How to read this report

Every report will start with a short “Market News” section. In this section, we scraped the latest financial news regarding the financial markets. This is a more macro vision of the market. Interest rates, unemployment reports, inflation, oil and energy, earning season, etc.

After the news report section we head to the trading idea section. Every idea is divided into 4 important parts:

-

-

-

- The company and its sector and description

- Recent news about the company

- Chart and its boundary lines

- A table with the company peers and competitors, including their financial and fundamentals.

-

-

A new report will be generated on a daily basis.

Does it work?

In short, yes.

you can read here how we use these methods for our real life trades.

Short declaimer

This report, including all content, is made for educational purposes only. Use on your own risk!

Most recent news about the financial markets

- Earnings Recession, Deflation, Liquidity Crunch likely to weigh on markets for months.

There’s a recession on the way for the S&P 500, according to some analysts. It’s likely to be worse than the current economic slowdown. It will be deflationary, deflationary and likely to cause a liquidity crunch. – The Economist

- Ryan Detrick compiled a list of 10 reasons the S&P 500 could keep climbing.

The SPDR S&P 500 ETF Trust (NYSE: SPY) is up 7.9% year-to-date. Carson Group’s Ryan Detrick compiled a list of 10 reasons why the stock market could keep grinding higher in 2023. When the S&p 500 is higher in January, it has historically finished the year higher 86% of the time.

- Hated Stocks, These 4 Worth Considering?

There are 100 hated stocks on Amazon, but only 4 are worth considering. For confidential support call the Samaritans on 08457 909090 or visit a local Samaritans branch, see www.samaritans.org for details. For confidential help, call the National Suicide Prevention Lifeline on 1-800-273-8255.

- Report on Invesco S&P 100 Equal Weight ETF.

Is Invesco S&P 100 Equal Weight ETF (EQWL) a strong ETF right now? Smart Beta ETF report for EQWL is available now. It’s based on the Invevco S/P 100 Equity Weight Exchange-Traded Fund.

- No One Can Tell When; Meanwhile, We Rally.

There’s a recession, but nobody knows when it will happen. Meanwhile, people are still trying to get back on their feet. – CNN.com/somniacommentarathon.com. For more information, go to: http://www.cnn.com/.

- Earnings season has started and so far, banks have delivered better-than-feared results.

The earnings season has started and so far the banks have delivered better-than-feared results. If the banking crisis is over, rates will go much higher, according to some analysts. Click here to read more about it. .

- ETF designed to protect against inflation is attracting inflows.

There are signs of moderating U.S. inflation, but some investors worry that price pressures will stay high. This exchange traded fund designed to protect against inflation is attracting inflows. Â in the U.K.

- 33 stocks in Russell 1000 have rallied more than 1,000%.

Bespoke Investment Group runs down the stocks in the Russell 1000 that have risen more than 1,000% in the last decade. Check out the 33 stocks that have rallied more than 1000% in last 10 years and the ’10 baggers’ here.

- Fear of missing out is driving investors to seek safety.

Market headwinds are still strong despite Thursday’s rally. Stocks typically fall after the VIX hits the ‘overbought’ level it’s at now, writes Lawrence McMillan, and stocks usually fall after it’s overbought.

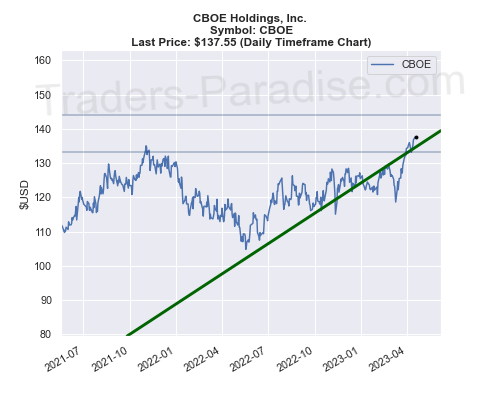

#1 Trading idea on CBOE

Company Name: CBOE Holdings, Inc.

Symbol: CBOE

Sector: Financial

Company Description: Cboe Global Markets owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets. Cboe is based in New York and is owned by American company CBOE Global Markets, which also owns the Bats Global Markets stock exchange.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CBOE — Elevated market volatility supports more defensive exchanges, Morgan Stanley says.

Michael Cyprys downgraded the rating for Nasdaq Inc. from Overweight to Equal Weight and reduced the price target from $70 to $60. The analyst also upgraded Virtu Financial. Elevated market volatility typically boosts trading volumes and risk management activity, which followed the banking crisis.

- News story for CBOE — CBOE has beaten estimates in each of the last four quarters.

CBOE has an impressive earnings surprise history. CBOE has the right combination of the two key ingredients for a likely beat in its next quarterly report, which is expected to be released in the next few days. CBOe has a history of beating estimates.

- News story for CBOE — Cboe Global rallies on strong market position, global reach, higher logical port fees.

Cboe Global (CBOE) stock is up 16.5% in a year. Cboe has strong market position, global reach, higher logical port fees and physical port fees, favorable growth estimates and solid capital position. CBOE’s stock rallies on the back of strong market positions and global reach.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

