How to read this report

Every report will start with a short “Market News” section. In this section, we scraped the latest financial news regarding the financial markets. This is a more macro vision of the market. Interest rates, unemployment reports, inflation, oil and energy, earning season, etc.

After the news report section we head to the trading idea section. Every idea is divided into 4 important parts:

-

-

-

- The company and its sector and description

- Recent news about the company

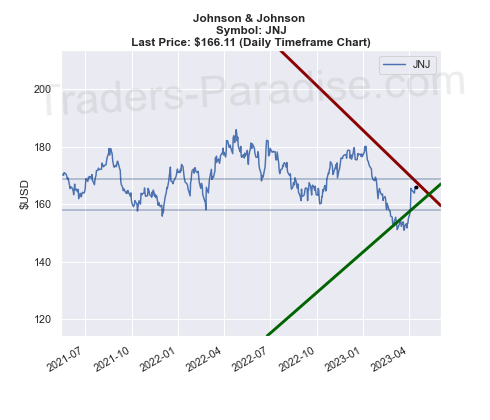

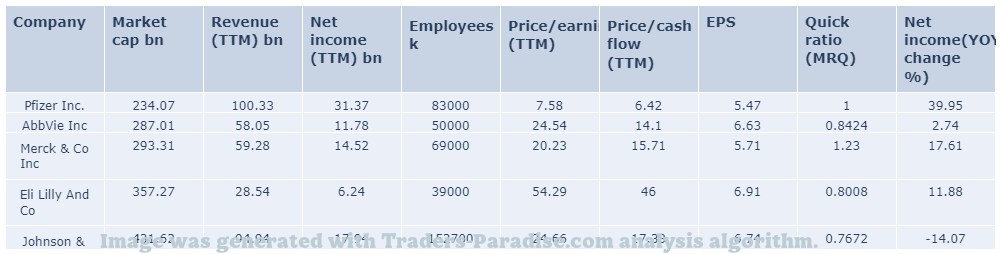

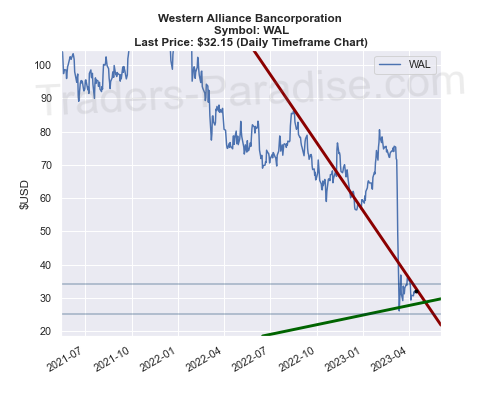

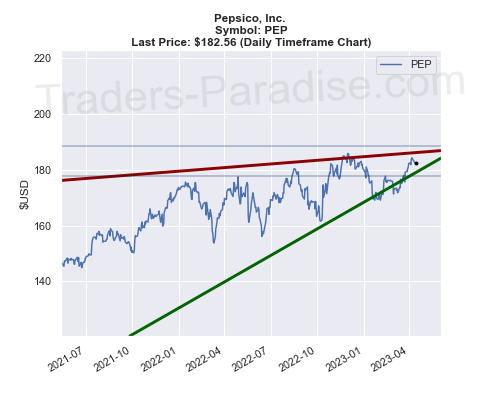

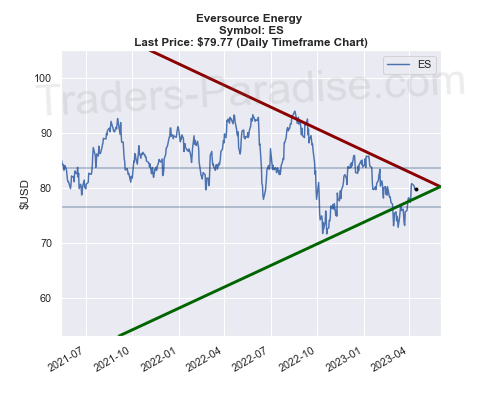

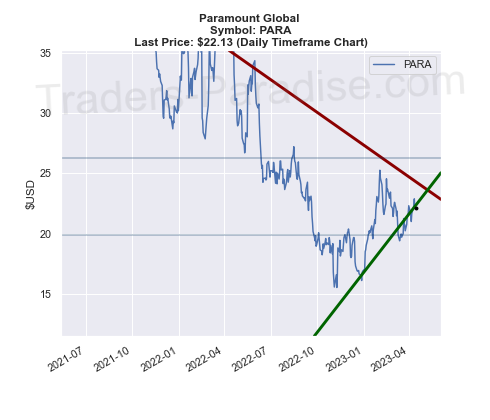

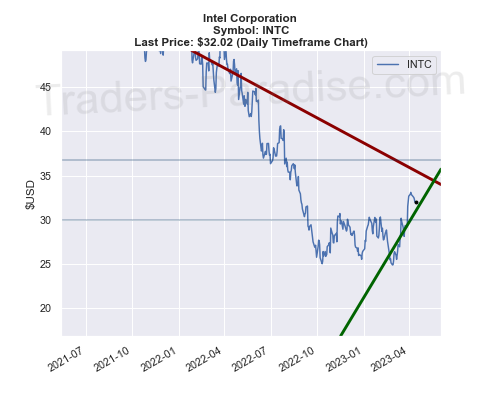

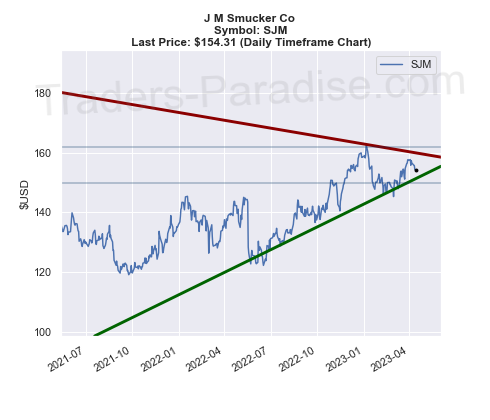

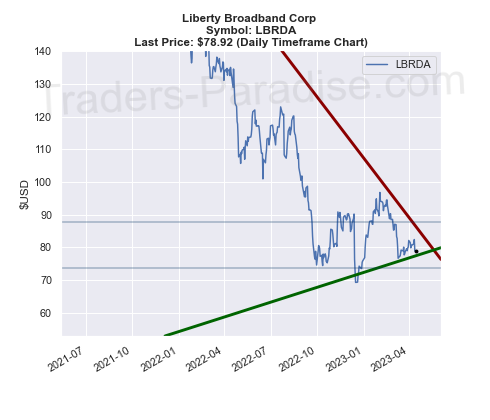

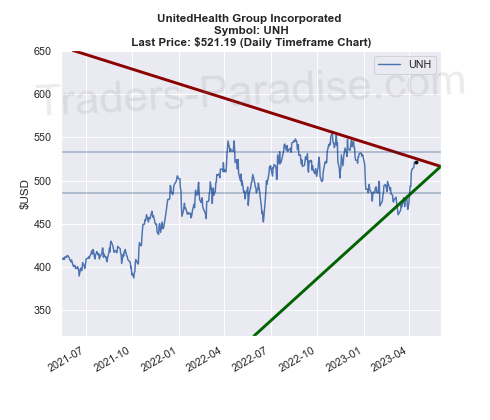

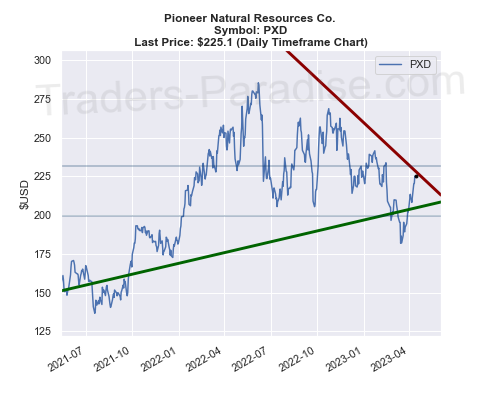

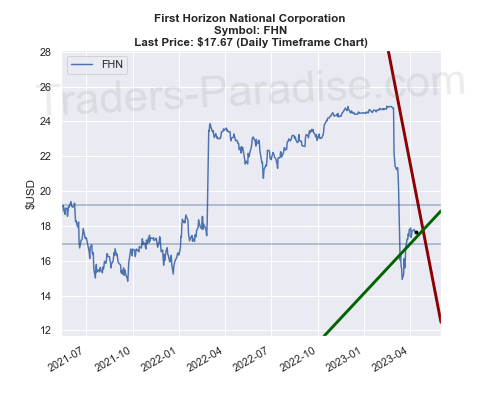

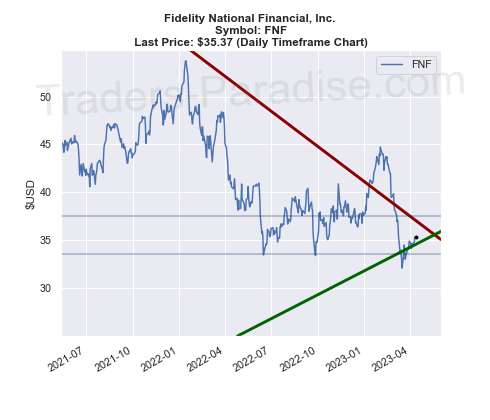

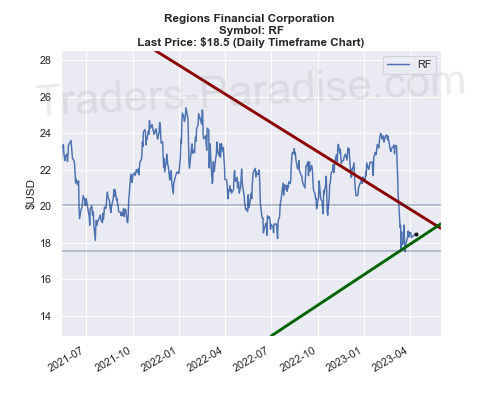

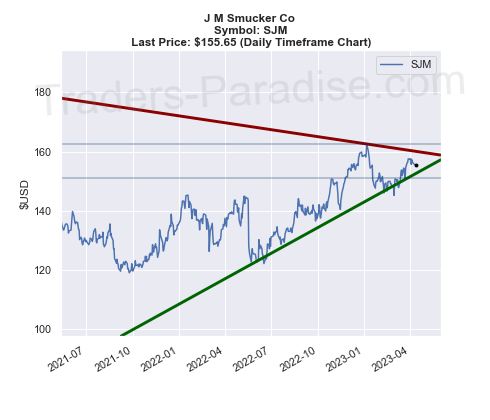

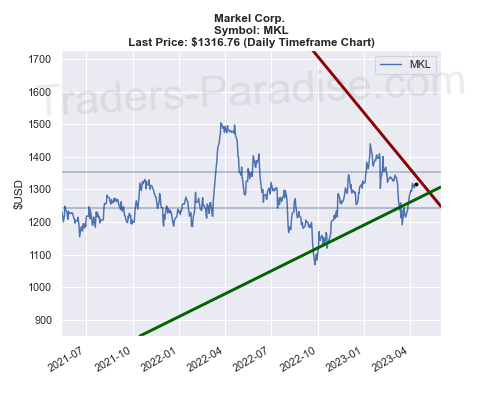

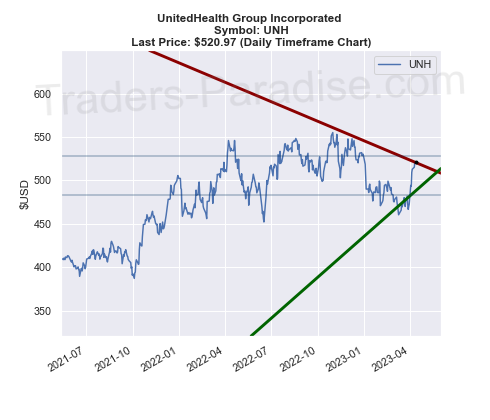

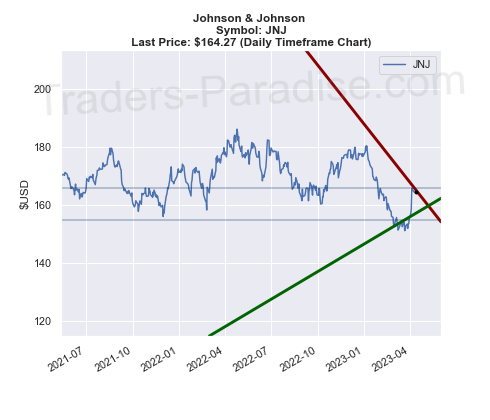

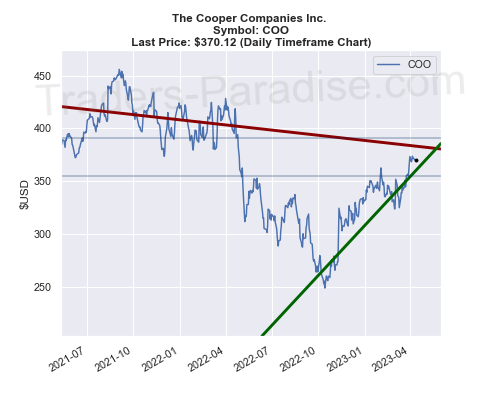

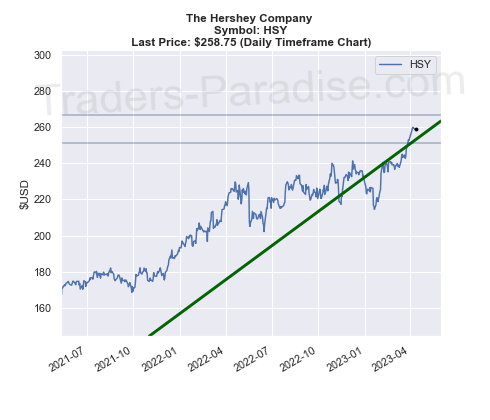

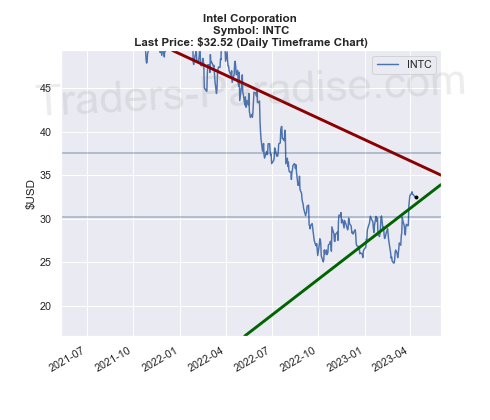

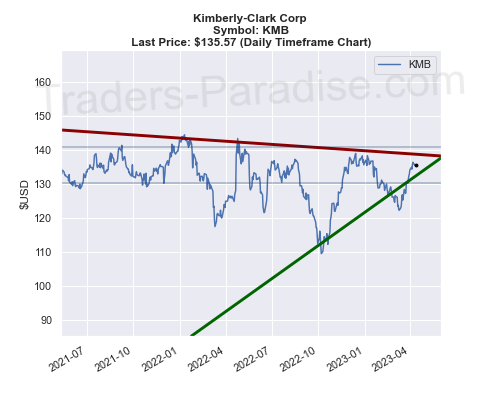

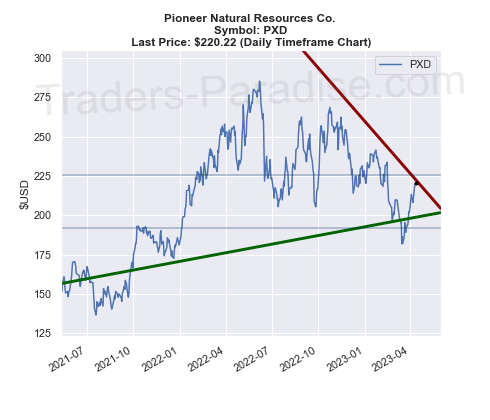

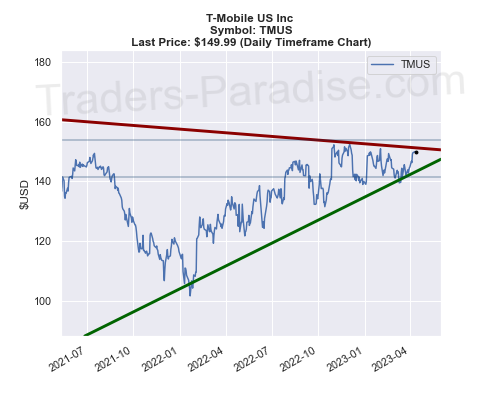

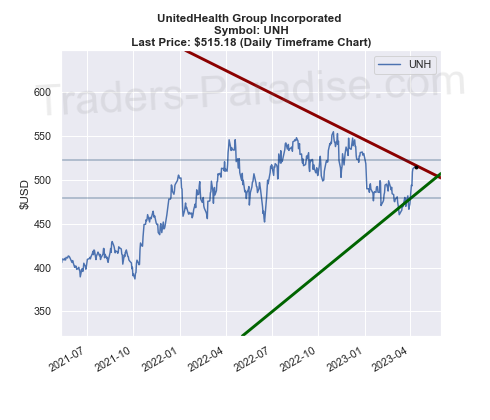

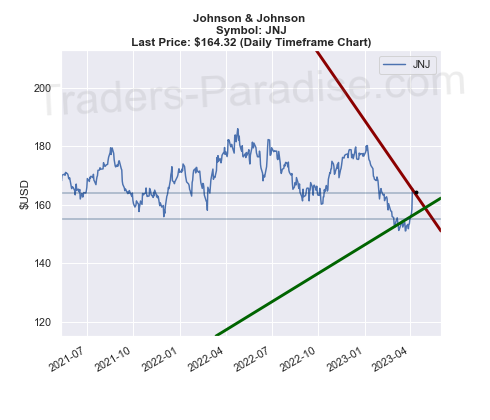

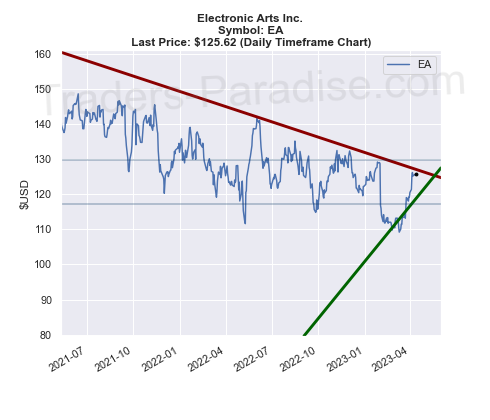

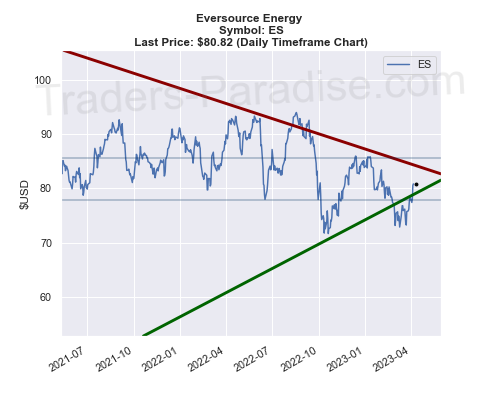

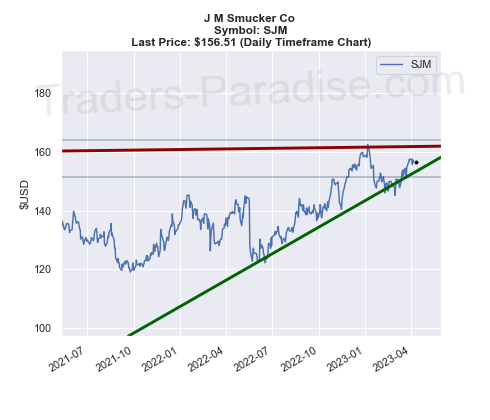

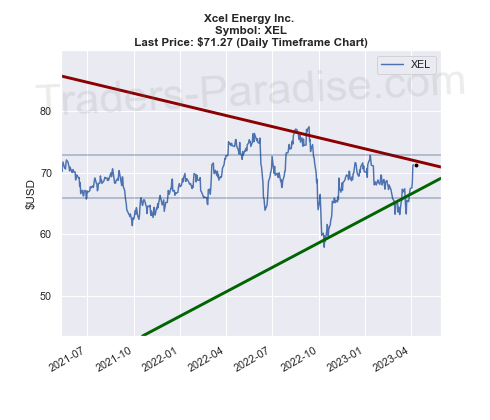

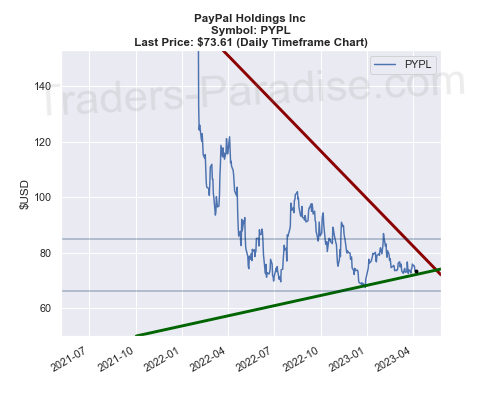

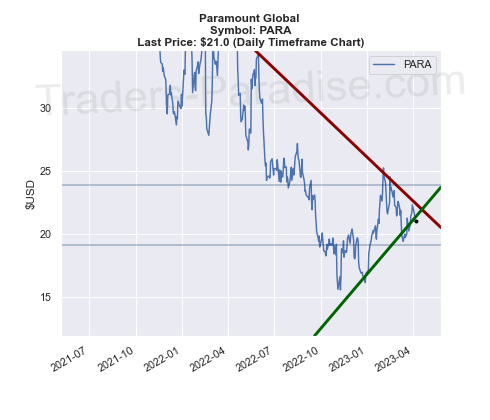

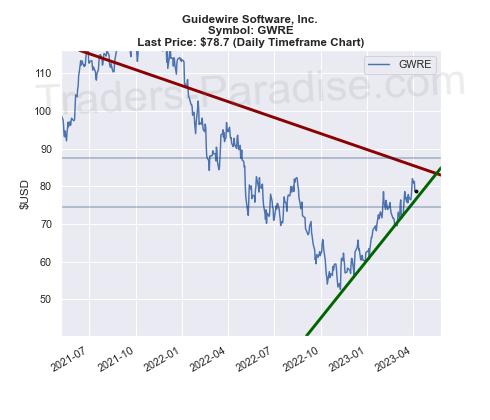

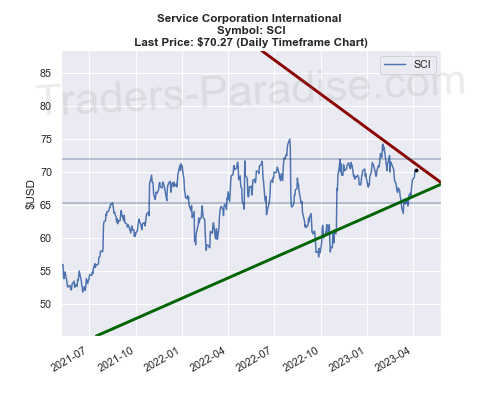

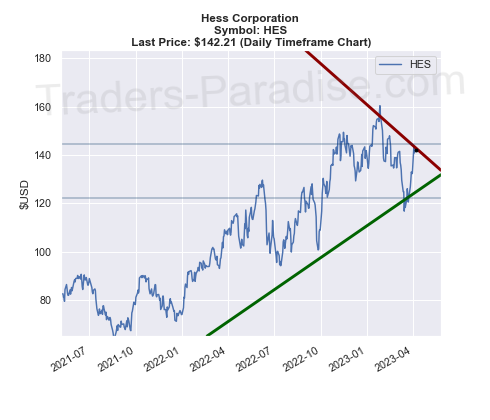

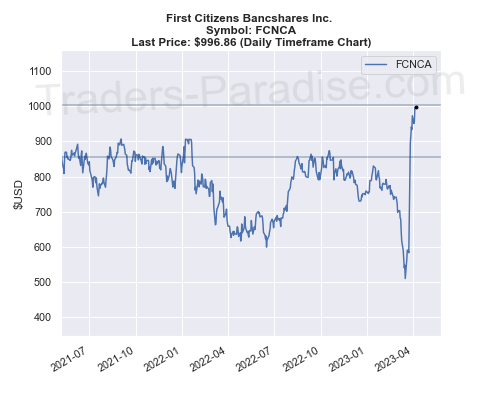

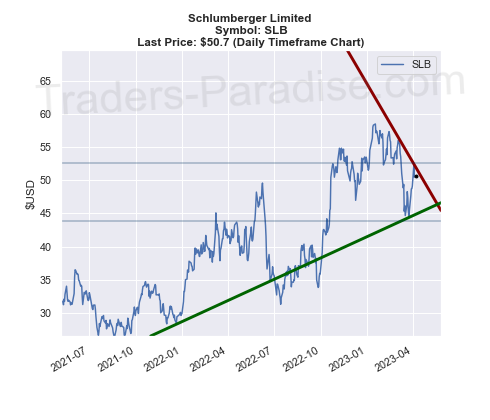

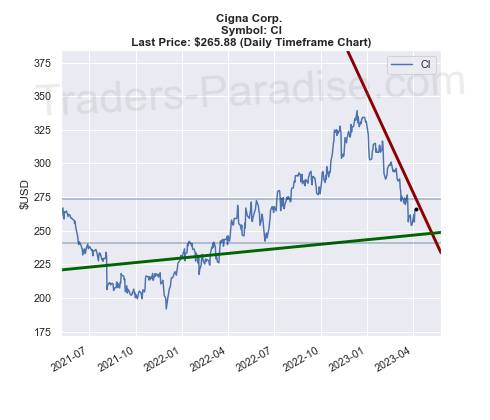

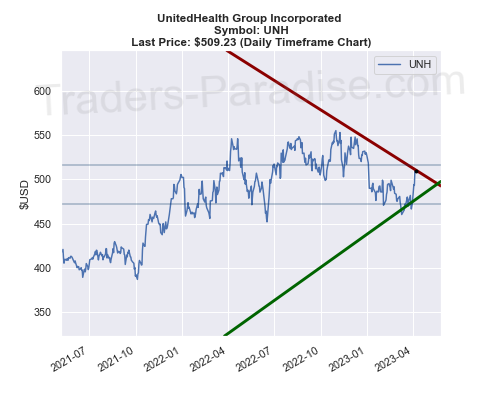

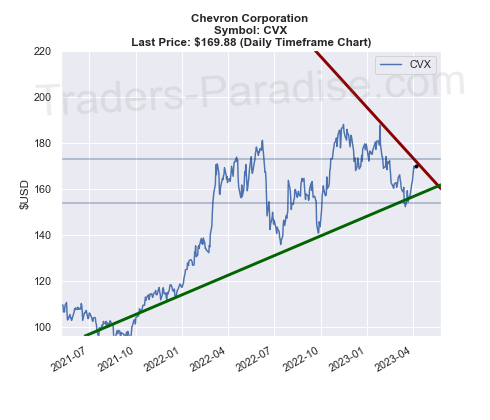

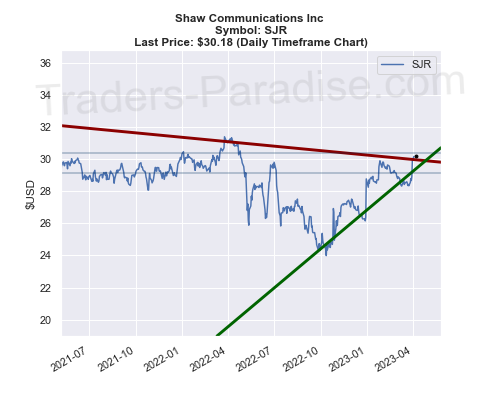

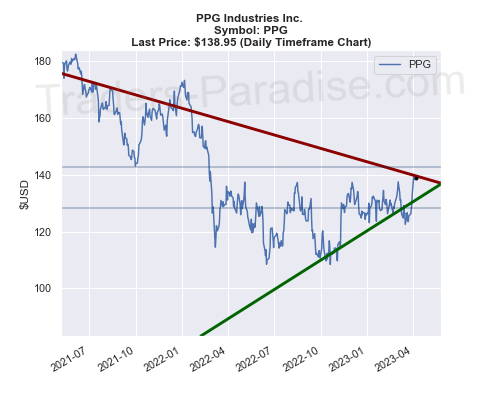

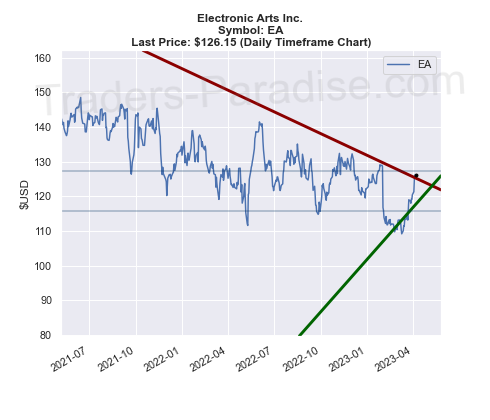

