How to read this report

Every report will start with a short “Market News” section. In this section, we scraped the latest financial news regarding the financial markets. This is a more macro vision of the market. Interest rates, unemployment reports, inflation, oil and energy, earning season, etc.

After the news report section we head to the trading idea section. Every idea is divided into 4 important parts:

-

-

-

- The company and its sector and description

- Recent news about the company

- Chart and its boundary lines

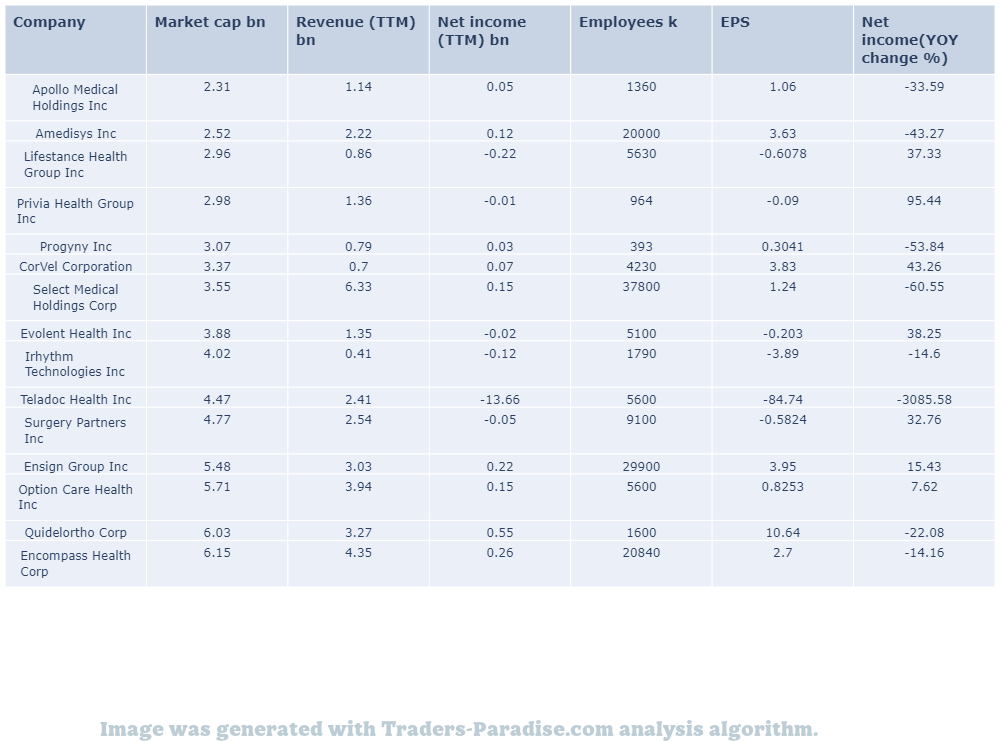

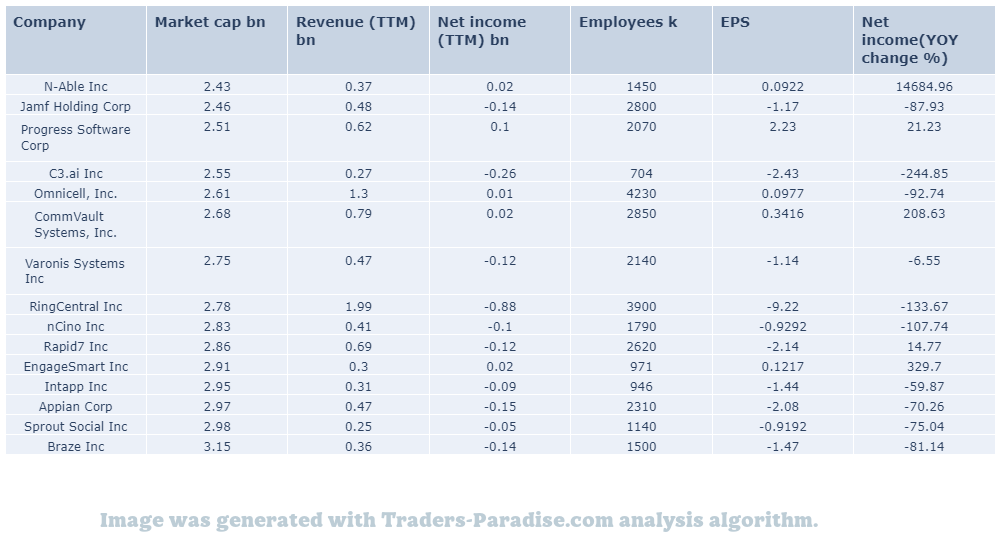

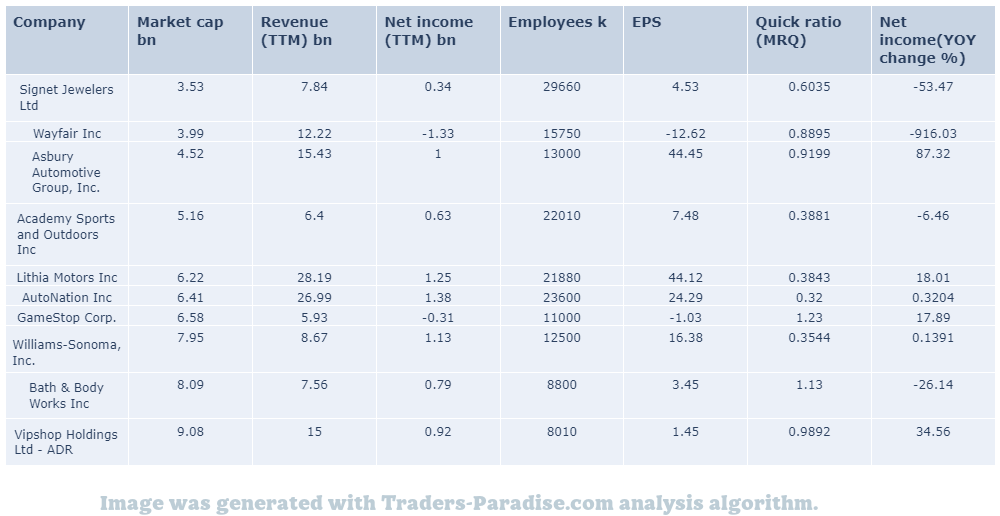

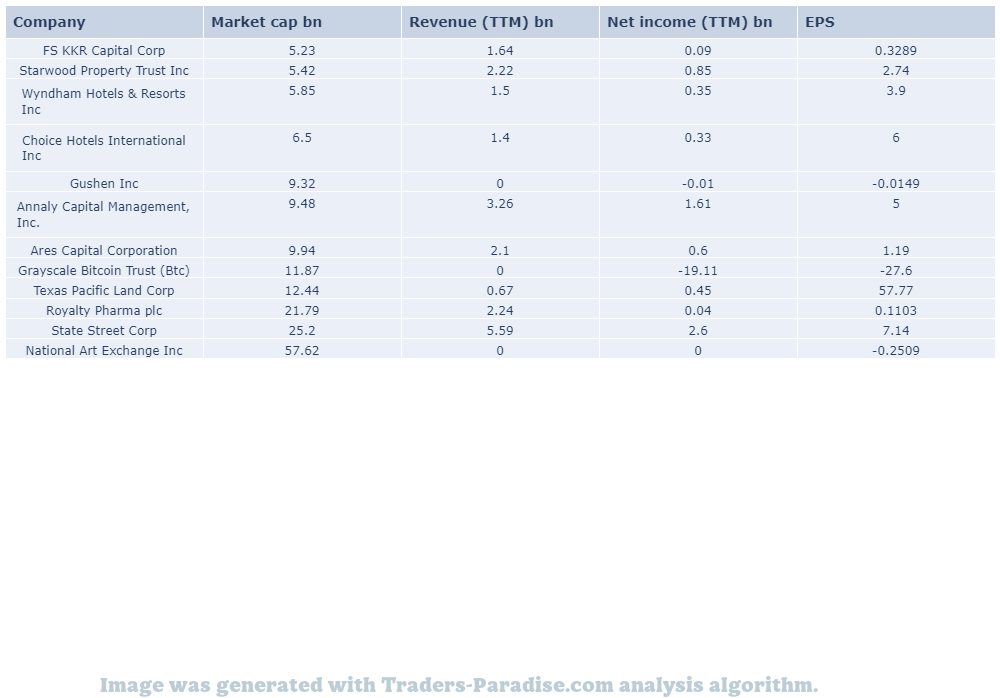

- A table with the company peers and competitors, including their financial and fundamentals.

-

-

A new report will be generated on a daily basis.

Does it work?

In short, yes.

you can read here how we use these methods for our real life trades.

Short declaimer

This report, including all content, is made for educational purposes only. Use on your own risk!