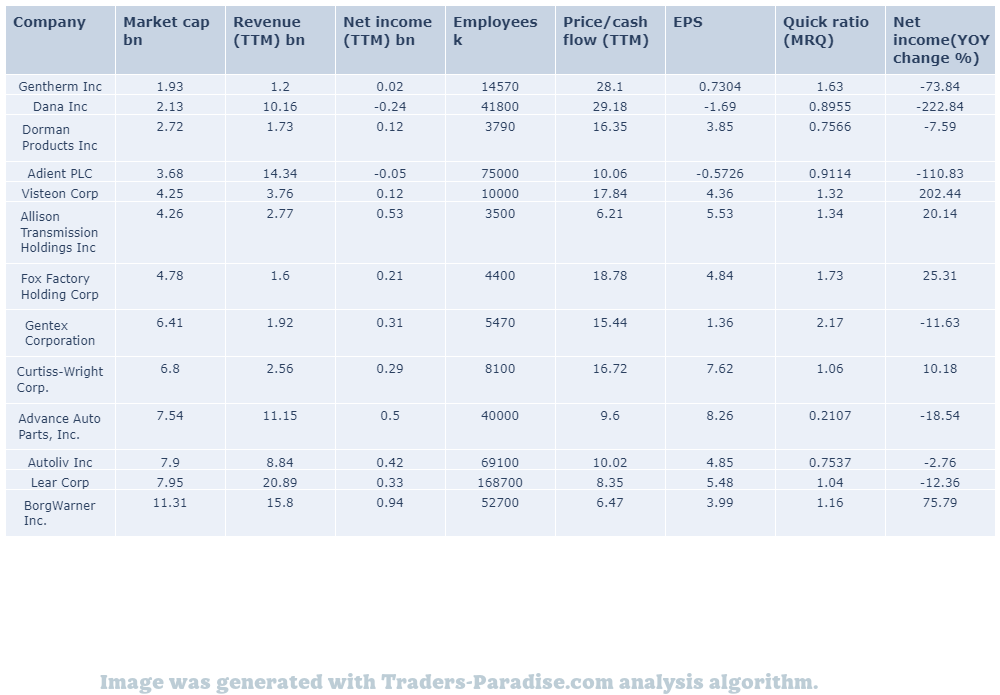

#2 Trading idea on AAP

Company Name: Advance Auto Parts Inc.

Symbol: AAP

Sector: Services

Company Description: Advance Auto Parts, Inc. is an American automotive aftermarket parts provider based in Raleigh, North Carolina. It serves both professional installer and do-it-yourself (DIY) customers. It is a provider of both professional and DIY parts.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for AAP — Some of the best-known names in the world of finance are on this list.

This article is part of our monthly series where we highlight five companies that are large-cap, relatively safe and dividend-paying. Read more here: 5 Relatively Safe And Cheap Dividend Stocks To Invest In – April 2023.

- News story for AAP — Shares ofAAP have

Advance Auto Parts (AAP) closed at $120.21 in the latest trading session, marking a -0.93% move from the prior day. Broader Markets (BME) closed the day at $1,068.21.

TECHNICAL ANALYSIS

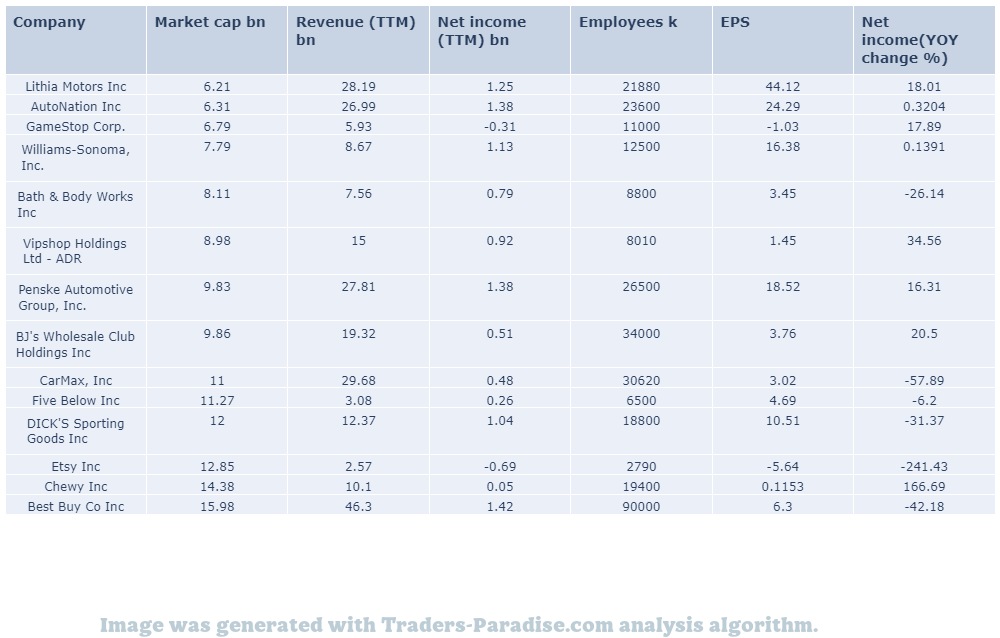

PEERS AND FUNDAMENTALS

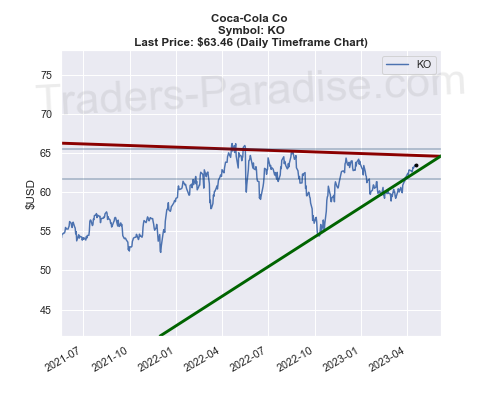

#3 Trading idea on KO

Company Name: Coca-Cola Co

Symbol: KO

Sector: Industrial Goods

Company Description: The Coca-Cola Company is an American multinational beverage corporation incorporated under Delaware’s General Corporation Law and headquartered in Atlanta, Georgia. It has interests in the manufacturing, retailing, and marketing of nonalcoholic beverage concentrates and syrups, and in the production of sodas.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KO — Analysts expect Coca-Cola to report better-than-expected earnings.

