators. I have to tell you this isn’t the right way. Nothing is wrong with waiting for the proper indicator, but if you don’t have decent knowledge about risk management in trading, you will not have profitable trades. The point is to know how to manage your risk, size your position for each trade, and set your orders accurately if you want to make a profit in trading.

And you might think it is unnecessary, and it isn’t so important. If that is your case, feel free to not continue with reading this post. But I have to warn you that if you never improve risk management in trading, you’re at risk of becoming a steady loser.

And why should you be that if there are some tips to avoid the most common problems?

Tips to improve risk management in trading

If you adopt some of these tips or approaches, you’ll stop losing your hard-earned money.

First, you must realize how you let the trade get out of your hands. Yes, it’s kind of looking back but never think about this as wasting your time. If you make a scrutinizing evaluation of your past trades that ended in losses, you’ll find the reasons behind them, and you’ll find the pattern. The main benefit of this introspection is to avoid similar behavior in the future. Knowing how and why you made mistakes, you’ll be prepared and will never repeat the same trading mistake in the future.

Setting orders and the risk/reward ratio

When you identify an entry signal, do you know where to set your stop-loss and take profit orders? You have to know that even before you enter the trade. How to do that? Let’s assume you know where to set the stop loss and take profit orders after determining the appropriate price levels. The next step should be to measure the risk/reward ratio.

If you find out the risk is bigger than the reward, just skip the trade. The worst thing you can do is stretch the take profit order or squeeze your stop loss to reach a higher risk/reward ratio.

Keep in mind; trading is mostly unpredictable, so the reward isn’t assured. The only thing you can control is the risk involved in your trades. You shouldn’t neglect that and act unreasonably. I’m a hundred percent certain that most of you determine the risk/reward ratio randomly and adjust your stops and profit orders to reach that ratio. Guys, it’s an entirely wrong way.

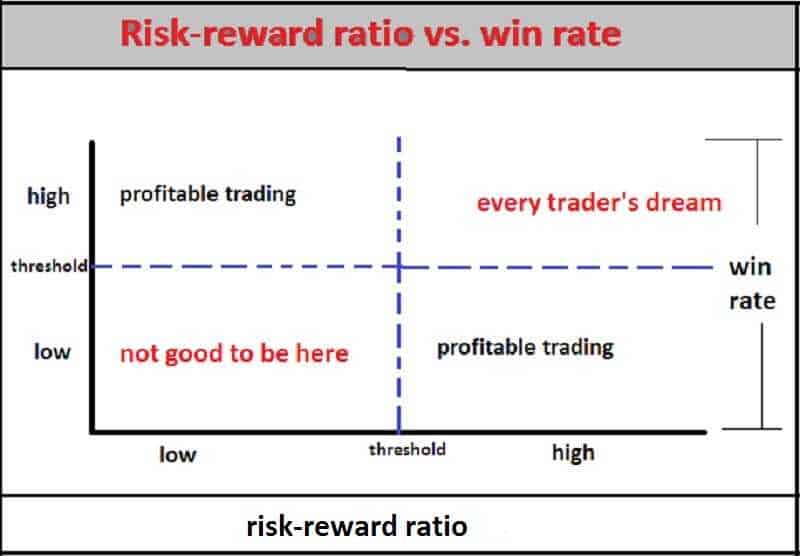

Compare win rate and risk/reward ratio together

Many traders insist that figuring out the win rate is pointless. But they miss out on a crucial point. Watching the win rate alone has no value, but if you observe win rate and risk/reward ratio together, you’ll be closer to winning trades. Having winning trades is every trader’s dream.

I want to be clear with this, you shouldn’t necessitate an excessively high win rate. For instance, a trading strategy with a win rate of 40 percent requires a risk/reward ratio below 0.6 to be profitable.

A win rate of 40 percent is average for the most profitable traders. Why should you want an insanely high win rate? That’s wrong and could lead you to significant losses.

Balance win rate and risk/reward ratio

You must find a balance between the win rate and the risk/reward ratio. For example, the high win rate could mean that the risk/reward ratio also is high.

Suppose you found a stock that is trading at $20, down from a recent high of $25. And you bought 50 shares because you had $1,000 for that purpose.

If the stock price went up to $25, you can make $5 for each of your 50 shares, and in total it is $250. You paid $1,000 so you have to divide 250 by 1,000 and the result is 0.25.

That means that your risk/reward is 0.25:1. It is a very low risk/reward ratio.