Most recent news about the financial markets

- 10-Bagger Stocks to Buy Now and Hold for the Long Haul

There are 3 10-billion-dollar stocks to buy now and hold for the long-term. They are: “3 10-Bagger Stocks to Buy Now and Hold for the Long Haul” and “3 Stocks To Buy Now And Hold For The Long-term”.

- Equities, other risk assets to take a hit when stimulus ends, report says.

Risk assets will take a hit when central banks pull away as much as $800 billion of stimulus that was deployed to boost the global economy. The risk rally has been fueled by the injection of over $1 trillion of central bank liquidity. Major equity indices recorded net gains this year despite looming concerns over high inflation, possibilities of recession and the banking crisis.

- ETFs pulled in $19.1 billion in capital last week.

ETFs pulled in $19.1 billion in capital for the week (ending Apr 14) Overall, 5 of the 5 biggest ETFs performed well last week despite the recent market volatility. 5 of them were the iShares MSCI All-Shares exchange traded fund (ITF).

- VOE and FXL saw massive trading volume in yesterday

VOE and FXL saw a lot of trading volume in yesterday’s trading session. VOE is a mid-cap and tech exchange-traded fund. FXL is a large mid-caps and technology exchange-trade fund. Voe is a small mid-sized tech fund.

- Earnings Recession, Deflation, Liquidity Crunch likely to weigh on markets for months.

There’s a recession on the way for the S&P 500, according to some analysts. It’s likely to be worse than the current economic slowdown. It will be deflationary, deflationary and likely to cause a liquidity crunch. – The Economist

- Tighter lending conditions drive U.S. into recession: Vanguard head of rates.

Roger Hallam, global head of rates at Vanguard, expects the U.S. economy to be in recession in the second half of this year due to tighter lending conditions. Hallam sees high volatility in rates over the short term and a lot of policy uncertainty right now.

- Ryan Detrick compiled a list of 10 reasons the S&P 500 could keep climbing.

The SPDR S&P 500 ETF Trust (NYSE: SPY) is up 7.9% year-to-date. Carson Group’s Ryan Detrick compiled a list of 10 reasons why the stock market could keep grinding higher in 2023. When the S&p 500 is higher in January, it has historically finished the year higher 86% of the time.

- Hated Stocks, These 4 Worth Considering?

There are 100 hated stocks on Amazon, but only 4 are worth considering. For confidential support call the Samaritans on 08457 909090 or visit a local Samaritans branch, see www.samaritans.org for details. For confidential help, call the National Suicide Prevention Lifeline on 1-800-273-8255.

#1 Trading idea on STE

Company Name: Steris Corp.

Symbol: STE

Sector: Healthcare

Company Description: Steris Corporation is an American Irish-domiciled medical equipment company. It specializes in sterilization and surgical products for the US healthcare system. It is a manufacturer of medical equipment for the U.S. and European healthcare systems. Its products include sterilization equipment and surgical equipment.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for STE — 4 analysts have a positive view on the stock.

Steris (NYSE:STE) has observed the following analyst ratings within the last quarter: “Bullish”, “Somewhat Bullish,” “Indifferent” and “Bearish”. These 4 analysts have an average price target of $218.0 versus the current price of Steris at $186.86.

- News story for STE — Top dividend stocks to buy and hold for 2023 and beyond.

There are 2 top dividend stocks to buy and hold for 2023 and beyond. If you’re willing to play the long game, these stocks will put money in your pocket for decades to come. They’re worth a lot of money if you play the game right.

TECHNICAL ANALYSIS

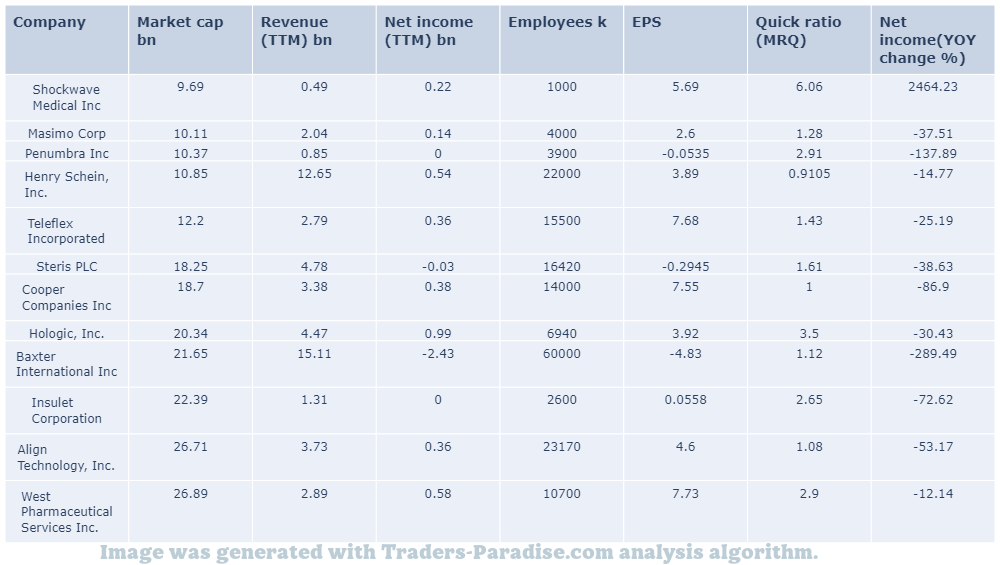

PEERS AND FUNDAMENTALS

#2 Trading idea on ECL

Company Name: Ecolab Inc.

Symbol: ECL

Sector: Consumer Goods

Company Description: Ecolab is an American corporation that develops and offers services, technology and systems that specialize in water treatment, purification, cleaning and hygiene in a wide variety of applications. It helps organizations both private market and public treat their water, not only for drinking directly, but also for use in food, healthcare, hospitality related safety and industry.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ECL — 7 analysts have a positive view on the stock.

7 analysts have an average price target of $169.86 for Ecolab (NYSE:ECL). The current share price is $163.27. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the upside potential.

- News story for ECL — Investors continue to be optimistic about Ecolab

Investors are optimistic about Ecolab (ECLc) owing to its strong business. ECL has 3 reasons to keep the stock in your portfolio. ELCL has a good chance to grow due to its good business prospects.

TECHNICAL ANALYSIS

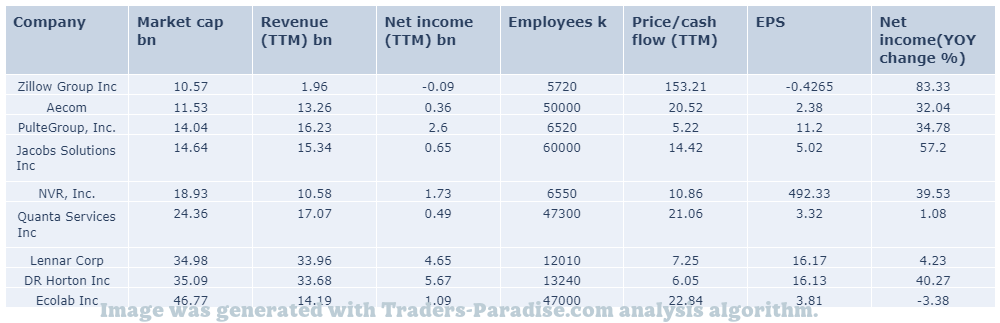

PEERS AND FUNDAMENTALS

#3 Trading idea on SUI

Company Name: Sun Communities Inc.

Symbol: SUI

Sector: Financial

Company Description: There are no photos of the event. None of the participants took part in it. None of them were involved in any of the events that took place. None were present at the event itself. None took part. None was present in the event that happened.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SUI — 4 analysts have rated the stock recently.

Sun Communities (NYSE:SUI) has observed the following analyst ratings in the last quarter: Bullish, Somewhat Bullish and Bearish. The company has an average price target of $160.5 with a high of $168.00 and a low of $151.00.

- News story for SUI — Shares of real estate investment trust (Reit) have slumped in recent months.