Coca-Cola’s earnings are expected to grow next week. Coca-Cola doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations ahead of Coke’s next week’s release.

- News story for KO — VYM or SCHD?

dividend are better buy for Retiring With Dividends: VYM or SCHD? For Retiring with Dividend: VyM or SchD? for retirement with dividends. for retiring with dividends? for retirement.

- News story for KO — Michael Saylor has doubled his stake in the cryptocurrency to $150 million.

Michael Saylor buys another $150 million in Bitcoin. The flagship cryptocurrency has nearly doubled in value since January and is now worth $2.5 billion. Michael Saylor Buys Another $150 Million in Bitcoin: Is the Crypto a Screaming Buy?

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

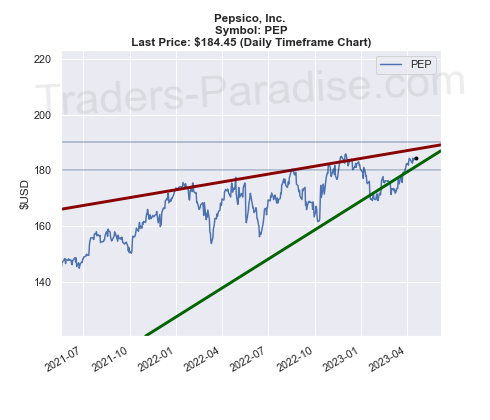

#4 Trading idea on PEP

Company Name: Pepsico, Inc.

Symbol: PEP

Sector: Consumer Goods

Company Description: PepsiCo, Inc. is an American based multinational food, snack, and beverage corporation headquartered in Harrison, New York, in the hamlet of Purchase. It oversees the manufacturing, distribution, and marketing of its products. Its business encompasses all aspects of the food and beverage market.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PEP — Shares of PepsiCo closed at $184.45 in recent trading session

the previous day. PepsiCo (PEP) closed at $184.45, marking a +0.51% move from the previous trading session. PEP is up 0.51%. PEP’s share price is up by 0.50%.

- News story for PEP — Raymond Raymond Raymond Raymond James boosted the price target for DexCom, Deckers Outdoor, Fortinet, Fortinet.

Raymond James upgraded DexCom’s stock from Outperform to Strong Buy. Stifel increased the price target for Deckers Outdoor Corporation from $485 to $550. Mizuho raised the target for Fortinet from $68 to $74. Citigroup boosted the target of Visa Inc. (NYSE: V).

- News story for PEP — Is It Safe to Invest in the Nasdaq Right Now?

The Nasdaq 100 is recovering after a brutal 2022. The Nasdaq is up 19% in 2023 and it’s safe to invest in the Nasdaq right now, according to Mr. Cevallos. He recommends buying shares of Nasdaq at current prices.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

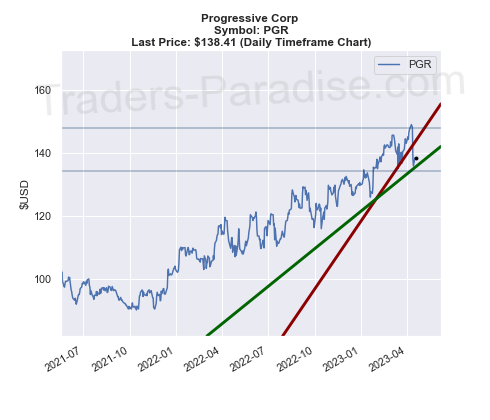

#5 Trading idea on PGR

Company Name: Progressive Corp

Symbol: PGR

Sector: Financial

Company Description: The Progressive Corporation is one of the largest providers of car insurance in the United States. The company insures motorcycles, boats, RVs, and commercial vehicles. It also provides home insurance through select companies. For more information, visit Progressive Corporation’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PGR — U.S. Insurance ETF (IAK) is a good place to start investing.

The iShares U.S. Insurance ETF (IAK) is a sector exchange traded fund (ETF) that tracks the insurance sector. IAK has a market value of $1.5 billion. iAK is a market performant.

- News story for PGR — Frequent catastrophes accelerating policy renewal rate and the resultant upward pricing pressure.

Frequent catastrophes are likely to boost the performance of Zacks Property and Casualty Insurance industry players. BRK.B, CB, PGR, RE and KNSL are among the companies that will gain from better pricing. .

- News story for PGR — Lemonade could be the next big thing in health care.

Lemonade is down 92% from its high. The innovative insurance company could have the most upside in its sector. Lemonade is a screaming buy. Lemonad is an insurance company that has a lot of potential for growth in the future.

