The lot size matters because it has a great impact on how much market movement will change your account.

To know what is the best lot size in Forex we have to know what lot size is. Particularly if you just stepped to this world of currency trading. The lot represents the smallest trade size you can set on the forex market. Keep in mind that the lot size will reflect how much risk you are willing to take.

Without a doubt, the forex market can produce unbelievable growth. For beginner traders, it sounds promising but if you don’t understand how the forex market works, your chances to have success are close to zero. Everyone would like to know what is the best lot size in Forex to start the trading. First of all, you have to know that your account must be kept safe. What does it mean?

If you choose the wrong lot size and have several losing trades in a row, which could happen even for the experienced traders, your account is at risk. It can be closed and deleted. For that not to happen, you’ll have to choose the best lot size in Forex. At least the right one.

Everyone will tell you to choose the best lot size, but how to do that? For example, you can use risk management as a great tool. You have to decide what amount you are prepared to risk without consequences. The same comes both for your demo trading account and for your real trades.

The lot size affects how much a market move changes your accounts. For example, a 100-pip move on a small trade is not the same as a 100-pip move on a large trade.

What is the lot size in Forex?

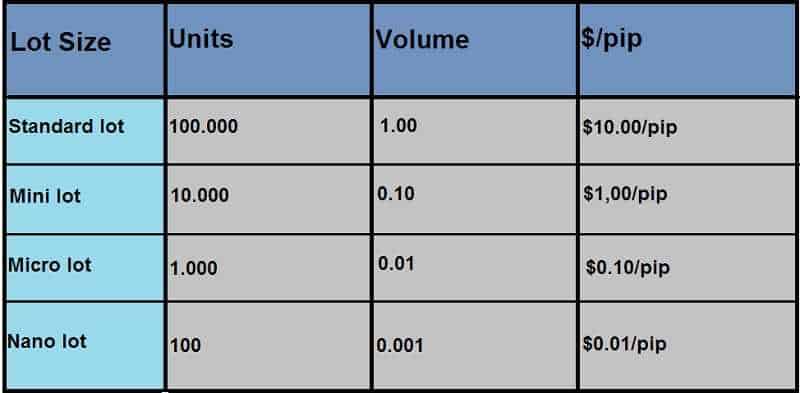

Forex is traded in precise amounts that are called lots. The Standard size for a lot is 100.000 units of the base currency. However, there are other lot sizes such as Mini lot size with 10.000 units, Mikro lot size with 1.000 units, and Nano lot size with 100 units. A lot represents the predetermined number of currency units you can buy or sell when entering the forex trade.

The standard lot in forex trading represents 100.000 units of the account currency. For example, if you are trading a dollar, this means your trade value is $100.000. Since the average pip value for the standard lot is roughly $10, this means every 10 pip move in the forex market will produce you $100 of profit or loss. Experts recommend trading this lot size only if your account is filled with at least $25.000.

As we said, the mini lot size represents 10.000 units based on your account currency. If your account is in dollars, the average pip will be about $1. Do you think it is modest? Well, the forex market can move for 100 pips per day and you can profit or lose $100 in your trading in an hour or two. Experts’ recommendation is to trade a mini lot size only if you have at least $2.000 on your trading account. For beginners, they have a suggestion, also: Avoid this lot size.

The micro lot size was the smallest lot size for a long time. It represents 1.000 units with a pip value of 10 cents. Experts highly suggest to the beginners to trade forex in this lot size. The suggested account value for trading in micro lot size is from $200 to $500, which varies depending on how many pairs you want to trade.

Several years ago, arrived the nano lot size with its 100 units of currency and an average pip value of 1cent. Beginners may start trading this lot size at just $25. You cannot find a lot of brokers that will offer you to trade this nano lot size but it can be useful to figure out how your new trading strategy is working, so you can use this lot size for testing it.

How to choose the best lot size for your forex trading?