In recent months, REITs have sold off heavily, which has led to some historic buying opportunities. Click here to see our two top REIT picks: Buy The Dip and Buy The Dip. . Â

TECHNICAL ANALYSIS

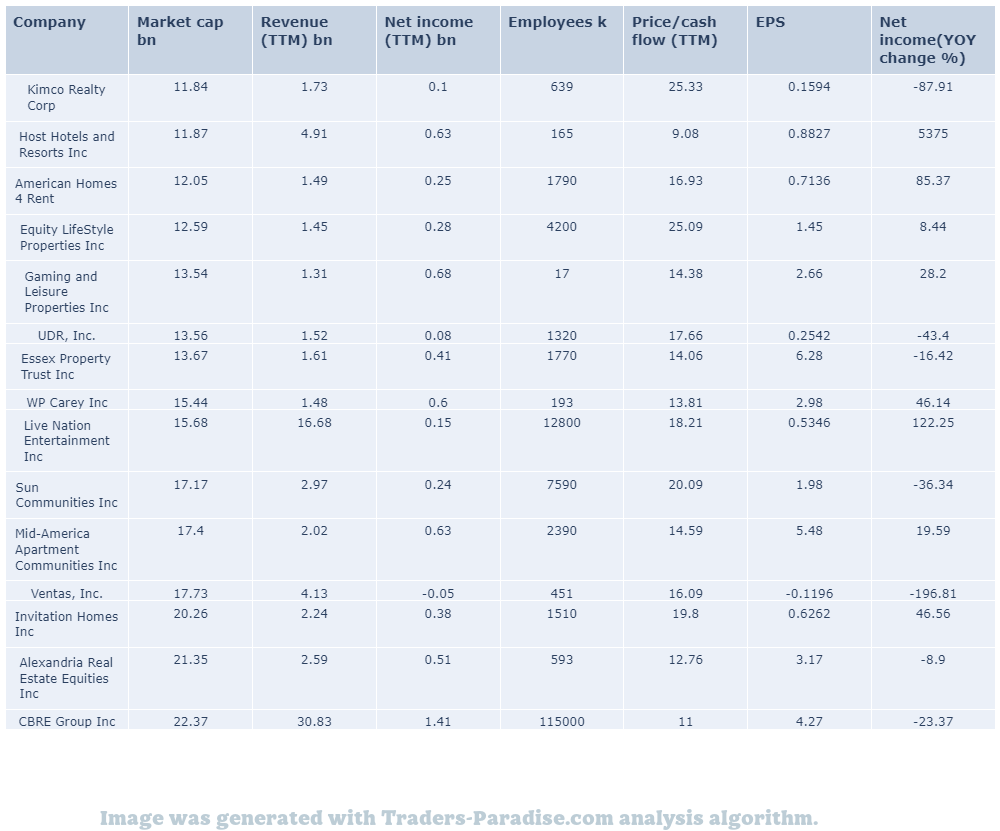

PEERS AND FUNDAMENTALS

#4 Trading idea on KO

Company Name: Coca-Cola Co

Symbol: KO

Sector: Industrial Goods

Company Description: The Coca-Cola Company is an American multinational beverage corporation incorporated under Delaware’s General Corporation Law and headquartered in Atlanta, Georgia. It has interests in the manufacturing, retailing, and marketing of nonalcoholic beverage concentrates and syrups, and in the production of sodas.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

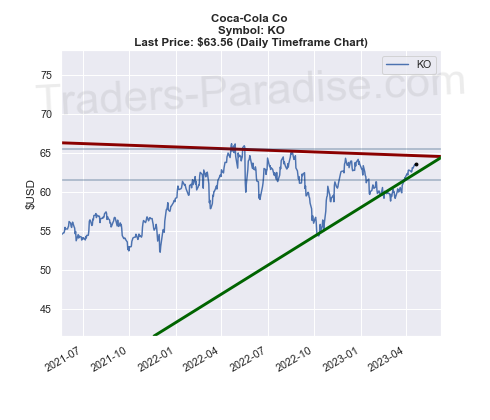

- News story for KO — Coca-Cola Outpaces Stock Market Gains, What You Should Know

Coca-Cola (KO) closed at $63.56 in the latest trading session, marking a +0.16% move from the prior day. Coca-Cola outpaced stock market gains by 0.16%. .

- News story for KO — Analysts expect PepsiCo to report better-than-expected earnings.

PepsiCo’s earnings are expected to grow next week. The company doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations ahead of the next week’s earnings release.

- News story for KO — Traits of Legendary Investors can increase your chances of success in the market.

Traders can increase their chances of success in the stock market by cultivating the traits of legendary investors, as explained by the 5 Traits of Legendary Investors below. . “Cultivating these traits can increase traders’ chances to succeed in stock market.”

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

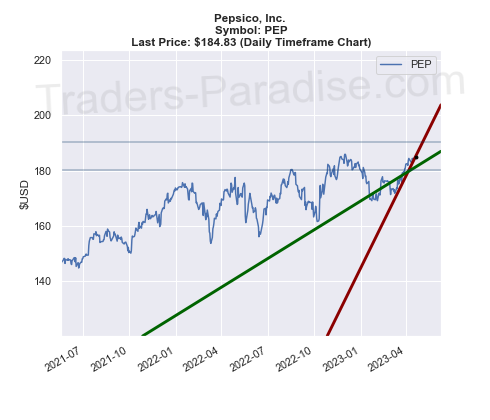

#5 Trading idea on PEP

Company Name: Pepsico, Inc.

Symbol: PEP

Sector: Consumer Goods

Company Description: PepsiCo, Inc. is an American based multinational food, snack, and beverage corporation headquartered in Harrison, New York, in the hamlet of Purchase. It oversees the manufacturing, distribution, and marketing of its products. Its business encompasses all aspects of the food and beverage market.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PEP — Analysts expect PepsiCo to report better-than-expected earnings.

PepsiCo’s earnings are expected to grow next week. The company doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations ahead of the next week’s earnings release.

- News story for PEP — Shares of PepsiCo closed at $184.45 in recent trading session

the previous day. PepsiCo (PEP) closed at $184.45, marking a +0.51% move from the previous trading session. PEP is up 0.51%. PEP’s share price is up by 0.50%.

- News story for PEP — Raymond Raymond Raymond Raymond James boosted the price target for DexCom, Deckers Outdoor, Fortinet, Fortinet.

Raymond James upgraded DexCom’s stock from Outperform to Strong Buy. Stifel increased the price target for Deckers Outdoor Corporation from $485 to $550. Mizuho raised the target for Fortinet from $68 to $74. Citigroup boosted the target of Visa Inc. (NYSE: V).

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

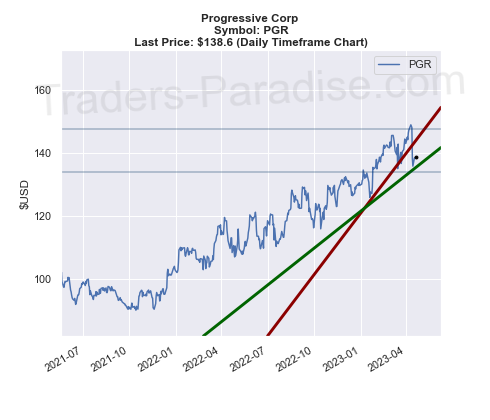

#6 Trading idea on PGR

Company Name: Progressive Corp

Symbol: PGR

Sector: Financial

Company Description: The Progressive Corporation is one of the largest providers of car insurance in the United States. The company insures motorcycles, boats, RVs, and commercial vehicles. It also provides home insurance through select companies. For more information, visit Progressive Corporation’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PGR — Berkshire Hathaway, The Progressive, Everest Re Group, Kinsale Capital Group.

Berkshire Hathaway, Chubb, The Progressive, Everest Re Group, and Kinsale Capital Group are part of the Zacks Industry Outlook article. Zacks industry outlook highlights Berkshire Hathaway Chubber, The Prosecco, and Everest Re. Group.

- News story for PGR — U.S. Insurance ETF (IAK) is a good place to start investing.

The iShares U.S. Insurance ETF (IAK) is a sector exchange traded fund (ETF) that tracks the insurance sector. IAK has a market value of $1.5 billion. iAK is a market performant.

- News story for PGR — Frequent catastrophes accelerating policy renewal rate and the resultant upward pricing pressure.

Frequent catastrophes are likely to boost the performance of Zacks Property and Casualty Insurance industry players. BRK.B, CB, PGR, RE and KNSL are among the companies that will gain from better pricing. .