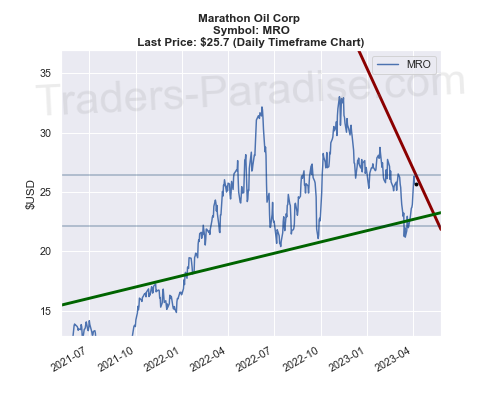

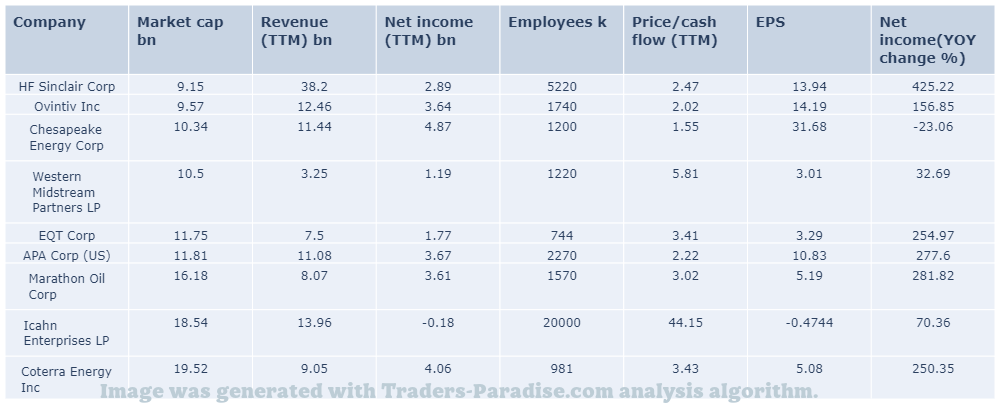

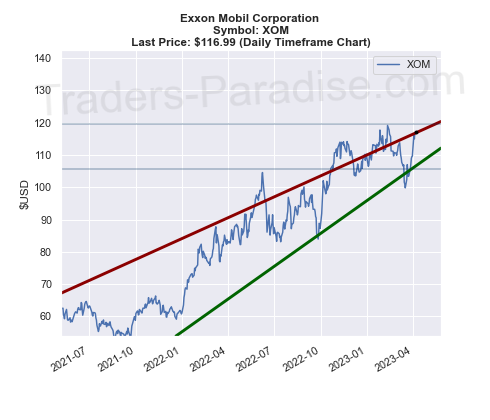

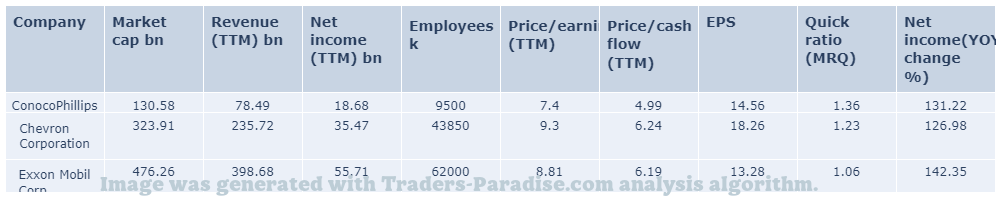

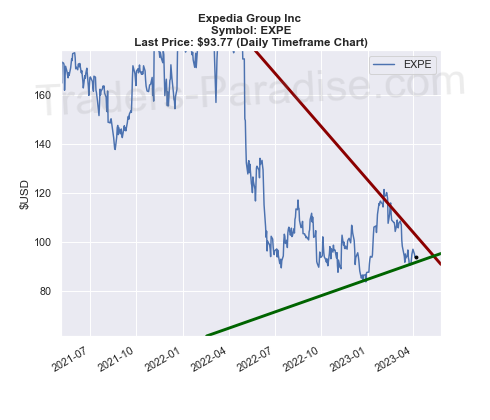

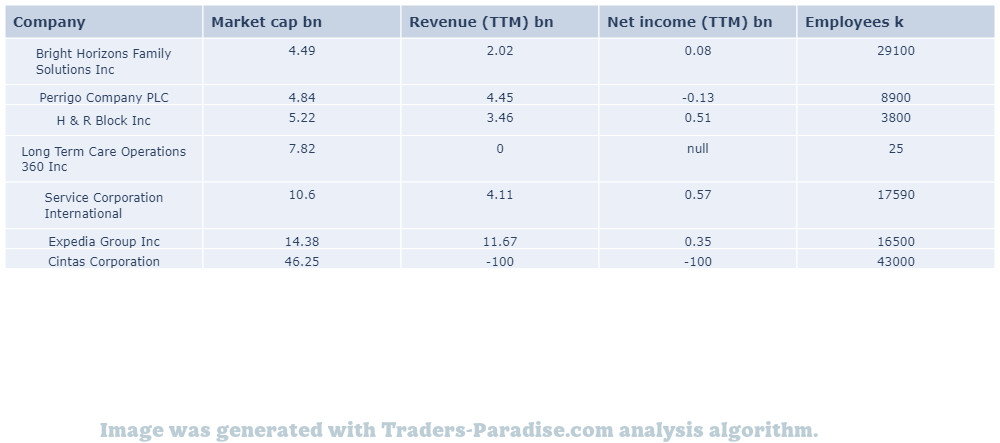

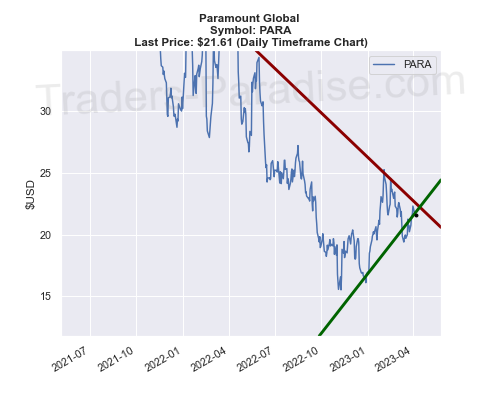

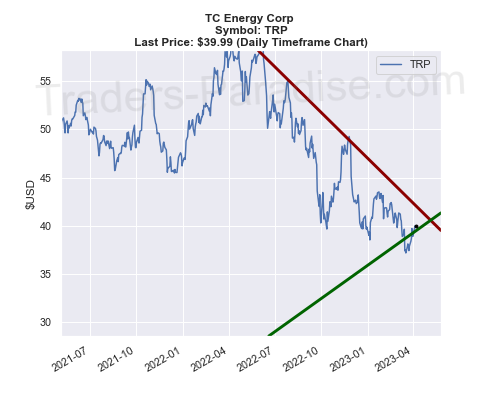

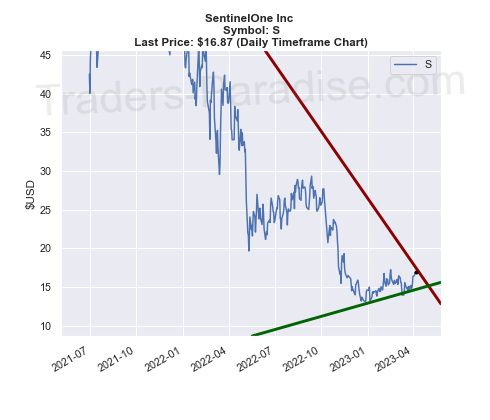

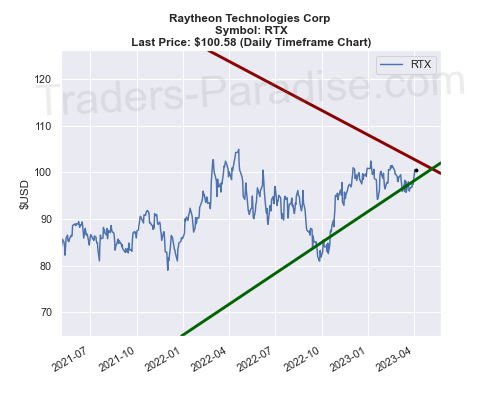

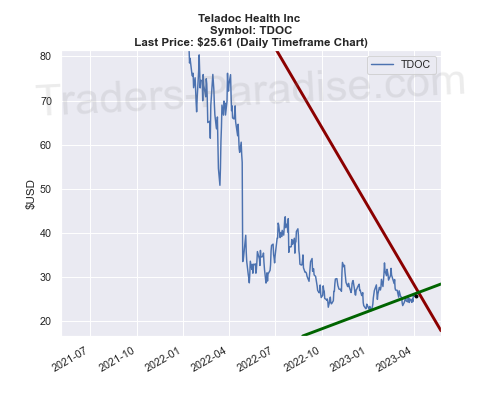

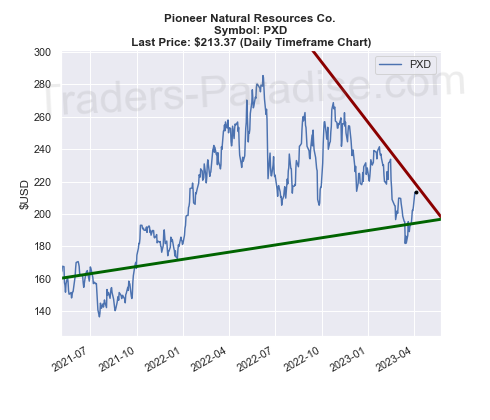

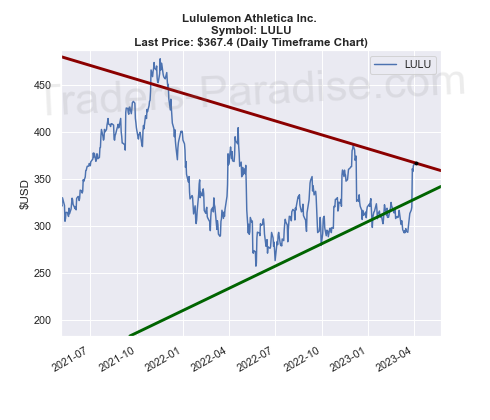

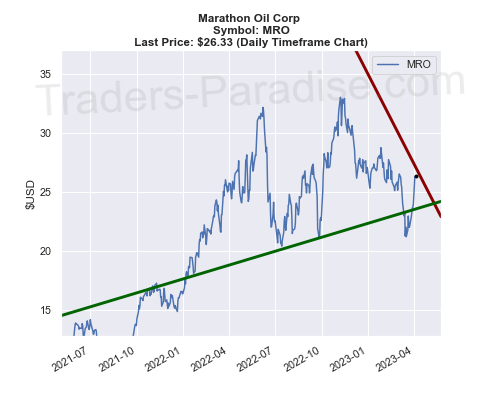

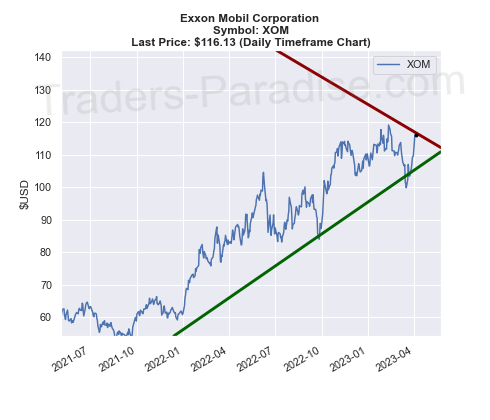

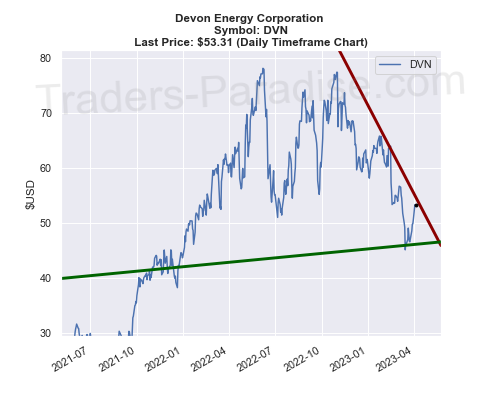

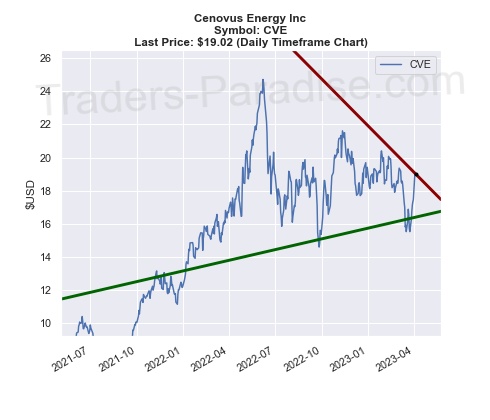

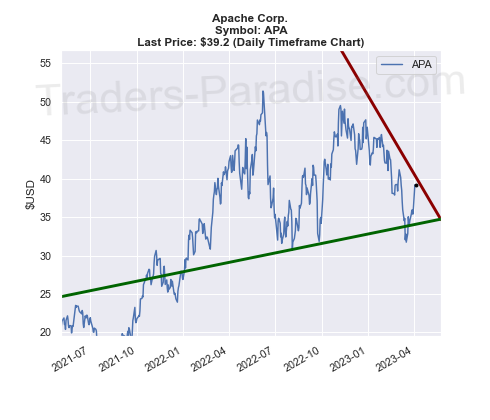

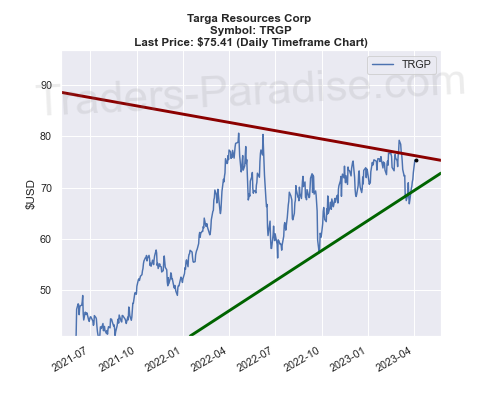

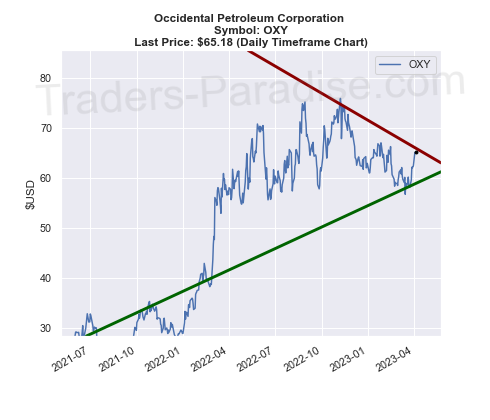

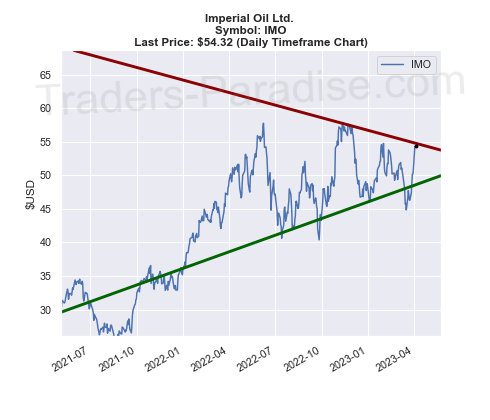

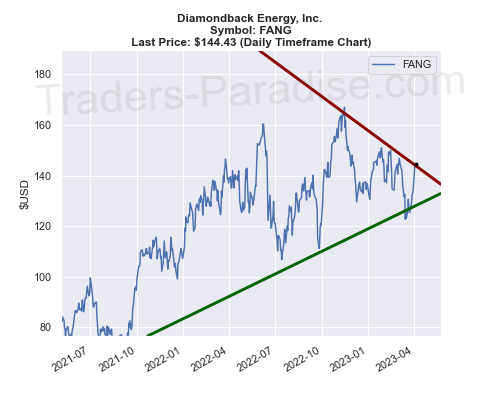

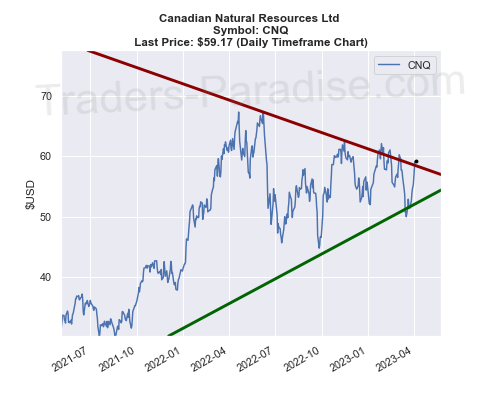

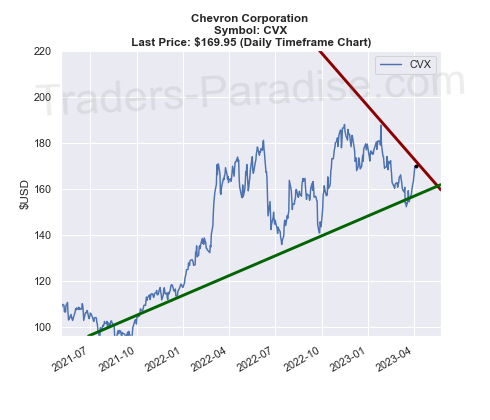

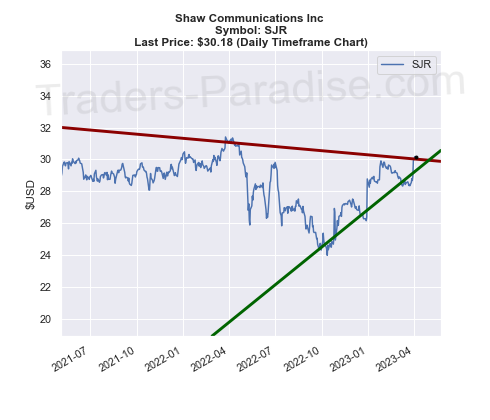

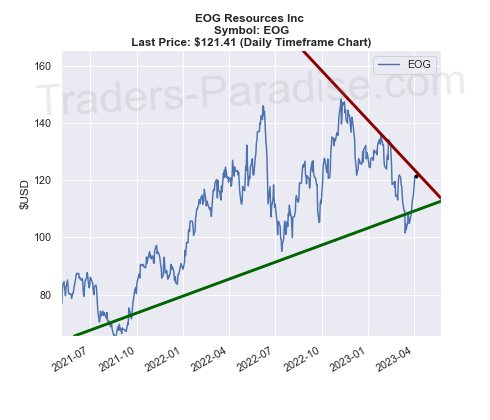

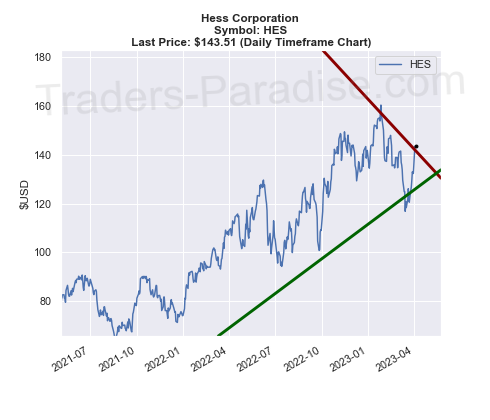

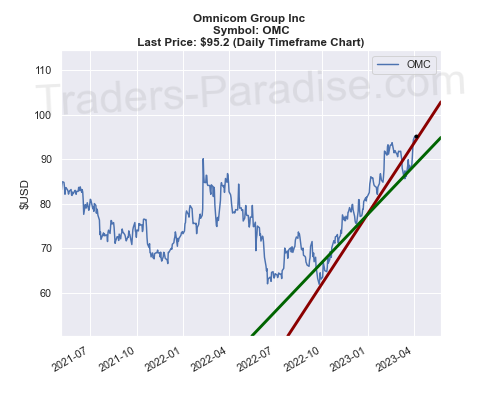

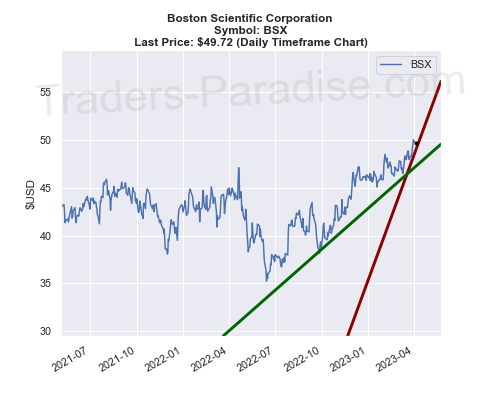

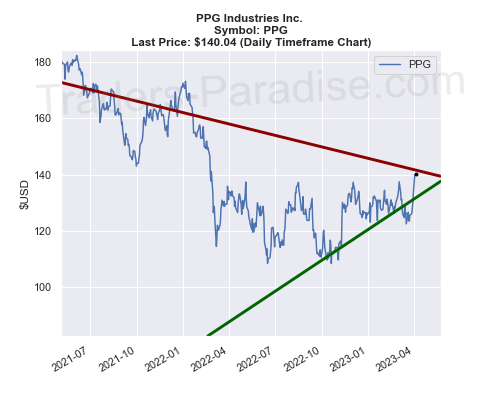

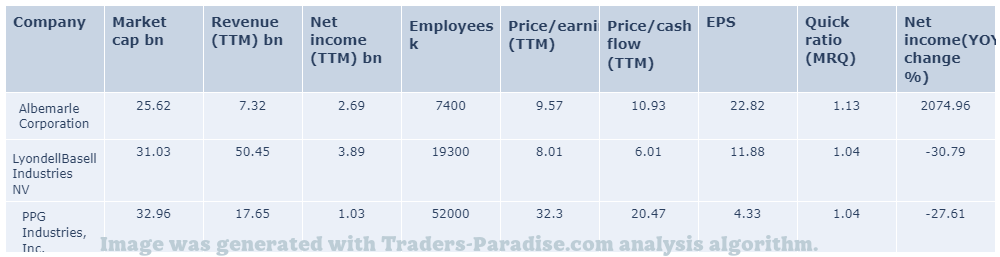

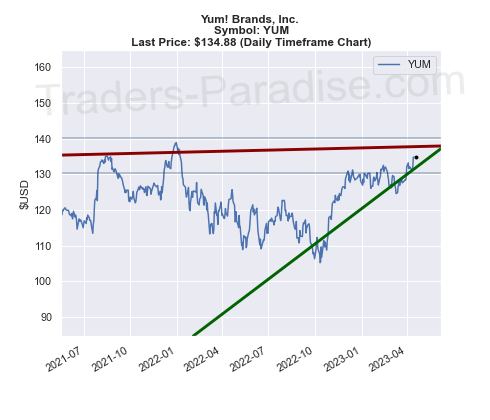

- Chart and its boundary lines

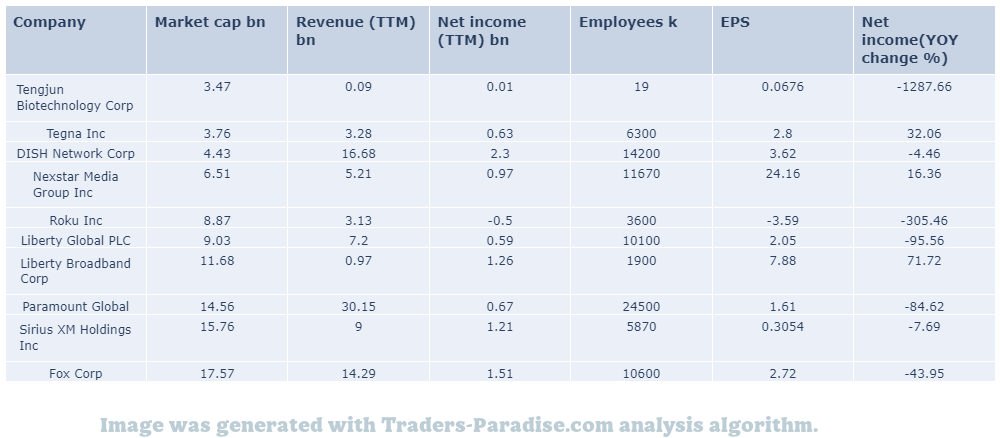

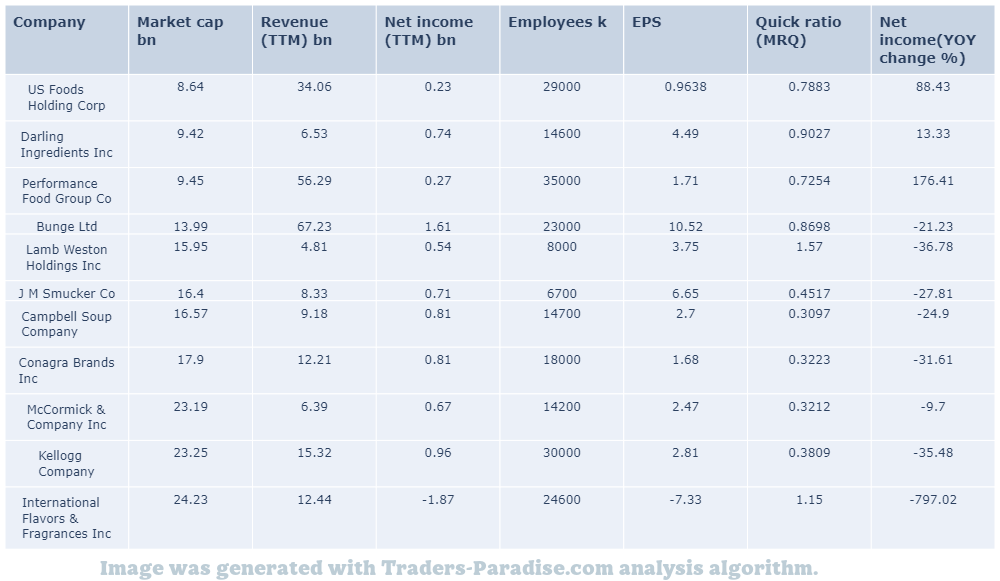

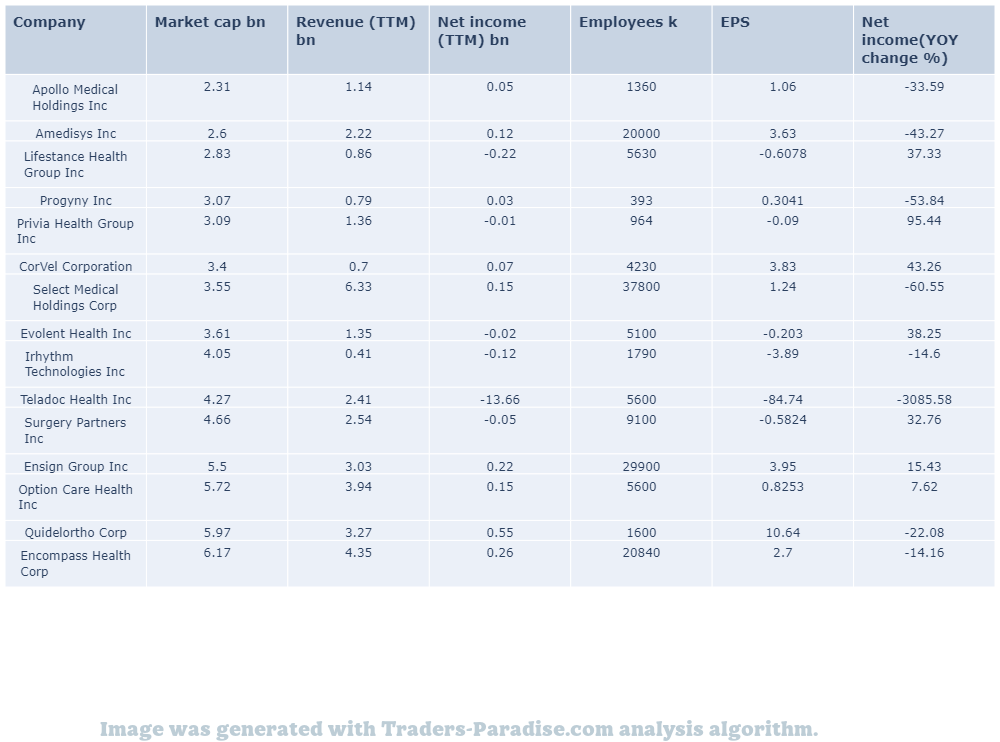

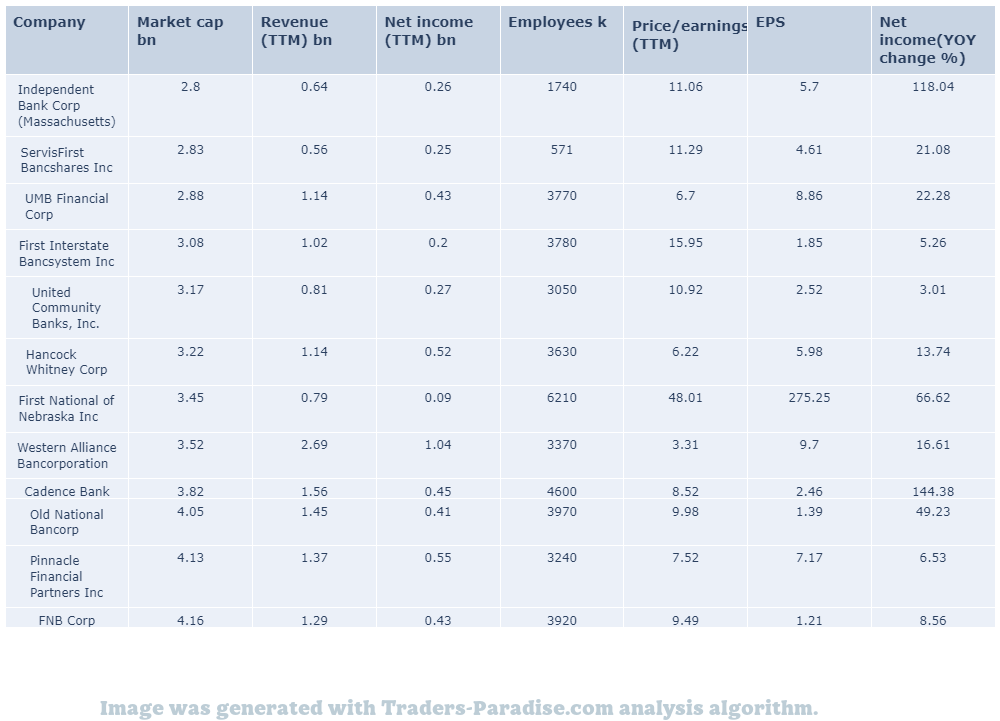

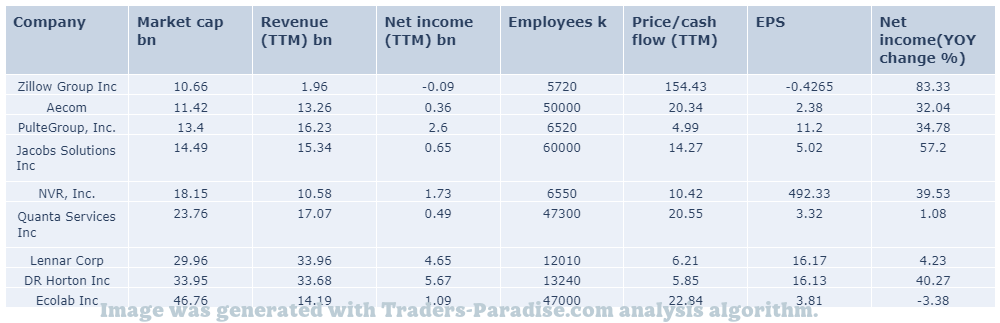

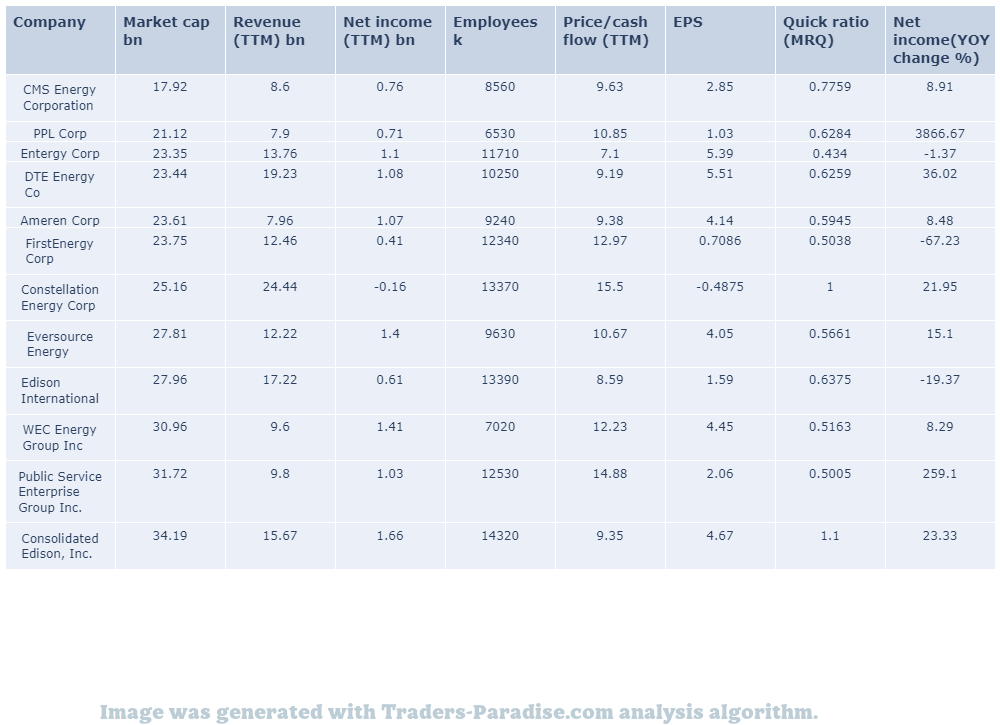

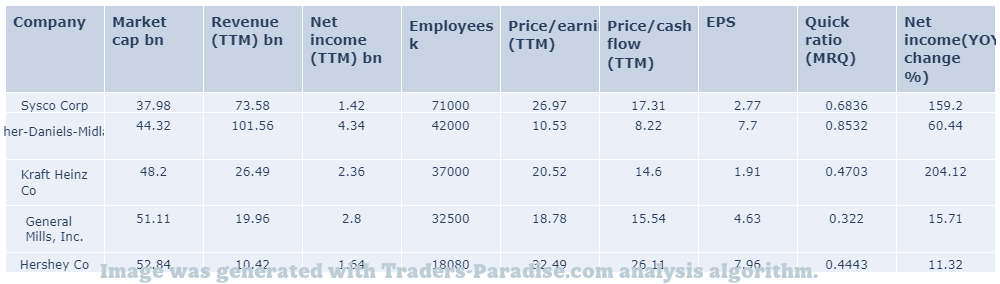

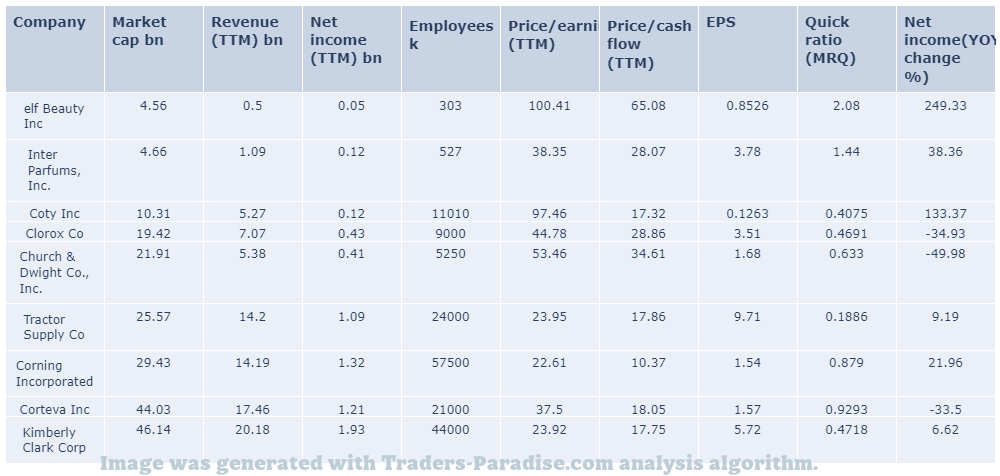

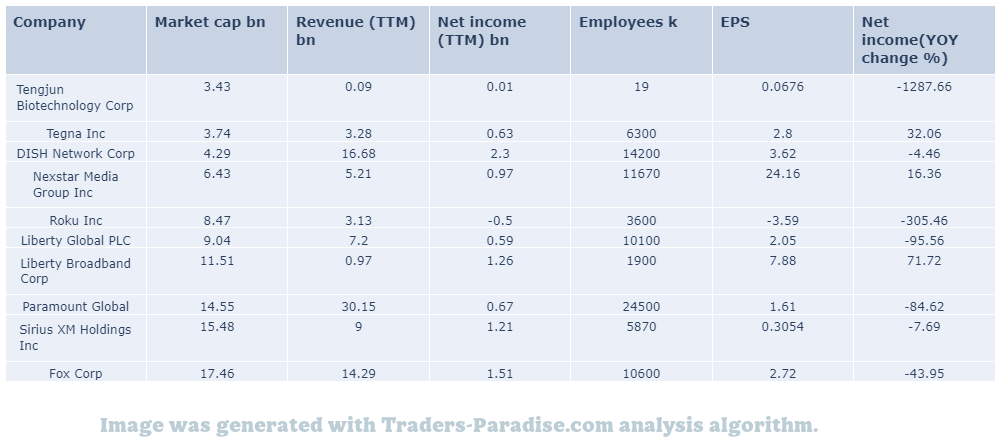

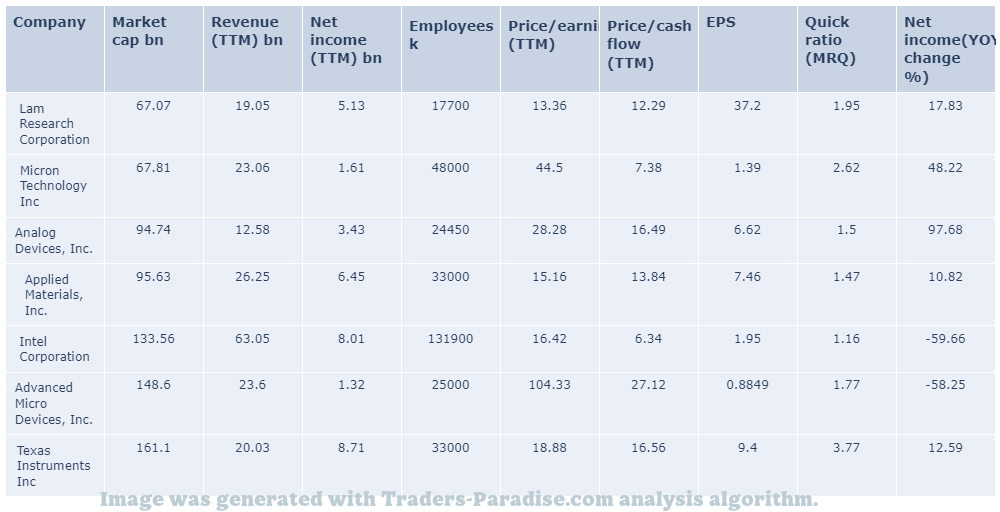

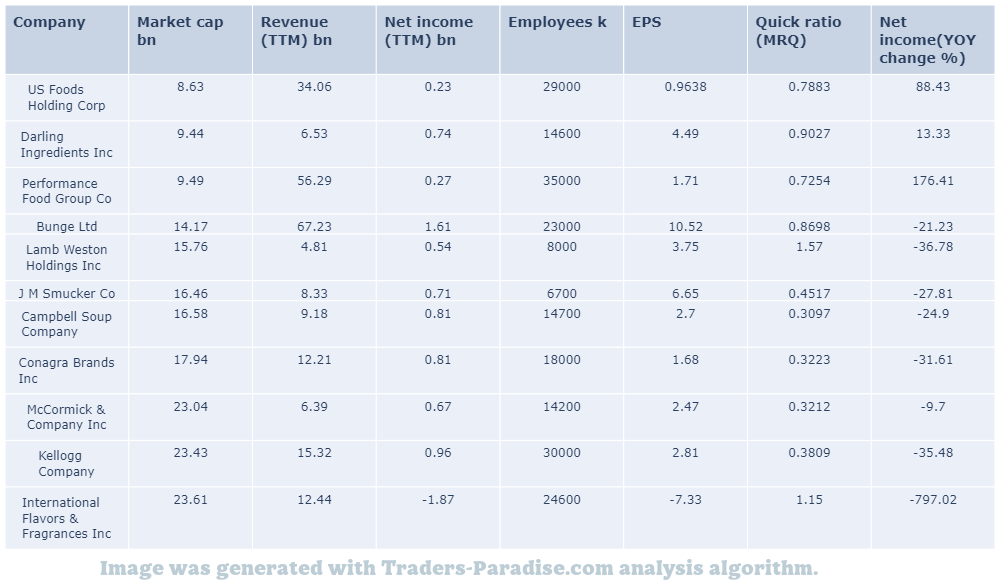

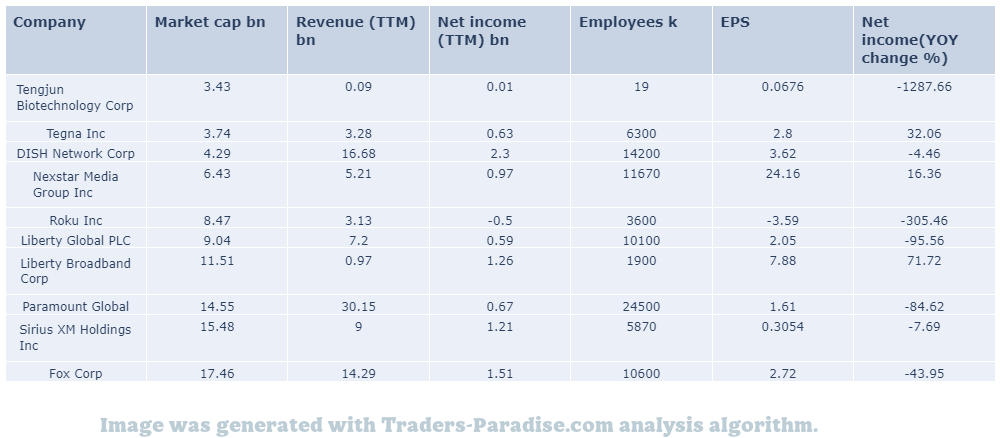

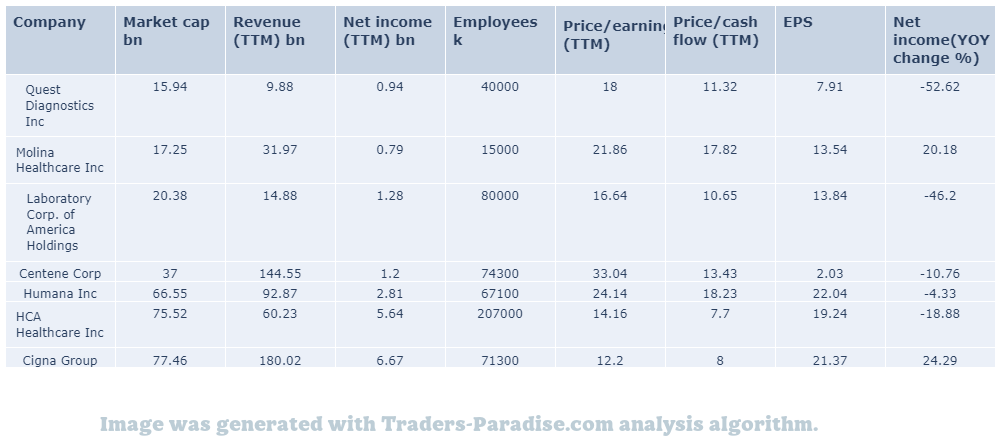

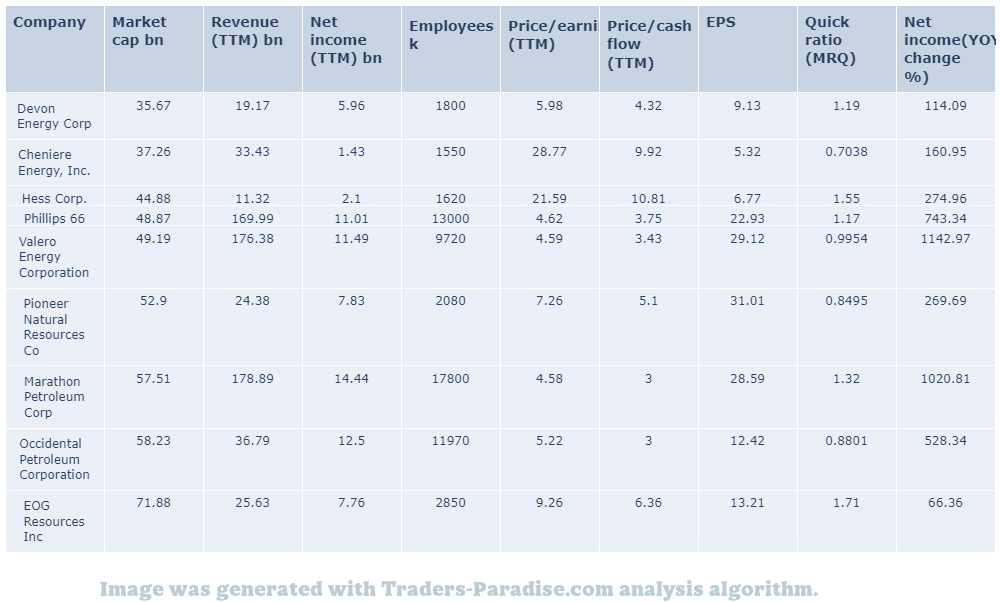

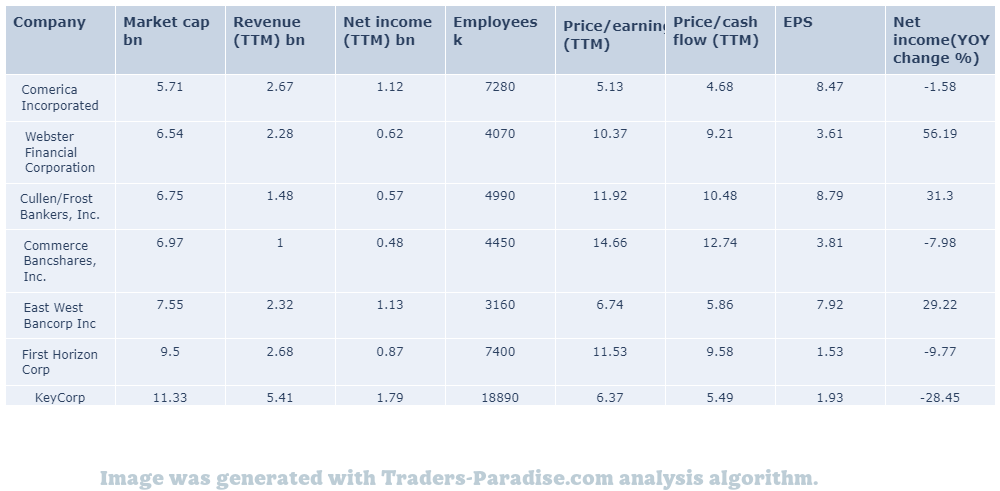

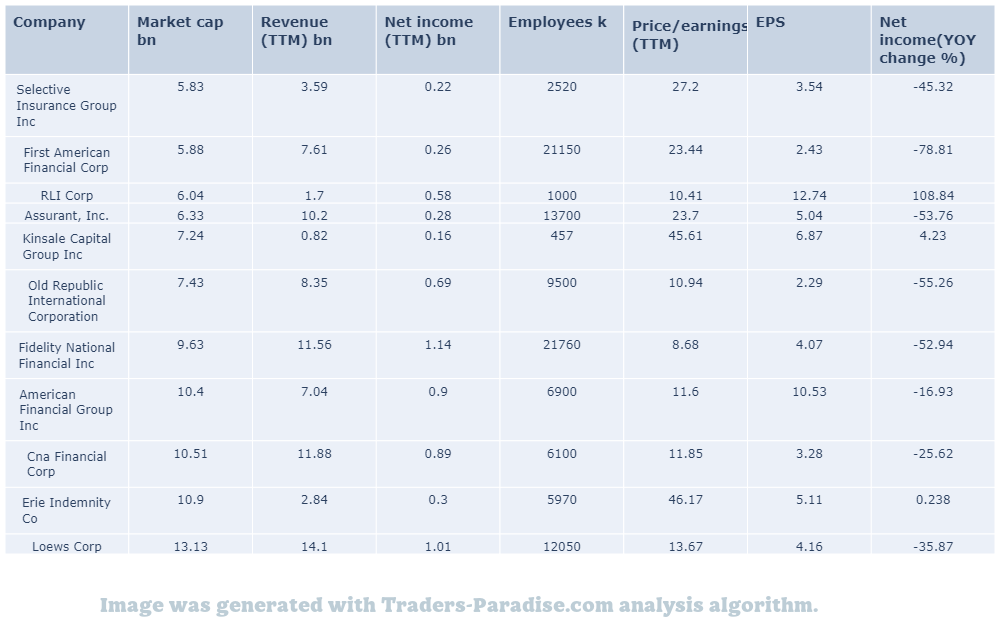

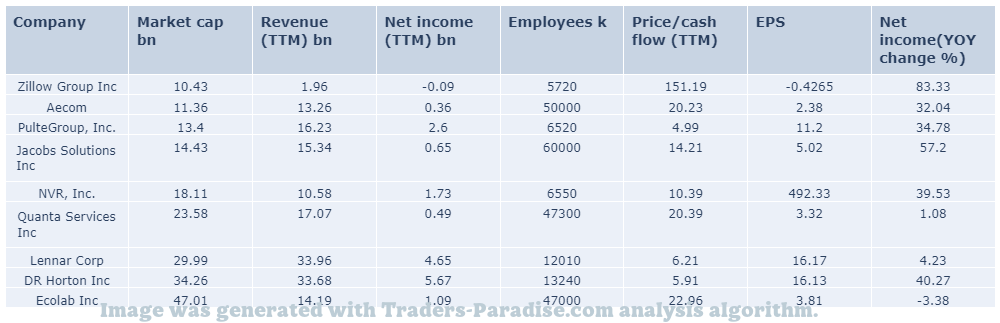

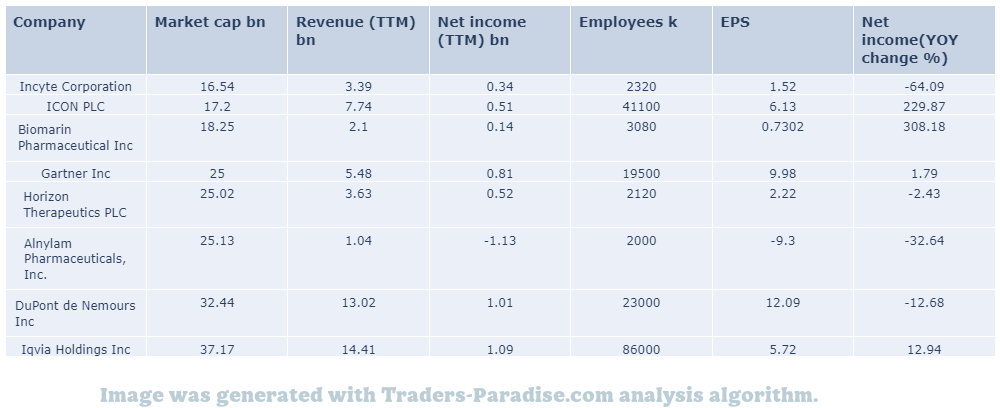

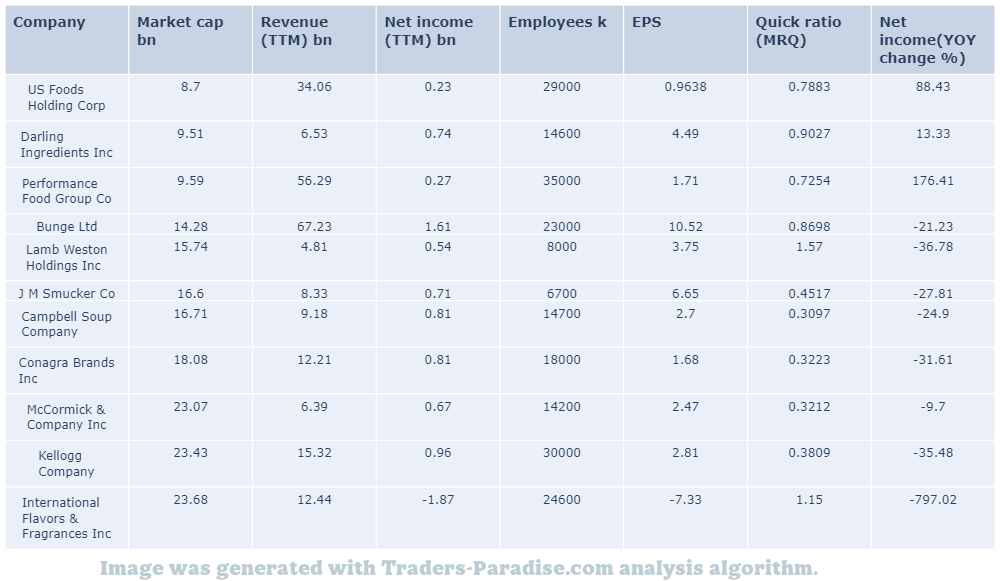

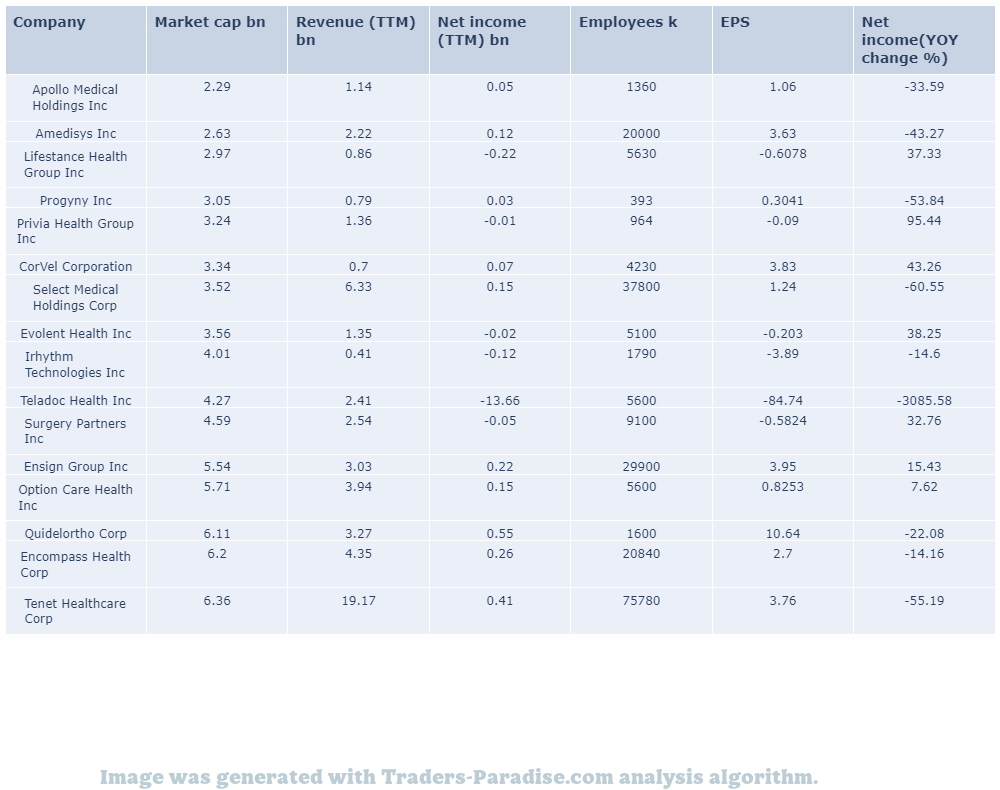

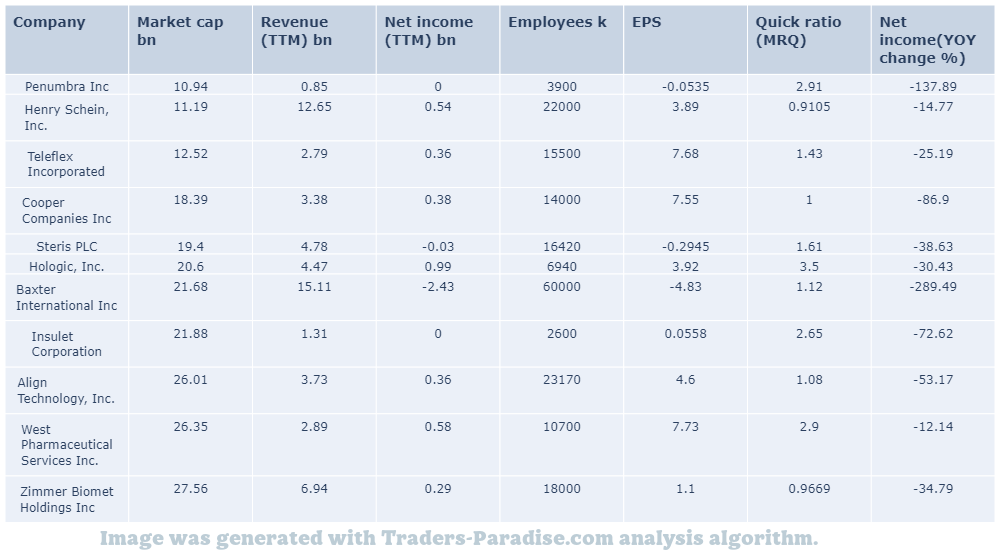

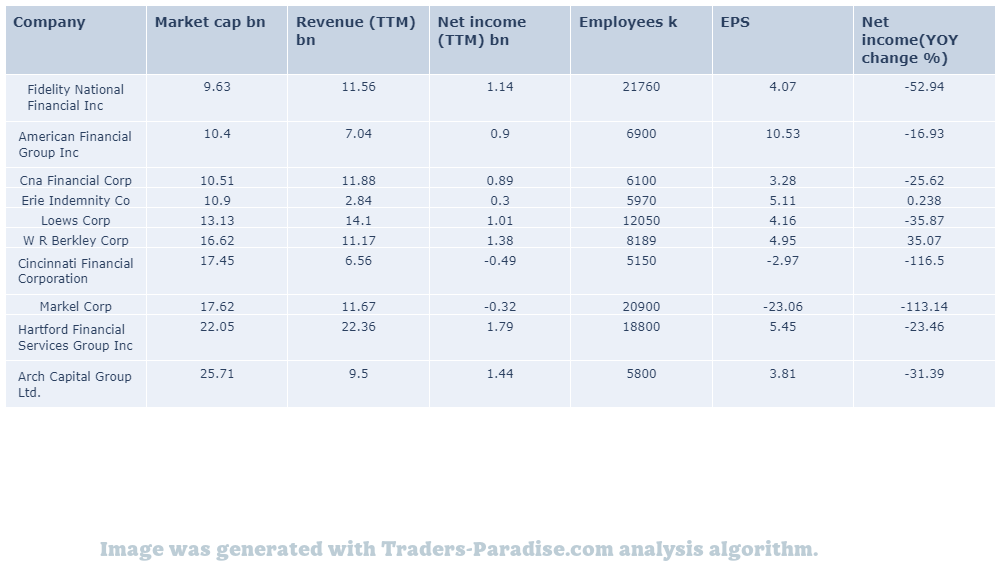