TECHNICAL ANALYSIS

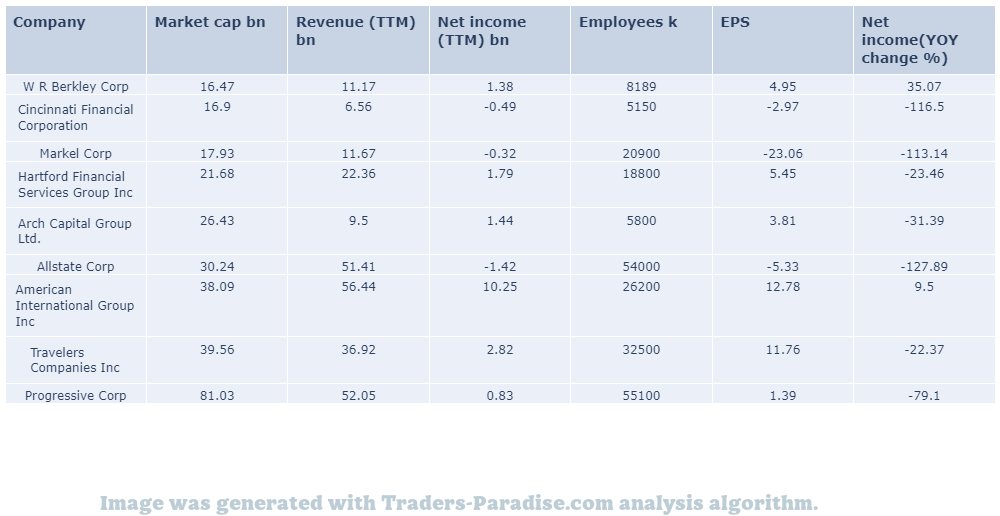

PEERS AND FUNDAMENTALS

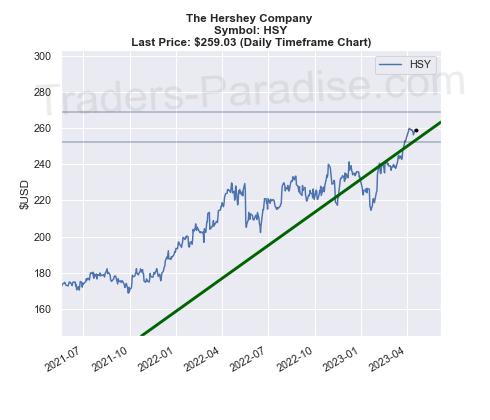

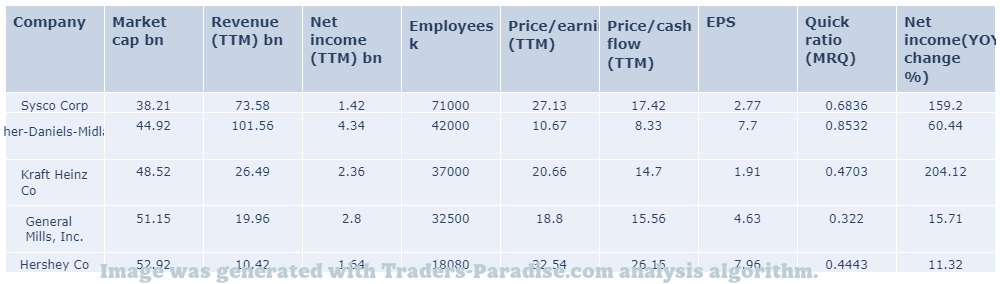

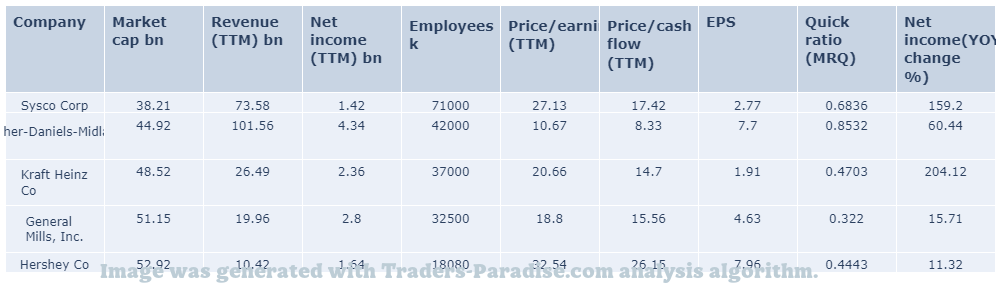

#6 Trading idea on HSY

Company Name: The Hershey Company

Symbol: HSY

Sector: Consumer Goods

Company Description: Hershey’s is one of the largest chocolate manufacturers in the world. It also manufactures baked products, such as cookies and cakes, and sells beverages like milkshakes. Its headquarters are in Hershey, Pennsylvania, and the company is based in the United States.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HSY — Beat the Market the Way: Hershey’s, Telesis Bio, General Mills in Focus.

Zacks’ time-tested methodologies served investors well in navigating the market last week. Check out some of our achievements from the past three months here. For more information, visit Zacks.com/Investor-Conversation or follow them on Twitter.

- News story for HSY — Activists have called for a conservative boycott of the beer.

Even if sales of Bud Light fall in response to conservative calls for a boycott, analysts say the impact is likely to evaporate quickly, as they say there will be no backlash to the conservative boycott. iReport.com: What do you think? Share your thoughts.

- News story for HSY — Acquisitions to bolster portfolio strength, boost revenues.

Hershey’s (HSY) is undertaking buyouts to augment portfolio strength and boost revenues. The company regularly brings innovation to its core brands. Solid Pricing and Portfolio Strength Fuel Hershey’s Growth. – S&P Capital Market Analyst.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

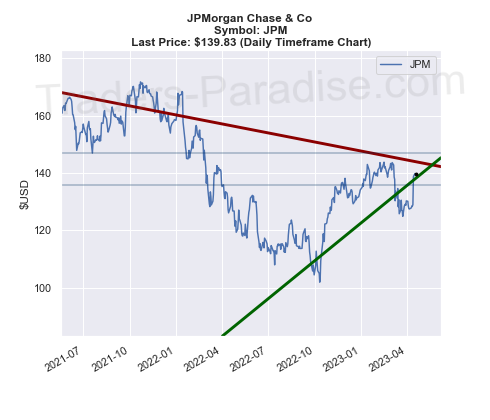

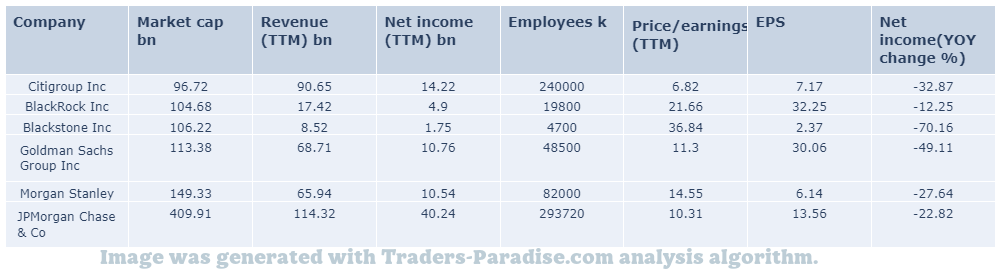

#7 Trading idea on JPM

Company Name: JPMorgan Chase & Co

Symbol: JPM

Sector: Financial

Company Description: JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York City. It is one of America’s Big Four banks, along with Bank of America, Citigroup, and Wells Fargo. The J.P. Morgan brand is used by the investment banking, asset management, private banking, private wealth management, and treasury services divisions.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for JPM — Previewing Bank of America Amid a Wave of Bank Earnings.