Assume that you have made 15 trades, of which 6 were winners and 9 were losers. So, the win/loss ratio is 6/9, or 2:3. In percentages, the win/loss rate is 6/9 = 0.66. This means you are losing just over 66 percent of the time. Using your total number of trades which is 15, your win-rate would be 6/15 = 0,4×100 = 40%.

You can be profitable with a 40 percent win rate if risk/reward is below 0.6. As can be seen from the formula for calculating the needed win rate for profitability based on the risk/reward ratio, 1/(1+ risk/reward ratio).

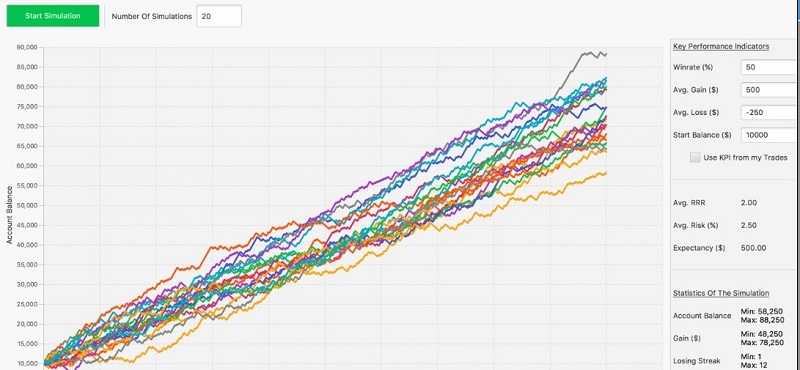

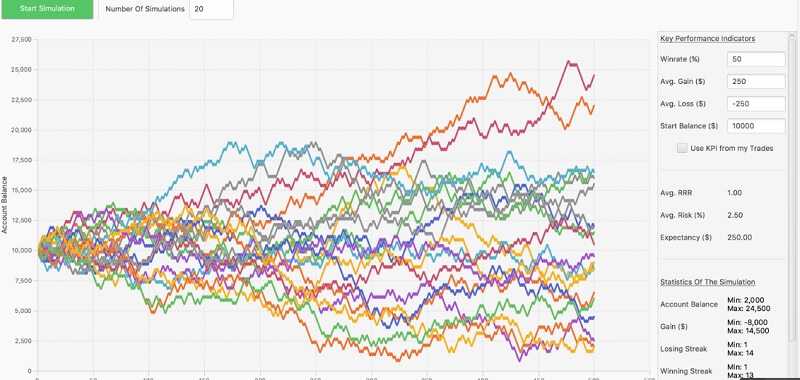

The risk/reward decreases when the win rate decreases. In other words, if you have more losses, your winners must be bigger to be profitable.

Size your position

I’ve met many traders that size their positions randomly picking some levels of 2 percent, 4 percent, and never change that. It’s totally insane. You have to estimate the chances to win because trading is all about possibilities. It’s normal to change position sizing for every trade if it is necessary, and mostly it is. Why should you hold the same position size when you see virtually no chances of winning?

In trading, every strategy has a different win rate. So, the risk/reward ratio for each of your trades will vary. This is especially important if you trade using many strategies or setups.

The point is to reduce the trades’ position size with low win rates and increase it for the trades with higher win rates.

If you want to improve risk management in trading, you should never overlook the risk/reward ratio and money management. Otherwise, you’ll blow your account. If you take too much risk to make a quick profit, you’ll likely end up in losses.

You’ll go bankrupt because of a lack of knowledge about risk management. Now onwards, you have to rigorously adhere to position sizing and risk management if you want to be a profitable trader.

Pay attention and improve risk management in trading

You might love your trading style or some strategy, particularly, but you should consider improving it to achieve more profitable trades. After some time, everyone should jump to the next level. I know you could be impressed by indicators, waiting for the right signals to show you the right time to enter the trade. It’s so exciting and sexy, right?

Well, it’s also risky if you never improve your risk management. It isn’t so exciting as watching the charts, candles, following the news, and waiting for the indicators, but it is essential for your future trades and your profits. Blinking indicators and trading strategies will benefit you for some time, but the real difference comes with improved risk management.

Don’t be worried. A small number of traders really pay attention to this matter unless they have a series of losing trades. Then and only then. they will start thinking about how to improve risk management in trading. But you have a chance to shortcut this path. Why suffer losses if you can trade with more attention to the risk management from the beginning instead.

It doesn’t take too much.

Did I miss something? Share your opinion with me, leave a comment, ask me what else you would like to know. I’m here for you, guys.