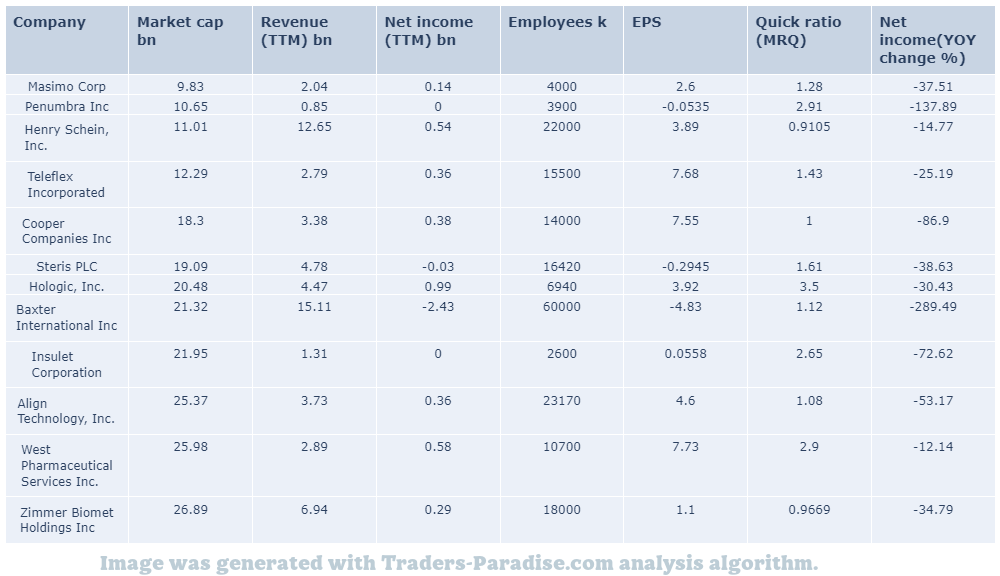

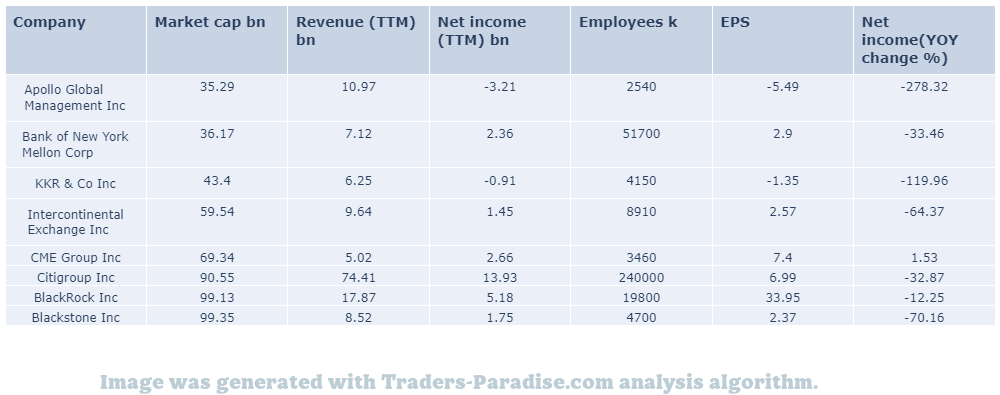

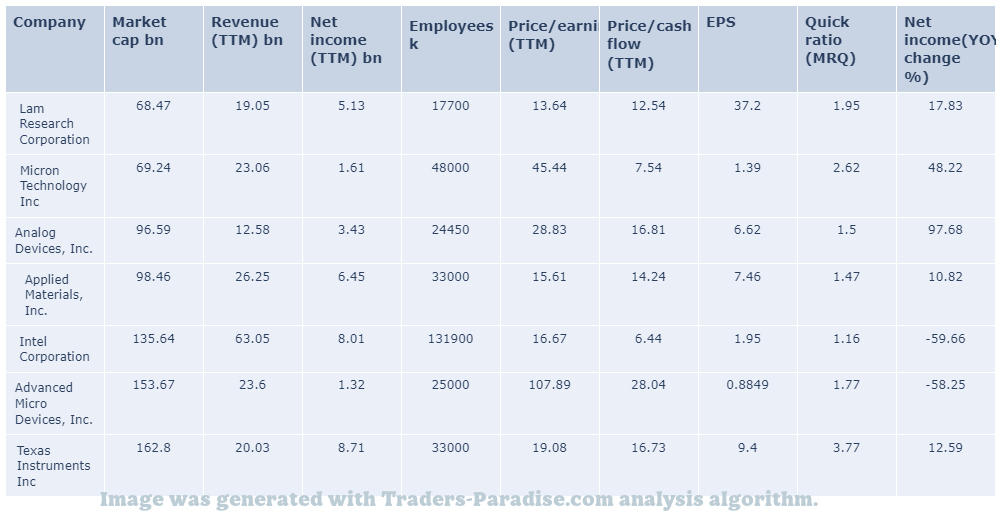

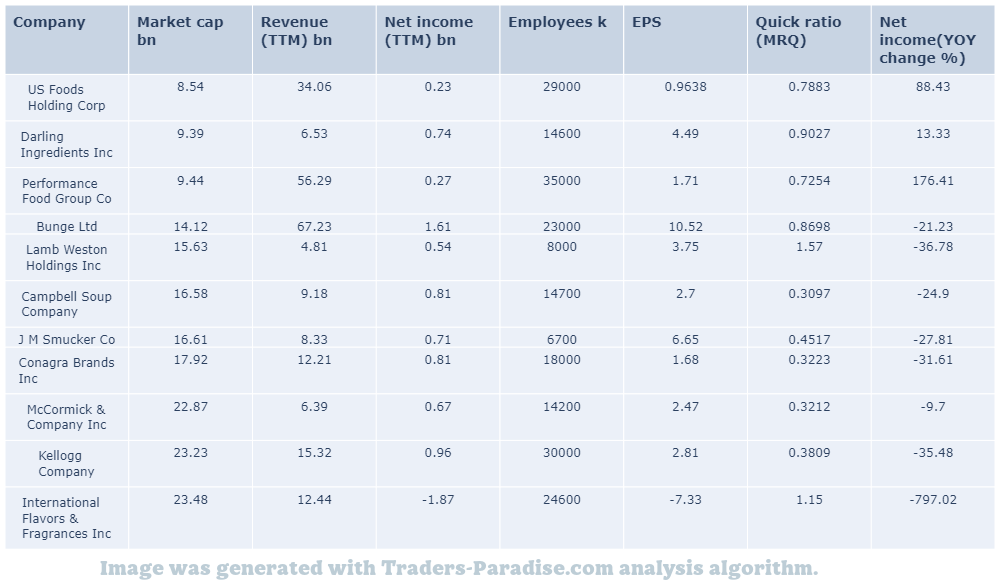

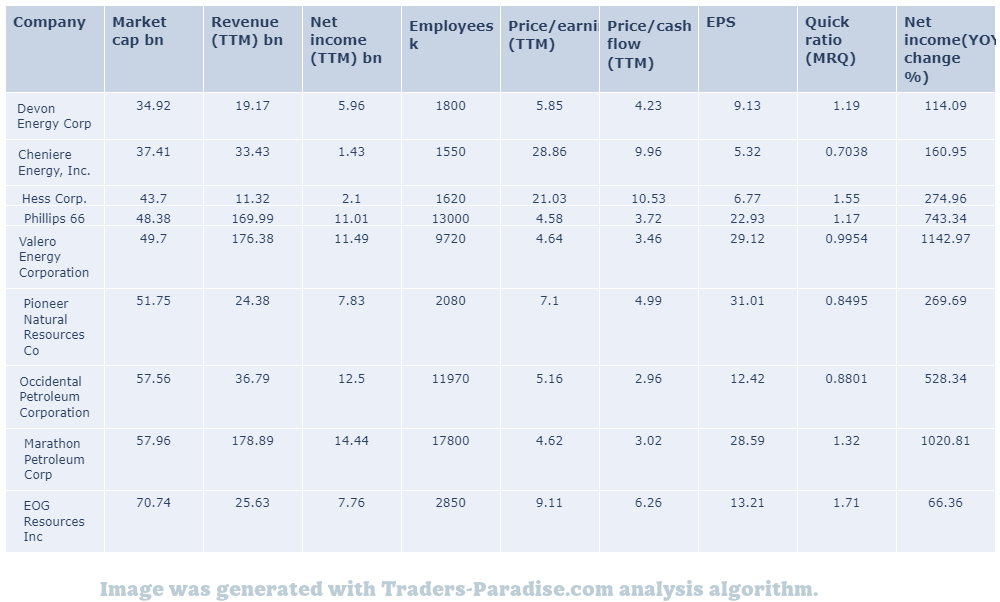

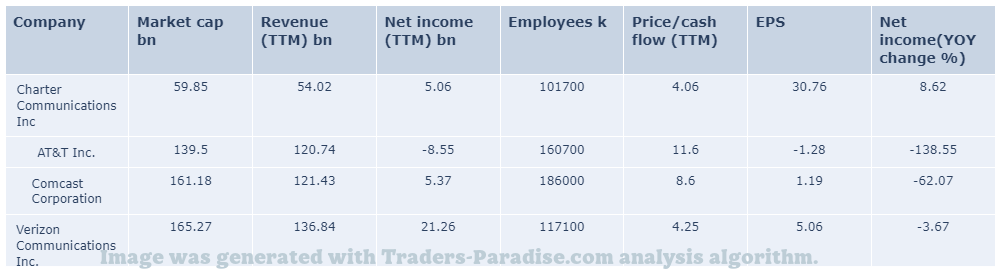

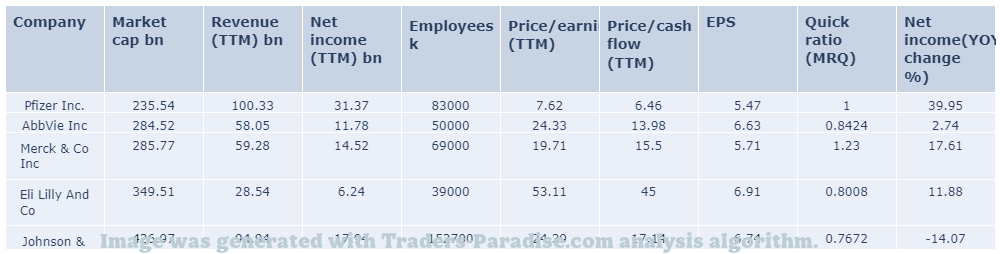

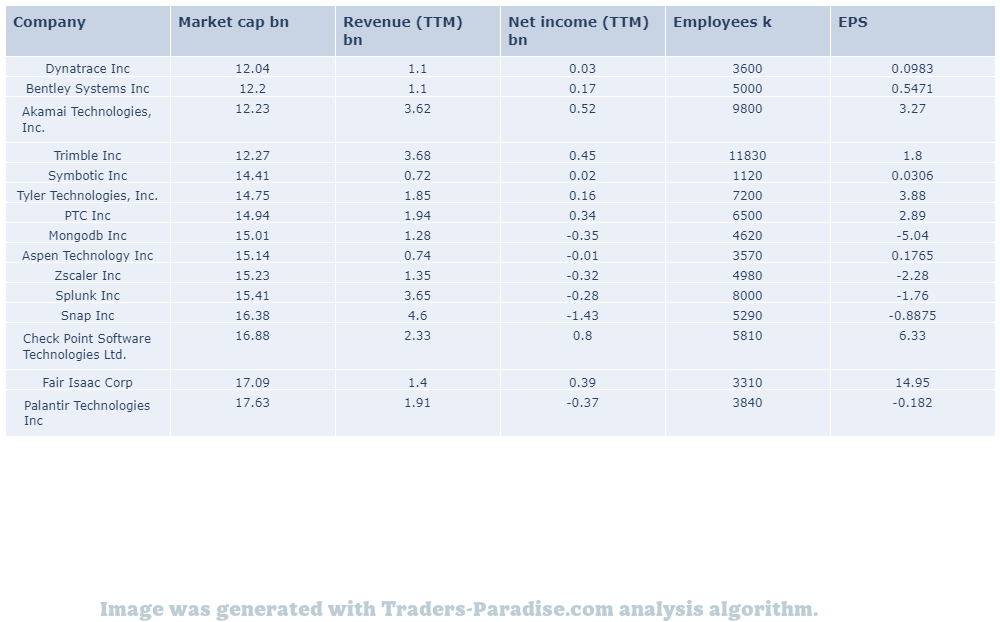

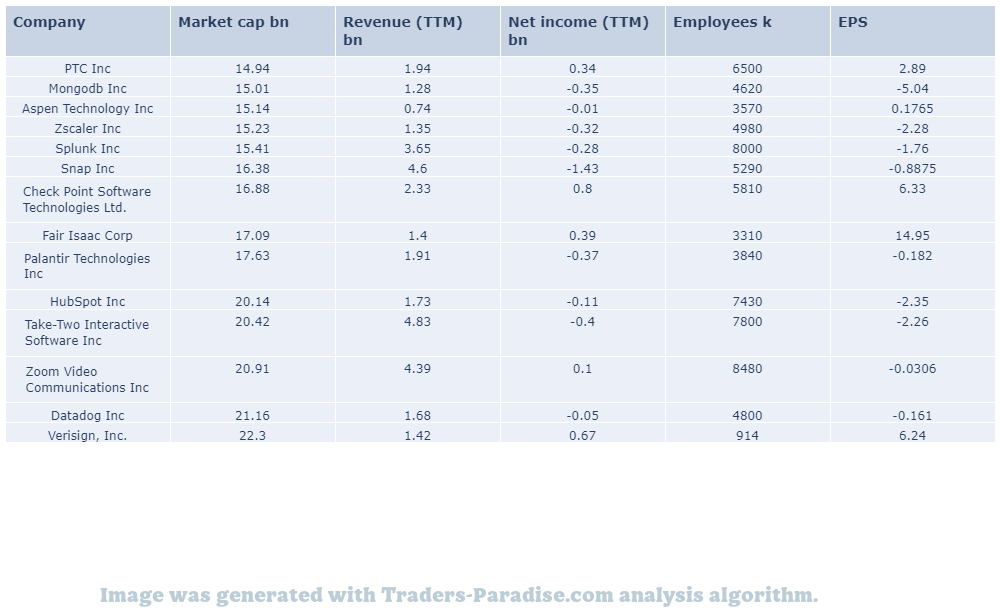

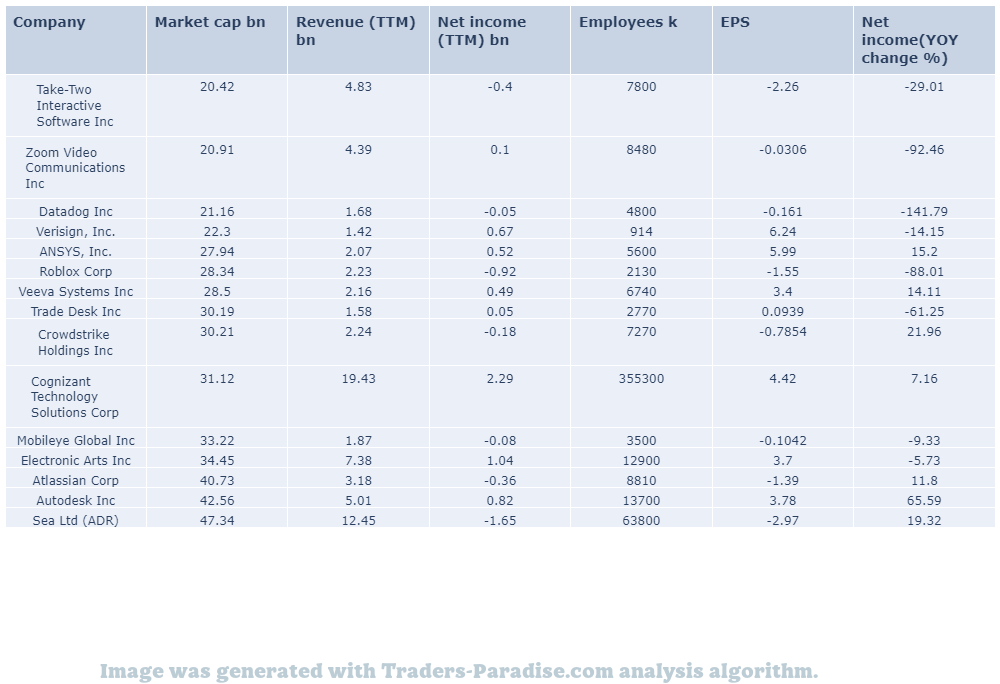

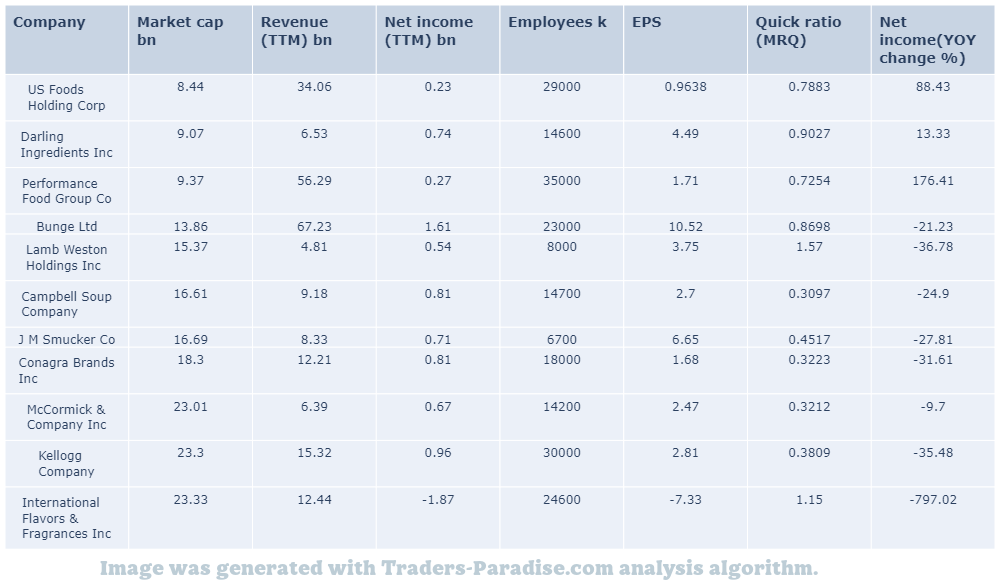

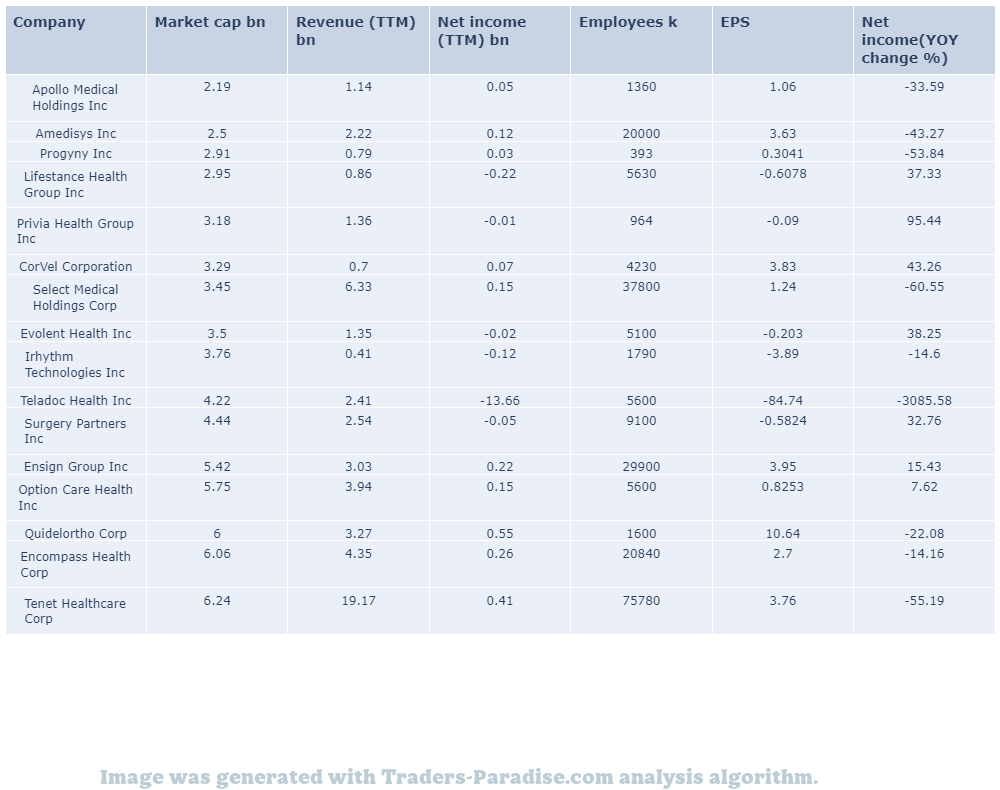

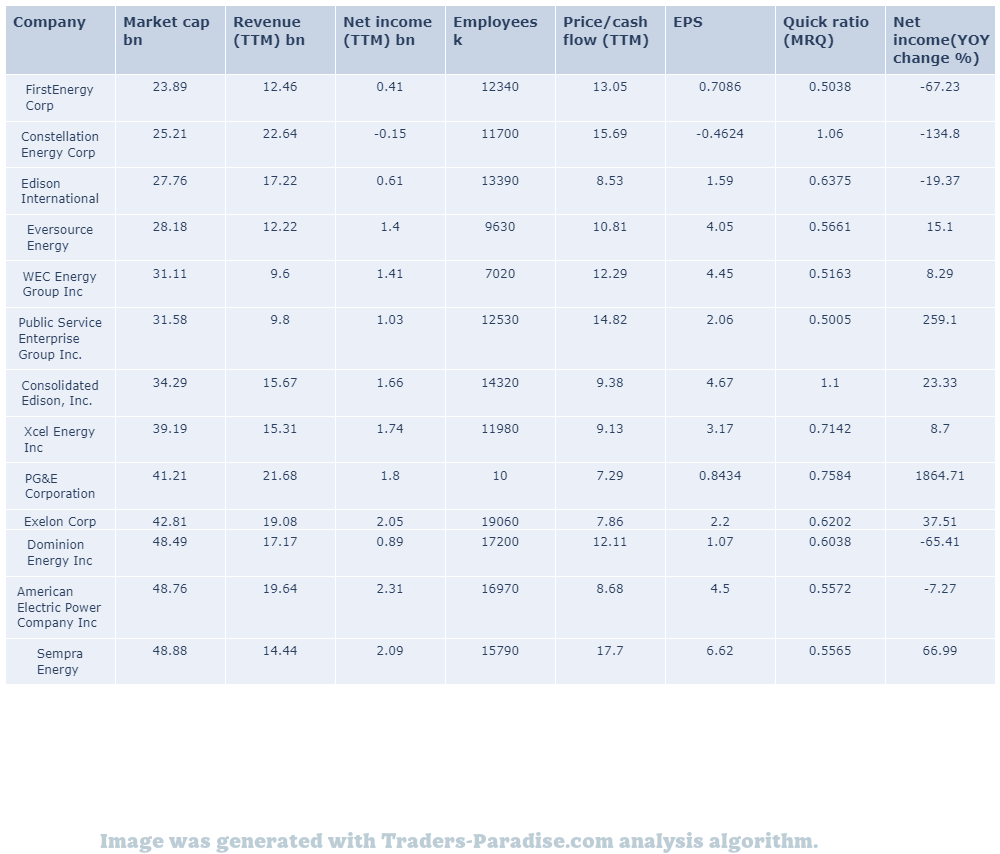

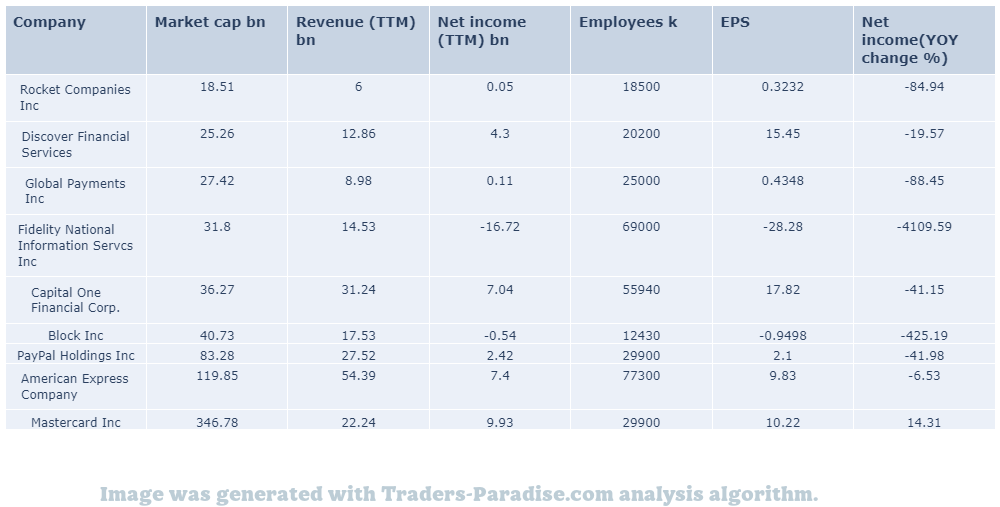

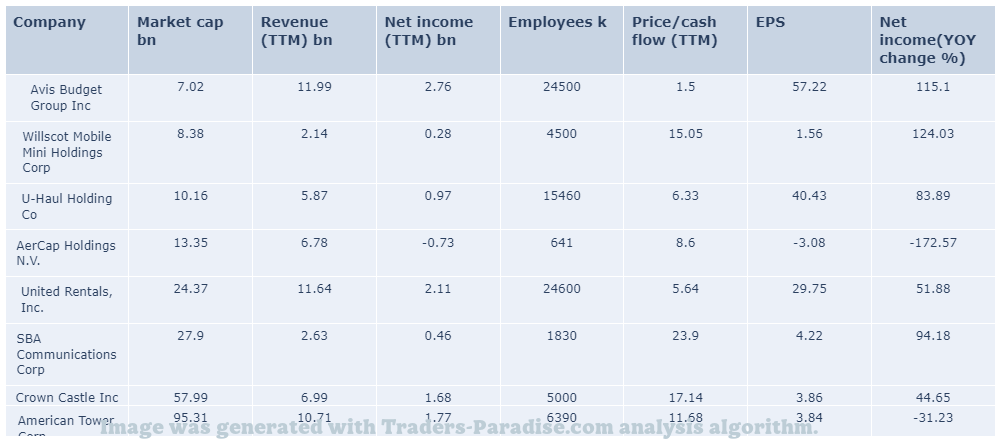

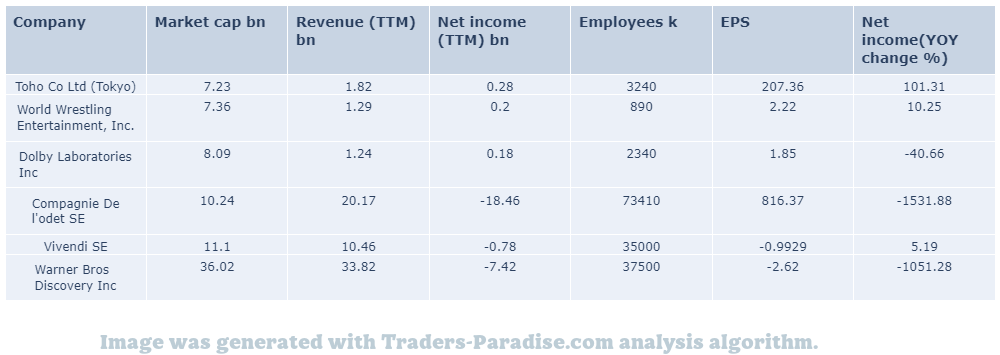

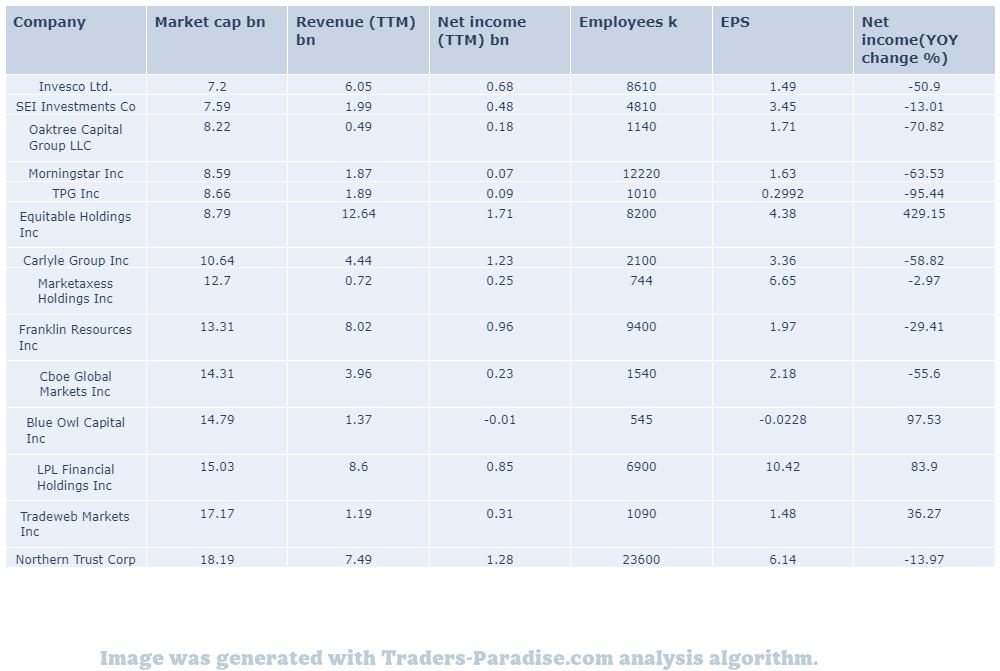

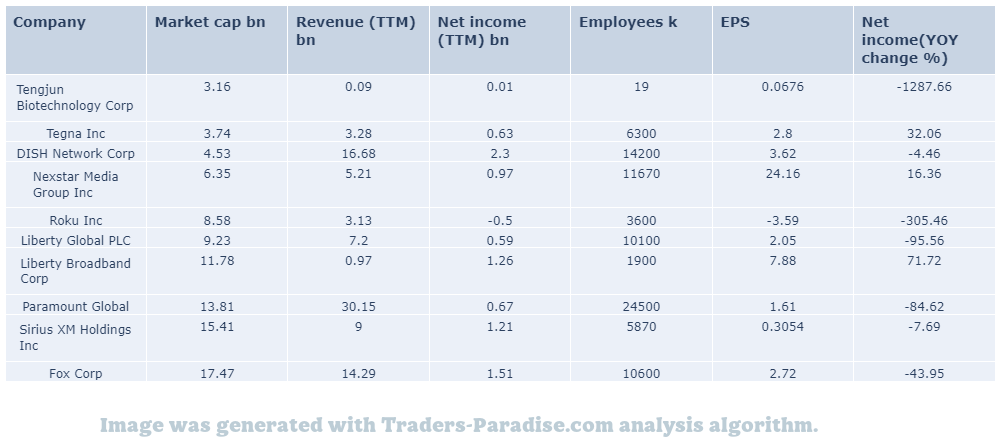

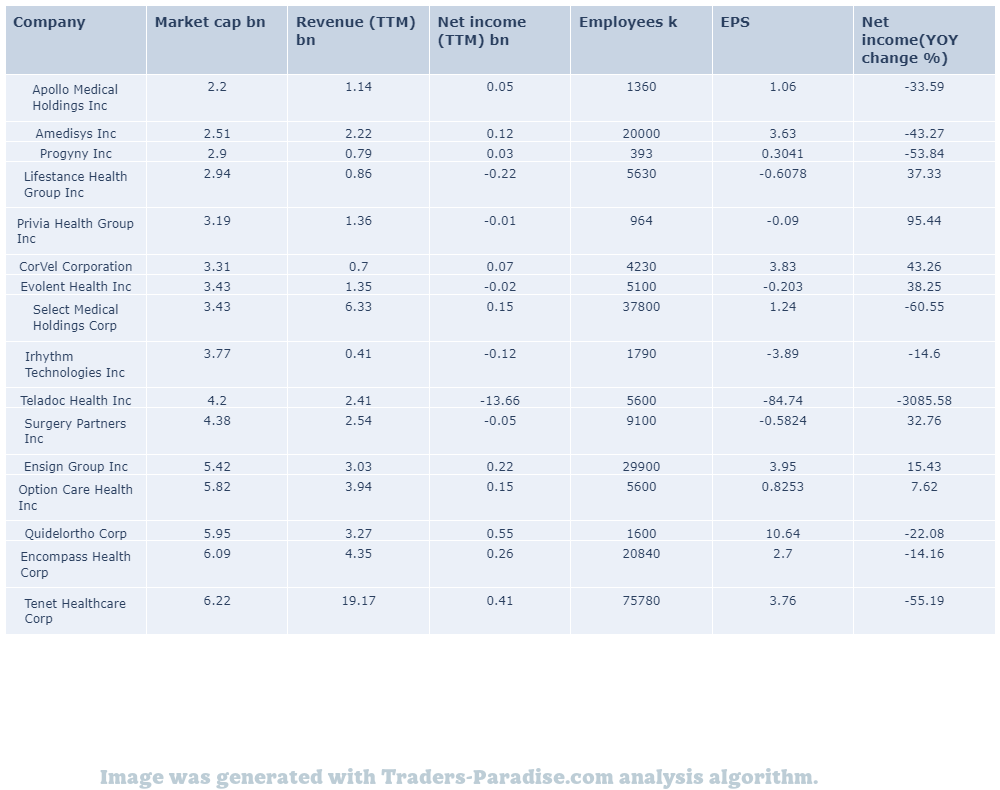

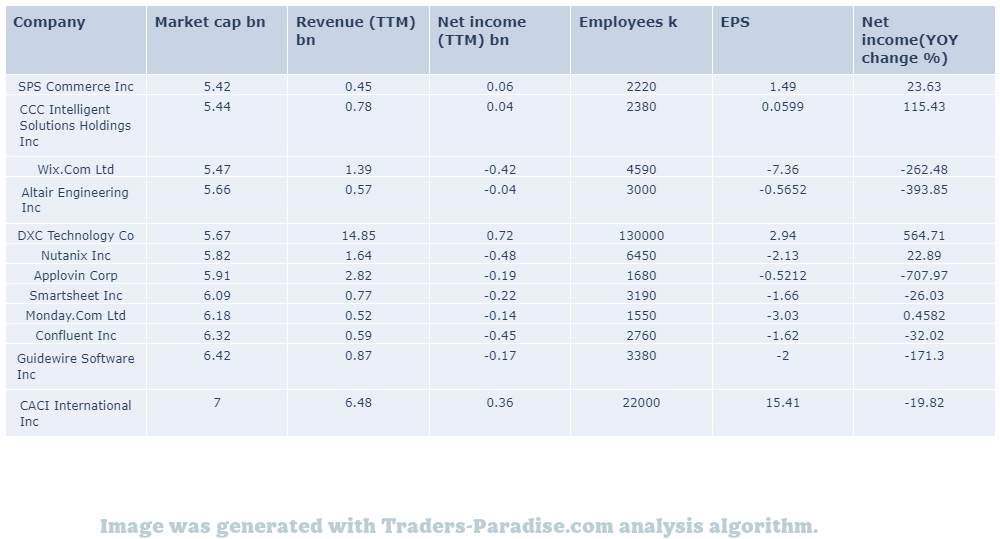

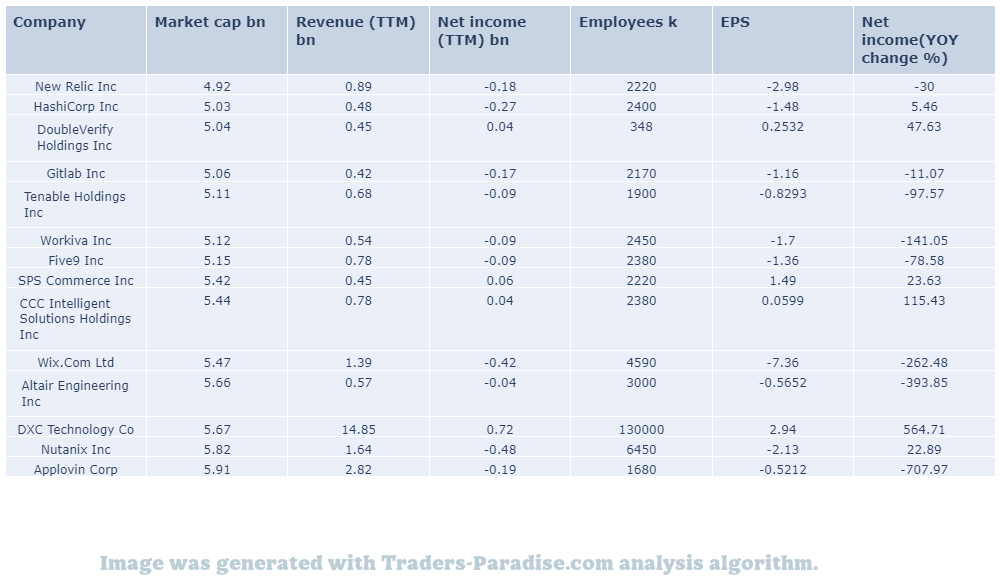

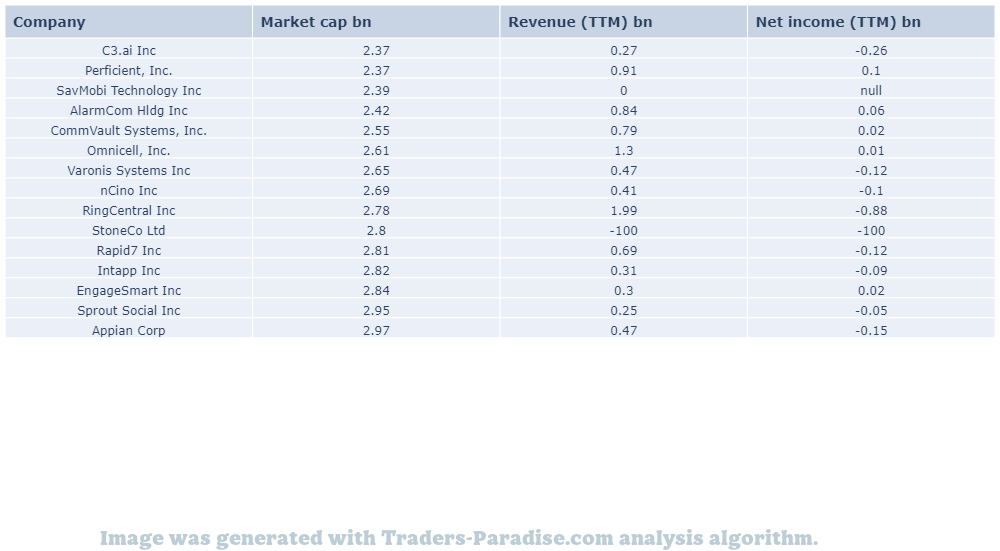

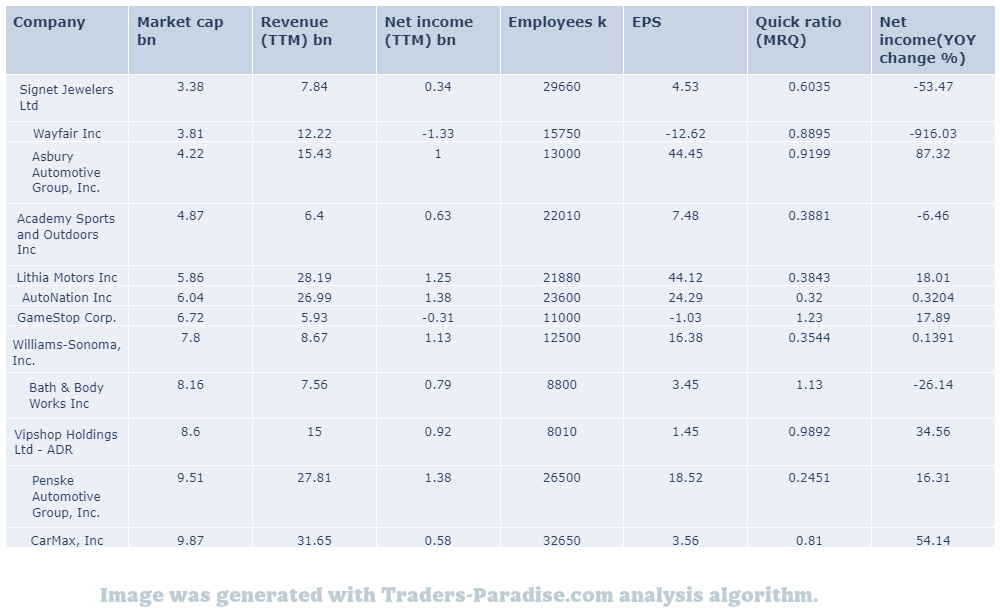

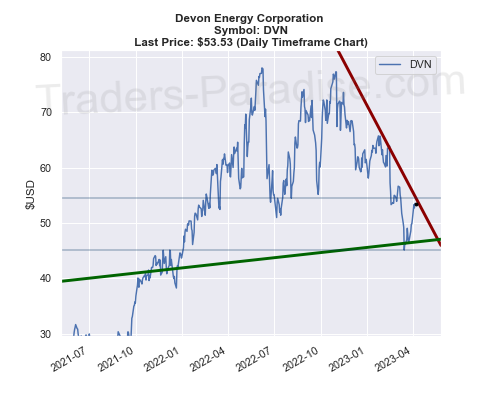

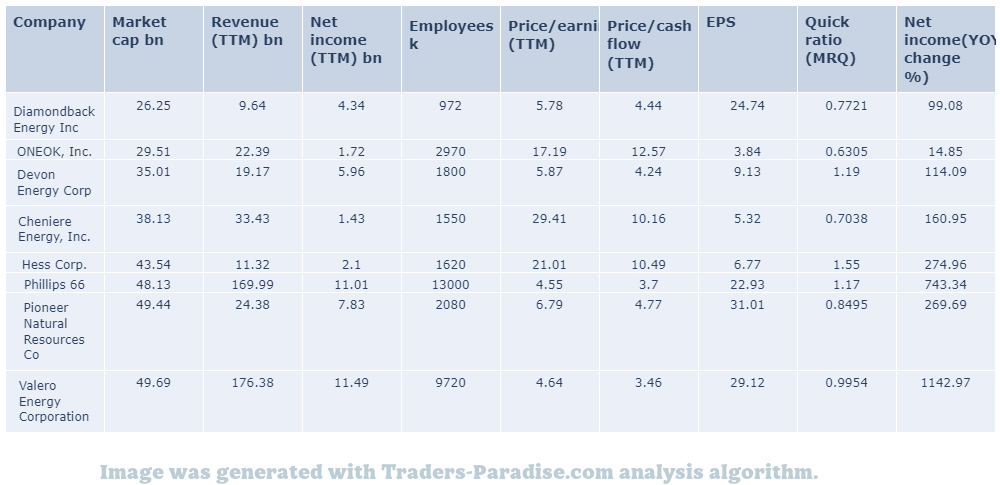

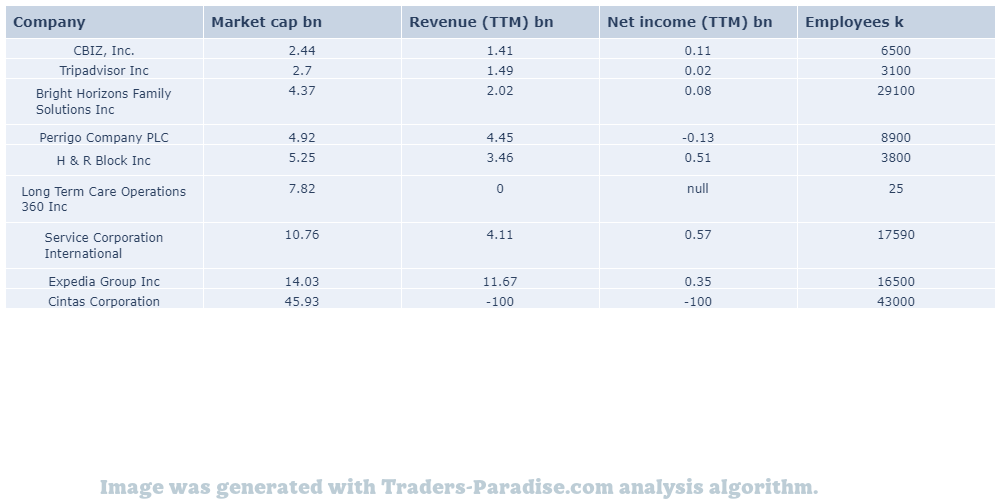

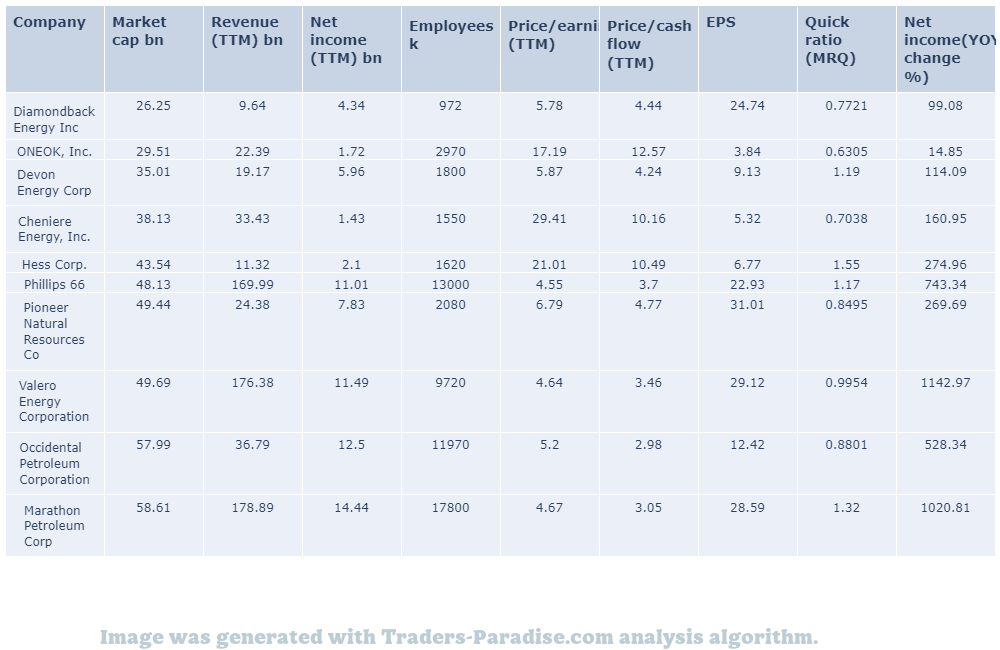

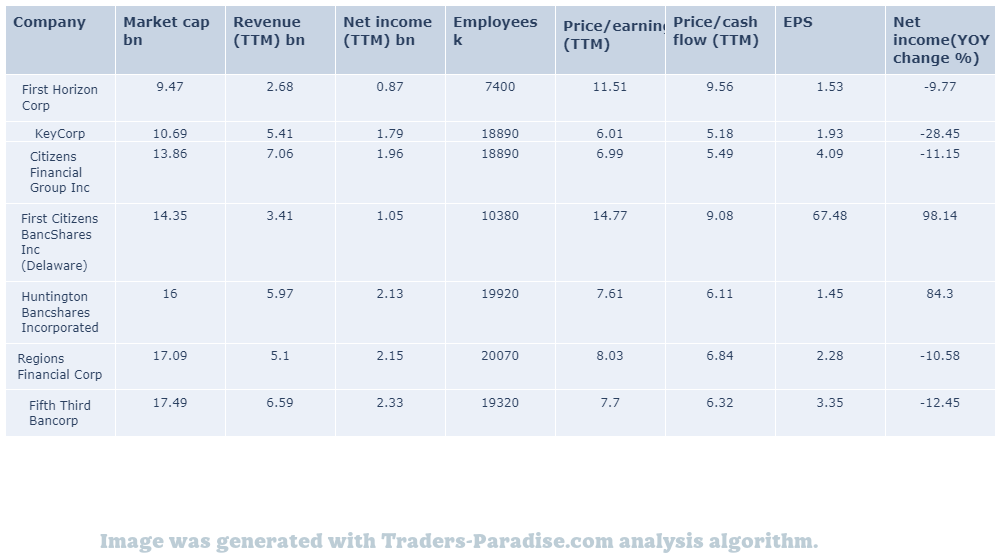

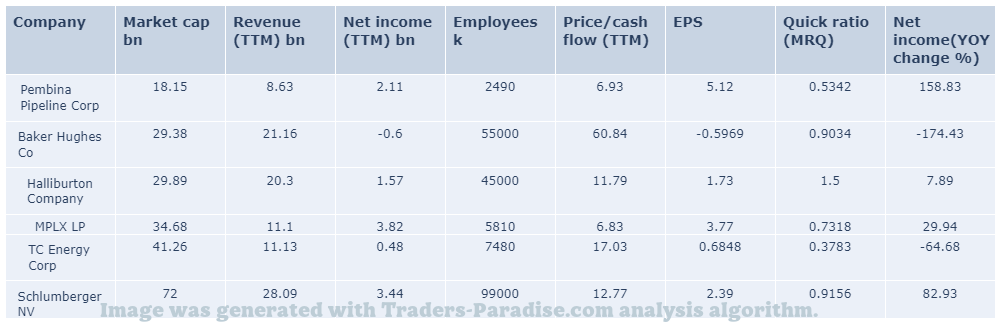

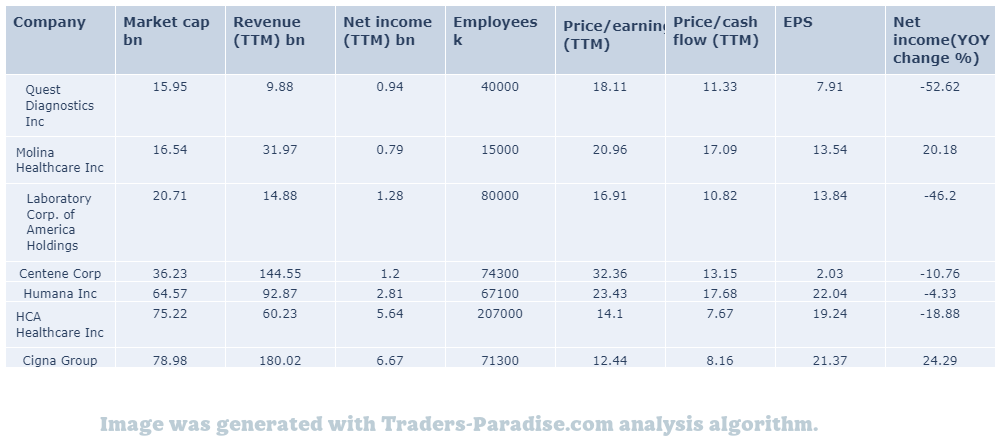

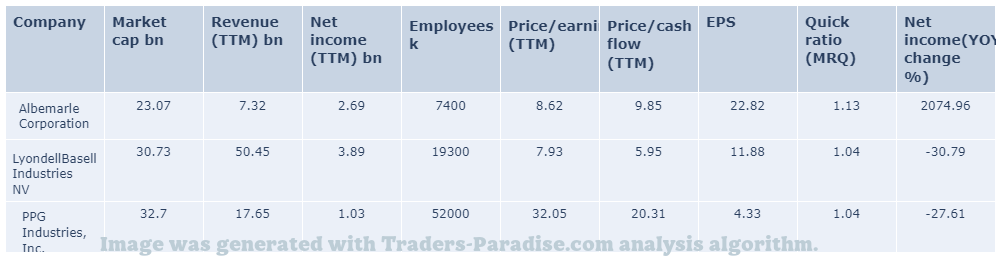

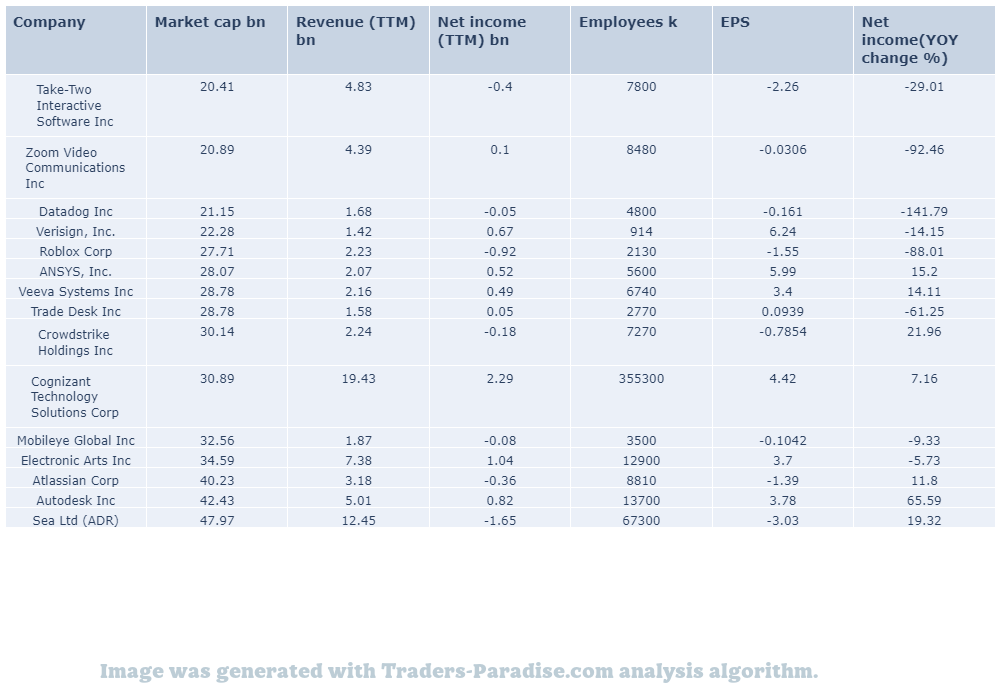

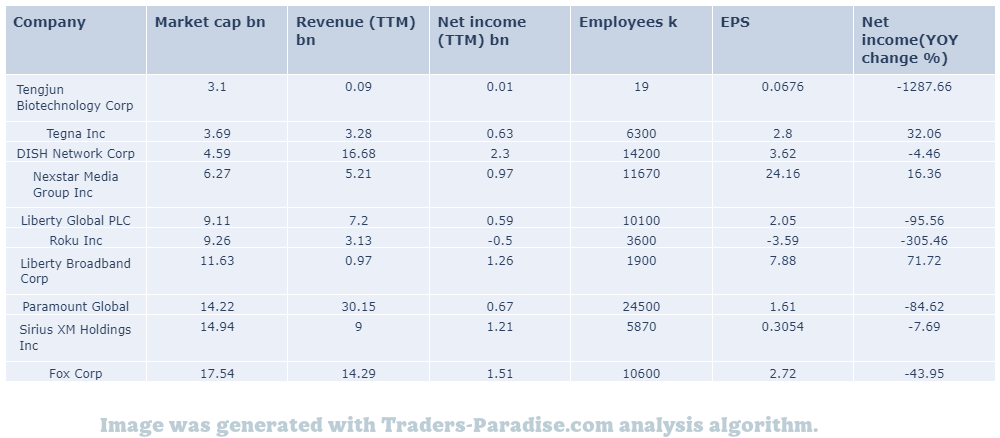

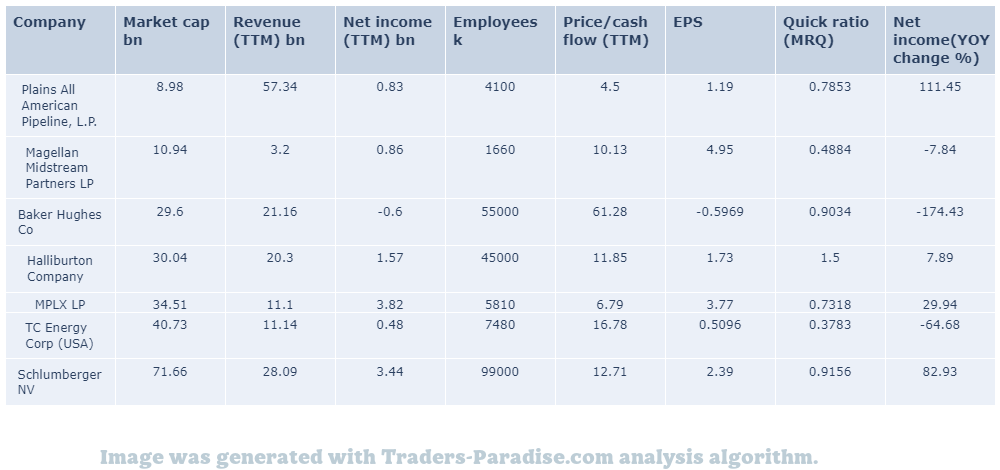

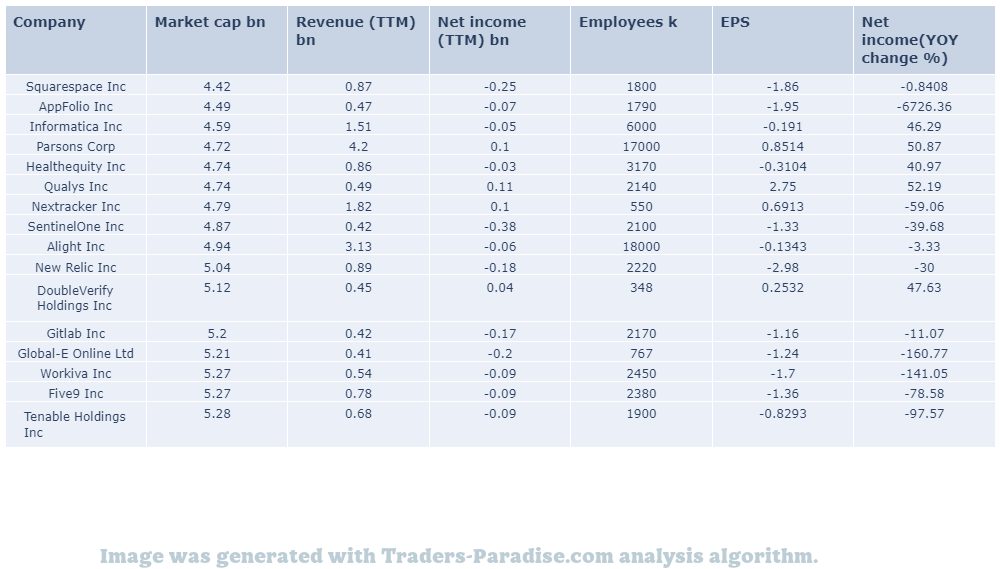

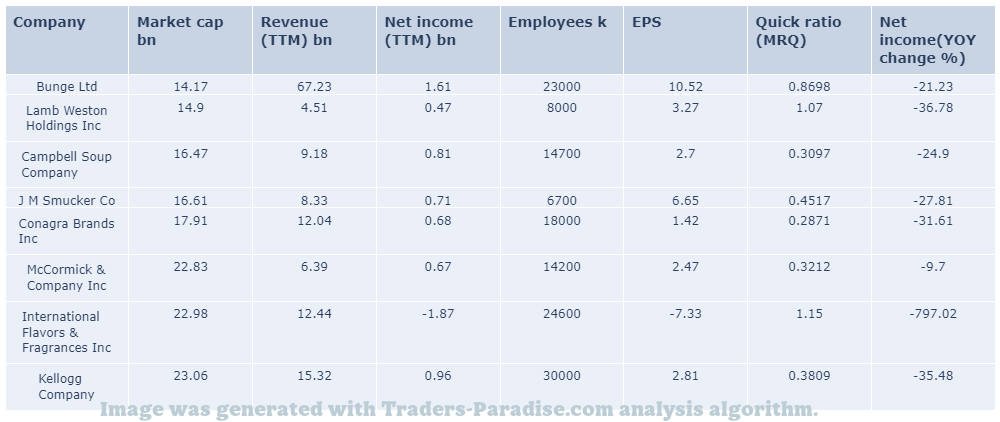

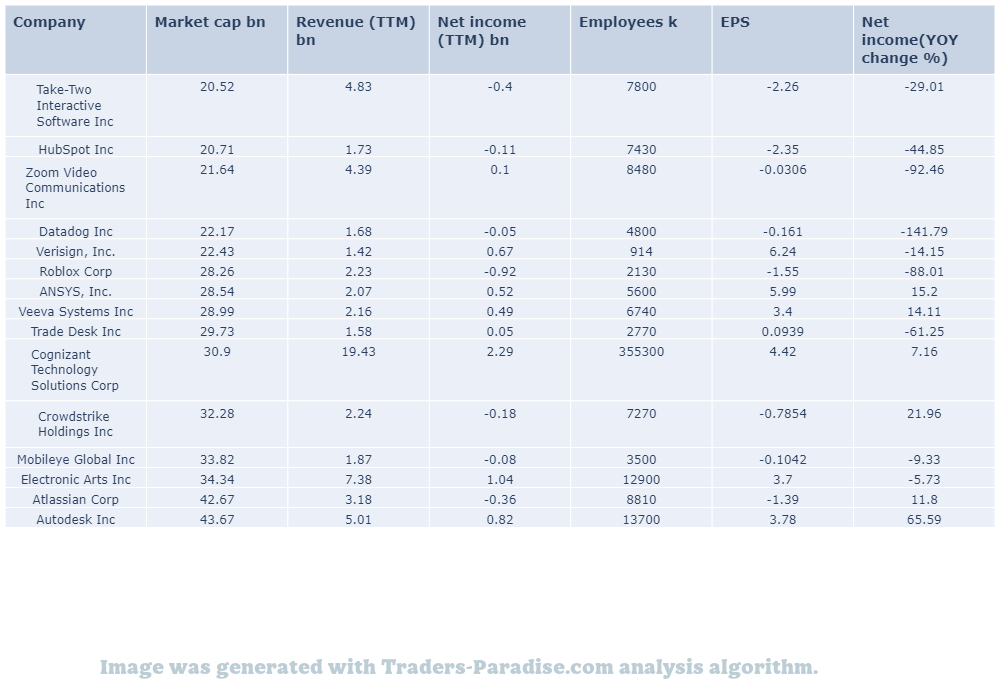

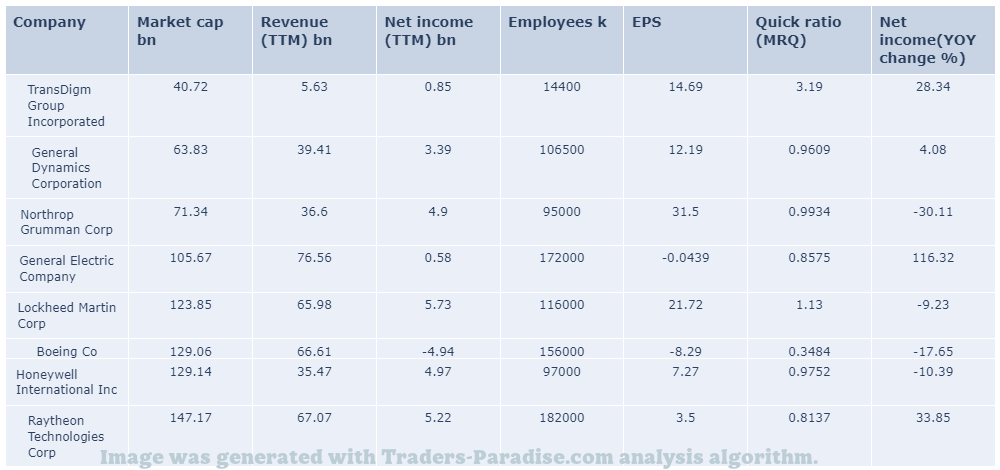

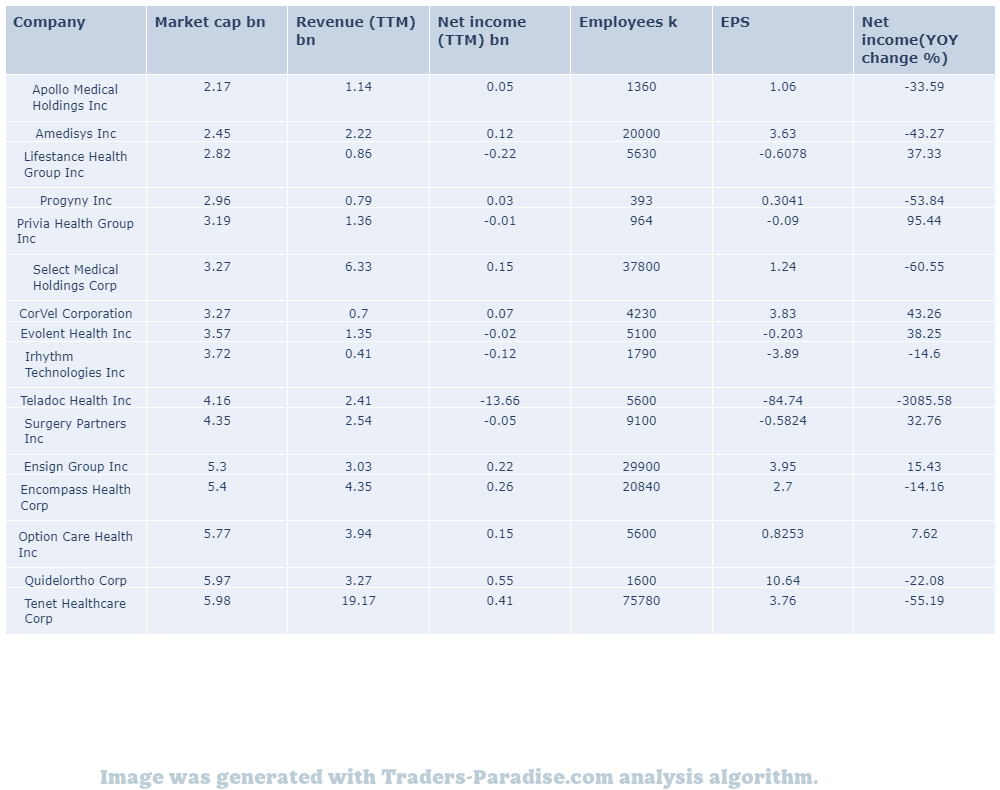

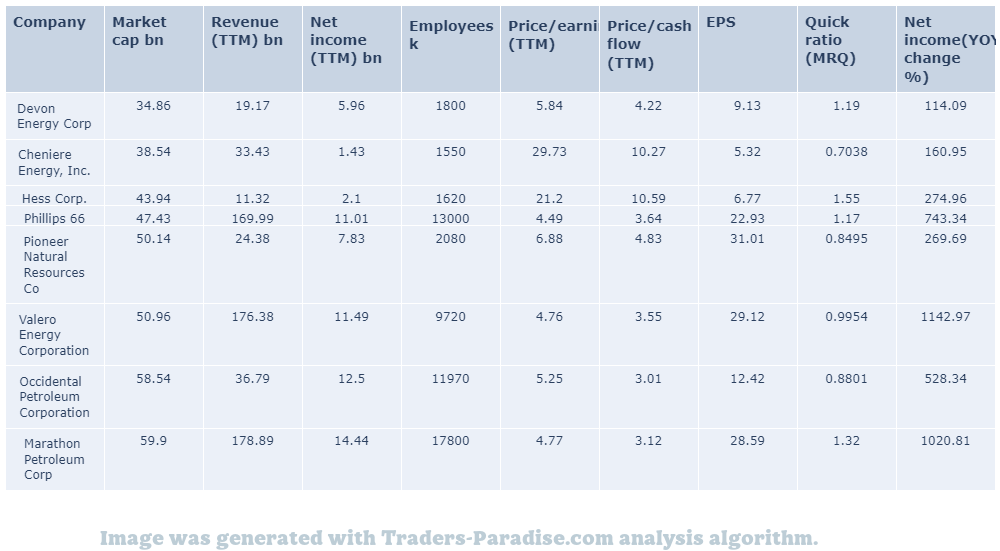

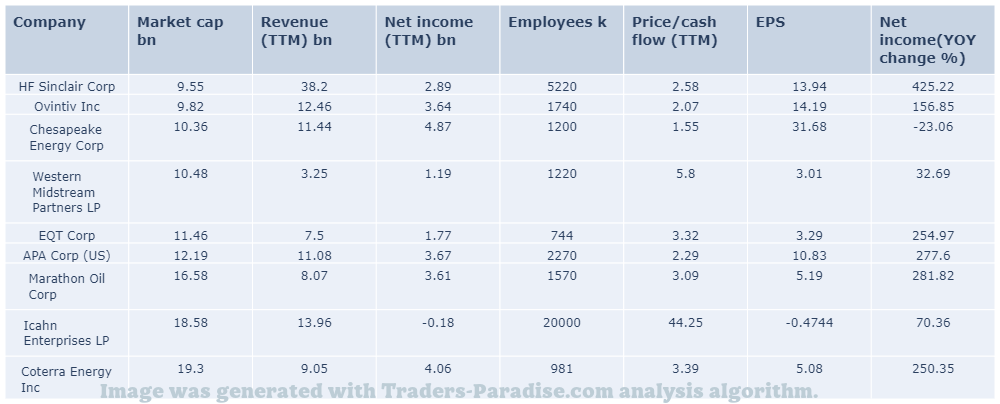

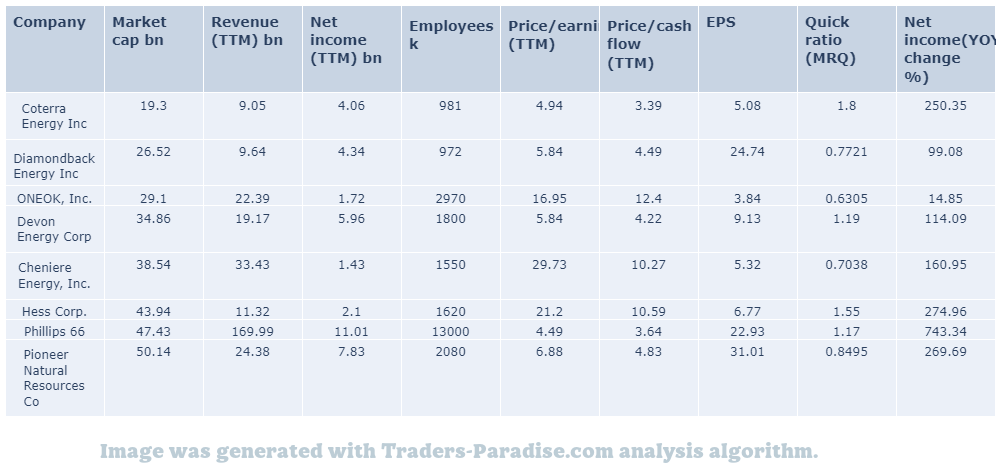

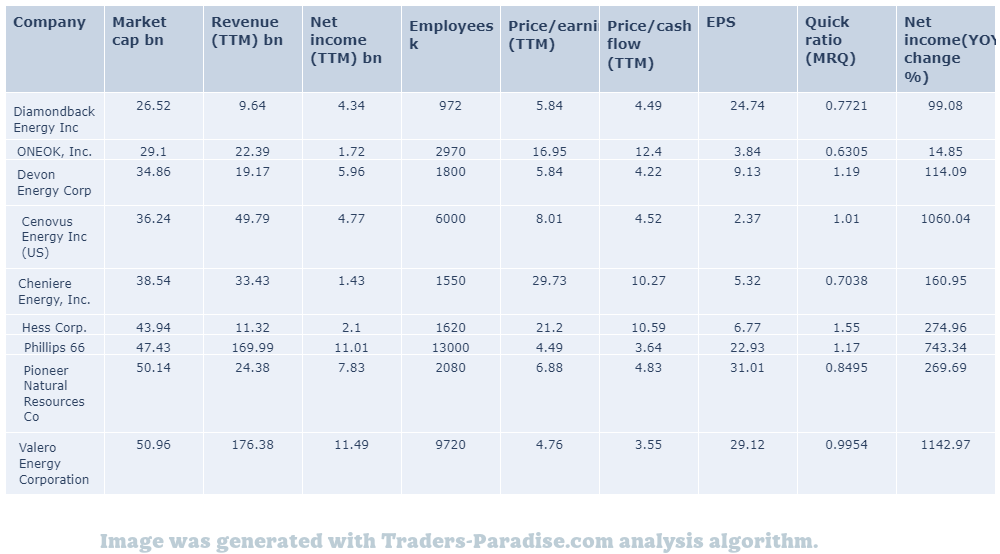

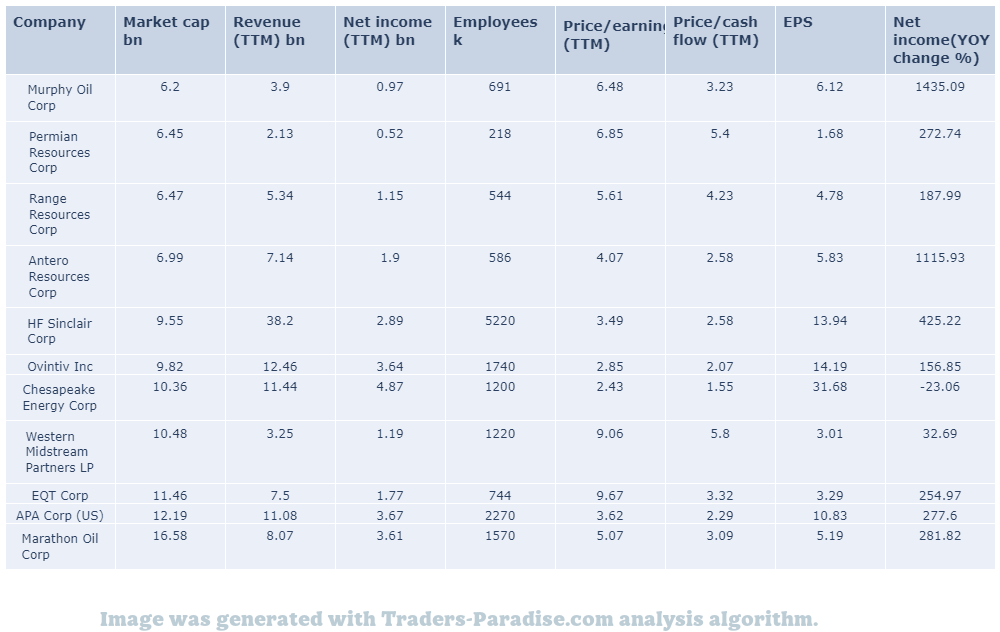

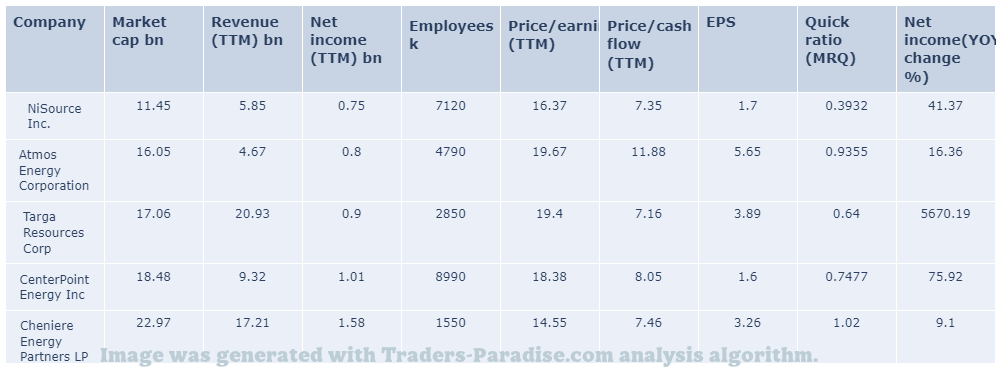

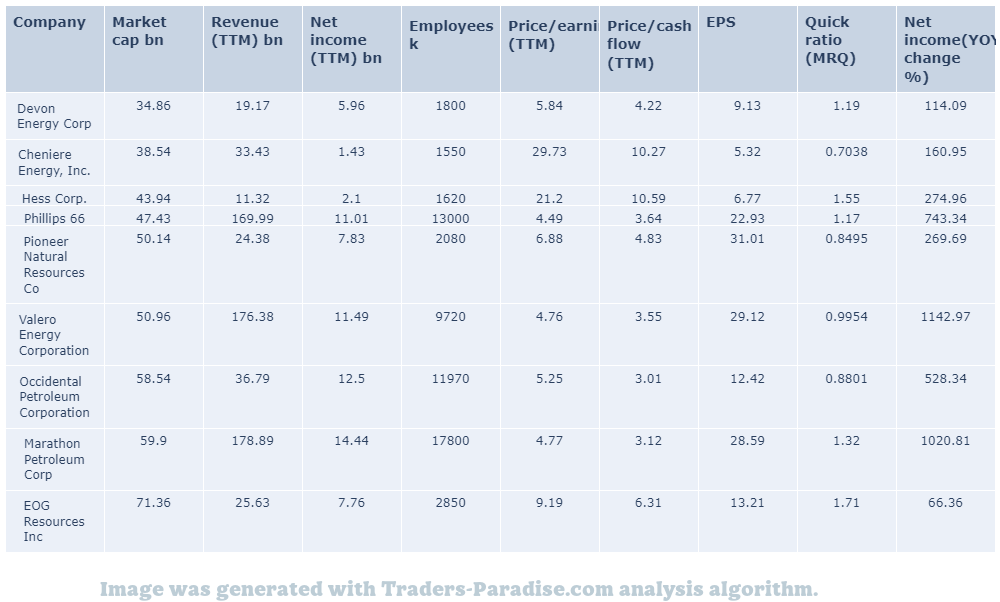

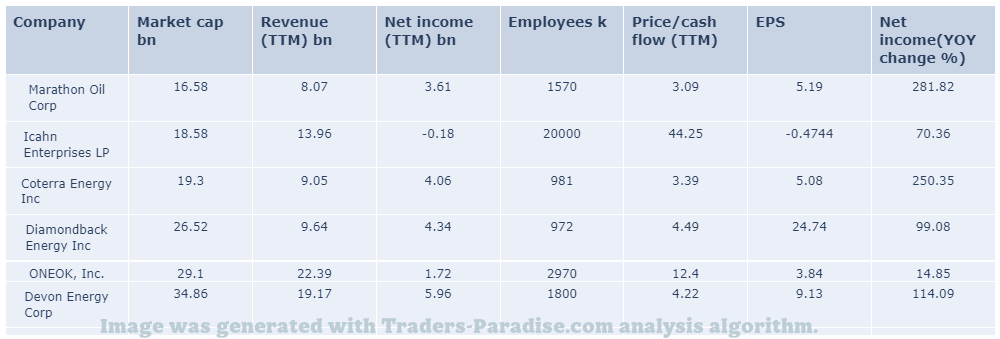

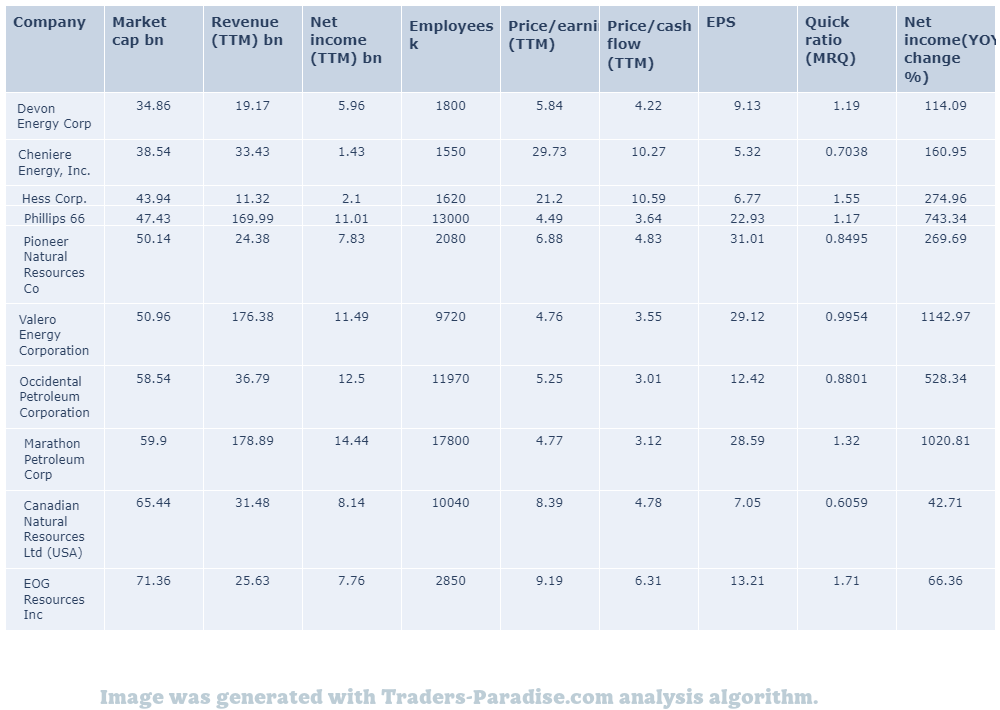

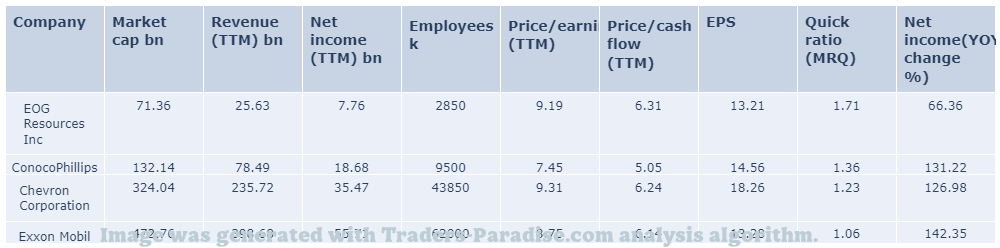

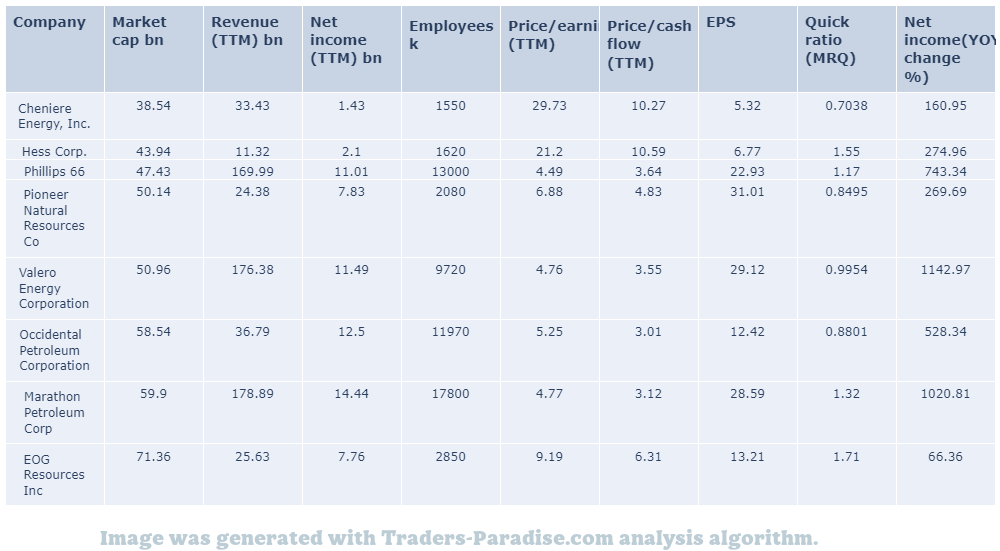

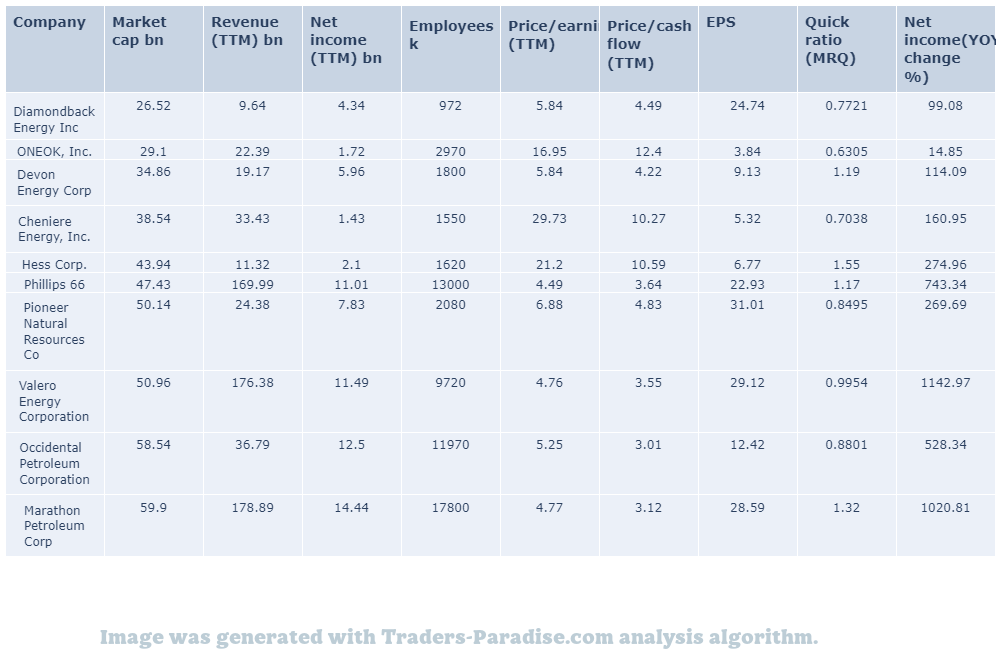

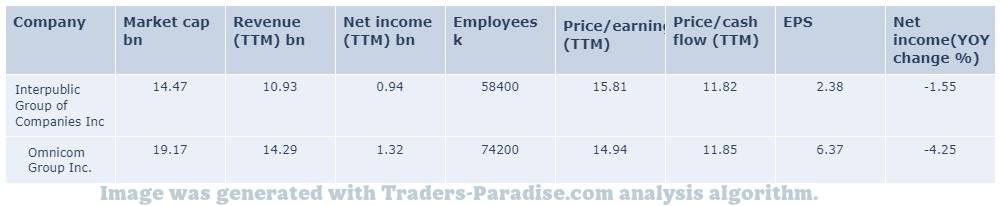

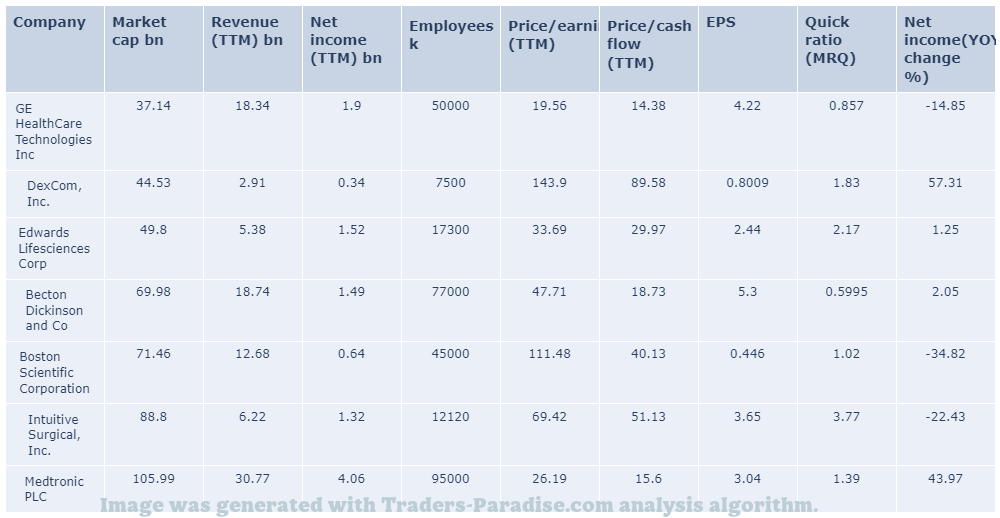

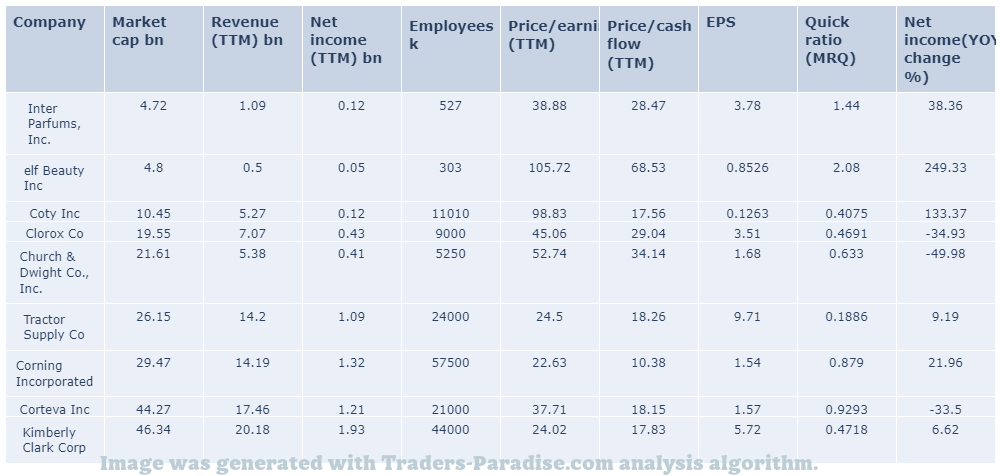

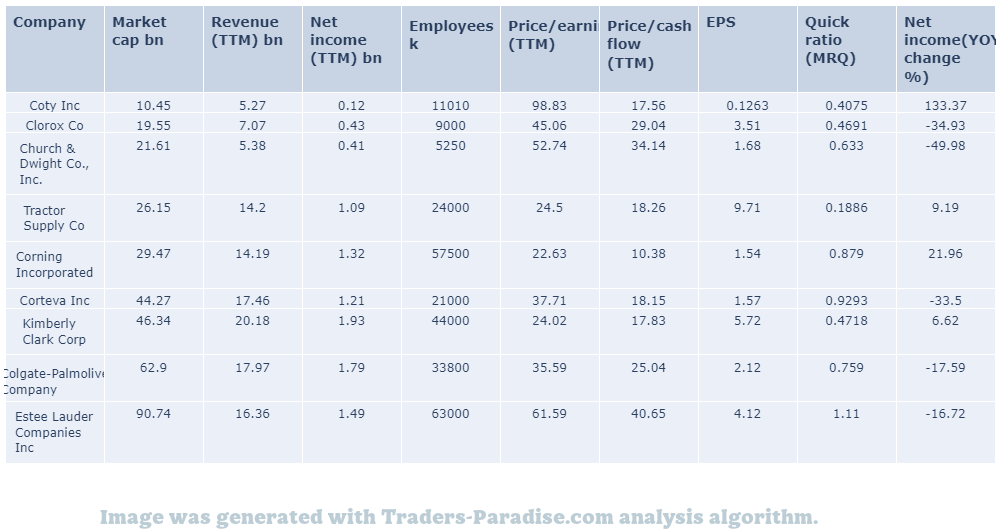