Bank of America is one of the companies that will report earnings this quarter. Bank of America will report its results on January 31st. The company is expected to report a profit of $5.2 billion. Â i

- News story for JPM — JPMorgan strategist says recession could cause stocks to plunge.

Even a mild recession could cause stocks to crater by 15% or more, JPMorgan’s Kolanovic says. The JPMorgan Chase & Co. strategist says equity investors should tread carefully and be aware of the risks they are taking on.

- News story for JPM — S&P 500 had its biggest one-month rally since 2009.

The S&P 500 saw the biggest rally in the one-month run-up to an earnings season since 2009. Jefferies notes that the market is now wondering what to do with the rally now that the earnings season is over.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

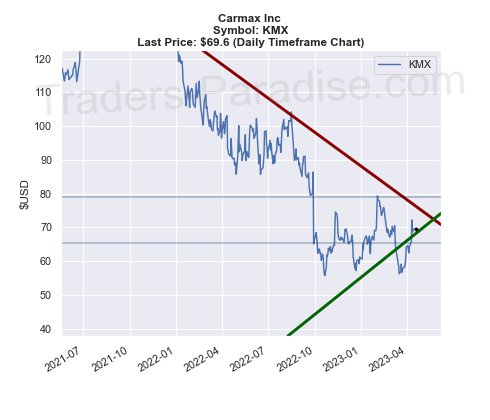

#8 Trading idea on KMX

Company Name: Carmax Inc

Symbol: KMX

Sector: Consumer Discretionary

Company Description: CarMax is a used vehicle retailer based in the United States. It operates two business segments: CarMax Sales Operations and CarMax Auto Finance. It has a fleet of more than 100,000 vehicles in its fleet. It sells vehicles through its own stores and online.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KMX — Stocks to avoid this week: What you need to know

3 Stocks to Avoid This Week: These investments seem pretty vulnerable right now and are not worth investing in at the present time. i.e. these stocks are not safe to invest in at this moment in time, and they are not financially viable.

- News story for KMX — CarMax posts mixed fiscal Q4 results. Ford to spend C$1.8 billion on high-volume EV manufacturing hub

CarMax reports mixed fiscal Q4 results. Ford announces plans to spend C$1.8 billion on its Oakville, ON, manufacturing site to transform it into a high-volume EV manufacturing hub. KMX’s Quarterly Show is held.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

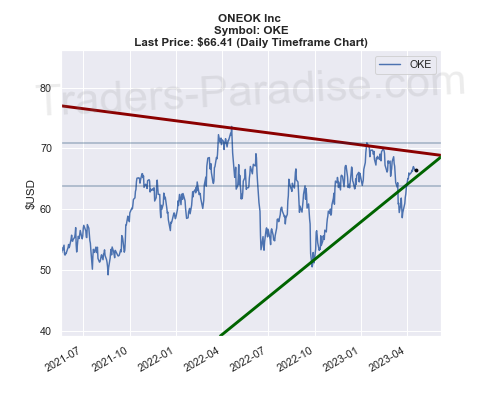

#9 Trading idea on OKE

Company Name: ONEOK Inc

Symbol: OKE

Sector: Energy & Transportation

Company Description: Oneok, Inc. is a diversified Fortune 500 energy corporation based in Tulsa, Oklahoma. Oneok is a Fortune 500 company. It is made up of a number of diversified companies. Oneok is an energy corporation. It’s a company that makes energy products.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for OKE — Shares of Oneok Inc.

of Oneok Inc. (OKE) closed the most recent trading day at $66.41, moving -0.92% from the previous trading session. OKE’s stock price is down 0.92%. OKE shares are up 0.2% from previous day.

- News story for OKE — Shares of Oneok Inc. closed at $66.25 in latest trading session

Oneok Inc. (OKE) closed at $66.25 in the latest trading session, marking a -0.27% move from the prior day. OKE’s stock moved by less than one per cent from the previous day’s closing price.

- News story for OKE — Shares of one of the largest processors of natural gas in the U.S.

ONEOK (OKE) is likely to benefit from high fee-based earnings and midstream assets located in productive regions. ONEOK rides on high fees. OKE is a midstream company with a focus on high-yielding assets.