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

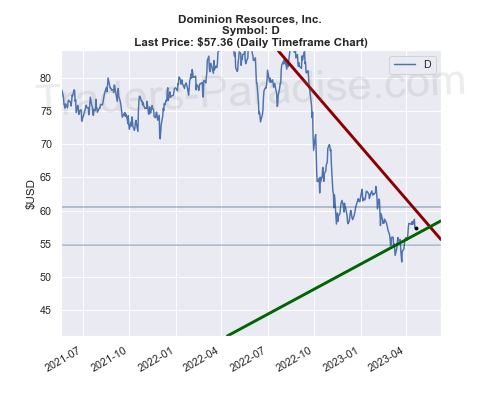

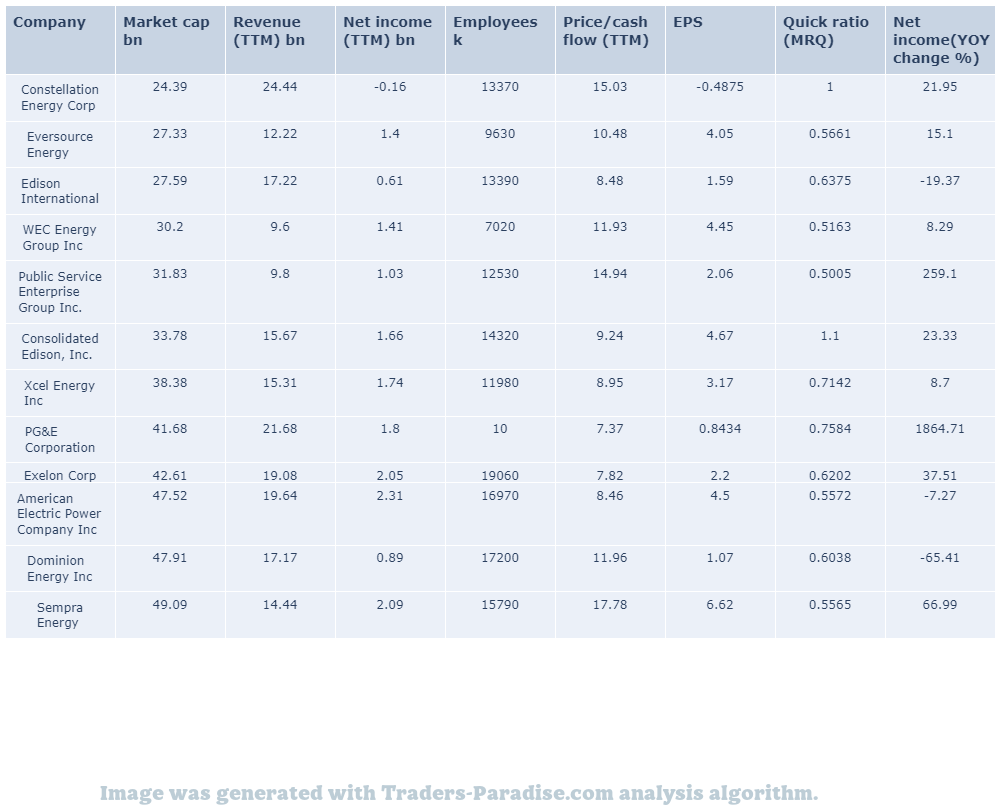

#7 Trading idea on D

Company Name: Dominion Resources, Inc.

Symbol: D

Sector: Utilities

Company Description: Dominion Energy supplies electricity in Virginia, North Carolina, and South Carolina and natural gas to parts of Utah, West Virginia, Ohio, Pennsylvania and North Carolina. Dominion also has generation facilities in Indiana, Illinois, Connecticut and Rhode Island. Dominion Energy is headquartered in Richmond, Virginia.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for D — 14 analysts have a positive view on the stock.

14 analysts have an average price target of $63.07 for Dominion Energy. The current price of Dominion Energy is $57.905. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the upside potential of the stock.

- News story for D — Memorandum of Understanding signed to develop green energy projects.

AVANGRID and NTUA sign a Memorandum of understanding to develop green energy projects in the Navajo Tribal Utility Authority (NTUA) territory. NTUA is a government agency of the Navajo tribe. AVANGRid (AGR) is a subsidiary of the AGR.

- News story for D — Approval for two dozen new solar and energy storage projects.

Dominion Energy (D) gets approval for two dozen new solar and energy storage projects in Virginia. Dominion Energy gets approval to produce 800 MW of clean energy from solar and storage projects. for the Virginia State Corporation Commission for the projects. For more information, visit Dominion Energy’s website.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

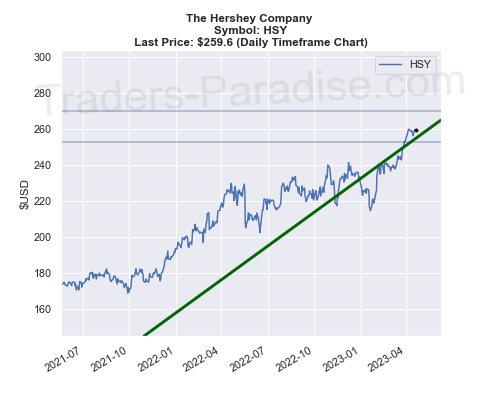

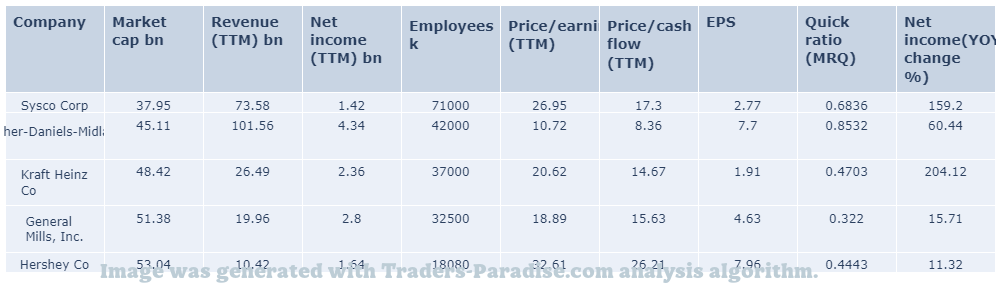

#8 Trading idea on HSY

Company Name: The Hershey Company

Symbol: HSY

Sector: Consumer Goods

Company Description: Hershey’s is one of the largest chocolate manufacturers in the world. It also manufactures baked products, such as cookies and cakes, and sells beverages like milkshakes. Its headquarters are in Hershey, Pennsylvania, and the company is based in the United States.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HSY — Hershey (HSY) Outpaces Stock Market Gains, What You Should Know

Hershey (HSY) closed at $259.60 in the latest trading session, marking a +0.22% move from the prior day. The stock market is up 0.22%. The Hershey’s stock market gain outpaced the stock market gains.

- News story for HSY — The move will help the company sustain its robust growth.

Hershey’s will acquire two production facilities from Weaver Popcorn Manufacturing. The move will help the company sustain its robust growth in the SkinnyPop brand and expand its supply chain. – Hershey’s (HSY) Latest Acquisition to Expand Supply Chain.

- News story for HSY — Beat the Market the Way: Hershey’s, Telesis Bio, General Mills in Focus.

Zacks’ time-tested methodologies served investors well in navigating the market last week. Check out some of our achievements from the past three months here. For more information, visit Zacks.com/Investor-Conversation or follow them on Twitter.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

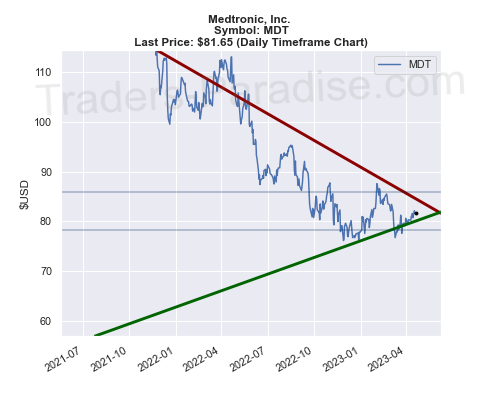

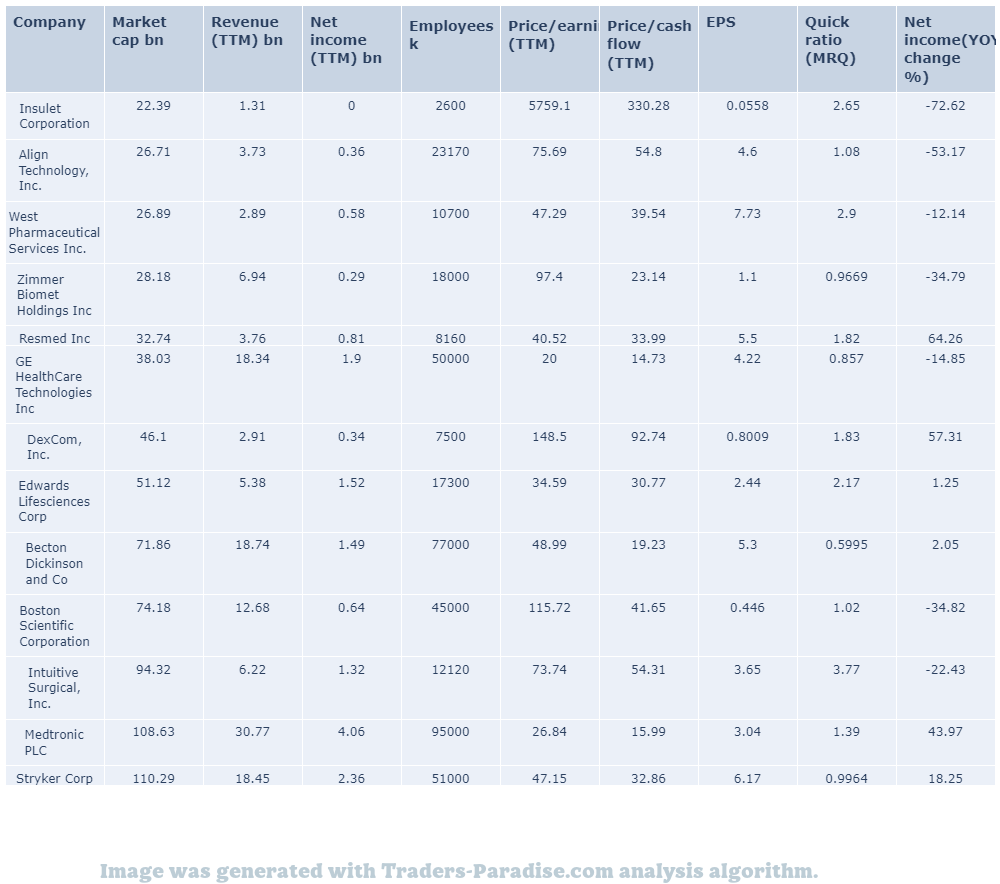

#9 Trading idea on MDT

Company Name: Medtronic, Inc.