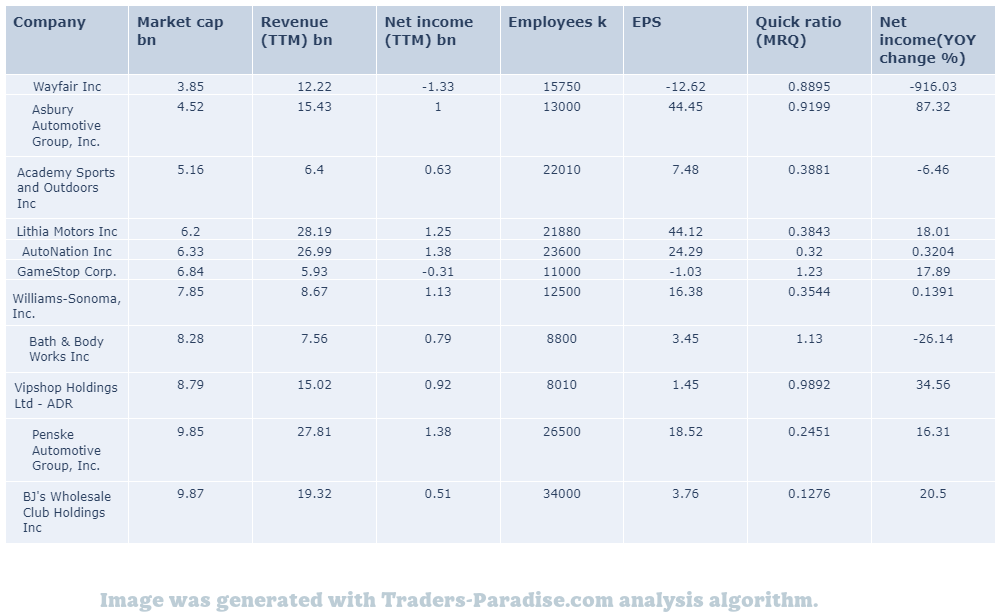

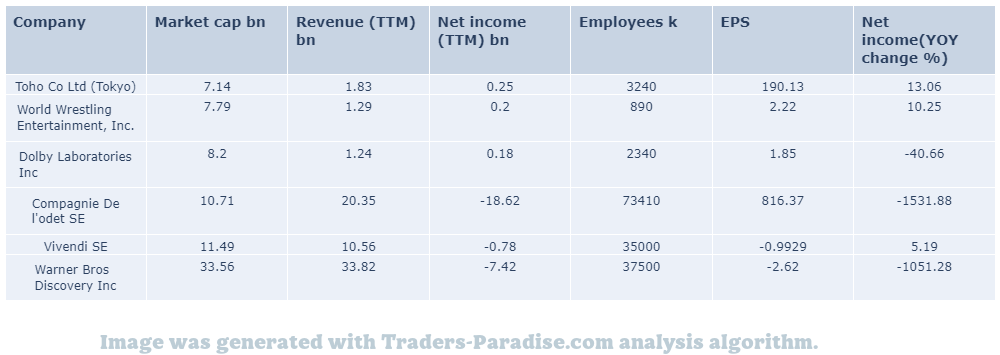

- A table with the company peers and competitors, including their financial and fundamentals.

-

-

A new report will be generated on a daily basis.

Does it work?

In short, yes.

you can read here how we use these methods for our real life trades.

Short declaimer

This report, including all content, is made for educational purposes only. Use on your own risk!

Most recent news about the financial markets

-

- No One Can Tell When; Meanwhile, We Rally.

There’s a recession, but nobody knows when it will happen. Meanwhile, people are still trying to get back on their feet. – CNN.com/somniacommentarathon.com. For more information, go to: http://www.cnn.com/.

- No One Can Tell When; Meanwhile, We Rally.

-

- Earnings season has started and so far, banks have delivered better-than-feared results.

The earnings season has started and so far the banks have delivered better-than-feared results. If the banking crisis is over, rates will go much higher, according to some analysts. Click here to read more about it. .

- Earnings season has started and so far, banks have delivered better-than-feared results.

-

- ETF designed to protect against inflation is attracting inflows.

There are signs of moderating U.S. inflation, but some investors worry that price pressures will stay high. This exchange traded fund designed to protect against inflation is attracting inflows.

- ETF designed to protect against inflation is attracting inflows.

-

- 33 stocks in Russell 1000 have rallied more than 1,000%.

Bespoke Investment Group runs down the stocks in the Russell 1000 that have risen more than 1,000% in the last decade. Check out the 33 stocks that have rallied more than 1000% in last 10 years and the ’10 baggers’ here.

- 33 stocks in Russell 1000 have rallied more than 1,000%.

-

- Fear of missing out is driving investors to seek safety.

Market headwinds are still strong despite Thursday’s rally. Stocks typically fall after the VIX hits the ‘overbought’ level it’s at now, writes Lawrence McMillan, and stocks usually fall after it’s overbought.

- Fear of missing out is driving investors to seek safety.

-

- Inflation rate slows, S&P 500 cools as banks kick off earnings season.