One of the best criteria is to determine your risk. You can calculate it in percentages with regard to the rule of 1%. This means in case you have to close out your trade for a loss but your risk has to be less than 1% of your total account. For example, if you have an account with $5.000, you shouldn’t risk losing more than $50 in any position. If your limit risk is 0,5% then you can lose $25 in any position.

Trade size is an important factor since larger lots boost profits and losses per pip. To identify how big your position size should be, use calculation cost per pip. Always calculate it.

How to calculate the trade size?

As with trading stocks, for every open position, you’ll need a stop-loss to set. In other words, you have to figure out where you want to exit the trade if the market starts to move against you.

There are numerous ways to set stops. You can use the main lines of support and resistance to place the order. For example, price action, , Fibonacci, pivots, can help to find these values. The point is to count the number of pips from your open price to your stop-loss order.

The last action in discovering the best lot size is to define the pip cost for your trade. Pip cost means how much you will lose, or gain per pip. When your lot size increases your pip cost will do the same and vice versa. So, how big should trade size be?

Let’s calculate the perfect cost per pip using the 1% risk rule, a $5.000 account, and a stop-loss 10 pips away to find the best lot size in Forex trading. Let’s do some math.

Starting balance = $5.000

1% risk x 0,1

Trade risk is $50

Trade risk : Stop-loss in pips = $50 : 10 = $5

5 : 0,0001=50.000

This means you can trade one lot of 50.000 for $5 per pip cost.

Determine position size when trading Forex

In Forex trading, the position size comes before determining entry or exit levels. That is to say, it is more important. What does it mean? Despite the prevalent thinking that the most important thing in trading is to have the best possible strategy, in Forex trading position size is more important. Your position size shouldn’t be too small or too big if you want to avoid taking too much risk. The same comes with taking a too small risk. Taking too much risk could lead you to drain your account to zero and quickly.

The position size is defined by the number of lots and the size of the lot you buy or sell in Forex trading. The risk you are taking consists of two parts: account risk and trade risk. You’ll have to fit these parts if you want an excellent position size. Your position size doesn’t depend on the market condition or your setups. It even doesn’t depend on your strategy. It is all about account risk limit per trade, pip risk per trade, and pip value.

You can calculate it. Here is the formula

the amount at risk = pips at risk x pip value x lots traded

The number of lots traded represents your position size.

Let’s imagine you have a $5,000 account and you risk 1% of your account on any trade. Your amount at risk is $50. If you’re trading the EUR/USD currency pair, you may decide to buy at 1.2051 and place a stop loss at 1.2041. This indicates you’re willing to put 10 pips at risk or $100.

Let’s imagine further that you are trading in mini lots. Any pip change will have a value of $1 So, put this in the formula.

$100 = 10 x $1 x lots traded

Let’s divide both sides of the formula by $10, and you’ll have

lots traded = 10

This means you are trading 10 mini lots. But this number of lots is equal to the one standard lot, so you could trade one standard lot, right? But what if the result in this formula is, for example, 7,18? That would mean that you should trade 7 mini lots and one micro lot.

Bottom line

The truth is that Forex traders usually trade in mini lots or micro-lots. You might think it isn’t so sexy, but it is a more secure path. When you keep your lot size as small as possible you have more chances to play this game longer and profit. The reason behind this is that these sizes of lots represent the ideal balance between capital you invest and the risk you are willing to take. Moreover, if you use a higher lot size and have less capital on your account, it is more possible to end up with empty hands than to have any profits. In other words, you will have losing trades.

The beginners should start to trade forex in micro-lots size or mini lot size. After they gain experience and confidence, they can pass to the next level. Also, as in any trading activity, you have to maintain balance in your trading account. One of the most important actions in trading is extremely visible here, in forex trading. The usage of stop-loss and target levels is extremely important.

In conclusion, the best lot size in forex trading depends on your capital, experience, goals, risk tolerance. Never risk too much, or the risk you’re not able to handle. Risk management is an essential part of any trade.