TECHNICAL ANALYSIS

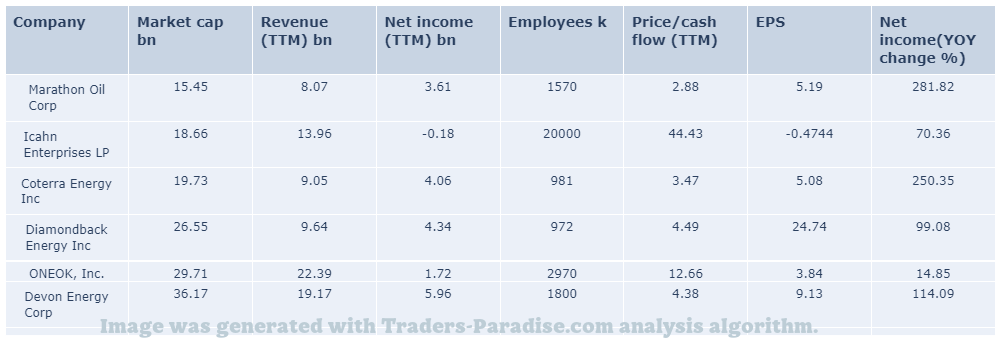

PEERS AND FUNDAMENTALS

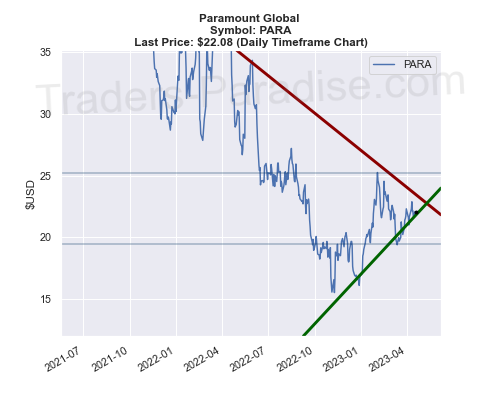

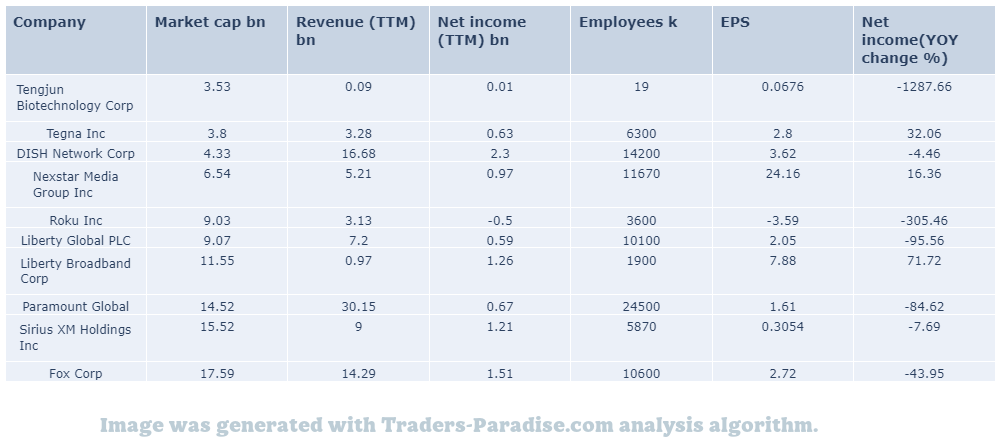

#10 Trading idea on PARA

Company Name: Paramount Global

Symbol: PARA

Sector: Technology

Company Description: Paramount Global is a global media and entertainment company. It is headquartered in New York, New York and has a global network of offices. It has more than 100,000 employees. It’s one of the world’s biggest media companies, with a turnover of over $20 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PARA — NFLX has underperformed the S&P 500 over the past year. Buffett says streaming is a poor business

Netflix’s growth story is fantastic on a GAAP EPS basis, but from a cash flow perspective, shareholder returns have been poor. Read why NFLX stock is a Sell here. – Warren Buffett says Netflix is a poor business. He believes Netflix’s streaming business is a failure.

- News story for PARA — Two Warren Buffett stocks to buy hand over Fist and one to avoid

Warren Buffett recommends two Warren Buffett stocks to buy and one to avoid. Warren Buffett loves financial stocks. He recommends Handy to Buy Handy and Handy Stocks to Avoid to avoid Handy. He also likes Handy stock to avoid to avoid handy stock.

- News story for PARA — Warren Buffett stock is down 78% this year.

Warren Buffett stock is oversold. It’s down 78% since the beginning of the year. It is the 1 stock you should not buy on the dip. – Warren Buffett Stock Down 78% You’ll Regret Not Buying on the Dip.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

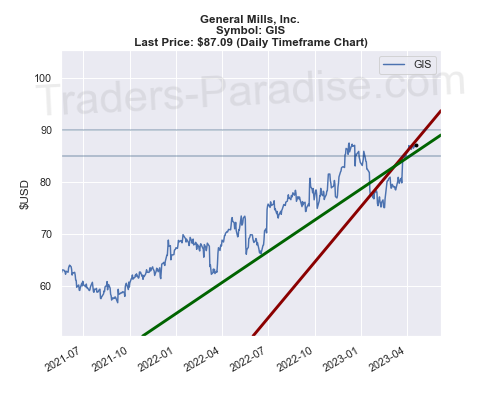

#11 Trading idea on GIS

Company Name: General Mills, Inc.

Symbol: GIS

Sector: Consumer Goods

Company Description: General Mills, Inc. is an American multinational manufacturer and marketer of branded consumer foods sold through retail stores. It is headquartered in Golden Valley, Minnesota, a suburb of Minneapolis, and it sells its products in stores there. Â

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GIS — Why General Mills (GIS) is a Great Choice

General Mills (GIS) is a great stock pick for momentum investors. General Mills has what it takes to be a top stock pick, according to the author’s research. i.e. it has the potential to become a top momentum stock.

- News story for GIS — Company plans to expand capacity to meet rising demand

Lamb Weston (LW) is expanding capacity to meet rising demand conditions for snacks and fries. The company’s stock has risen more than 25% in the last 6 months due to these strategic growth efforts. The stock rose by 25% on the back of increased demand.

- News story for GIS — Beat the Market the Way: Hershey’s, Telesis Bio, General Mills in Focus.