Consumer price index gained 5% in March, down from 6% increase in February. Core CPI inflation was 5.6%, in-line with economist estimates. The Fed’s March meeting minutes suggested the recent banking crisis could trigger a U.S. recession later this year.

- Inflation rate slows, S&P 500 cools as banks kick off earnings season.

#1 Trading idea on ECL

Company Name: Ecolab Inc.

Symbol: ECL

Sector: Consumer Goods

Company Description: Ecolab is an American corporation that develops and offers services, technology and systems that specialize in water treatment, purification, cleaning and hygiene in a wide variety of applications. It helps organizations both private market and public treat their water, not only for drinking directly, but also for use in food, healthcare, hospitality related safety and industry.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ECL — Investors continue to be optimistic about Ecolab

Investors are optimistic about Ecolab (ECLc) owing to its strong business. ECL has 3 reasons to keep the stock in your portfolio. ELCL has a good chance to grow due to its good business prospects.

- News story for ECL — Passive income grew by 22.63% in February and 46.87% in March.

Nicholas Ward’s passive income stream grew by 22.63% in February and by 46.87% in March. Read more as I review my February and March results in this piece. Nicholas Ward’s Dividend Growth Portfolio: Special Fixed Income Edition.

- News story for ECL — Price-to-Sales (P/S) ratio is a misleading indicator.

U.S. Wide-Moat Stocks On Sale – The April 2023 Heat Map. We believe that the most widely used valuation multiples are terribly flawed. Click here to read a complete analysis of the heat map and the analysis of U.S wide-moat stocks on sale.

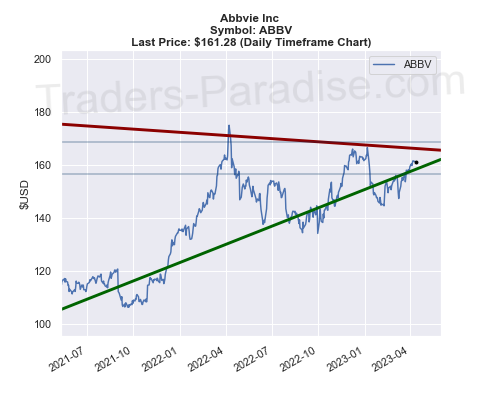

TECHNICAL ANALYSIS

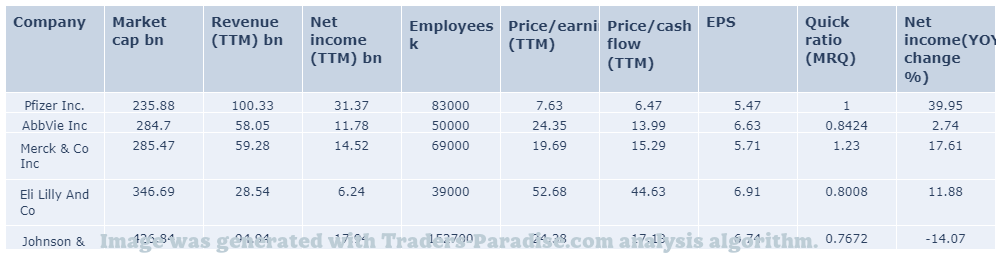

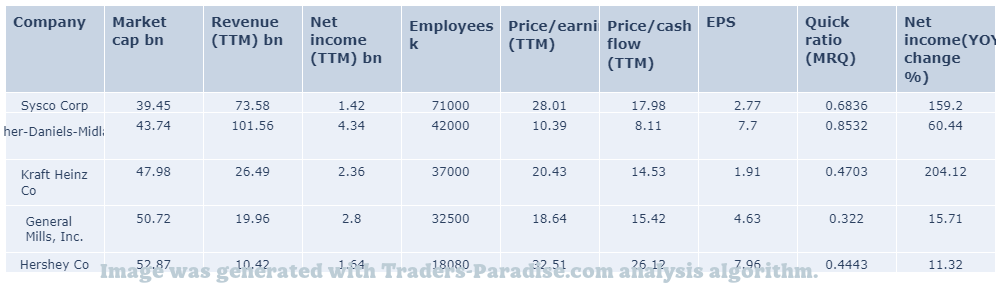

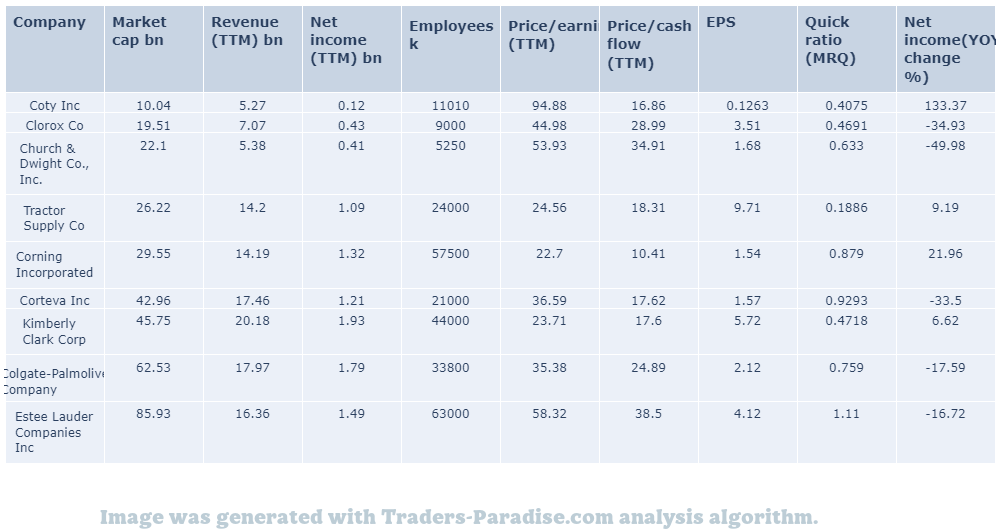

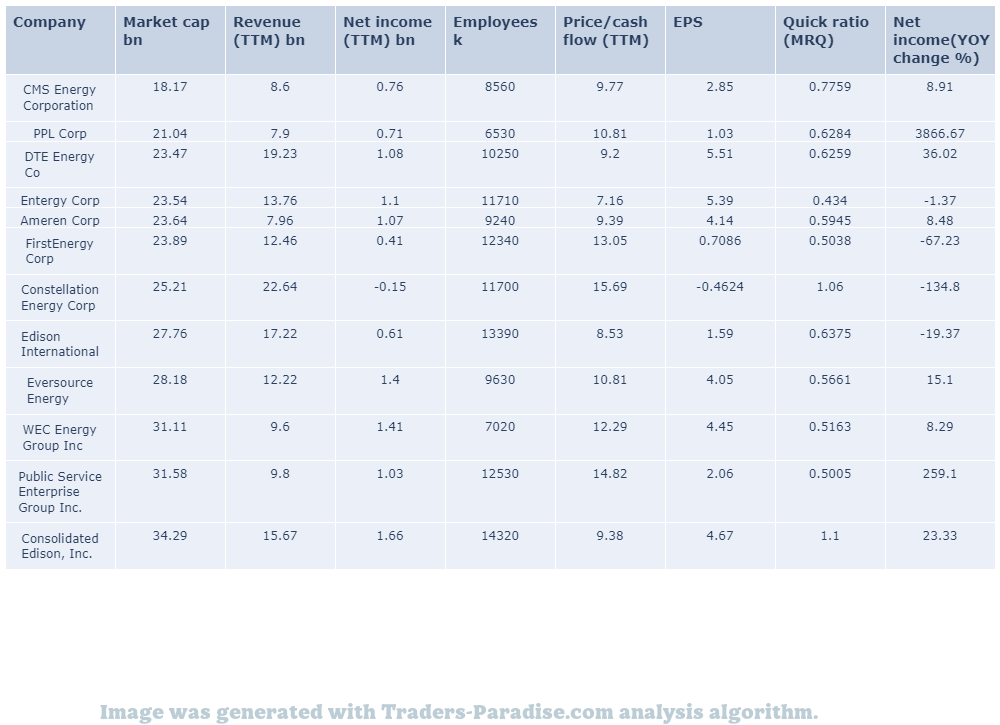

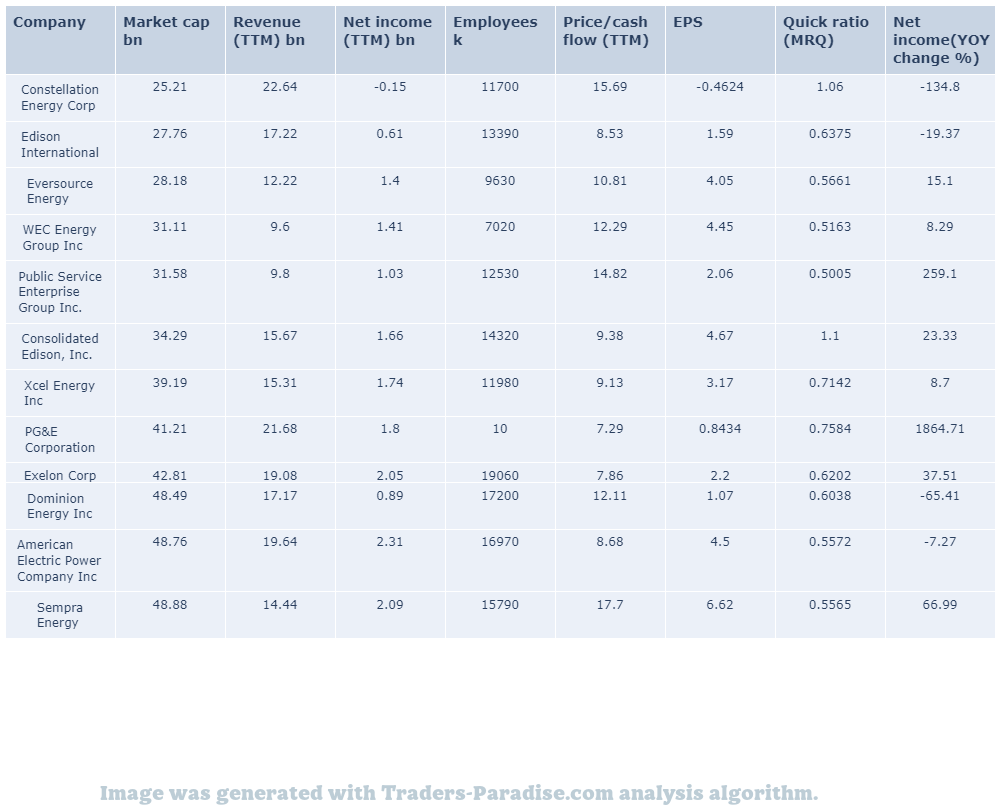

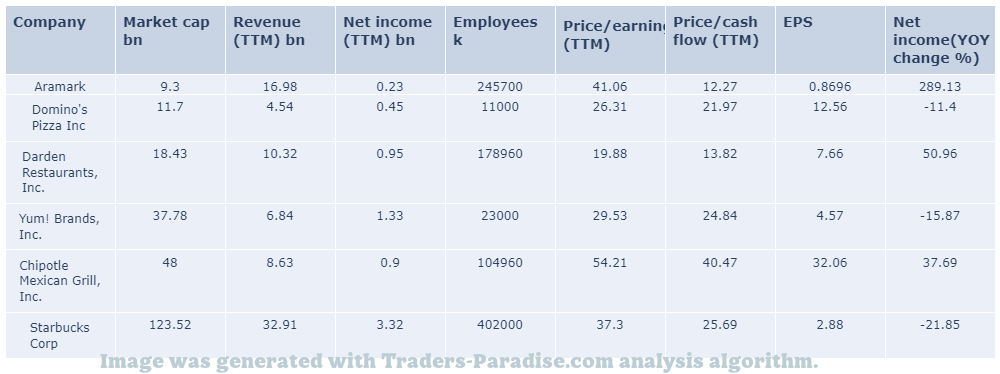

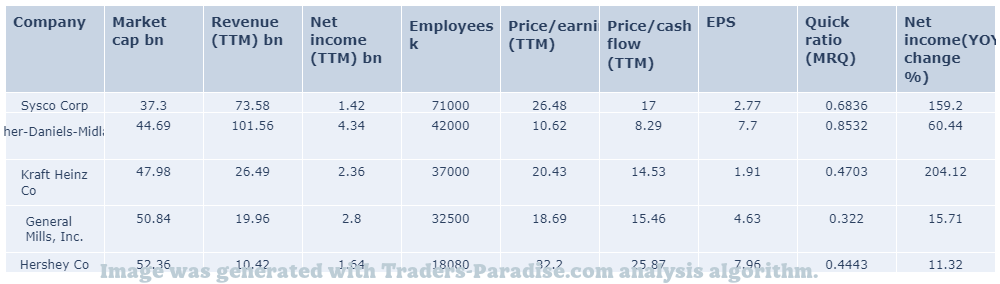

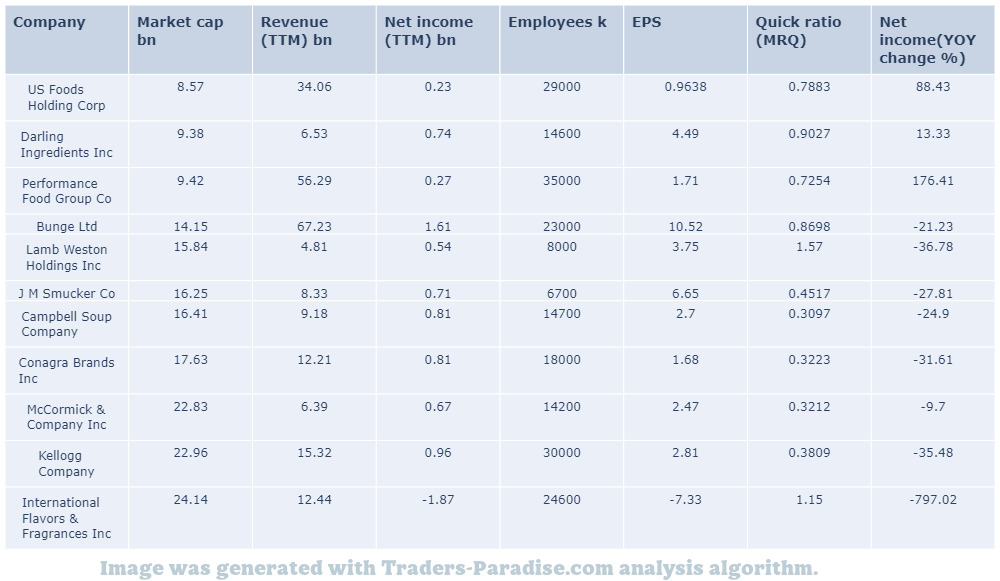

PEERS AND FUNDAMENTALS

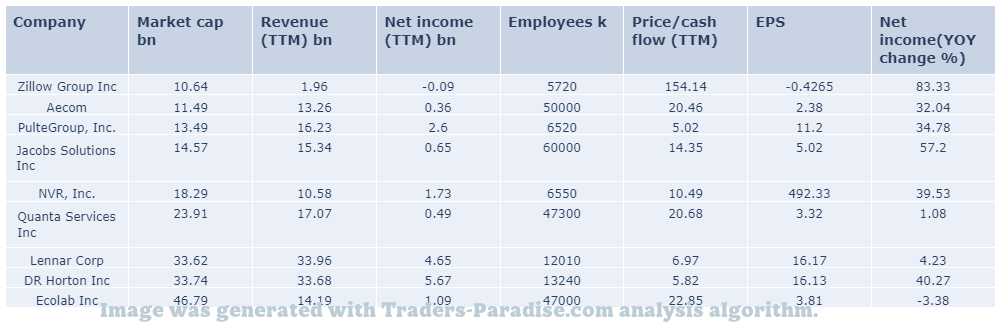

#2 Trading idea on YUM

Company Name: Yum! Brands, Inc.