Symbol: MDT

Sector: Healthcare

Company Description: Medtronic plc is an American-Irish registered medical device company that operates in the United States. Medtronic has an operational and executive headquarters in Fridley, Minnesota in the US and is headquartered in Dublin, Ireland. It has an annual revenue of $20 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MDT — Shares of Medtronic closed at $81.65 in recent trading session

(MDT) closed at $81.65, marking a -0.57% move from the previous day. Medtronic stock is down 0.57%. The market is up 0.5%. . , by the way.

- News story for MDT — Truist Securities has decided to maintain its Hold rating on Medtronic.

Truist Securities has maintained its Hold rating of Medtronic (NYSE:MDT) and lowered its price target from $90.00 to $88.00. The shares are trading up 1.16% over the last 24 hours at $81.64 per share.

- News story for MDT — A look back at some of the key events that drove Medtronic’s share price higher.

In 2013, if you invested $10,000 in Medtronic, you would have today $20,000. Is it a good buy right now? If so, how much would you have today if you had invested that amount in 2013?

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

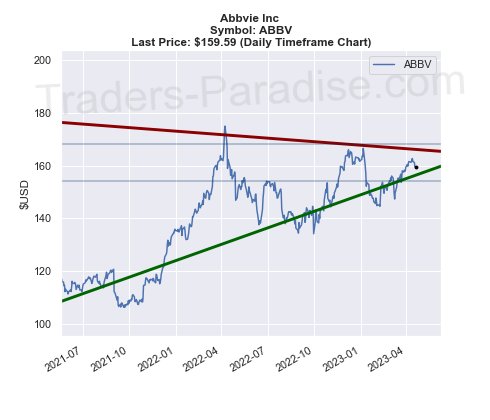

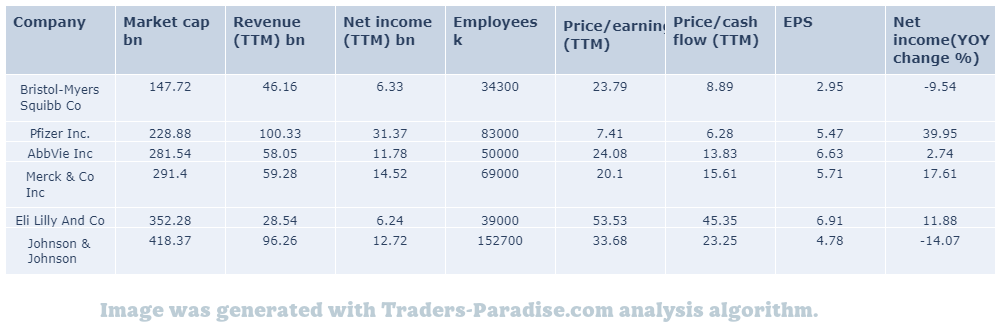

#10 Trading idea on ABBV

Company Name: Abbvie Inc

Symbol: ABBV

Sector: Healthcare

Company Description: AbbVie is an American publicly traded biopharmaceutical company. It originated as a spin-off of Abbott Laboratories. It was founded in 2013. It’s a publicly traded company that was created as a result of a merger between Abbott and Abbvie.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ABBV — Shares of AbbVie closed at $159.59 in Friday trading session

of AbbVie (ABBV) closed at $159.59, marking a -0.99% move from the previous day. Abbvie’s stock price is down 0.99%. AbbBv’s stock is up 0.9%.

- News story for ABBV — Qulipta is first and only oral CGRP receptor antagonist approved to prevent migraines.

FDA Expands AbbVie’s (ABBV) Qulipta Label in Chronic Migraine. Abbvie’s is the first and the only oral CGRP receptor antagonist approved to prevent episodic and chronic migraines.

- News story for ABBV — German drugmaker is diversifying its portfolio. Keytruda is Merck’s top-selling drug

Merck’s acquisition of Prometheus Biosciences will help the drug company diversify and reduce the risk of overreliance on its cancer drug Keytruda. Merck’s takeover of Prometheus gives it a foothold in immunology and will help it diversify its product line.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

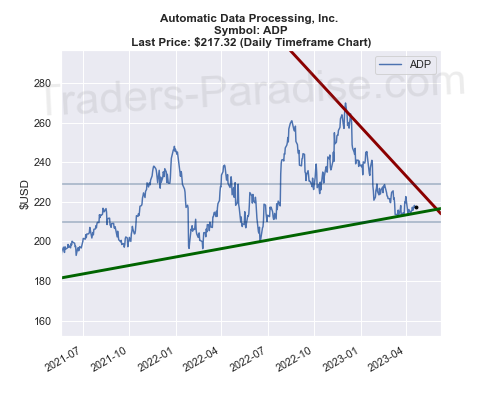

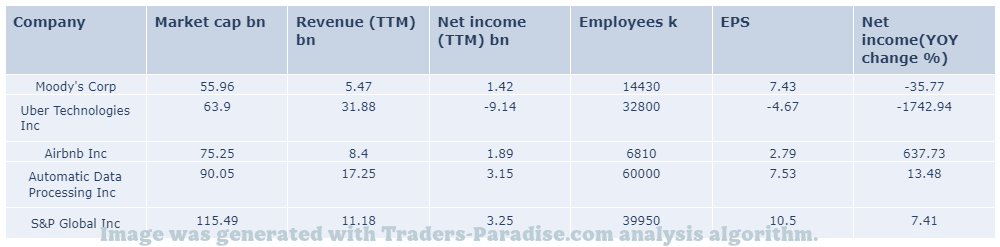

#11 Trading idea on ADP

Company Name: Automatic Data Processing, Inc.

Symbol: ADP

Sector: Technology

Company Description: Automatic Data Processing, Inc. (ADP) is an American provider of human resources management software and services. ADP is a provider of HR management software. It is based in New York City. Its products include ADP HR, HRX, and HRX Professional.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ADP — Shares of NIKE, Toyota, and ConocoPhillips are down in after-hours trading.

Today’s Research Daily features Q1 earnings season update and new research reports on NIKE, Toyota Motor and ConocoPhillips. It also includes the Q1 Earnings Scorecard and Analyst Reports for NIKE and Toyota Motor, and Q1 Results for Conoco Phillips.

- News story for ADP — Airport traffic figures for March, 2023.

April 17th, 2023 Aéroports de Paris SA will release the traffic figures for March 20th, 2017 and April 17th of 2023. Aérosport SA will publish the figures on the press release of April 17, 2017. The traffic figures are based on the March 2017 figures.