Zacks’ time-tested methodologies served investors well in navigating the market last week. Check out some of our achievements from the past three months here. For more information, visit Zacks.com/Investor-Conversation or follow them on Twitter.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

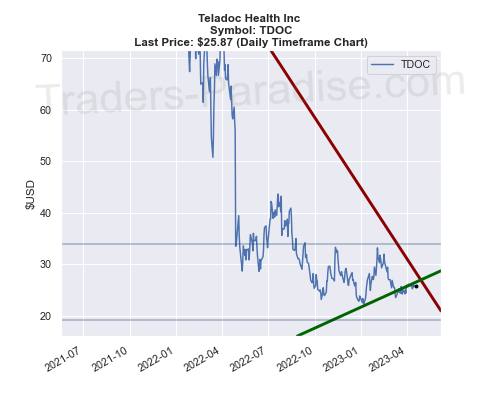

#12 Trading idea on TDOC

Company Name: Teladoc Health Inc

Symbol: TDOC

Sector: Healthcare

Company Description: Teladoc Health provides business-to-business virtual health care services in the United States and internationally. The company is headquartered in Purchase, New York and provides services in both the U.S. and abroad. Teladoc is a privately-owned company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TDOC — Shares of Teladoc closed at $25.87 in recent trading session

oc (TDOC) closed at $25.87, marking a +1.09% move from the previous day. Teladoc (CDOC) outpaced stock market gains. in the latest trading session, and the market gains.

- News story for TDOC — Stocks to consider if you are sitting on cash.

These two stocks are great bargains and may lift your portfolio in the long run. They are both undervalued and have good growth potential. They’re also good value for money at current valuations. They may be worth buying in the future. They have good long-term growth prospects.

- News story for TDOC — Surging demand for virtual care is boosting revenues.

Teladoc Health (TDOC) is well-poised for growth on the back of solid revenues, sustained demand for virtual care services and sufficient cash-generating abilities. Here’s why you should hold Teladoc’s stock right now.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#13 Trading idea on DE, might be reaching some kind of top

Company Name: Deere & Company

Symbol: DE

Sector: Industrial Goods

Company Description: John Deere is the brand name of Deere & Company, an American corporation that manufactures agricultural, construction, and forestry machinery, diesel engines, drivetrains used in heavy equipment and lawn care equipment, and diesel engines used in agricultural and construction machinery.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for DE — Top-rated Efficient Stocks to Boost Your Portfolio Returns.

Deere (DE), Arcos Dorados (ARCO) and Sea Limited (SE) are efficient stocks to boost portfolio returns. Deere is one of the world’s top-rated efficient stocks. Arcos and Sea are among the best-rated in the world.

- News story for DE — Aerospace business has been performing well

Barnes (B) shares have risen more than 25% in 6 months. It is backed by healthy aftermarket business in the Aerospace segment. Its shareholder-friendly measures are also encouraging, according to the company’s website. The company’s share price is expected to rise further in the coming months.

- News story for DE — Real-time health monitoring system alerts clinicians about changes in patients’ vital signs.

Honeywell’s real-time health monitoring system alerts clinicians about changes in patients’ vital signs when connected to the patient’s phone or computer. Honeywell (HON) Unveils Real-Time Health Monitoring System for Clinicians. For confidential support call the Samaritans on 08457 90 90 90 or visit a local Samaritans branch or click here.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#14 Trading idea on WAL, might be reaching some kind of top

Company Name: Western Alliance Bancorporation

Symbol: WAL

Sector: Financial

Company Description: Western Alliance Bancorporation is the banking holding company for Western Alliance Bank offering various banking products and related services in Arizona, California and Nevada. The company is headquartered in Phoenix, Arizona and offers products and services mainly in Arizona and California, but also in Nevada.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WAL — Western Alliance (WAL)

Western Alliance (WAL) closed at $31.57 in the latest trading session, marking a -0.85% move from the prior day. Broader Markets (BME) closed the day at $30.57. WAL is down more than 0.85%.

- News story for WAL — Earnings Expected to Grow: What to Know Ahead of Q1 Release.

Central Valley Community Bancorp (CVCY) is expected to grow its earnings in its upcoming report. Get prepared with the key expectations for CVCY’s Q1 earnings report. for a likely earnings beat in the upcoming report and for the future.

- News story for WAL — Questions to ask banks ahead of earnings season.

This will be one of the most highly anticipated earnings seasons for banks following the recent banking crisis. The 3 most pressing questions for banks heading into the earnings season are “What are the most important things to ask them?” and “What is the most pressing question for you?”