Symbol: YUM

Sector: Services

Company Description: Yum! Brands, Inc. is an American fast food corporation listed on the Fortune 1000. It owns KFC, Pizza Hut, Taco Bell, The Habit Burger Grill, and WingStreet. The brands are operated by a separate company, Yum China.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for YUM — Check out the latest Portfolio update for your investments.

The DivHut Portfolio Update is scheduled for March 2023. The portfolio update is due on March 20th, 2017. Â “DivHut” is a portfolio management company. It offers portfolio management services.

- News story for YUM — The study looked at prices at several fast-casual and fast-food chains. Customers say Taco Bell offers the worst bang for their buck

A new study looked at the prices at several fast-casual and fast-food chains and at how diners feel about the value offered relative to cost. This restaurant chain offers the worst bang for the buck, according to customers. It’s not even the most expensive.

- News story for YUM — Taco Bell is looking to expand its online presence.

Yum! Brands’ (YUM) emphasizes on integrating aggregator channels into its point-of-sale system to drive growth. Inflationary pressures are a concern for YUM’s stock price. YUM! Brands is a great stock to buy now.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#3 Trading idea on WMT

Company Name: Wal-Mart Stores Inc.

Symbol: WMT

Sector: Services

Company Description: Walmart Inc. is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores from the United States. It also owns and operates Sam’s Club retail warehouses. It is headquartered in Bentonville, Arkansas.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WMT — Retail giant borrows $5 billion in corporate bond market.

Walmart borrows $5 billion in the corporate bond market on Wednesday. The move highlights a thaw in the financial markets after the collapse of Silicon Valley Bank and the recovery of the credit markets. Â. Â y

- News story for WMT — PubMatic is seeing strong demand from Walmart Plus.

PubMatic CEO Rajeev Goel talks about how the sell-side advertising platform is faring. A Bull Case for Walmart Plus is published by A.P. Press. in the form of an article titled “A Bull Case For Walmart Plus”.

- News story for WMT — Shares of Walmart closed at $148.48 in recent trading session

Walmart (WMT) closed the most recent trading day at $148.48, moving -0.68% from the previous trading session. Broader Markets (MRW) closed at $150.48. For confidential support, call the Samaritans on 08457 90 90 90 or visit a local Samaritans branch or click here.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

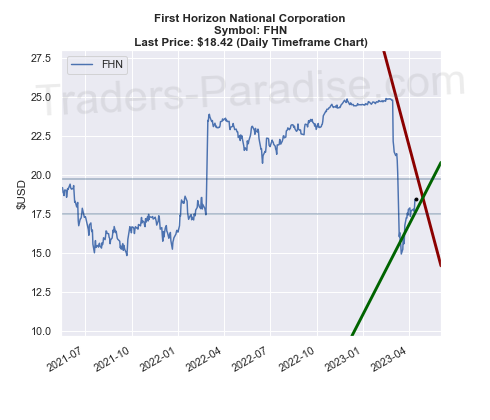

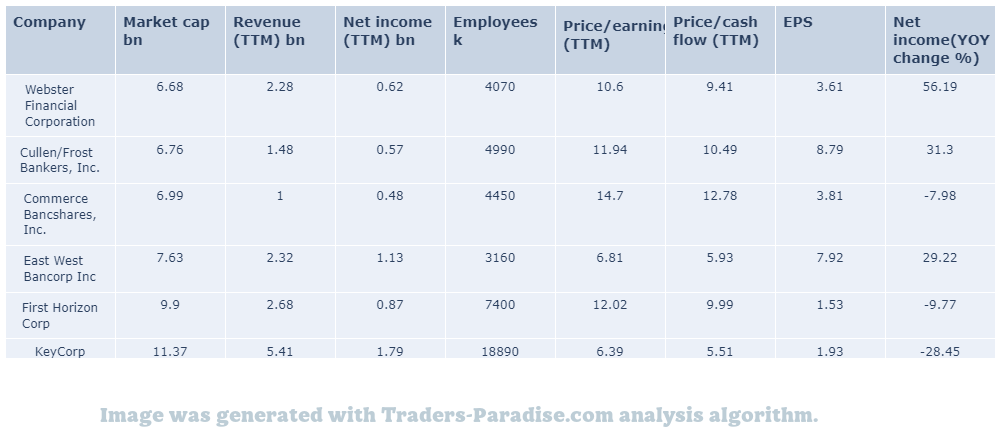

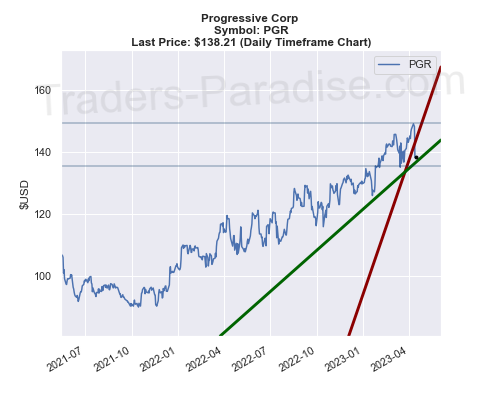

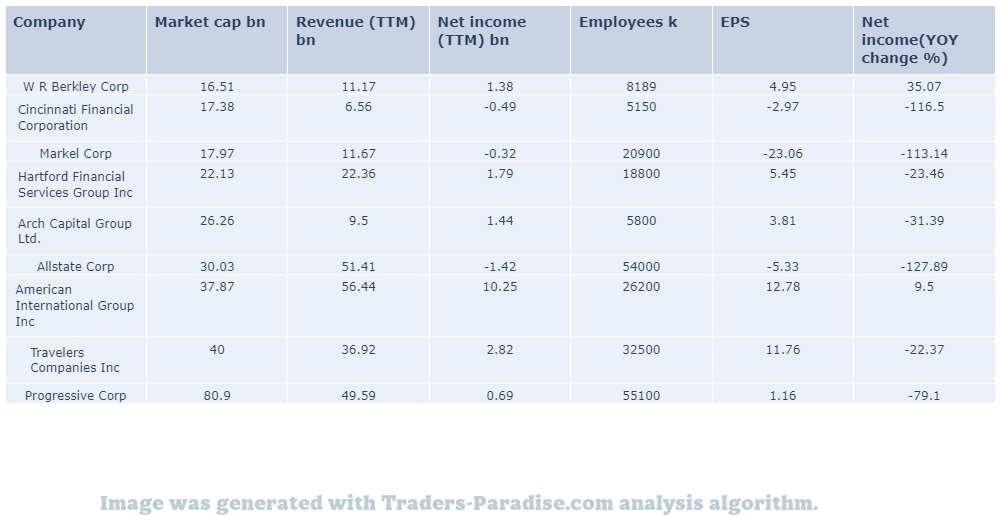

#4 Trading idea on PGR

Company Name: Progressive Corp

Symbol: PGR

Sector: Financial

Company Description: The Progressive Corporation is one of the largest providers of car insurance in the United States. The company insures motorcycles, boats, RVs, and commercial vehicles. It also provides home insurance through select companies. For more information, visit Progressive Corporation’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PGR — U.S. Insurance ETF (IAK) is a good place to start investing.

The iShares U.S. Insurance ETF (IAK) is a sector exchange traded fund (ETF) that tracks the insurance sector. IAK has a market value of $1.5 billion. iAK is a market performant.

- News story for PGR — Frequent catastrophes accelerating policy renewal rate and the resultant upward pricing pressure.

Frequent catastrophes are likely to boost the performance of Zacks Property and Casualty Insurance industry players. BRK.B, CB, PGR, RE and KNSL are among the companies that will gain from better pricing. .

- News story for PGR — Lemonade could be the next big thing in health care.

Lemonade is down 92% from its high. The innovative insurance company could have the most upside in its sector. Lemonade is a screaming buy. Lemonad is an insurance company that has a lot of potential for growth in the future.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

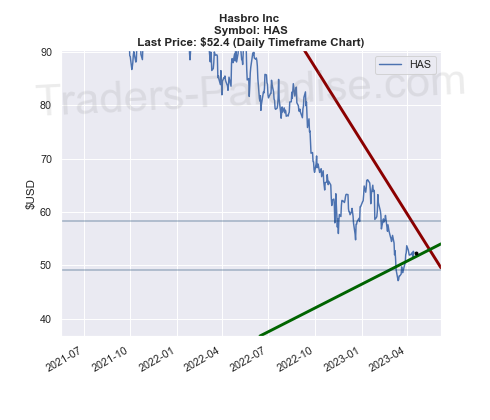

#5 Trading idea on HAS

Company Name: Hasbro Inc

Symbol: HAS

Sector: Industrial Goods

Company Description: Hasbro, Inc. is an American multinational conglomerate with toy, board game, and media assets. It is headquartered in Pawtucket, Rhode Island and is a major employer of young people in the United States. It has more than 100,000 employees.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HAS — Shares of the toymaker have dropped to their lowest level in more than a decade.

Hasbro’s stock has sold off dramatically, pushing the yield up toward historical highs. The giant toy maker’s stock is no longer a good investment. The stock market sell-off has pushed up the yield to historical highs, which is good for Hasbro’s shareholders.

TECHNICAL ANALYSIS

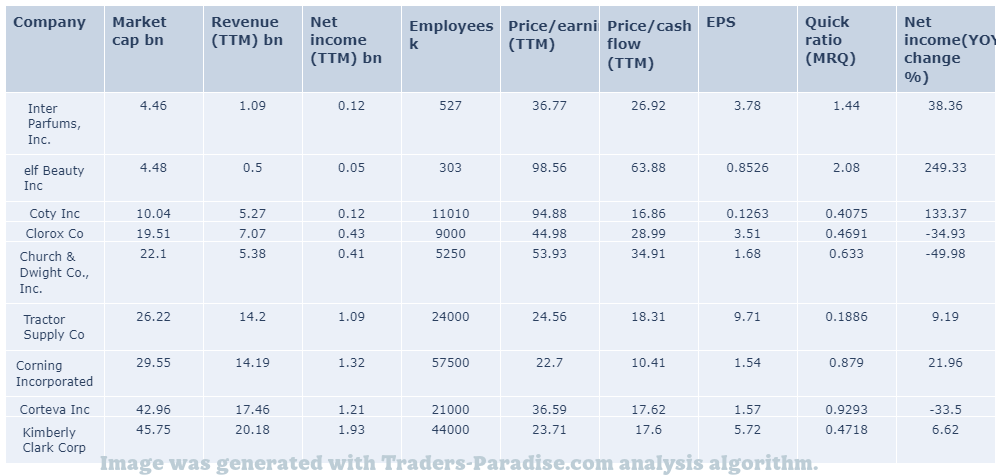

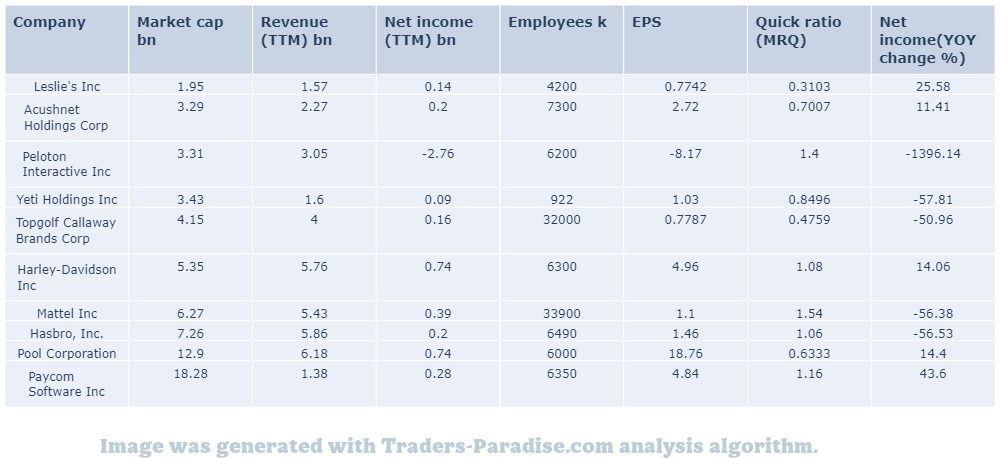

PEERS AND FUNDAMENTALS

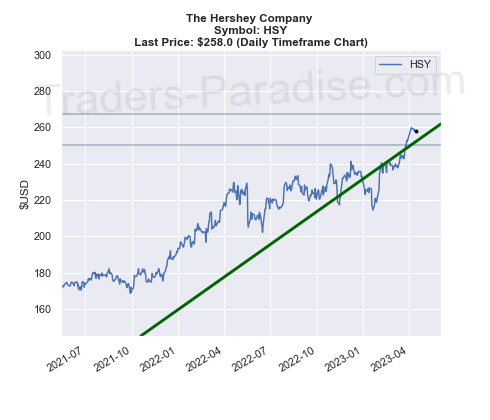

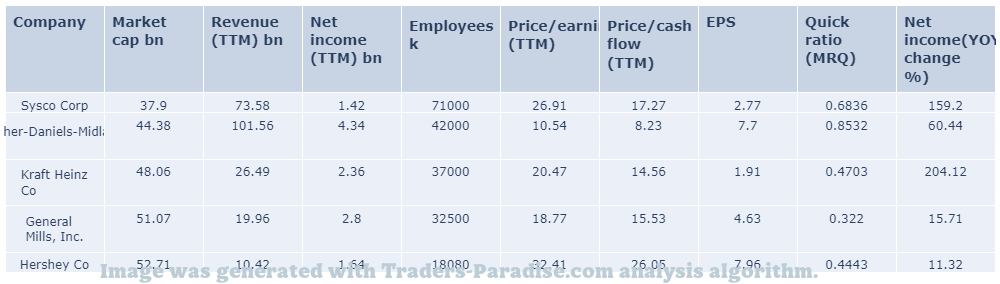

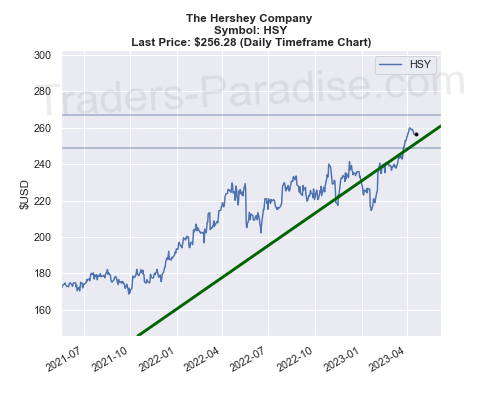

#6 Trading idea on HSY

Company Name: The Hershey Company

Symbol: HSY

Sector: Consumer Goods

Company Description: Hershey’s is one of the largest chocolate manufacturers in the world. It also manufactures baked products, such as cookies and cakes, and sells beverages like milkshakes. Its headquarters are in Hershey, Pennsylvania, and the company is based in the United States.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HSY — Beat the Market the Way: Hershey’s, Telesis Bio, General Mills in Focus.

Zacks’ time-tested methodologies served investors well in navigating the market last week. Check out some of our achievements from the past three months here. For more information, visit Zacks.com/Investor-Conversation or follow them on Twitter.

- News story for HSY — Activists have called for a conservative boycott of the beer.

Even if sales of Bud Light fall in response to conservative calls for a boycott, analysts say the impact is likely to evaporate quickly, as they say there will be no backlash to the conservative boycott. iReport.com: What do you think? Share your thoughts.

- News story for HSY — Acquisitions to bolster portfolio strength, boost revenues.

Hershey’s (HSY) is undertaking buyouts to augment portfolio strength and boost revenues. The company regularly brings innovation to its core brands. Solid Pricing and Portfolio Strength Fuel Hershey’s Growth. – S&P Capital Market Analyst.

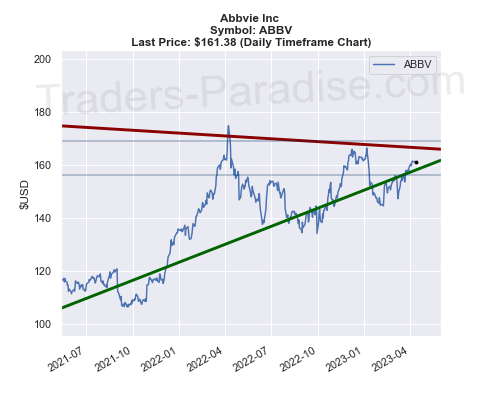

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

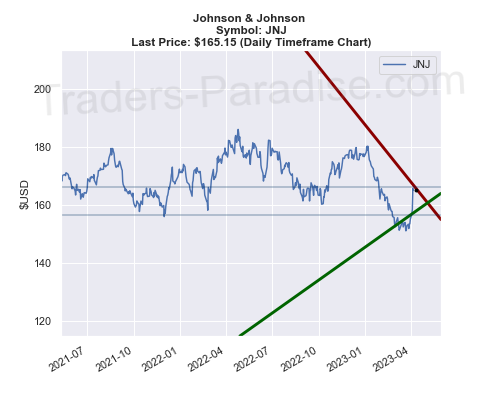

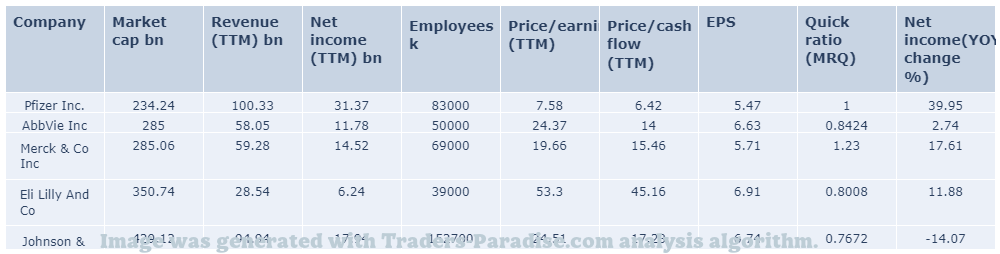

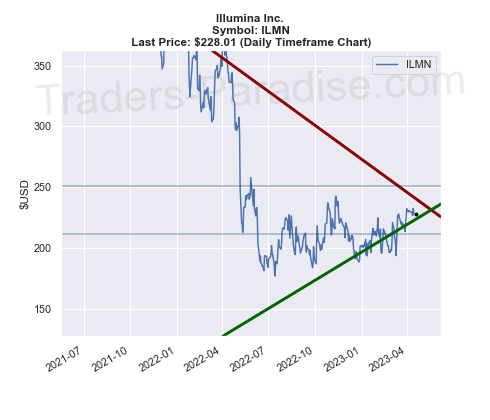

#7 Trading idea on ILMN

Company Name: Illumina Inc.

Symbol: ILMN

Sector: Healthcare

Company Description: Illumina, Inc. was incorporated on April 1, 1998. Its headquarters are located in San Diego, California. The company provides a line of products and services that serves the sequencing, genotyping and gene expression, and proteomics markets. It develops, manufactures and markets integrated systems for the analysis of genetic variation and biological function.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ILMN — Illumina is seeing strong demand for its products.

There aren’t many factors driving Illumina’s growth at the moment, so you shouldn’t buy the dip with Illumina stock. – here’s why you should not buy the Dip with the Illumina Stock. – Here’s why it’s not worth buying the Dip.

- News story for ILMN — Illumina collaborates with Henry Ford Health to conduct a series of studies.

Illumina (ILMN) partners with Henry Ford Health for NGS Test. The studies are likely to focus on the genetic drivers of cardiovascular disease and will be conducted on the NGS test for the first time in the U.S. and in Europe.

- News story for ILMN — Shares of Illumina are down more than 20% this year.

Illumina is in trouble with regulators in two major markets and it won’t help the stock. – The stock is down about 10% since the start of the year, but there is still hope for Illumina stock in the long-term.

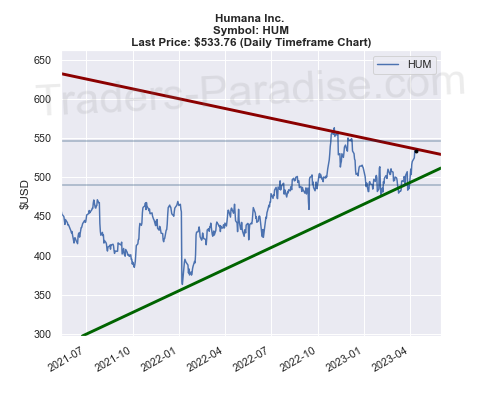

TECHNICAL ANALYSIS

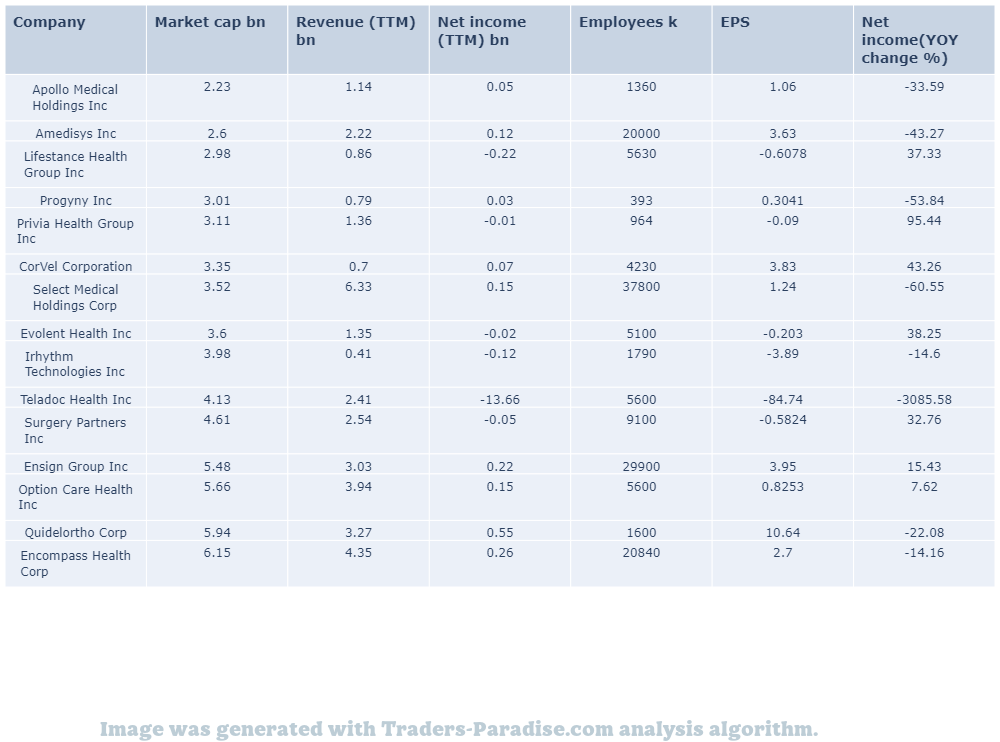

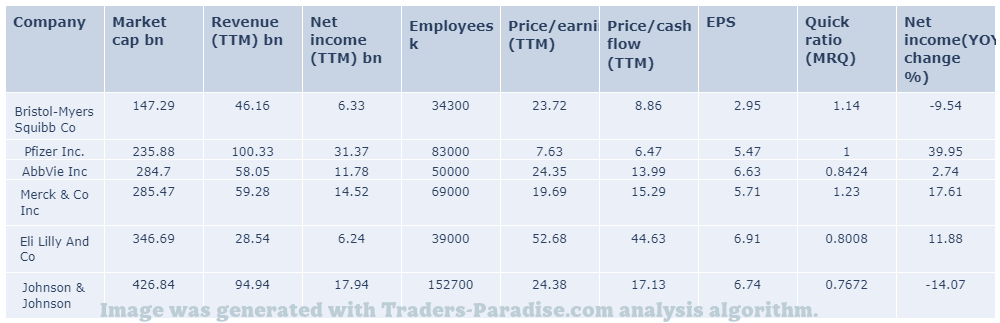

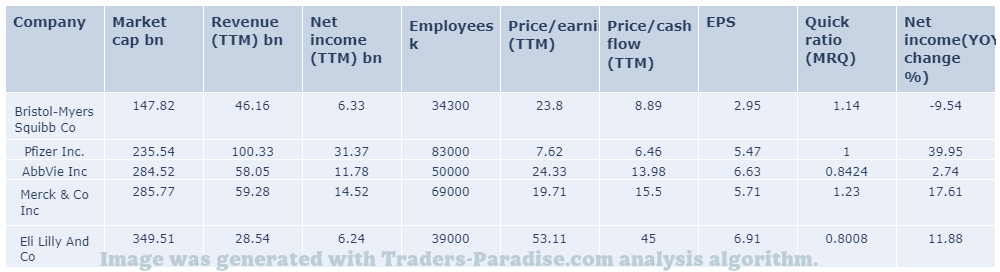

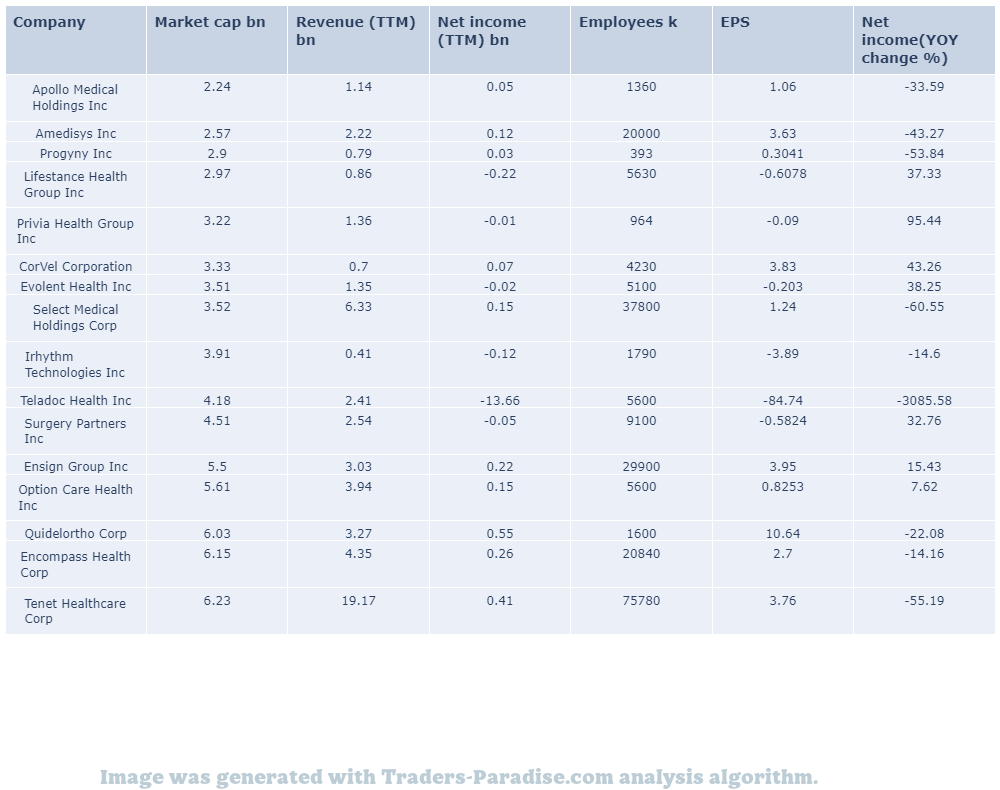

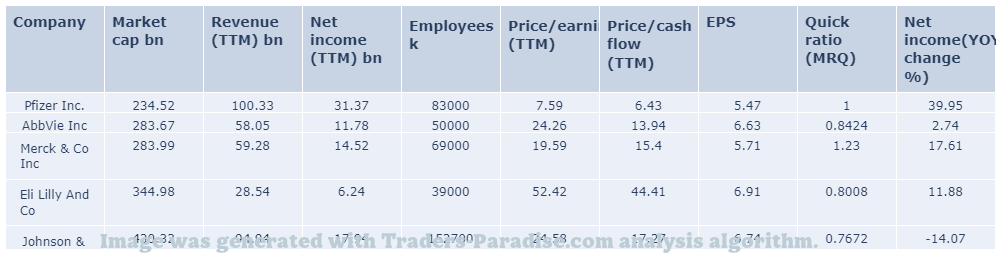

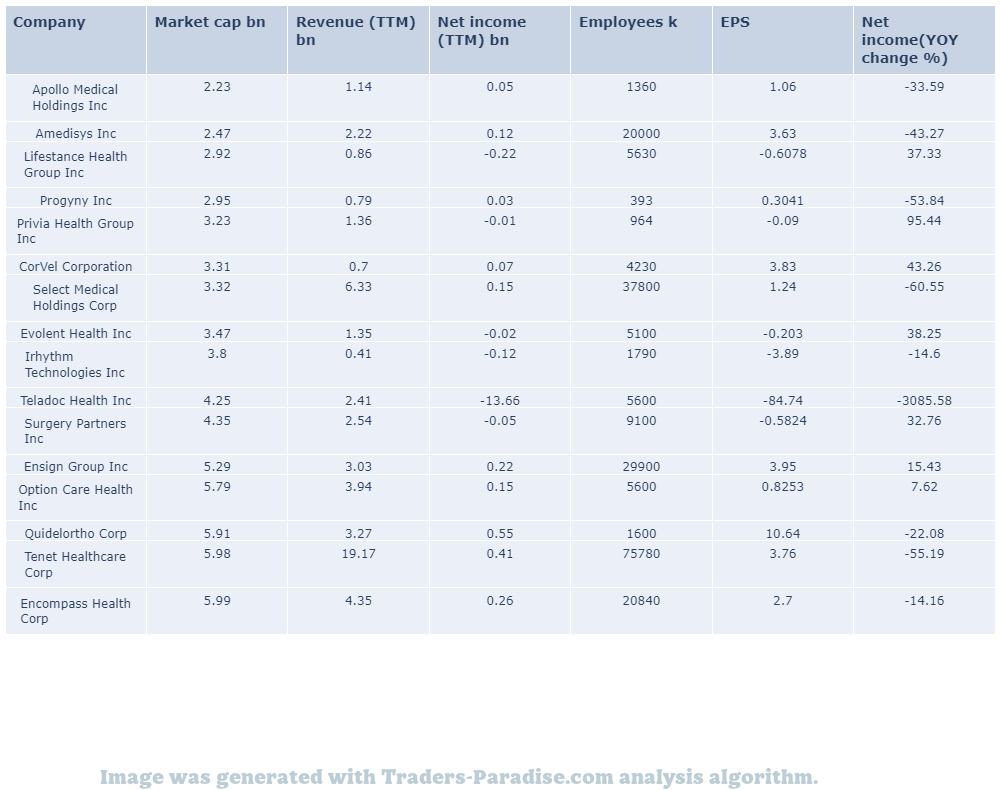

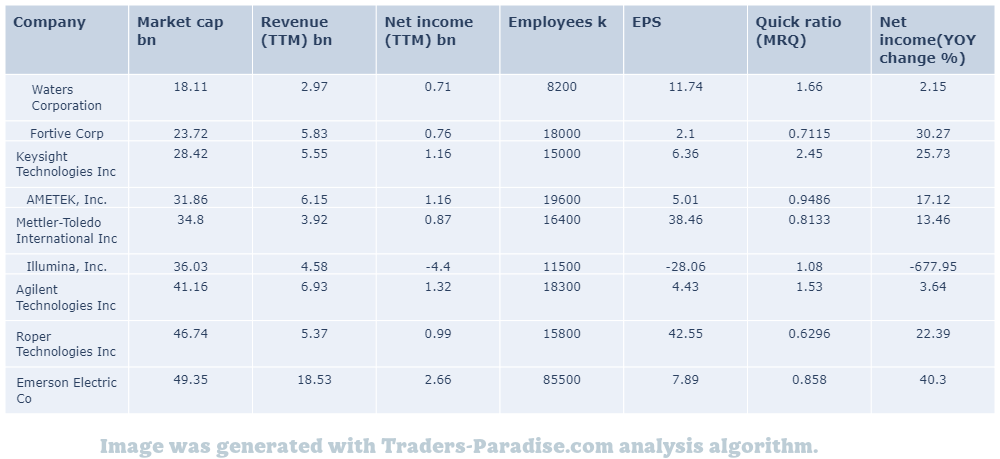

PEERS AND FUNDAMENTALS

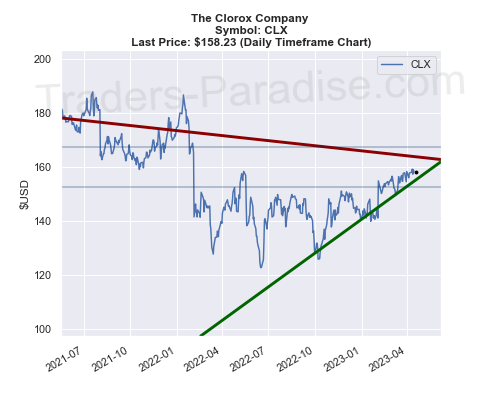

#8 Trading idea on CLX

Company Name: The Clorox Company

Symbol: CLX

Sector: Consumer Goods

Company Description: The Clorox Company is an American global manufacturer and marketer of consumer and professional products. It is based in Oakland, California. It’s a global manufacturer of consumer products and a marketer in the field of professional products, including cleaners and disinfectants.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CLX — Time-tested methodologies helped investors navigate the market well last week.

Zacks’ time-tested methodologies helped investors navigate the market well last week. Here are some of the key performance data from the past three months. Take the Zacks Approach to Beat the Market: NVIDIA, Novo Nordisk, Magenta in Focus.

- News story for CLX — Wall Street analysts have a negative outlook for Clorox.

Clorox (NYSE:CLX) has observed the following analyst ratings: Bullish, Somewhat Bullish and Bearish. 7 analysts have an average price target of $141.86. The current price of Clorox is $157.69. The greater the number of bullish ratings, the more positive analysts are.

