ESG investors who combine these stocks with traditional assets and generate better returns. ESG stocks become the hottest investing trend.

By Guy Avtalyon

Everyone would like to know what is the hottest investing trend today. Despite many expectations that it easily could be pharmaceuticals or biotech stocks due to the current pandemic, the new investing trend is quite surprising. Some would expect that developing a new vaccine for the new coronavirus could attract investors’ attention. But it looks that some other industry has more potential. Some other stocks are able to generate better returns. We are talking about ESG investing.

Yes, that’s true. ESG stocks generate better returns than the overall market all the time. And it is pretty interesting if we know the ESG stocks carry less volatility then many many other stocks. Even if it is surprising, ESG investing is a fast-growing trend. So if anyone asks you what is the hottest investing trend today, you\re free to say ESG and you’ll be right.

What is ESG investing?

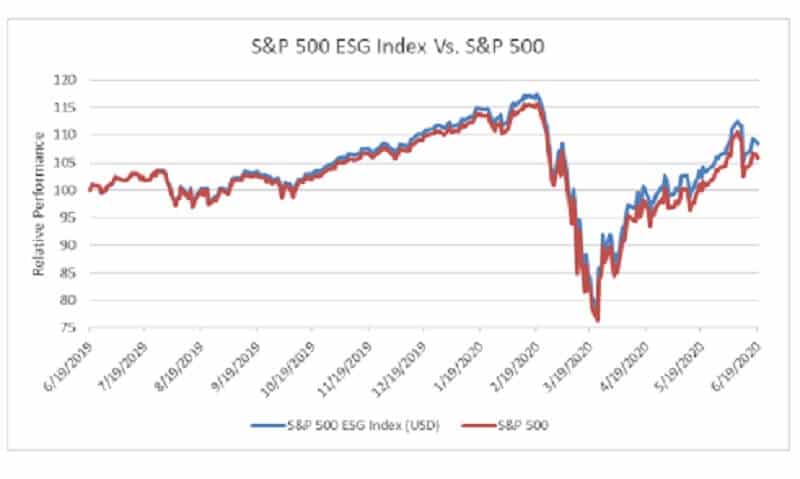

ESG investing is also known as sustainable investing. It is all about environmental, social, and governance. These three classes are massively under investors’ attention and a lot of money is already invested in this sector. We can discuss whether it is a smart investment decision or not but data shows it is. Take a look at this chart below.

The chart shows the S&P 500 ESG index’s relative performance. We can see that it has outperformed its benchmark by approximately 3 percentage points during the past 52-weeks.

Investing is related to the future. No matter what are you looking for the main goal of investing is to improve your future. Stocks also want to develop their better performances in the future, so it looks like they have the same goal as investors. But why is ESG the hottest investing trend today? How does it become such a profitable class for investors? As we said, ESG stocks generate better returns, they generate profits and hence, reward all investors involved.

Why is ESG the hottest investing trend now?

The global trend for many years is sustainability. That means the sustainable company plans the future and plans to be present in the future, not just to shine for a few years, to get a few bucks and turn all operations off.

ESG investing is a common term for investments that seek better returns. The other goal is the long-term impact on the environment, society. Sustainable investing comes in forms of ESG, impact investing, socially responsible investing or SRI, and also, values-based investing. The other school of thought adds ESG under the umbrella of SRI where there is also, ethical investing and impact investing.

The Financial Times describes ESG as “a generic term… used by investors to evaluate corporate behavior and to determine the future financial performance of companies.”

Today, almost the whole of civilization is working on sustainability, and the businesses that do the same are popular and supported. Bank of America published a study that shows that 86% of customers believe companies should consider ESG problems. For example, data from that study reveals that 94% of Generation Z and 87% of Millennials are very interested in this issue. For them it is important, (well, not only for these two generations), that the companies’ focus is on renewable energy, waste management, diversity. Also, consumers showed a great level of determination in the answers about the company’s reputation toward their focuses on the environment. How the companies treat it is maybe one of the main criteria when customers have to decide if the company has a good or bad reputation.

Sustainable investing strategies

ESG is the hottest investing trend today. It outperformed the market in recent years. So it looks the gap in returns will only grow as time goes by.

ESG investing is influential, and it’s only increasing. Bank of America estimates that $20 trillion is going to flow into ESG funds in the next two decades. For the purpose of comparison and to have a real picture how big is that amount you have to know that the entire S&P 500 is worth about $25.6 trillion.

ESG investing strategies are not new but here are some tips.

Choose the best in the class. This strategy includes the selection of the best performing or most modernized companies recognized by ESG analysis.

Investing strategy based on engagement activities such as active ownership of shares, voting on company governance is one of them, for example. The goal of this long-term process is to influence the behavior of the ESG company.

ESG integration into traditional financial analysis and investment decisions. This strategy focuses on the possible impact of ESG issues on company outlook. That in turn may change the investment decision. For example, if the impact of ESG is positive, the company is likely to look more favorable as an investment opportunity.

As you can notice, momentum is growing. Shareholders are demanding action more and more. The consequences arise for companies that fail to adjust.

Conscious capitalism is a management strategy that highlights adjusting the business with shareholders to share success. A company that matches that goal not only runs for profits to shareholders, but also takes care of employees, the environment, clients, and community. That generates long-term profitability.

How to trade ESG stocks

First, do your research. Open an account to trade ESG stocks. Fund your account and pick the company. You can use your account to invest in ESG stocks by buying shares or trade on the price movement using spread betting or CFDs. You can go long or short on ESG stocks like with any other stock. Also, you don’t need to take ownership of any shares.

Where to find the hottest investing trend?

For example, tech startups are some of the hottest investing trends. They broadly implement sustainable practices and make up a respectable part of ESG investing. Innovation-focused companies that develop advanced technologies, do it in a way that is in the best interest of civilization. For example, Microsoft or Apple, both are among the largest sustainability-focused companies. They generated great returns to their investors in the past few decades. And also, the important part is their reputation among customers. It’s excellent.

Since ESG investing isn’t all about the environment, something is about community impact or employee satisfaction. These companies are recognized as employee-friendly, also. These characteristics will drive their share prices in the future to stay on the top in the investment world.

Still, some will argue that taking this approach in investing could mean reducing returns. But some researches advise otherwise. For example, you can choose the easiest approach and buy ESG-focused ETFs that track the index. Some of them outperformed their benchmarks last year and continue this year also. ESG investments had record amounts of capital inflows in Q1 this year.

ESG has a great influence on reducing risk. Adding ESG stocks in investment portfolios can help investors to reduce risk. Consider ESG and prioritize stocks. They have to align with the values most important for you. Use the ratings from an ESG agency to examine the company.

One note, climate change ruled the headlines at the beginning of this year. Seizing fossil fuels is an issue per se, many companies announced that would limit investment in coal, for example. So, ESG investments are possible to have strong growth in the coming years and decades. ESG investing is the hottest investing trend today and an excellent way to profit.