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

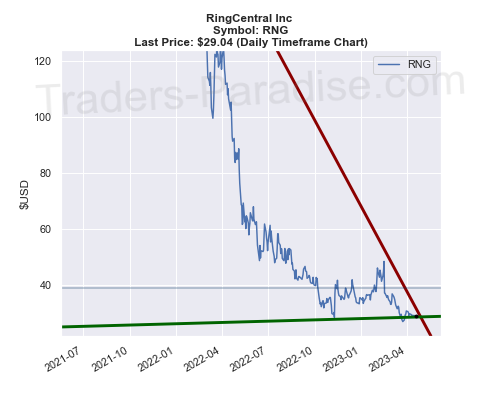

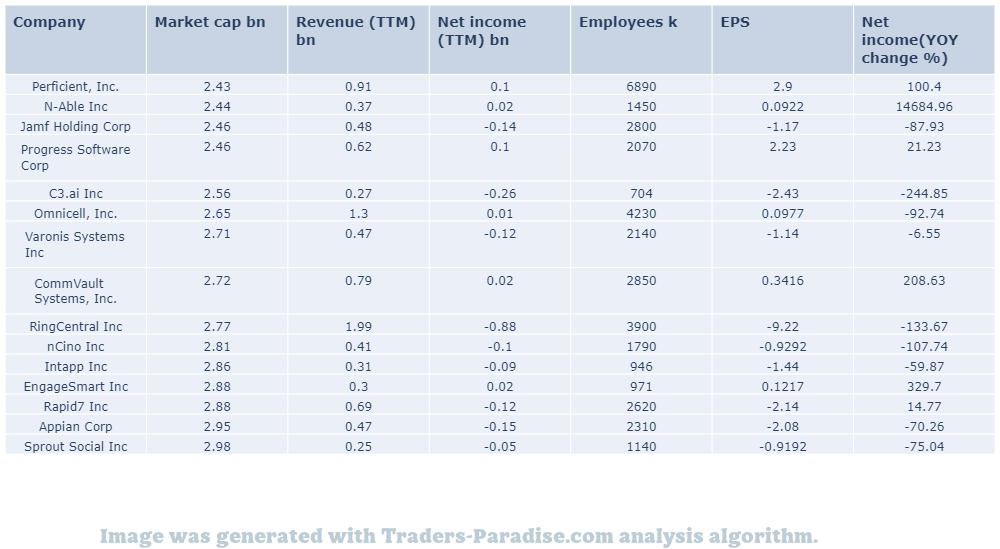

#15 Trading idea on RNG, might be reaching some kind of top

Company Name: RingCentral Inc

Symbol: RNG

Sector: Technology

Company Description: RingCentral, Inc. offers software-as-a-service solutions that enable businesses to communicate, collaborate and connect in North America. The company is headquartered in Belmont, California and offers its services in English and in Spanish. for more information, visit ringcentral.com.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for RNG — RNG has posted better-than-expected results in three of the last four quarters.

RingCentral (RNGR) has an impressive earnings surprise history. RingCentral’s next quarterly report is expected to beat estimates again. RNGR currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly earnings report.

- News story for RNG — Surge in AI hiring is a ‘beacon of light’ for tech world.

AI has been a ‘beacon of light for the tech world’ after months of layoffs, high interest rates and the collapse of Silicon Valley Bank, says one tech exec. Startups are hiring for the next big thing and AI is a good fit.

- News story for RNG — Here’s Why (RNG) is a Strong Growth Stock

RingCentral (RNG) is a Strong Growth Stock. Find strong stocks with the Zacks Style Scores, a top feature of Zacks Premium research service. For more information, go to: www.zacks.com/sportscores/zacks-style-scores.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

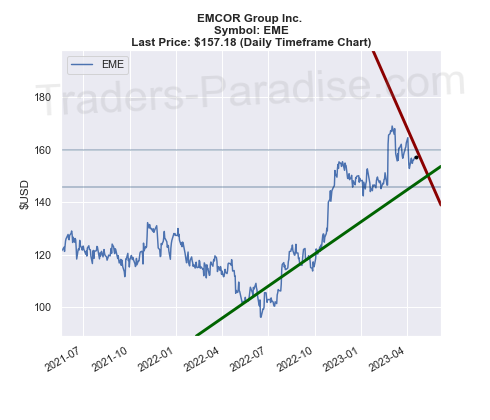

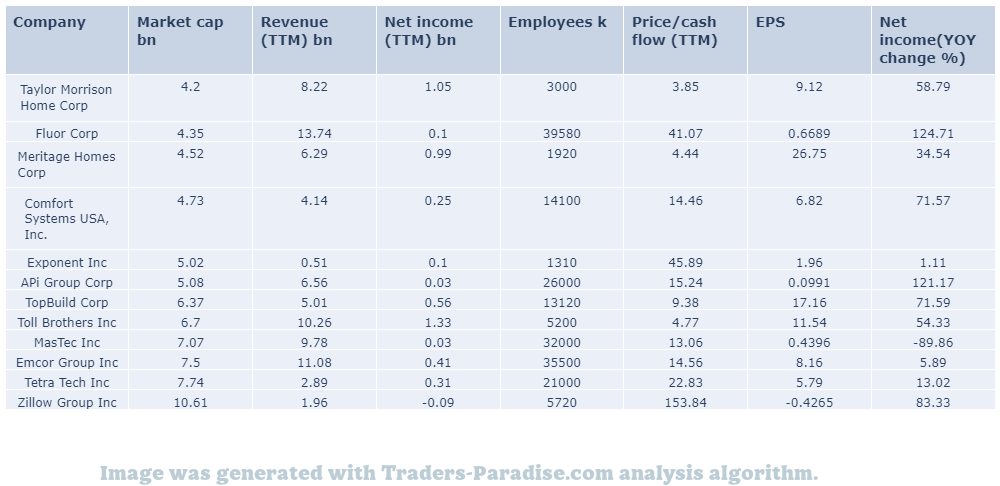

#16 Trading idea on EME, might be reaching some kind of top

Company Name: EMCOR Group Inc.

Symbol: EME

Sector: Industrial Goods

Company Description: EMCOR Group, Inc. provides electrical and mechanical installation and construction services in the United States. The company is headquartered in Norwalk, Connecticut and has a turnover of $1.5 billion. It has a workforce of about 2,000 people.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for EME — The air conditioning and heating company has been on an acquisition spree in recent years.

Watsco’s Q1 performance is likely to reflect in its Q1 results. Technology innovation, acquisitions and operating efficiencies are likely to be reflected in the company’s results. Watsco is expected to report earnings after the close of business on April 30th.

- News story for EME — Telecoms, renewable energy and power generation businesses set to benefit

Growth across telecommunications, transmission, renewable energy and power generation businesses is set to benefit EME, MTZ, DY and GVA from the Zacks Building Products – Heavy Construction industry despite macroeconomic headwinds. EME is one of the four stocks to watch from the industry.

- News story for EME — 5 stocks to watch that recently hiked dividends.

QUALCOMM (QCOM), H.B. Fuller Company (FUL), GFL Environmental (GFL), Constellation Brands (STZ) and EMCOR Group (EME) recently hiked their dividends. 5 Stocks to Watch That Recently Hiked Dividends

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.

Leave a Reply