- News story for CLX — Pricing actions, revenue management initiatives, brand strength and digital growth position Colgate for growth

Pricing actions, revenue management initiatives, innovation, brand strength and digital growth position Colgate (CL) for growth amid higher costs and currency headwinds. Here’s why investors should hold Colgate stock for now. – Colgate’s stock is up 2% this morning.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

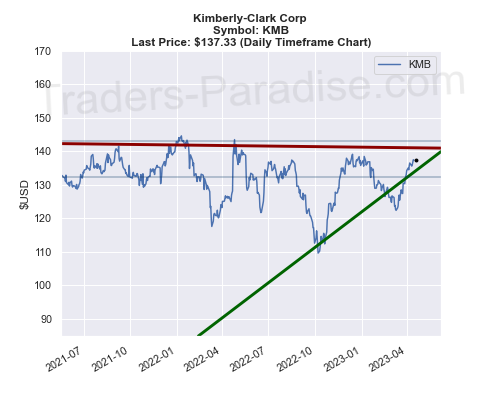

#9 Trading idea on KMB

Company Name: Kimberly-Clark Corp

Symbol: KMB

Sector: Industrial Goods

Company Description: Kimberly-Clark Corporation is an American multinational personal care corporation that produces mostly paper-based consumer products. The company manufactures sanitary paper products and surgical & medical instruments. Its brand name products include Kleenex facial tissue, Kotex feminine hygiene products, Cottonelle, Scott and Andrex toilet paper, Wypall utility wipes, KimWipes scientific cleaning wipes and Huggies disposable diapers and baby wipes.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KMB — First-quarter earnings are likely to have benefited from increased demand for digital water solutions.

Badger Meter’s (BMI) first-quarter performance is likely to have benefited from increased demand for its digital smart water solutions. Badger Meter will report its earnings before the end of the first quarter on April 30th. BMI’s shares are expected to rise after the report.

- News story for KMB — The company is undertaking several operational and supply chain efficiency programs.

Tyson Foods (TSN) is undertaking several operational and supply chain efficiency programs to place itself better in the long run. TSN is expanding its capacity and expanding its brand portfolio. TNS is investing in its supply chain and in its operations.

- News story for KMB — Acquisitions to bolster portfolio strength, boost revenues.

Hershey’s (HSY) is undertaking buyouts to augment portfolio strength and boost revenues. The company regularly brings innovation to its core brands. Solid Pricing and Portfolio Strength Fuel Hershey’s Growth. – S&P Capital Market Analyst.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

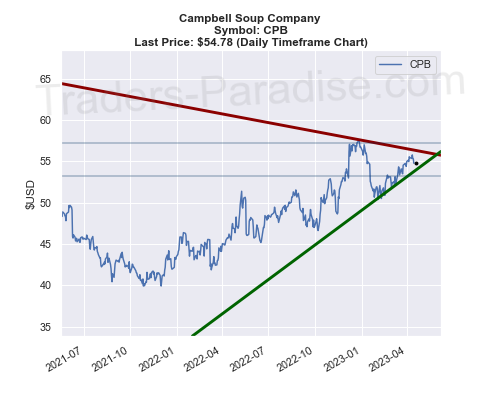

#10 Trading idea on CPB

Company Name: Campbell Soup Company

Symbol: CPB

Sector: Consumer Goods

Company Description: Campbell’s is an American processed food and snack company. It is doing business as Campbell’s. It sells Campbell’s soups and Campbell’s cereals. It’s also a manufacturer of Campbell’s Snacks. It also makes Campbell’s Ice Cream.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CPB — 6 analysts have a bullish view on the stock, with one giving a sell rating.

6 analysts have an average price target of $53.17 for Campbell Soup. The current price of Campbell Soup is $54.85. The greater the number of bullish ratings, the more positive analysts are for the company, according to Benzinga.com.

- News story for CPB — Management on track to deliver cost savings.

Campbell Soup’s snacks unit is backed by a proven growth model with strength in the power brands and higher innovation. Management is on track to deliver cost savings, according to the company’s management. Campbell Soup’s shares are up 1.5%.

- News story for CPB — Check out our Style Scores for some of the best-performing stocks of the year.

is a great way to pick strong, market-beating stocks for your investment portfolio. Zacks Style Scores help investors pick stocks with strong market performance and value. It’s a good tool to choose a stock for your portfolio. It has a Zacks Rank of #1.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

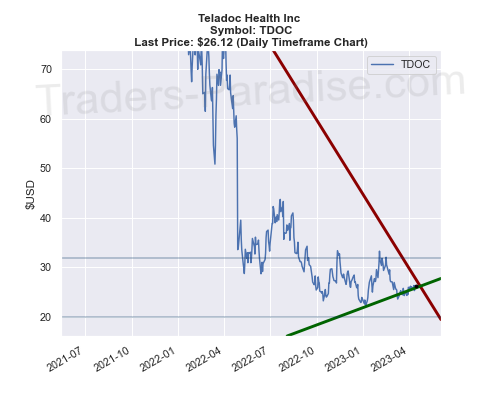

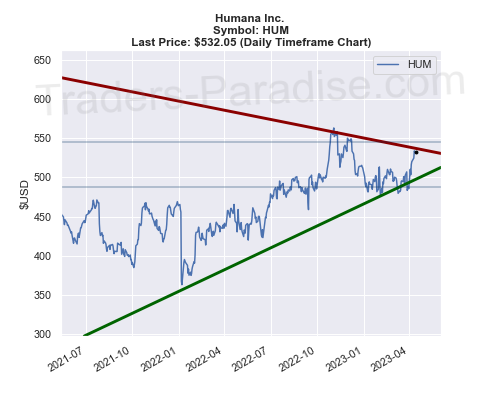

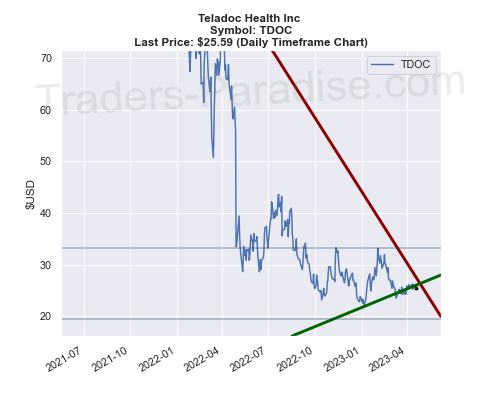

#11 Trading idea on TDOC

Company Name: Teladoc Health Inc

Symbol: TDOC

Sector: Healthcare

Company Description: Teladoc Health provides business-to-business virtual health care services in the United States and internationally. The company is headquartered in Purchase, New York and provides services in both the U.S. and abroad. Teladoc is a privately-owned company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TDOC — Stocks to consider if you are sitting on cash.

These two stocks are great bargains and may lift your portfolio in the long run. They are both undervalued and have good growth potential. They’re also good value for money at current valuations. They may be worth buying in the future. They have good long-term growth prospects.

- News story for TDOC — Surging demand for virtual care is boosting revenues.

Teladoc Health (TDOC) is well-poised for growth on the back of solid revenues, sustained demand for virtual care services and sufficient cash-generating abilities. Here’s why you should hold Teladoc’s stock right now.

- News story for TDOC — Analyst says TDOC is well positioned to be bellwether.

Stephens analyst Jeff Garro initiated Teladoc Health coverage with an Equal-Weight rating and a price target of $25. He believes TDOC is well positioned to be the bellwether digital health company due to its unique assets and scale. TDOC has 80M+ members, 30K+ providers, 60+ NPS, 20M+ annual visits.

TECHNICAL ANALYSIS

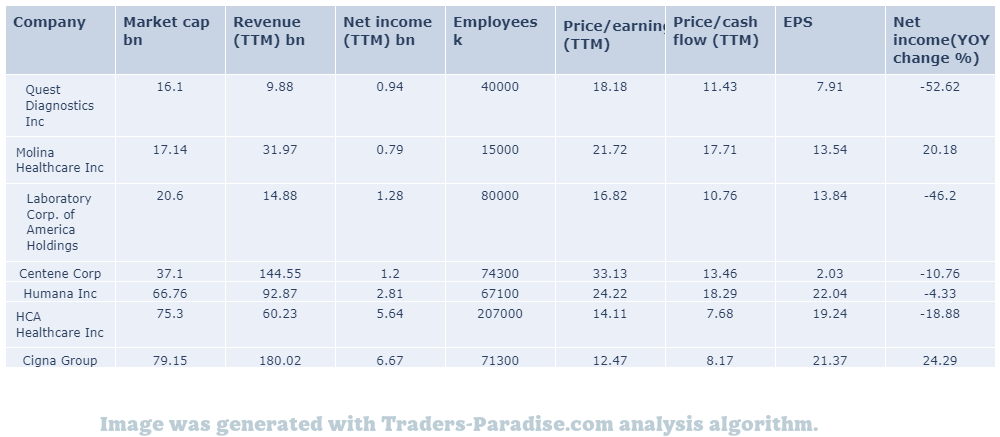

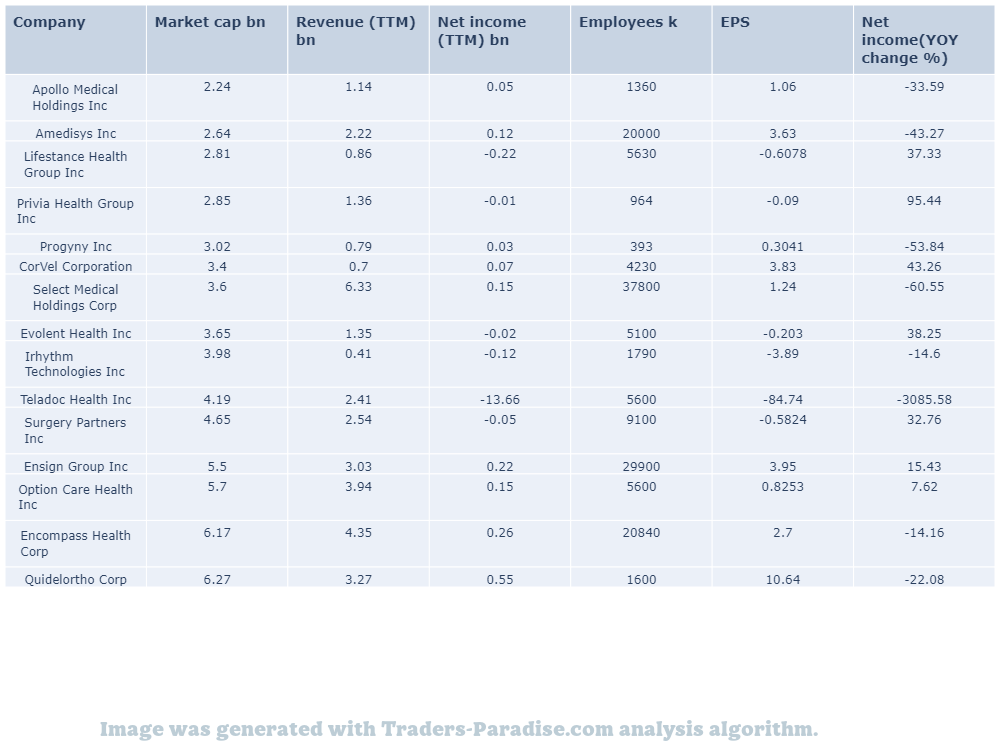

PEERS AND FUNDAMENTALS

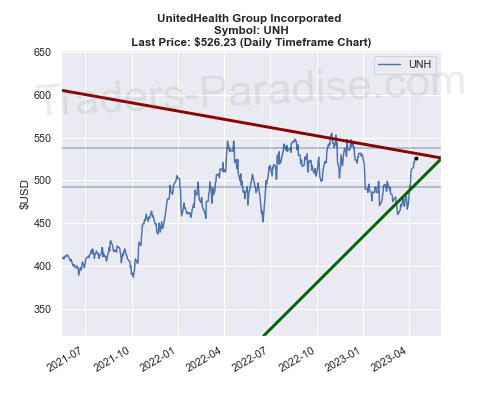

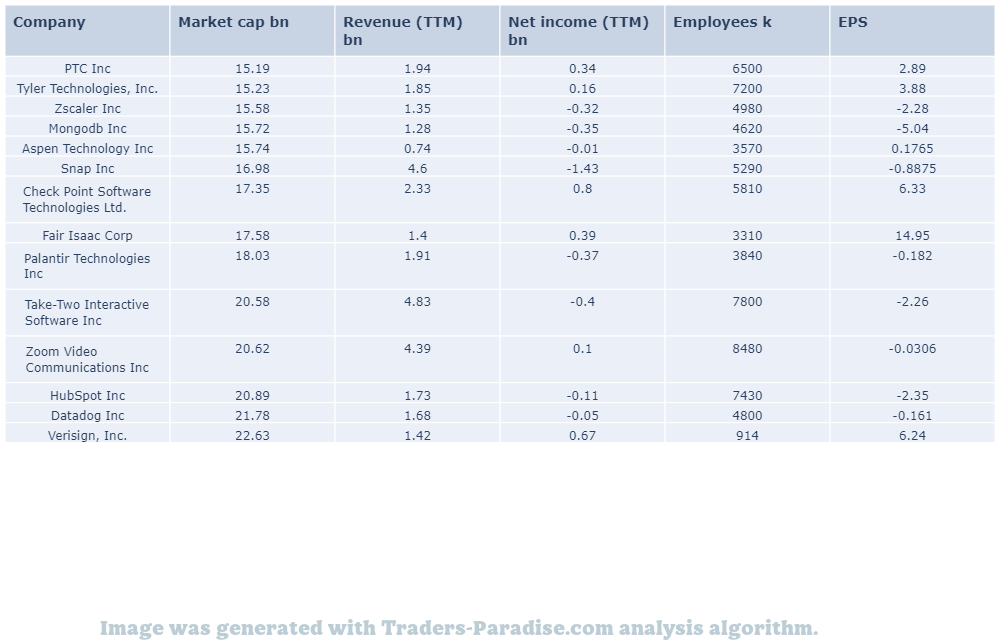

#12 Trading idea on ZM, might be reaching some kind of top

Company Name: Zoom Video Communications Inc

Symbol: ZM

Sector: Technology

Company Description: Zoom Video Communications, Inc. provides a premier video communications platform in the Americas, Asia Pacific, Europe, the Middle East, and Africa. The company is headquartered in San Jose, California, and provides services in the following regions: Asia Pacific and Europe.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ZM — Zoom Video Communications (ZM) closed at $69.50 in latest trading session

Zoom Video Communications (ZM) closed at $69.50 in the latest trading session, marking a -0.97% move from the prior day. Broader Markets closed the trading session at $70.50, a decline of 0.97%.

- News story for ZM — Zoom to acquire Workvivo to bolster employee experience.

Zoom will acquire Workvivo to bolster the employee experience offering. The employee communication and engagement platform will give Zoom customers new ways to keep employees informed, engaged and connected in today’s hybrid work model. It will help Zoom customers to keep their employees informed and connected.

- News story for ZM — Some of the fallen pandemic growth stocks are likely to make a comeback.

Some of the fallen pandemic growth stocks will likely make a comeback, as some of the falling growth stocks are going to be bought by investors again. iReport.com has a list of 3 supercharged tech stocks to buy without hesitation and shares are worth a look.

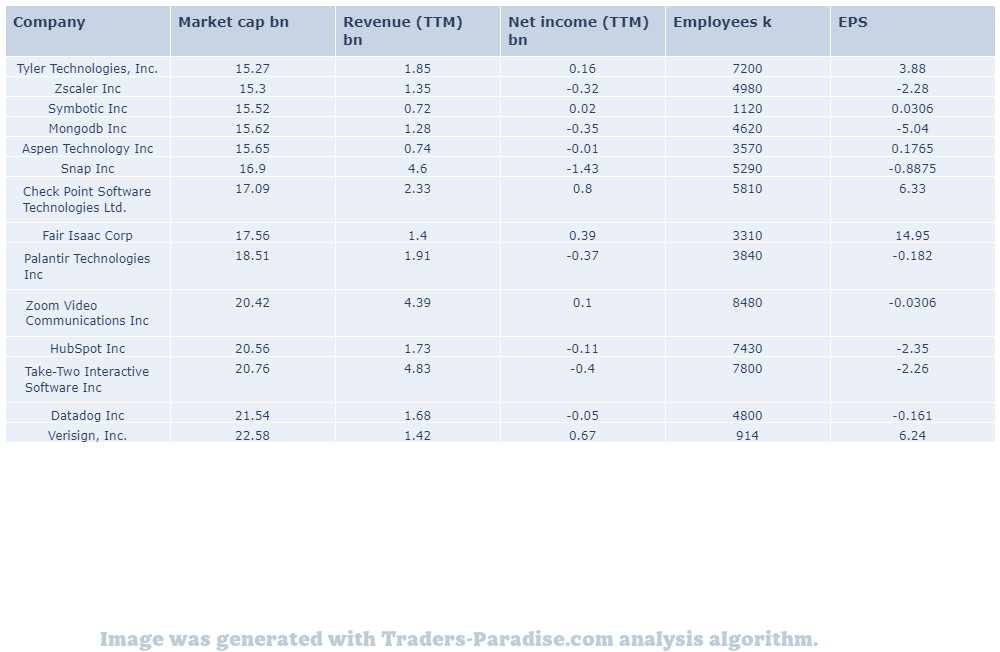

TECHNICAL ANALYSIS

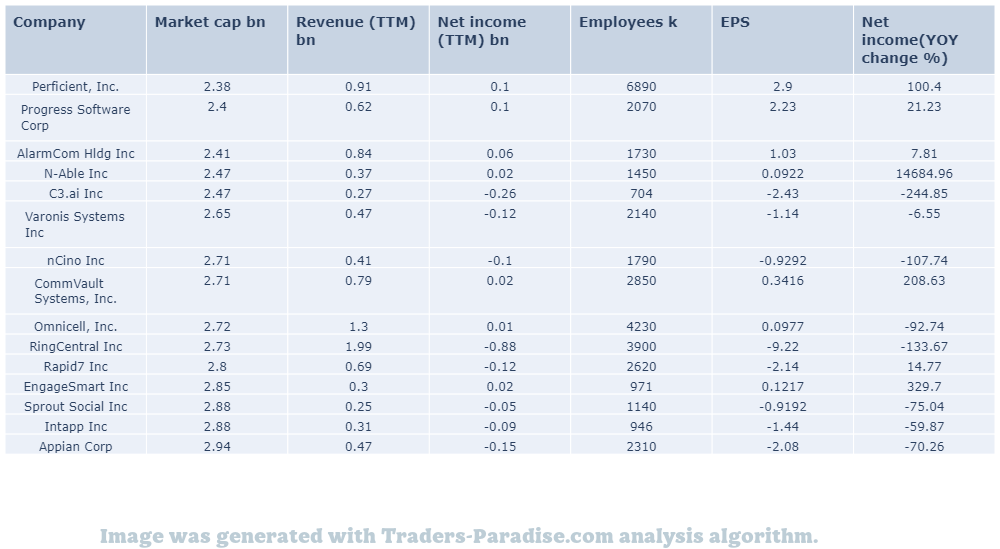

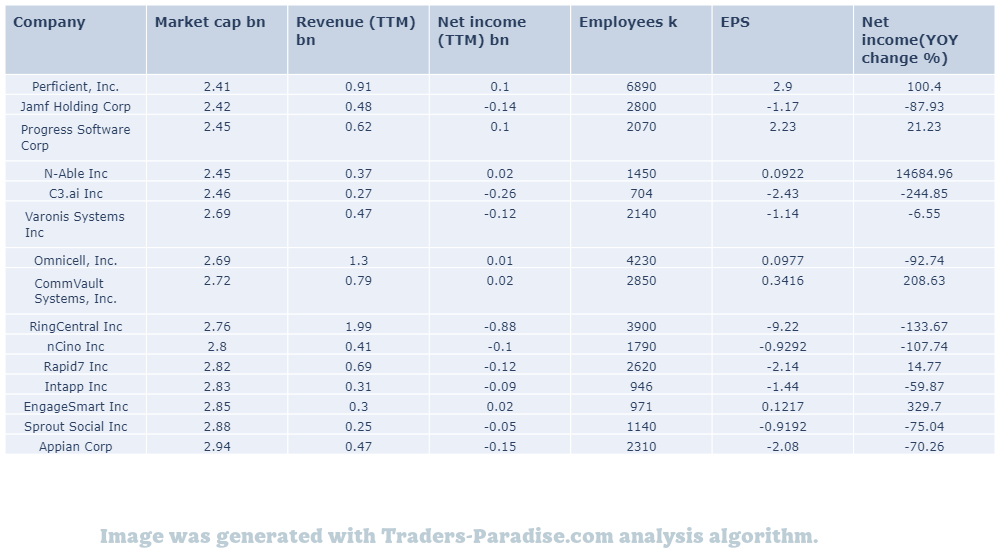

PEERS AND FUNDAMENTALS

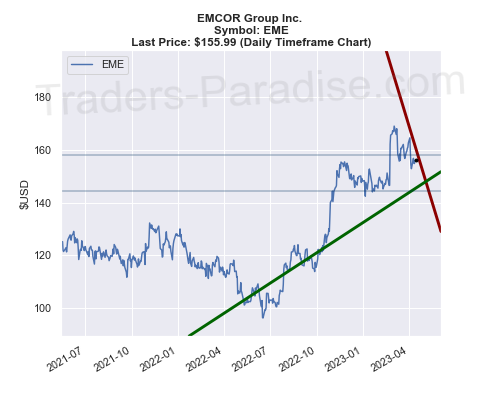

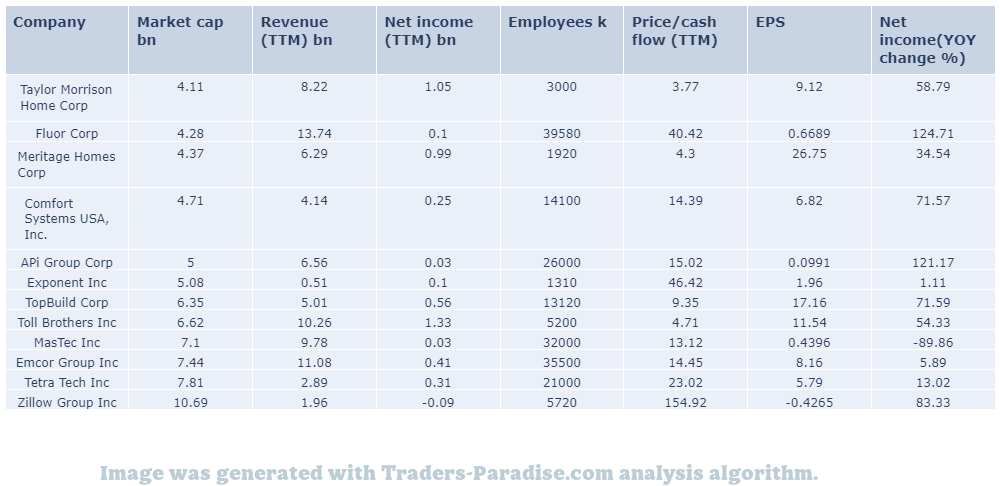

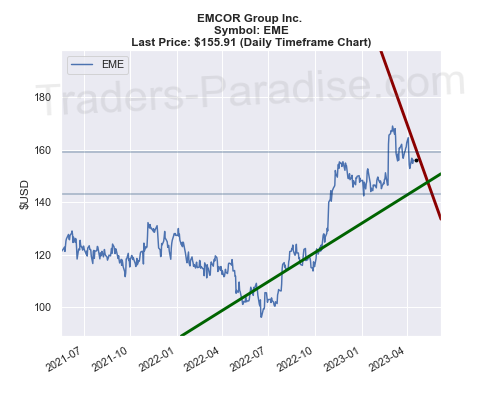

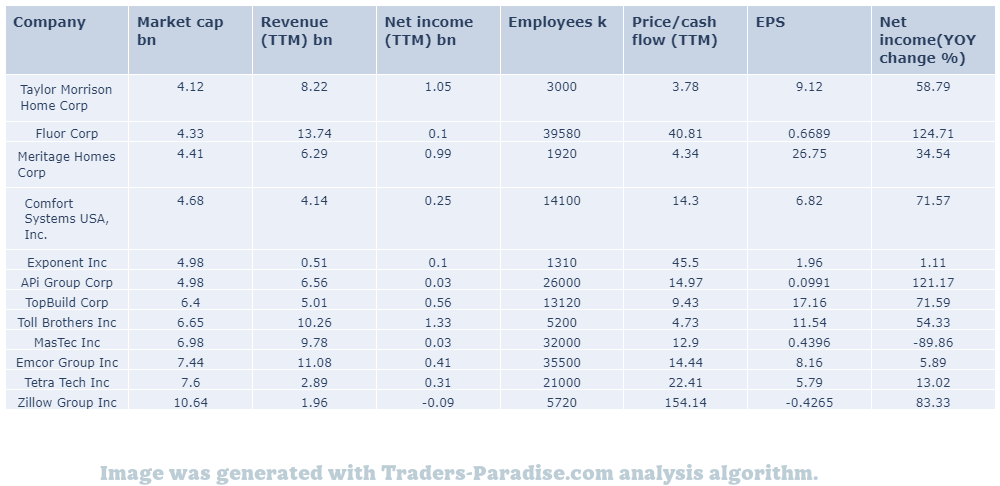

#13 Trading idea on EME, might be reaching some kind of top

Company Name: EMCOR Group Inc.

Symbol: EME

Sector: Industrial Goods

Company Description: EMCOR Group, Inc. provides electrical and mechanical installation and construction services in the United States. The company is headquartered in Norwalk, Connecticut and has a turnover of $1.5 billion. It has a workforce of about 2,000 people.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for EME — 5 stocks to watch that recently hiked dividends.

QUALCOMM (QCOM), H.B. Fuller Company (FUL), GFL Environmental (GFL), Constellation Brands (STZ) and EMCOR Group (EME) recently hiked their dividends. 5 Stocks to Watch That Recently Hiked Dividends

- News story for EME — Emcor Group has an impressive earnings surprise history.

Emcor Group (EME) is expected to beat earnings estimates again in its next quarterly report. Emcor has an impressive earnings surprise history and possesses the right combination of the two key ingredients for a likely beat in the next quarter’s report. The company has a positive outlook for the future.

- News story for EME — Fastenal to report higher demand for manufacturing amid inflationary pressures.

Fastenal’s (FAST) Q1 results are likely to reflect higher demand from manufacturing amid inflationary pressures, negative product and customer mix and adverse price/cost dynamics. Fastenal is expected to report Q1 earnings on April 25th.

TECHNICAL ANALYSIS

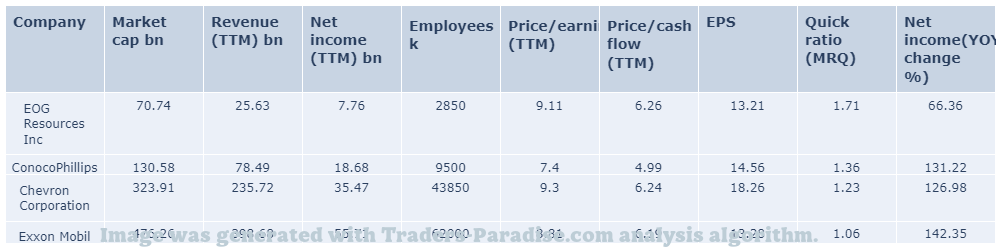

PEERS AND FUNDAMENTALS

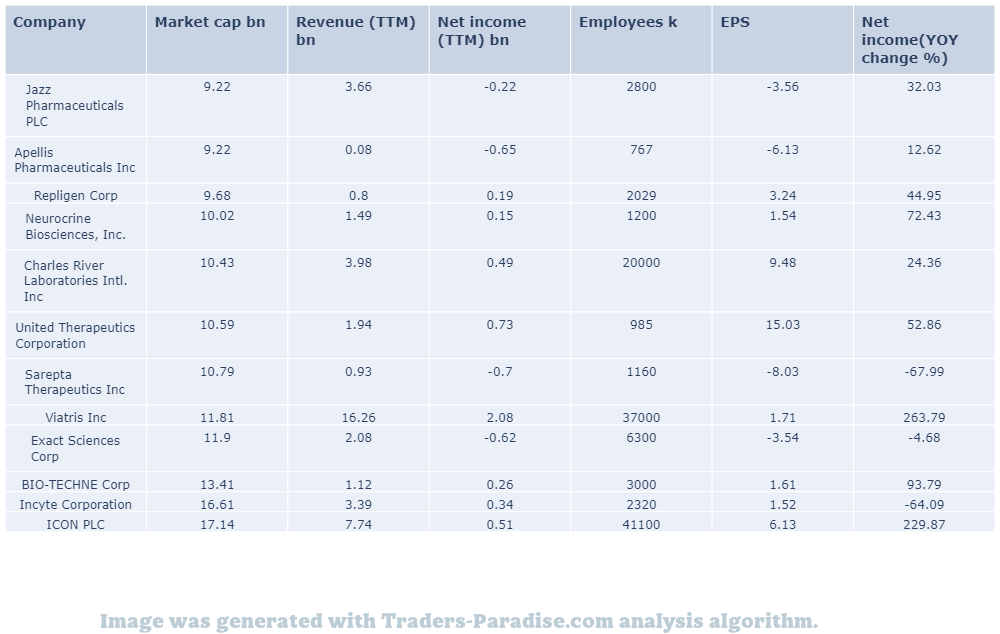

#14 Trading idea on TECH, might be reaching some kind of top

Company Name: Techne Corp.

Symbol: TECH

Sector: Healthcare

Company Description: Bio-Techne Corporation develops, manufactures, and sells life science reagents, instruments, and services for the global clinical diagnostic and research markets. The company is headquartered in Minneapolis, Minnesota, and it sells products for the life science and research market.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TECH — Bullish Somewhat Bullish Indifferent Somewhat Bearish Bearish Total Ratings 3 2 0 0 0 last quarter.

8 analysts have offered 12-month price targets for Bio-Techne. The company has an average price target of $103.62 with a high of $120.00 and a low of $89.00. The greater the number of bullish ratings, the more positive analysts are on the company.

- News story for TECH — Techne reported better-than-expected earnings and revenues.

Techne (TECH) delivered earnings and revenue surprises of -4.08% and 6.34% for the quarter ended December 2022. Techne’s Q2 Earnings and Revenues Missed Estimates. Tech’s future prospects remain unclear.

- News story for TECH — Analysts expect Illumina to report a decline in earnings.

Illumina (ILMN) doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for the Illumina’s upcoming report and prepare to be disappointed with the expected decline in earnings.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

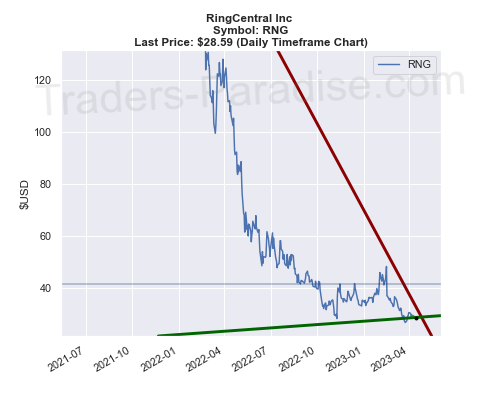

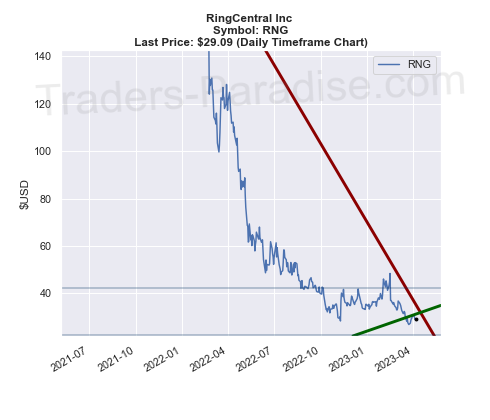

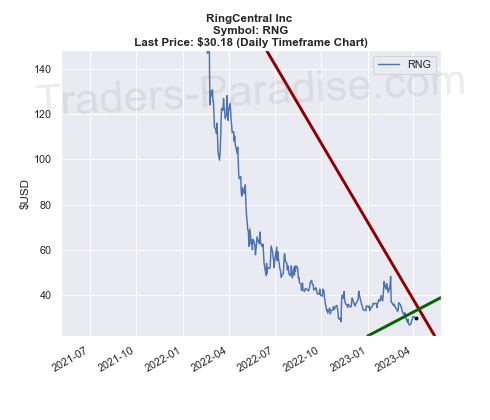

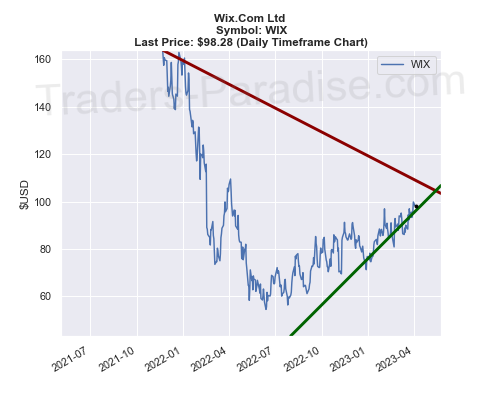

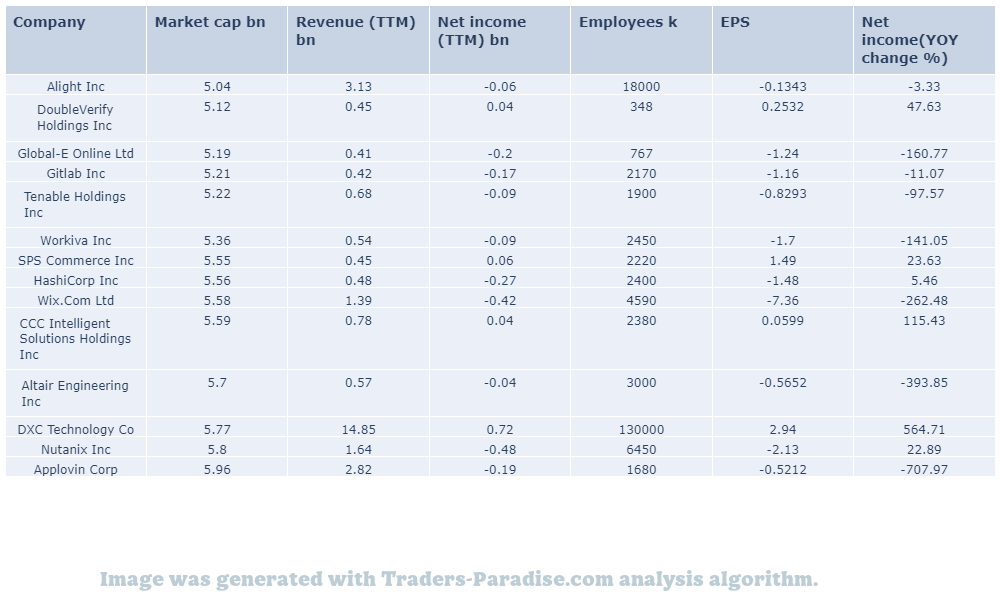

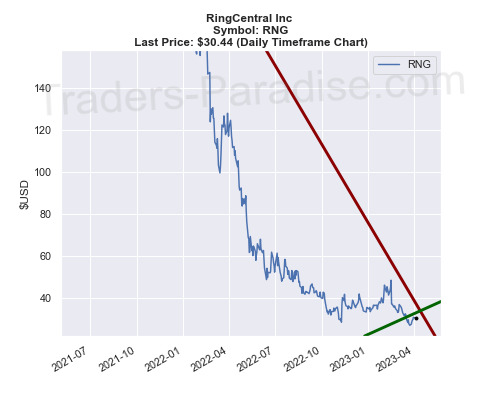

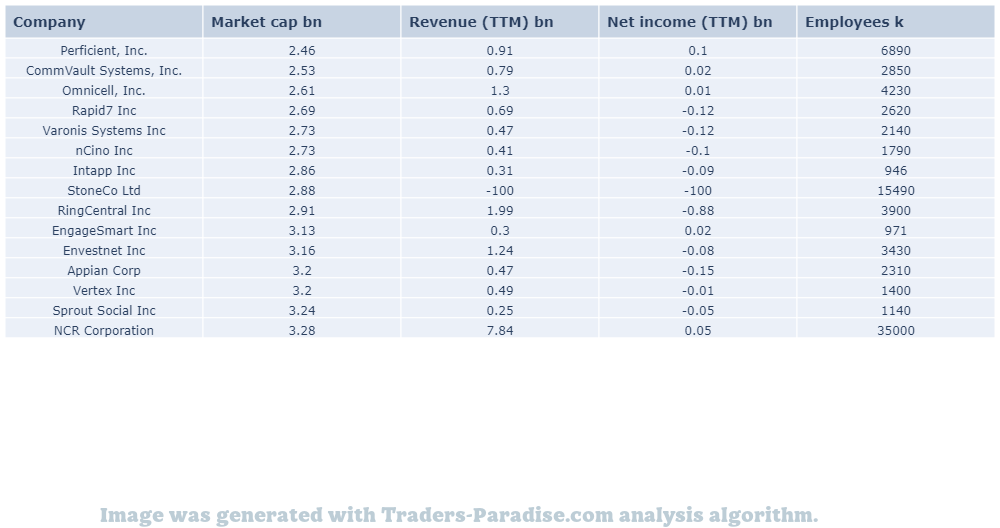

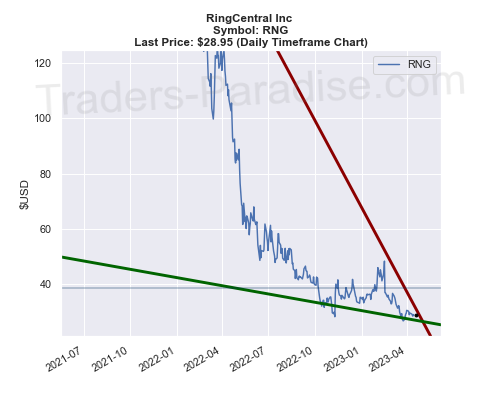

#15 Trading idea on RNG, might be reaching some kind of top

Company Name: RingCentral Inc

Symbol: RNG

Sector: Technology

Company Description: RingCentral, Inc. offers software-as-a-service solutions that enable businesses to communicate, collaborate and connect in North America. The company is headquartered in Belmont, California and offers its services in English and in Spanish. for more information, visit ringcentral.com.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for RNG — RNG has posted better-than-expected results in three of the last four quarters.

RingCentral (RNGR) has an impressive earnings surprise history. RingCentral’s next quarterly report is expected to beat estimates again. RNGR currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly earnings report.

- News story for RNG — Surge in AI hiring is a ‘beacon of light’ for tech world.

AI has been a ‘beacon of light for the tech world’ after months of layoffs, high interest rates and the collapse of Silicon Valley Bank, says one tech exec. Startups are hiring for the next big thing and AI is a good fit.

- News story for RNG — Here’s Why (RNG) is a Strong Growth Stock

RingCentral (RNG) is a Strong Growth Stock. Find strong stocks with the Zacks Style Scores, a top feature of Zacks Premium research service. For more information, go to: www.zacks.com/sportscores/zacks-style-scores.

