4 min read

To invest in a mutual fund, you can buy into a mutual fund through a mutual fund company, bank, or brokerage firm (similar to stocks).

Typically, funds are either equity funds (investment in stocks), fixed income funds (investment in bonds), or money markets (kind of like cash).

You will have to consider what is the minimum threshold for investing in the mutual fund. Because different funds have different investment minimums.

Also, you will have to decide if you want to invest in a load or no-load fund.

This means you will either be paying commission or not. But regardless of if you invest in a load or no-load fund, you’ll still be paying some fees. So, you have to factor that in when deciding.

And, it is really simple to invest in a mutual fund.

You simply determine the amount of money you’d like to invest in a mutual fund over the phone, online, or in person. There are so many options today.

Online brokers generally often offer more diverse selections. However, you will have to open an individual retirement account.

There are several expenses to account for. Like, transaction fees accumulated when investing in a mutual fund, early redemption fees if you wish to sell a fund in the first 60 to 90 days, and expense ratios that are a percentage of your investment.

You can make money off of your mutual fund by selling it for more than you paid for it. Or through a variety of distributions like dividends or interest that can be paid out throughout your investment. However, most mutual funds will reinvest dividends for you unless you specify otherwise.

Can money invested in mutual funds be lost?

We will try to keep it simple. If you have invested only in mutual funds, theoretically the money can be lost.

Reasonably – it depends.

Well, investments are time unstable. So, at some period, your portfolio can hit the loss.

But over the long period in time, the odds of losing your money are close to null.

Yes, there might be accidents like some major market breakdown which could destroy your collected profits notably. But, in most cases, it is for a short time and markets would recover and your investment too.

Let us explain.

During the 2008 financial crisis, the fall in stock prices led to near 50% decline in the portfolio value of many people nearly throughout the world. Many people had panicked because this was a huge story. But, inside a one year, the portfolio value jumped back to its 100%. So, if some investor was really holding till today, it would be extra up 50–60% at least. In short, the possibilities of losing in the long-term are very small when investing in mutual funds.

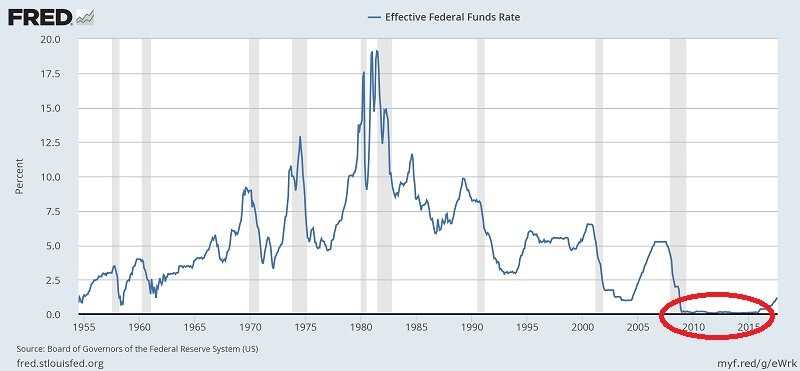

Take a look at this chart:

Let’s do some math.

You invested $100 and holding it for 10 years earning 15% CAGR = $404.5.

You remember from the previous lessons: CAGR is the compound annual growth rate (CAGR).

Some breakdown in the 11th year decreased prices by half – $202. But, this is still a return of 7.3%.

The risk, if you are forced to sell here is not reaching your financial intentions and considerably it will influence your habits if you are retired.

But what we can learn from the history of the present business world? The value of assets has jumped back to healthy from the critical after the great depressions.

One note more. Instead of focusing on the systematic investment plan (SIP) a better choice is a focus on the systematic withdrawal plan (SWP). That’s the point where you begin to take out your money from risky assets. You are close to your goal and place in secured assets.

So, the chances of not reaching your financial aims are reduced.

The note: Mutual fund investments are subject to market risk.

You have to keep this in your mind forever when investing in mutual funds. There are no investments without some risk associated with it.

Missing or getting the money depends completely on the investment period an investor picks.

We will show you how it looks in one more chart. We aimed out the period of big crisis 2008, in the red circle.

For example, you invest $1,000 for a day or two. If the stock market slips the preceding day, the value of your $1,000 will surely not appreciate.

Also, if you invest the same amount for a week and the market is in a downtrend throughout that week, the invested money will not yield any profit.

If you choose to stay invested for a year or more than that, though there is no guarantee, there is a possibility that your $1,000 may go up as a long-term investment horizon is always likely to give better results.

In other words, you won’t lose all your money.

Money can be lost mostly due to wrong timing.

When the market is bullish, people invest aggressively. When the market corrects, people get scared and they take out money when the market is down or sideways.

Say, investing in stocks through mutual fund route is a safer way to putting in money in the ever-volatile stock market. In a mutual fund, your investments are managed by professionals, who ensure the protection of your capital.

Past trends have shown that usually mutual funds are profitable giving an average return of around 10-12%.

Mutual fund investments become even safer and convenient if done via SIP (Systematic Investment Plan) route. SIP is a type of investment set up whereby rather than putting in a lump sum, you put in small amounts of money either in monthly, quarterly or annual installments. This, in turn, enables the fund to benefit from the power of compounding and also isn’t too much of a burden on the investor.

Leave a Reply