- News story for ADP — Airport operator says it will close three of its five terminals

Aéroports de Paris SA will offer a holiday for the month of mars 2023. Aéroporte.com will send an e-mail with details of the holiday to all interested parties. For confidential support call the Samaritans on 08457 909090.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

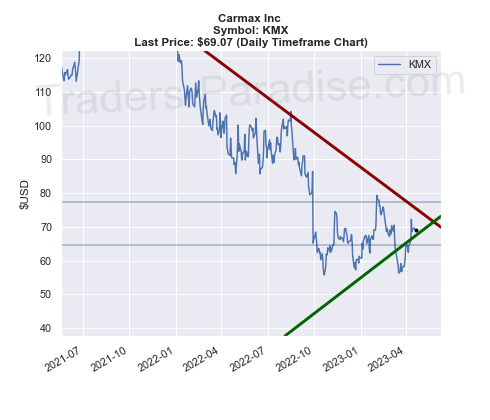

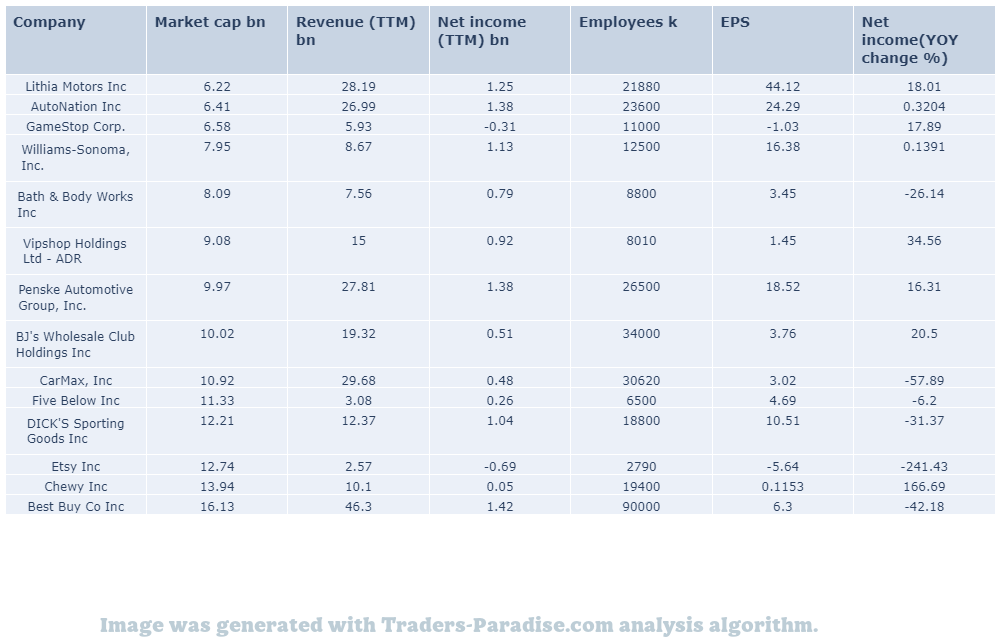

#12 Trading idea on KMX

Company Name: Carmax Inc

Symbol: KMX

Sector: Consumer Discretionary

Company Description: CarMax is a used vehicle retailer based in the United States. It operates two business segments: CarMax Sales Operations and CarMax Auto Finance. It has a fleet of more than 100,000 vehicles in its fleet. It sells vehicles through its own stores and online.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KMX — CarMax, Ford, Blink Charging and XPeng are part of top Analyst Blog.

CarMax, Ford, Blink Charging and XPeng are part of the Zacks top Analyst Blog. Zacks Analyst Blog highlights CarMax and Ford as well as XPeng on the Analyst Blog’s list of high-ranked companies. Â

- News story for KMX — Stocks to avoid this week: What you need to know

3 Stocks to Avoid This Week: These investments seem pretty vulnerable right now and are not worth investing in at the present time. i.e. these stocks are not safe to invest in at this moment in time, and they are not financially viable.

- News story for KMX — CarMax posts mixed fiscal Q4 results. Ford to spend C$1.8 billion on high-volume EV manufacturing hub

CarMax reports mixed fiscal Q4 results. Ford announces plans to spend C$1.8 billion on its Oakville, ON, manufacturing site to transform it into a high-volume EV manufacturing hub. KMX’s Quarterly Show is held.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

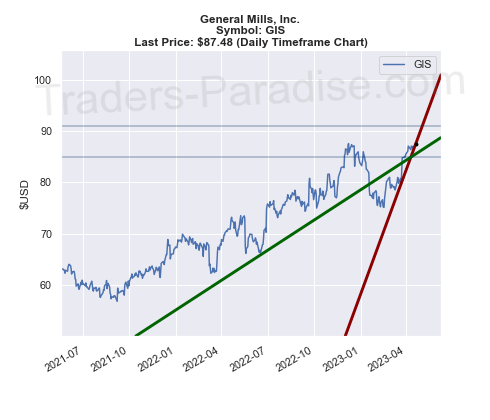

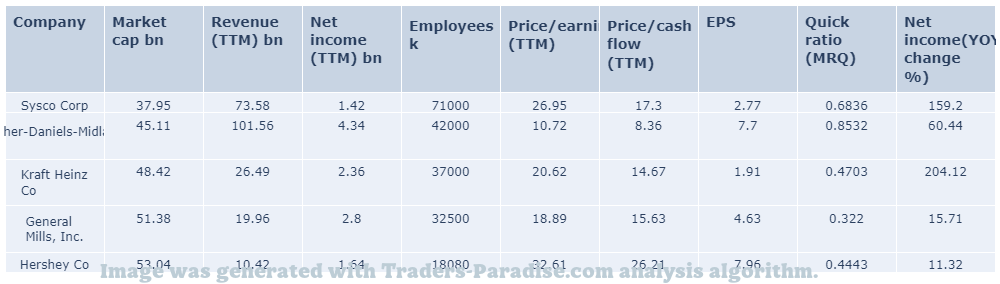

#13 Trading idea on GIS

Company Name: General Mills, Inc.

Symbol: GIS

Sector: Consumer Goods

Company Description: General Mills, Inc. is an American multinational manufacturer and marketer of branded consumer foods sold through retail stores. It is headquartered in Golden Valley, Minnesota, a suburb of Minneapolis, and it sells its products in stores there. Â

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GIS — Inters (IPAR) focuses on product launches to boost assortment strength.

Inter Parfums (IPAR) has grown 35% in 3 months due to product launches. The company’s strength in strategic partnerships is driving growth, as well as its focus on product launches to boost its assortment strength. iipar.com reports.

- News story for GIS — The move will help the company sustain its robust growth.

Hershey’s will acquire two production facilities from Weaver Popcorn Manufacturing. The move will help the company sustain its robust growth in the SkinnyPop brand and expand its supply chain. – Hershey’s (HSY) Latest Acquisition to Expand Supply Chain.

- News story for GIS — TreeHouse Foods is benefiting from price action to counter inflation.

TreeHouse Foods (THS) is benefiting from pricing action to counter inflation. The company is also well-positioned based on its focus on enhancing its portfolio, as well as focus on its portfolio expansion. Â .

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#14 Trading idea on TDOC

Company Name: Teladoc Health Inc

Symbol: TDOC

Sector: Healthcare

Company Description: Teladoc Health provides business-to-business virtual health care services in the United States and internationally. The company is headquartered in Purchase, New York and provides services in both the U.S. and abroad. Teladoc is a privately-owned company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TDOC — ARK Invest 13F Royalty Portfolio

Cathie Wood’s ARK Invest 13F Portfolio – Q1 2023 Update is available on her website. It’s tracking Cathie’s arkinvest13f.com portfolio. Cathie has invested in ARKInvest 13F since March 2013.

- News story for TDOC — Stocks in the S&P 500 and Nasdaq closed lower on Monday.

Two mid-cap stocks jumped more than 10% on Tuesday even though markets remained flat. The companies enjoyed some positive trends. Â in spite of the market’s flatness, the stocks’ shares rose more than ten per cent.

- News story for TDOC — telehealth leader is expanding its weight management offerings.

stock rocketed higher Tuesday morning. Teladoc is expanding its weight management and pre-diabetes offerings, as well as its telehealth service. Â y i a to e

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

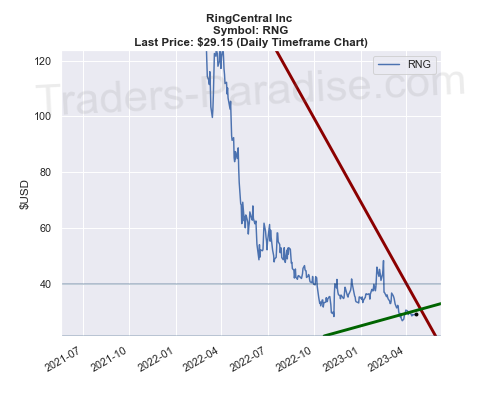

#15 Trading idea on RNG

Company Name: RingCentral Inc

Symbol: RNG

Sector: Technology

Company Description: RingCentral, Inc. offers software-as-a-service solutions that enable businesses to communicate, collaborate and connect in North America. The company is headquartered in Belmont, California and offers its services in English and in Spanish. for more information, visit ringcentral.com.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for RNG — RNG has posted better-than-expected results in three of the last four quarters.

RingCentral (RNGR) has an impressive earnings surprise history. RingCentral’s next quarterly report is expected to beat estimates again. RNGR currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly earnings report.

- News story for RNG — Surge in AI hiring is a ‘beacon of light’ for tech world.

AI has been a ‘beacon of light for the tech world’ after months of layoffs, high interest rates and the collapse of Silicon Valley Bank, says one tech exec. Startups are hiring for the next big thing and AI is a good fit.