TECHNICAL ANALYSIS

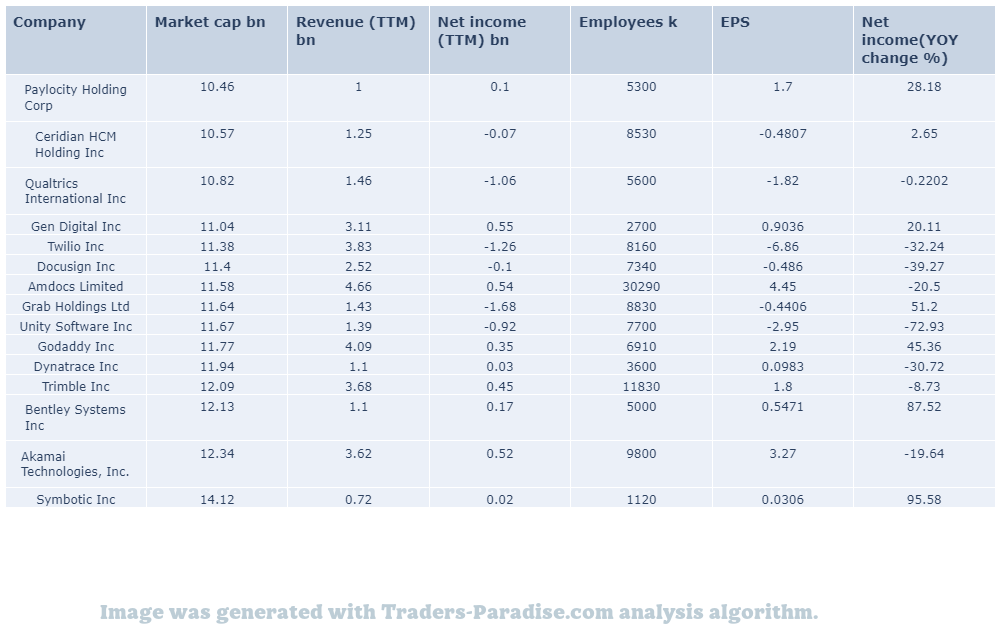

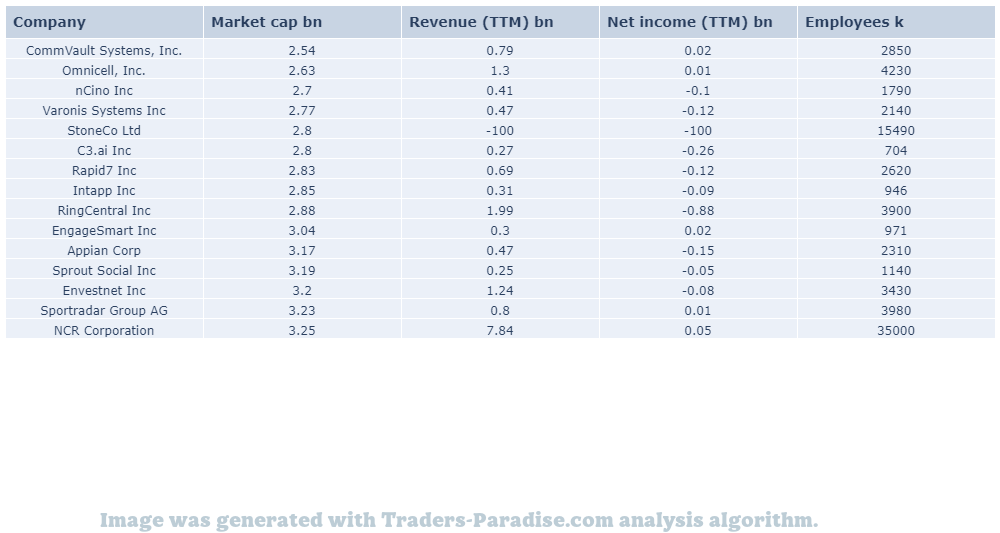

PEERS AND FUNDAMENTALS

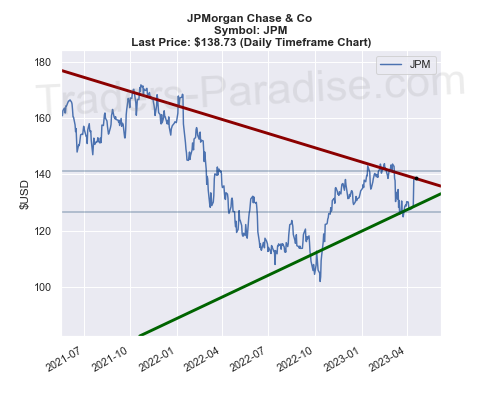

#16 Trading idea on JPM, might be reaching some kind of top

Company Name: JPMorgan Chase & Co

Symbol: JPM

Sector: Financial

Company Description: JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City. It is one of America’s Big Four banks, along with Bank of America, Citigroup, and Wells Fargo. The J.P. Morgan brand is used by the investment banking, asset management, private banking, private wealth management, and treasury services divisions.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for JPM — Analysts at Jefferies say rally is not a bad sign.

The S&P 500 saw the biggest rally in the one-month run-up to an earnings season since 2009. Jefferies analysts say that’s not a bad sign, as it’s a good sign of things to come. The earnings season starts next week.

- News story for JPM — Bank reports better-than-expected results for its first quarter.

JPMorgan Chase & Co. reported better-than-expected results for its first quarter on Friday. The bank reported Q1 net revenue (managed) of $39.3 billion, up 25% Y/Y. Its EPS of $4.10 beat the consensus of $3.41.

- News story for JPM — JPMorgan, Citigroup and Wells Fargo all reported better-than-expected results.

JPMorgan, Citigroup and Wells Fargo are highlights of Zacks Earnings Preview article. Zacks has a special focus on JPMorgan, Citibank, Wells Fargo and their upcoming quarterly results. For more information, go to Zacks’ website here.

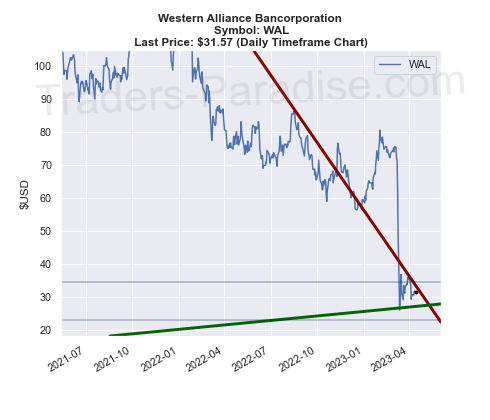

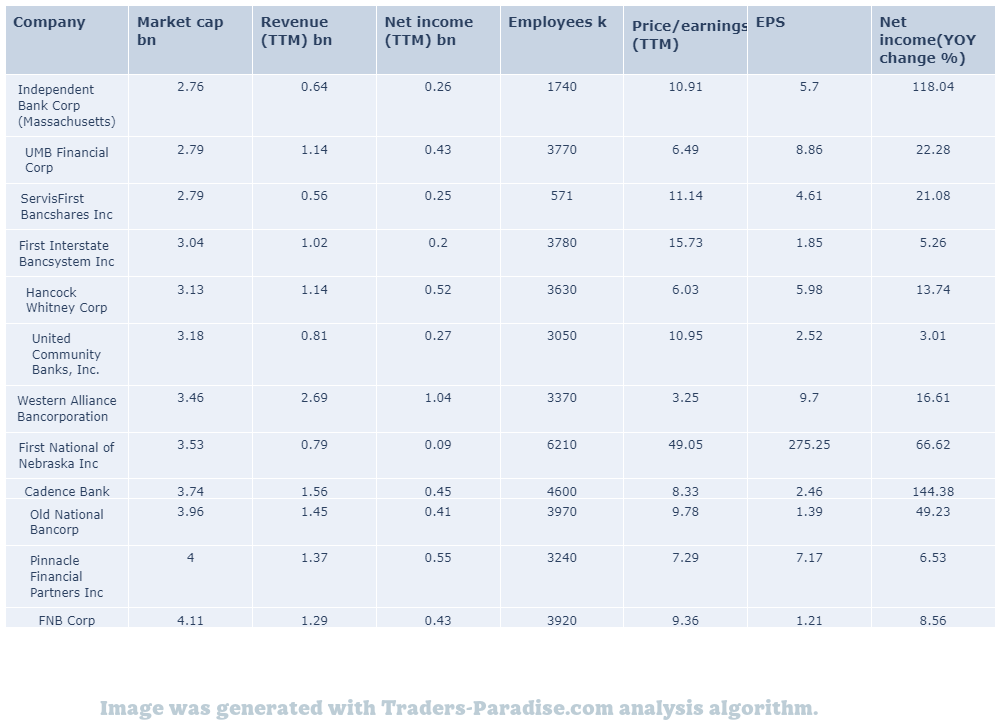

TECHNICAL ANALYSIS

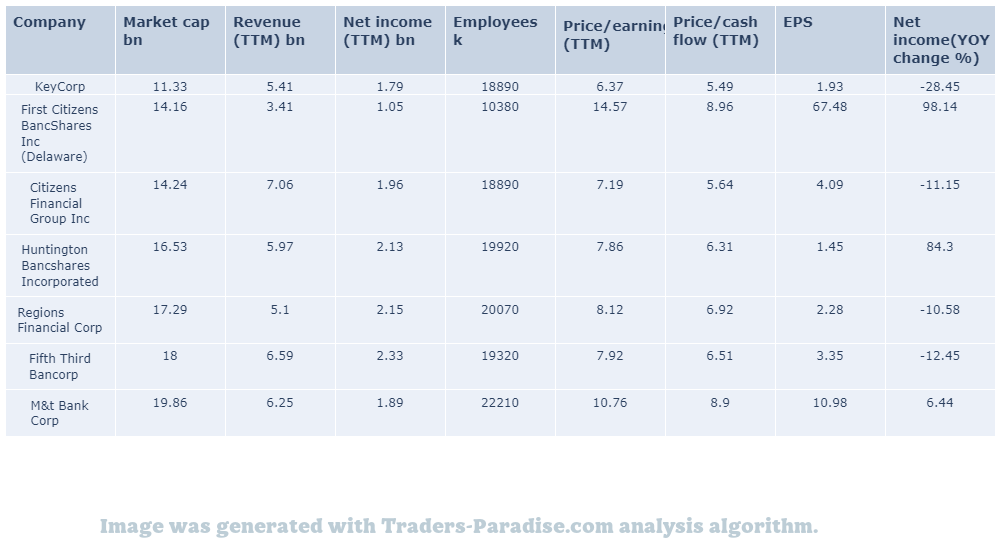

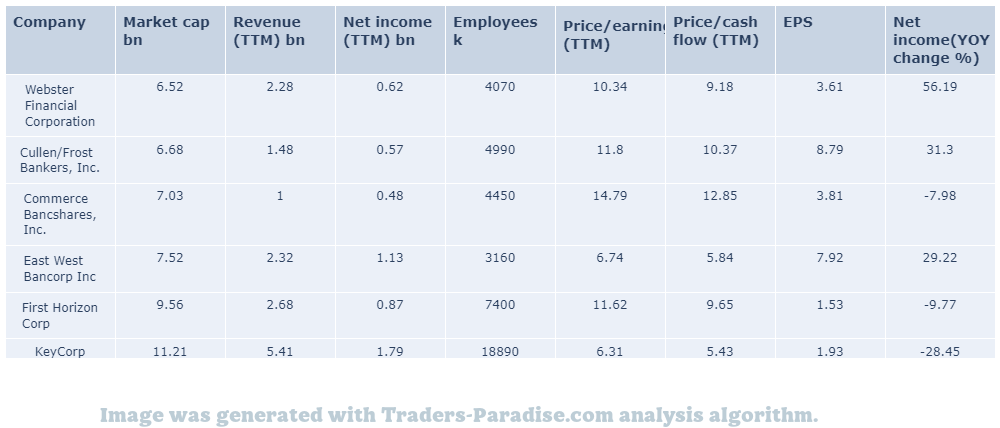

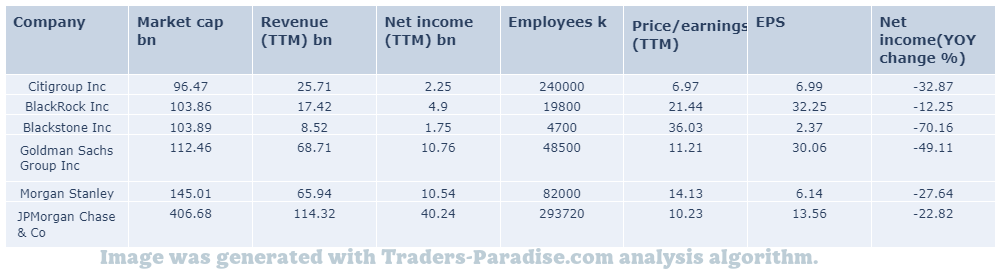

PEERS AND FUNDAMENTALS

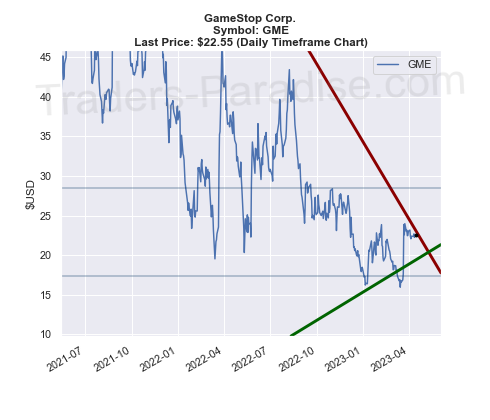

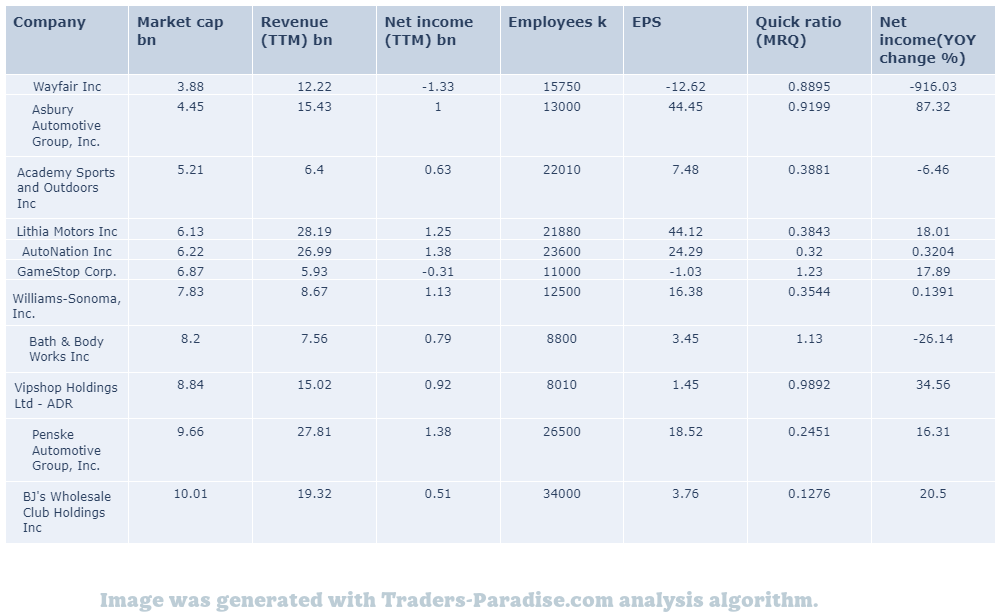

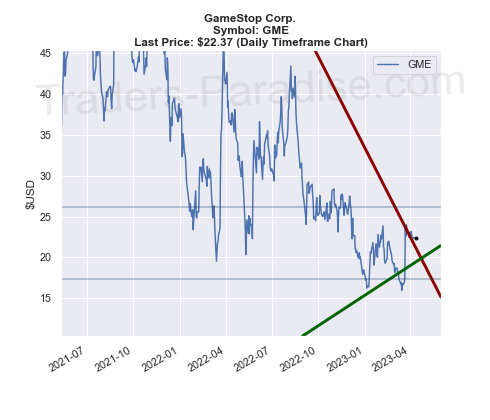

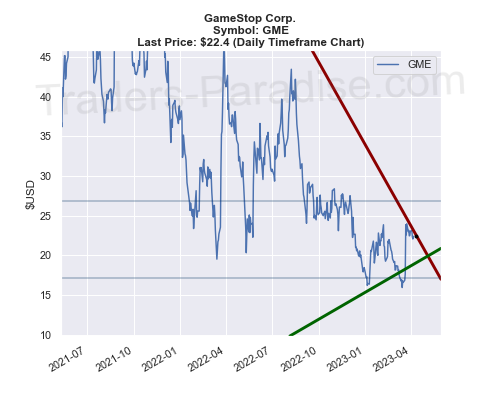

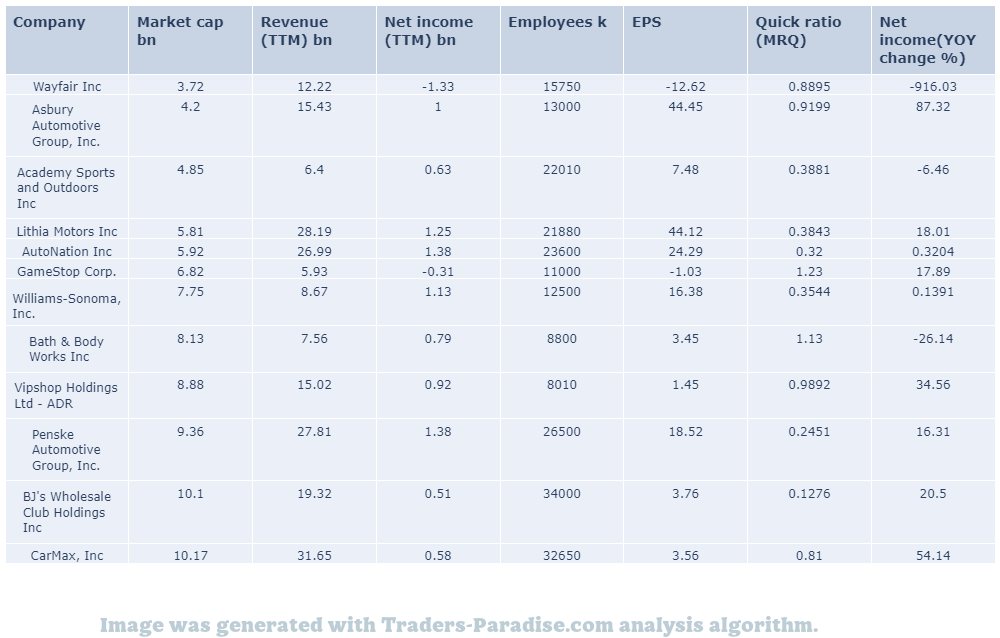

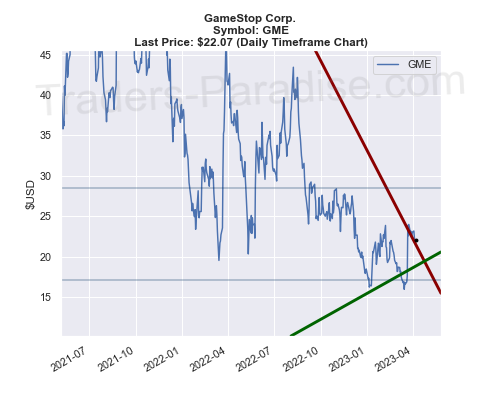

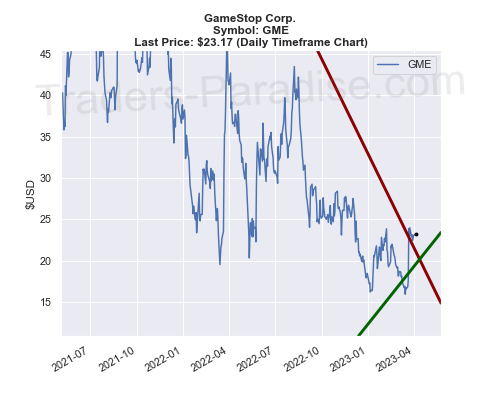

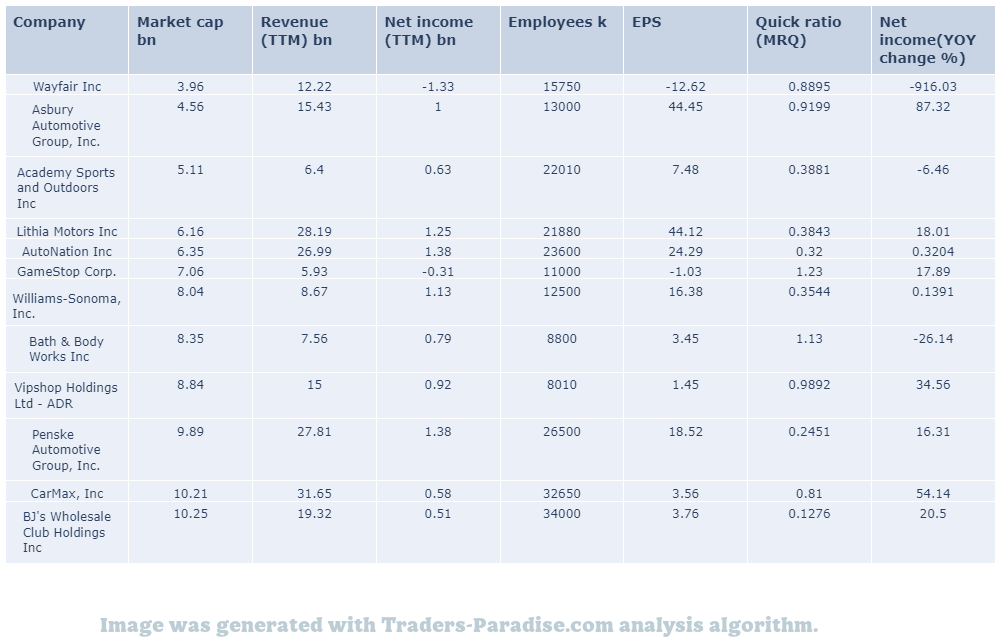

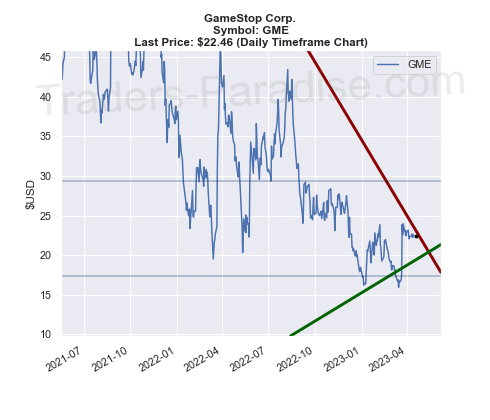

#17 Trading idea on GME, might be reaching some kind of top

Company Name: GameStop Corp.

Symbol: GME

Sector: Services

Company Description: GameStop Corp. is headquartered in Grapevine, Texas, and the company is a subsidiary of GameStop Inc., which is based in New York City. The company is valued at more than $20 billion, according to the company’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GME — Earnings expectations may be about to drop, says Morgan Stanley.

Mike Wilson is worried that investors have waved an all-clear to fallout from the banking crisis. Earnings expectations may be about to drop, says the Morgan Stanley strategist. ‘Gradually, then suddenly,’ he says. Â

- News story for GME — Shares of the video game retailer have dropped more than 20% this year.

GameStop closed the most recent trading day at $22.46, moving -0.4% from the previous trading session. Broader Markets closed at $21.46 on the same day, down 0.4%. for the overall market.

- News story for GME — Call of the day zeros in on big technical levels for stock markets.

Watch the S&P 500 and Nasdaq’s technical levels for stock markets to find out if you should buy stocks. Grindstone’s Austin Harrison says it’s the technical level that matters right now and it’s all that matters for investors.

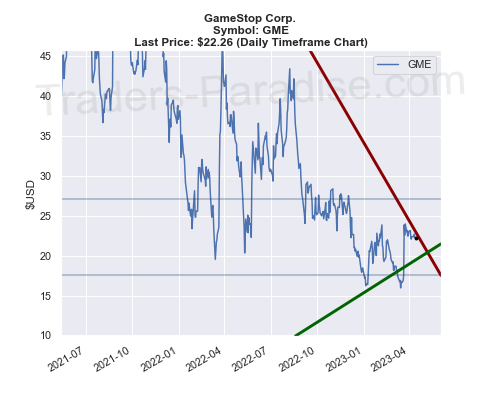

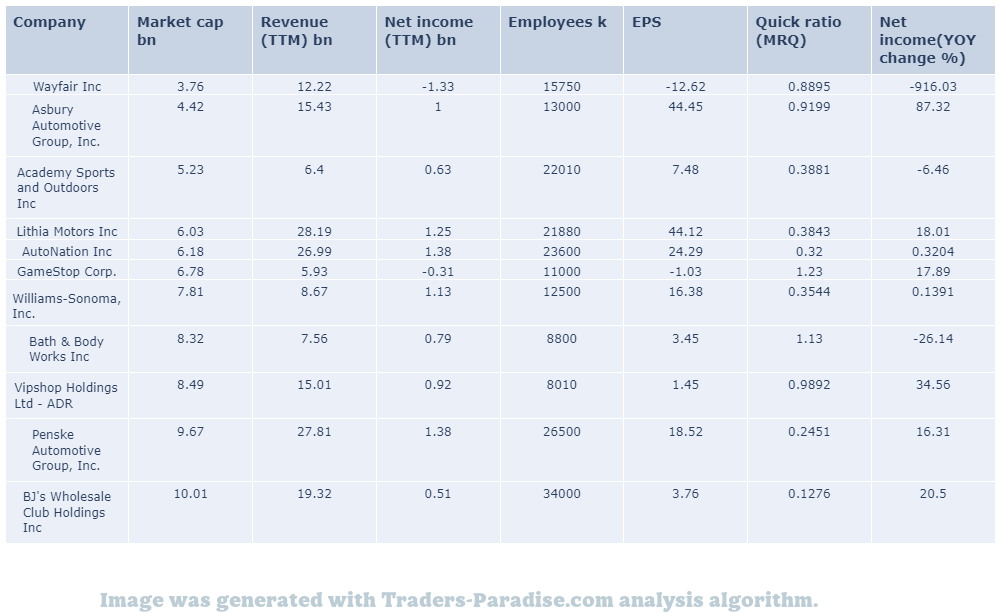

TECHNICAL ANALYSIS

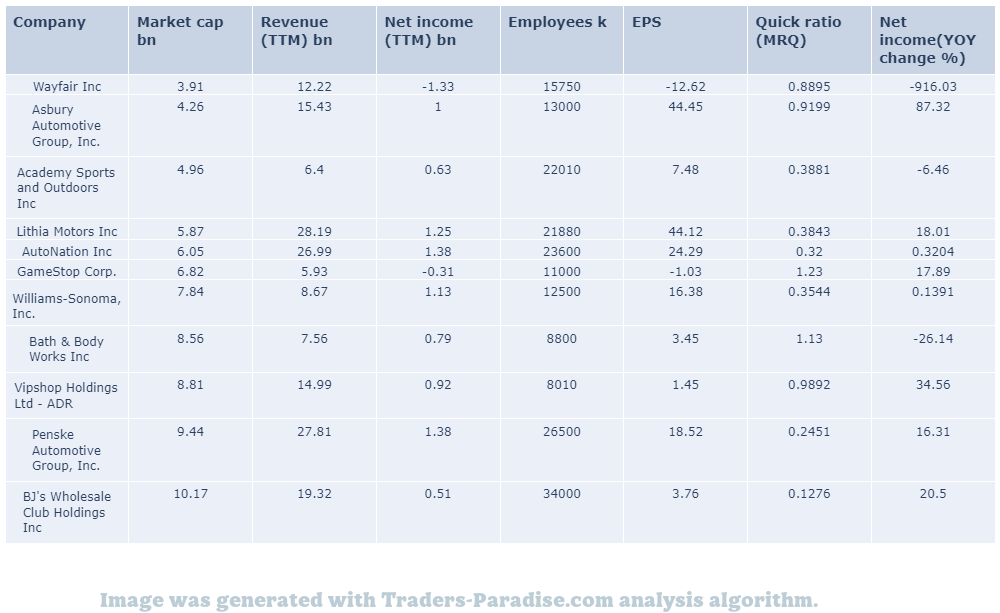

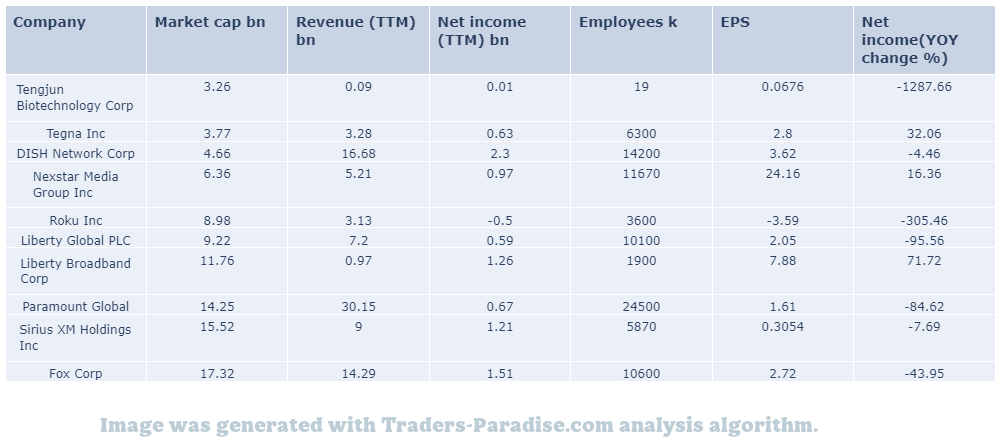

PEERS AND FUNDAMENTALS

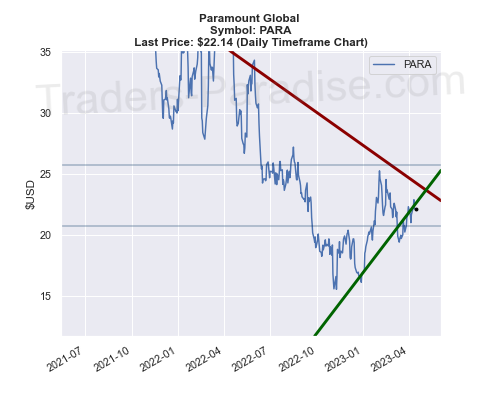

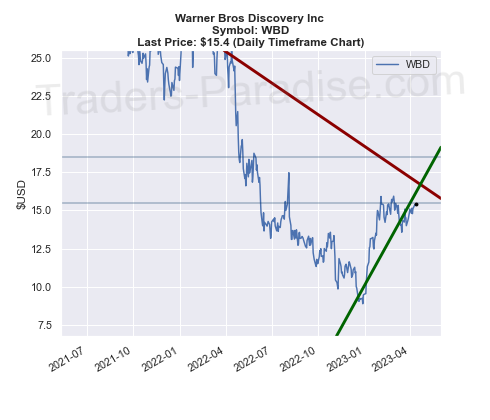

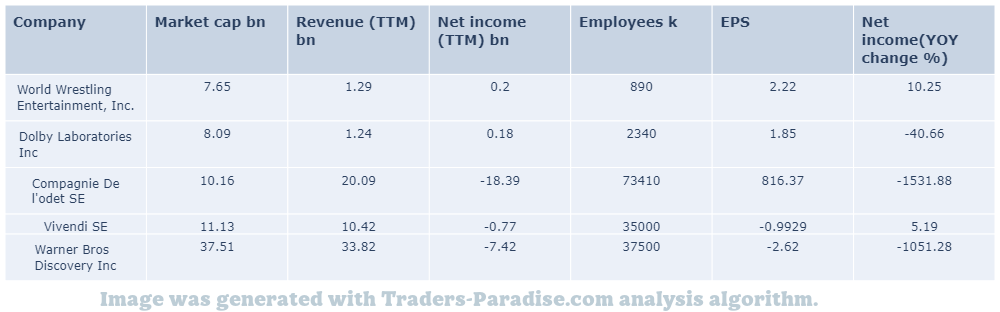

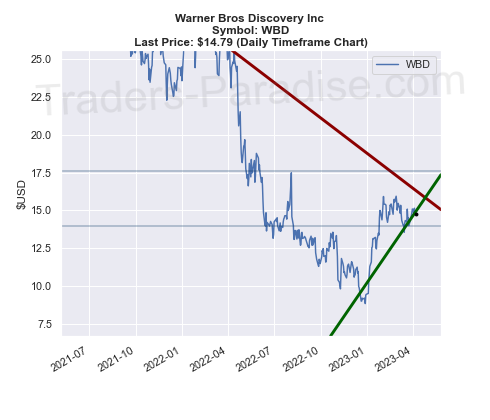

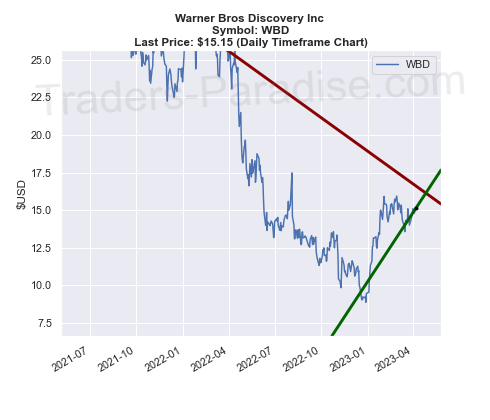

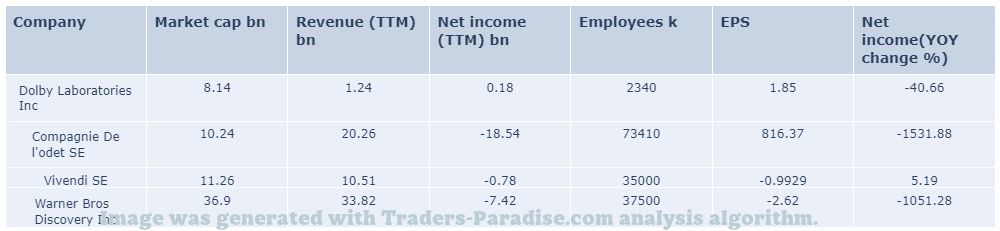

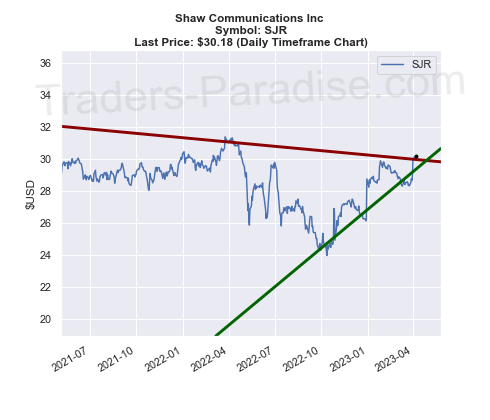

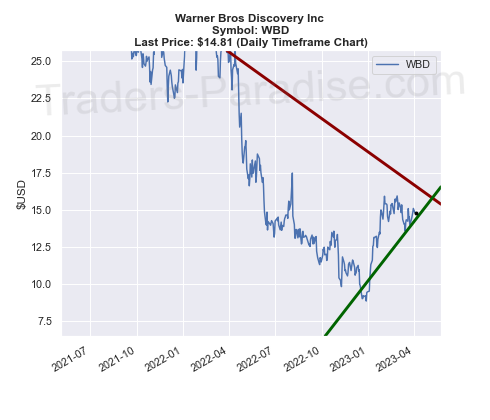

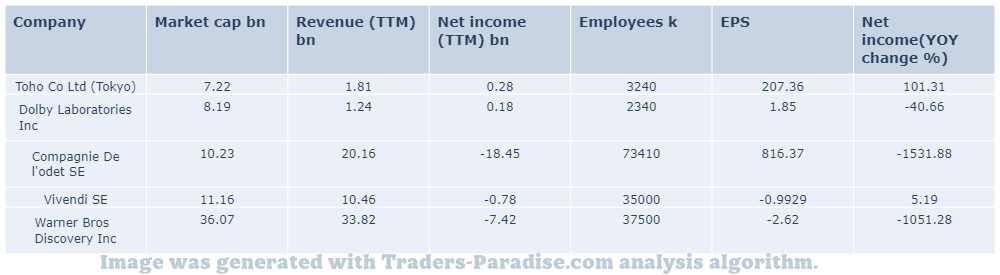

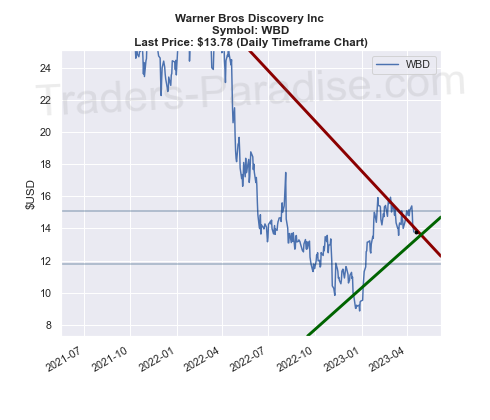

#18 Trading idea on WBD, might be reaching some kind of top

Company Name: Warner Bros Discovery Inc

Symbol: WBD

Sector: Technology

Company Description: Warner Bros. is headquartered in New York, New York and is owned by Warner Bros. Pictures. The company is a division of Warner Bros., which is based in Los Angeles. It’s worth $2.5 billion in annual revenue.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WBD — Two of the biggest names in entertainment face off in a battle of the streaming giants.

Warner Bros. and Walt Disney are trying to find their footing in the streaming space. Discovery is a Warner Bros. series. Disney’s “Discovery” is a Walt Disney series. “Dionysus” is from Warner Bros., which is from Hollywood.

- News story for WBD — Weekly take on events in the world of business.

Netflix, Tesla, banks and credit-card companies are expected to report their earnings in the week ahead. They are likely to see a decline in profits due to cheaper content and less demand for cars and workout videos. Â

- News story for WBD — Is Netflix getting stronger or weaker?

Streaming has become a tough business. Netflix is not getting stronger or weaker right now. Netflix has a lot of challenges ahead of it, but it’s not going to get stronger any time soon. Netflix’s future is in its own hands.

TECHNICAL ANALYSIS

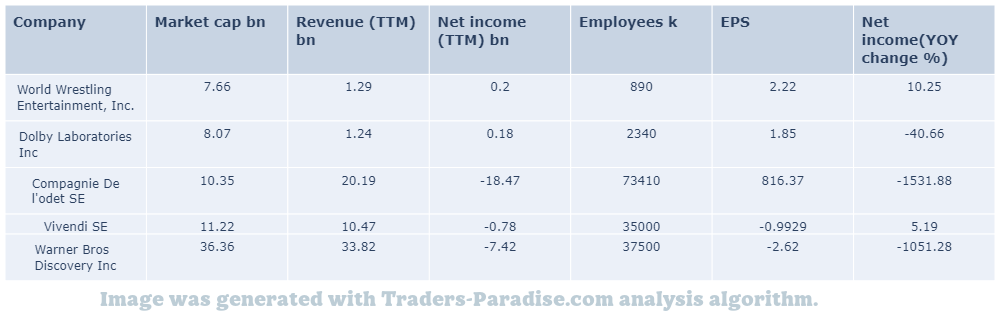

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.