- News story for RNG — Here’s Why (RNG) is a Strong Growth Stock

RingCentral (RNG) is a Strong Growth Stock. Find strong stocks with the Zacks Style Scores, a top feature of Zacks Premium research service. For more information, go to: www.zacks.com/sportscores/zacks-style-scores.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

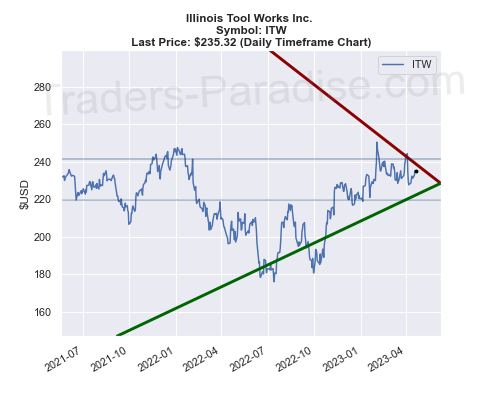

#16 Trading idea on ITW, might be reaching some kind of top

Company Name: Illinois Tool Works Inc.

Symbol: ITW

Sector: Industrial Goods

Company Description: Illinois Tool Works Inc. is an American company that produces engineered fasteners and components, equipment and consumable systems, and specialty products. ITW was founded in 1881 and is based in Chicago, Illinois. It is one of the world’s largest manufacturers of machine tools.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ITW — Earnings are likely to have benefited from strong Americas performance.

Allegion’s (ALLE) Q1 earnings are likely to have benefited from the strong performance of the Allegion Americas segment, partly offset by labor, material and freight-related cost inflation. Allegion is set to report Q1 Earnings on April 25th.

- News story for ITW — First-quarter earnings are likely to reflect gains from growing product demand.

O-I Glass is expected to report first-quarter results that will reflect gains from the growing product demand. OI Glass will report its results on April 25th. Â OI’s shares are down 2.5% since the start of the year.

- News story for ITW — Packaging Corp is set to report first-quarter earnings.

PPG’s first-quarter 2022 results are likely to reflect the impacts of a decline in demand. PPG Corp’s Q1 2022 results. PGG’s Q2 2022 results will reflect the decline in the demand. PKG’s Q3 2022 results, as well.

TECHNICAL ANALYSIS

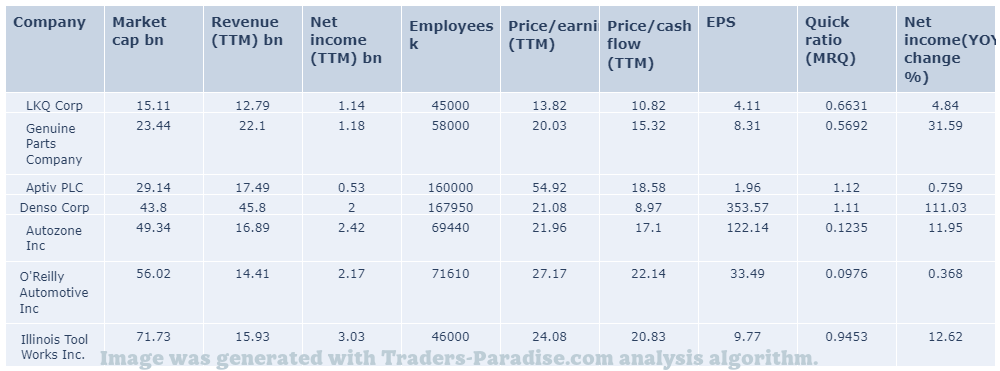

PEERS AND FUNDAMENTALS

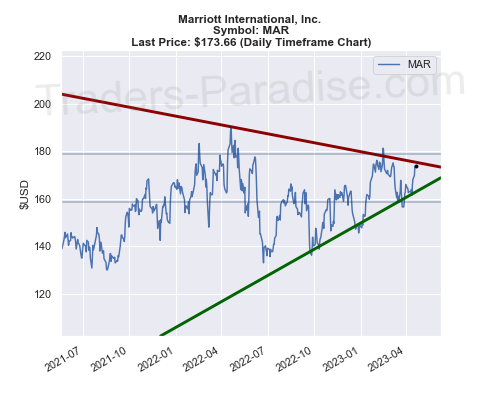

#17 Trading idea on MAR, might be reaching some kind of top

Company Name: Marriott International, Inc.

Symbol: MAR

Sector: Services

Company Description: Marriott International, Inc. is an American multinational company that operates, franchises, and licenses lodging including hotel, residential, and timeshare properties. It is headquartered in Bethesda, Maryland and has a turnover of $20 billion. It operates hotels, residential and timeshares.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MAR — Global supply-chain challenges and rising inflation are expected to weigh on results.

Whirlpool’s (WHR) Q4 results are expected to reflect the continued impacts of global supply-chain challenges and rising inflation. Whirlpool will report its Q1 results on April 30th. Â i

- News story for MAR — Snap-on is expected to report better-than-expected earnings.

Snap-on (SNA) is preparing for Q1 earnings. Business momentum, the Value Creation plan, the Rapid Continuous Improvement process and other cost-reduction initiatives are expected to have aided Snap-on in Q1. SNA will report Q1 results on April 25th.

- News story for MAR — Stocks with strong Earnings ESP are more likely to beat estimates.

Zacks Earnings ESP gives investors a better idea of which stocks are likely to beat quarterly earnings estimates. Zacks has a special tool that helps investors find stocks with positive earnings surprises. It’s called the Zacks EPS tool and it’s used to help investors find Consumer Discretionary Stocks.

TECHNICAL ANALYSIS

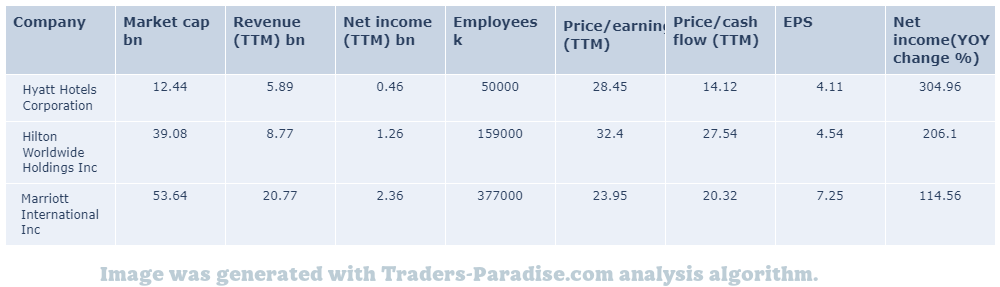

PEERS AND FUNDAMENTALS

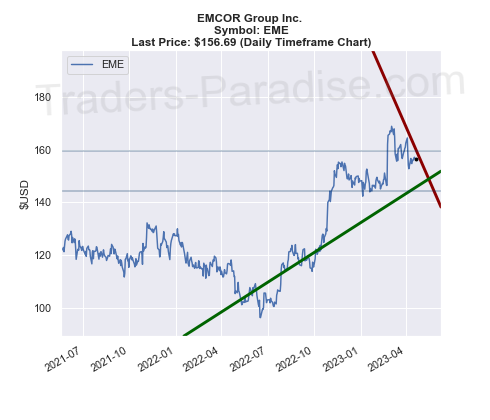

#18 Trading idea on EME, might be reaching some kind of top

Company Name: EMCOR Group Inc.

Symbol: EME

Sector: Industrial Goods

Company Description: EMCOR Group, Inc. provides electrical and mechanical installation and construction services in the United States. The company is headquartered in Norwalk, Connecticut and has a turnover of $1.5 billion. It has a workforce of about 2,000 people.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for EME — Rising mortgage rates, macroeconomic uncertainties likely to weigh on results.

D.R. Horton’s (DHI) fiscal second-quarter performance is likely to have suffered from rising mortgage rates and macroeconomic uncertainties. The company’s earnings release is scheduled for Wednesday, July 25th at 10:30 AM ET.

- News story for EME — EMCOR Group, MasTec, Dycom and Granite Construction are part of the Industry Outlook article.

EMCOR Group, MasTec, Dycom Industries and Granite Construction are part of the Zacks Industry Outlook article. Zacks industry outlook highlights include EMCOR Group and MasTEC. for this article. For more information, visit Zacks.com/industry-outlook.

- News story for EME — The air conditioning and heating company has been on an acquisition spree in recent years.

Watsco’s Q1 performance is likely to reflect in its Q1 results. Technology innovation, acquisitions and operating efficiencies are likely to be reflected in the company’s results. Watsco is expected to report earnings after the close of business on April 30th.

TECHNICAL ANALYSIS

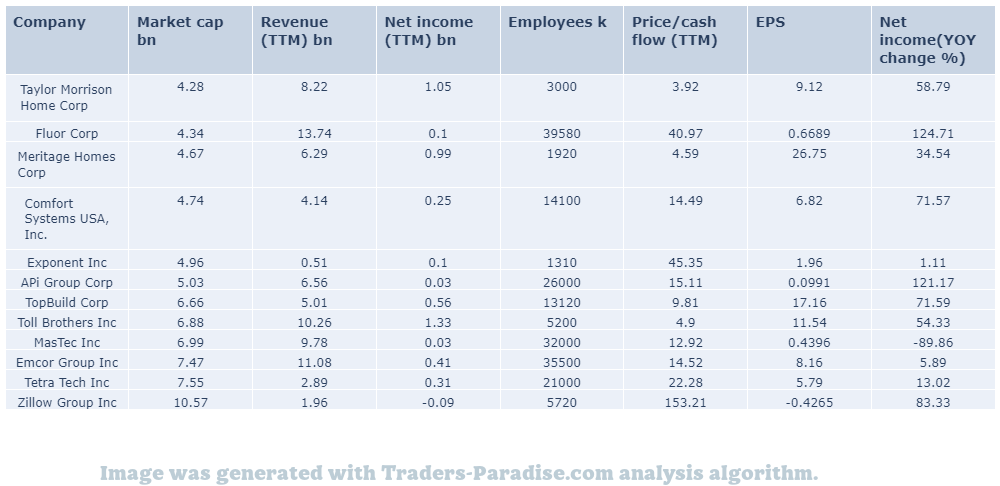

PEERS AND FUNDAMENTALS

#19 Trading idea on DE, might be reaching some kind of top

Company Name: Deere & Company

Symbol: DE

Sector: Industrial Goods

Company Description: John Deere is the brand name of Deere & Company, an American corporation that manufactures agricultural, construction, and forestry machinery, diesel engines, drivetrains used in heavy equipment and lawn care equipment, and diesel engines used in agricultural and construction machinery.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for DE — Deere (DE) Outpaces Stock Market Gains, What You Know

of Deere (DE) closed at $396.69, marking a +1.35% move from the previous day. Deere stock market gains (DE). Deere shares (DE): What you should know about Deere share market gains.

- News story for DE — All images are copyrighted.

Deere, Arcos Dorados and Sea Deere are featured in the Zacks Screen of the Week article. Zacks.com featured highlights include Deere, Dorados, Sea and Deere. . “Deere” and “Dorados” are featured highlights.

- News story for DE — Top-rated Efficient Stocks to Boost Your Portfolio Returns.

Deere (DE), Arcos Dorados (ARCO) and Sea Limited (SE) are efficient stocks to boost portfolio returns. Deere is one of the world’s top-rated efficient stocks. Arcos and Sea are among the best-rated in the world.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

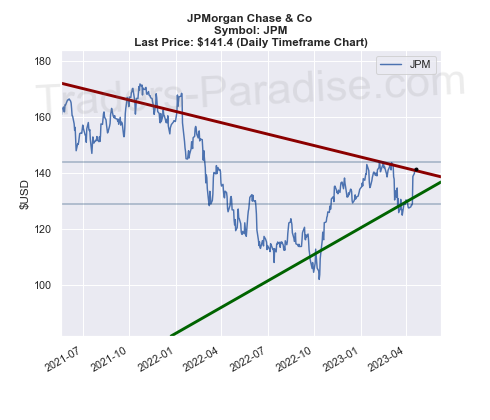

#20 Trading idea on JPM, might be reaching some kind of top

Company Name: JPMorgan Chase & Co

Symbol: JPM

Sector: Financial

Company Description: JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City. It is one of America’s Big Four banks, along with Bank of America, Citigroup, and Wells Fargo. The J.P. Morgan brand is used by the investment banking, asset management, private banking, private wealth management, and treasury services divisions.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for JPM — JPMorgan, Citigroup, Goldman Sachs all reported better-than-expected results.

Big banks have reasons to love higher interest rates, as shown in their Q1 results. Borrowers don’t like higher rates, but big banks and their shareholders love them. . for more information, go to: http://www.businessinsider.com/how-did-the-big-banks-report-their-first-quarter-financial-results-and-what-have-they-learned-from-it.

- News story for JPM — Fed meeting, earnings season, and jobless claims due by end of the week.

The Fed meeting, earnings season, and jobless claims are all due by the end of the week. Stocks are trading in an extremely tight range, which is a sign they may be ready to explode in one direction or another. The current market volatility is due to this.

- News story for JPM — ‘Loss of confidence’ can lead to short-term liquidity crisis, Lord Mayor says.

U.S. banking turmoil offers fresh lessons for the U.K., says Lord Mayor of London Nicholas Lyons. A loss of confidence can lead to a short-term liquidity crisis, he says. in March, he was speaking at London Events.

TECHNICAL ANALYSIS

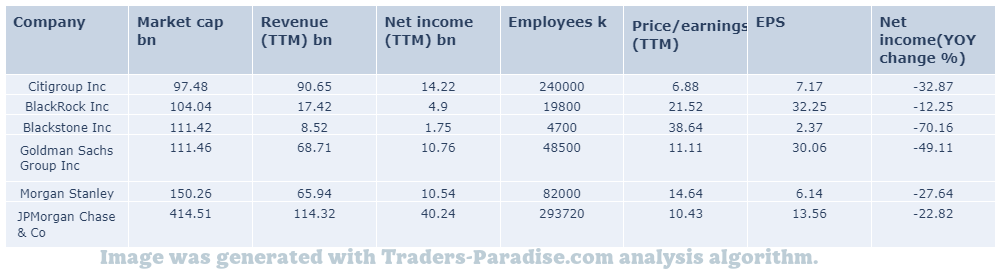

PEERS AND FUNDAMENTALS

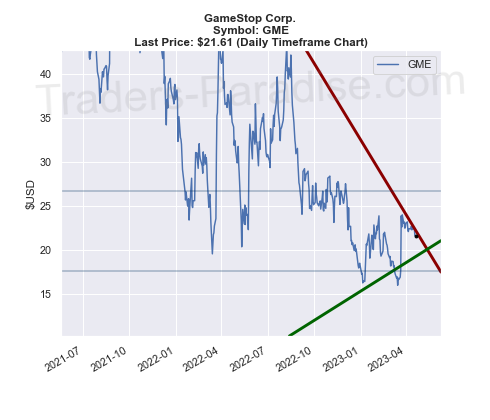

#21 Trading idea on GME, might be reaching some kind of top

Company Name: GameStop Corp.

Symbol: GME

Sector: Services

Company Description: GameStop Corp. is headquartered in Grapevine, Texas, and the company is a subsidiary of GameStop Inc., which is based in New York City. The company is valued at more than $20 billion, according to the company’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GME — Virtu CEO lashes Gensler reforms as Democratic plan to curb retail trading

SEC Chairman Gensler is trying to overhaul the structure of U.S. securities markets. Virtu CEO slams the Democratic plan to curb retail trading as a way to curb it. He’s made a few enemies along the way and has made some new friends.

- News story for GME — Citi sees silver outperforming other precious metals this year.

Citi Citigroup analysts say investors may want to get some exposure to silver now, as it’s poised to see a big benefit from dollar weakness they say isn’t over. If King Dollar is wobbling, silver is your best investment, they say.

- News story for GME — Shares of the health insurer are down more than 20% this year.

In investing there are pros and cons to any question. Conn’s (CONN) is the bear of the day for today’s discussion. It’s a good idea to consider the pros and conns to any investing question. It is a useful tool for investors.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#22 Trading idea on STT, might be reaching some kind of top

Company Name: State Street Corp

Symbol: STT

Sector: Financial

Company Description: State Street Corporation is an American financial services and bank holding company headquartered at One Lincoln Street in Boston with operations worldwide. State Street Corporation has a presence in the following countries: Canada, the U.S., Australia, and New Zealand. It is a holding company of State Street Bank.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for STT — Keefe, Bruyette & Woods cuts price target on shares of State Street.

Shares of State Street Corp (NYSE: STT) crashed on Monday after the company reported lower-than-expected revenues and earnings for its first quarter. Analyst Michael Brown maintained an Outperform rating, but reduced the price target from $84 to $90.

- News story for STT — State Street reports worse-than-expected Q1 results.

State Street Corporation (NYSE: STT) reported worse-than-expected Q1 results. Revenues of $3.10 billion were up 1% Y/Y, but earnings of $1.52 missed the consensus estimate by $0.64.

- News story for STT — Tesla, Netflix, Bank of America, Goldman Sachs all set to report earnings this week.

S&P 500 closed higher on Monday ahead of a heavy week of earnings results from major companies. Big banks, including Goldman Sachs Group Inc, Bank of America Corp and Morgan Stanley are all set to release earnings this week. Tesla Inc (NASDAQ: TSLA) and Netflix Inc will also report earnings.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.

Leave a Reply