3 min read

The truth is, there are players in the market that are hunting your stop loss.

Stop loss orders are designed to limit the amount of money that can be lost on a single trade, by exiting the trade when a specific price is reached.

For example, a trader might buy a stock at $50 expecting it to rise. Trader place a stop loss order at $47. But the price goes against the trader’s expectations and reaches $47. In that case, the stop loss order will be executed, limiting the loss to $3 per share.

All new traders should use a stop loss. The stop loss order is placed when the trader enters a position.

Why is that so important?

Markets are moving very quickly. A stop-loss is employed to limit the possibility of a loss. It also gives the possibility to trader having to get out of the trade if the price goes against him.

Stop loss is a must.

Stop loss position is very important and you should be able to distinguish where to set it. A too tight stop loss can be easily triggered even when you take the right position. And a too wide stop loss is like having no stop loss at all.

Where is the best place to set the stop loss?

You should place the stop loss at the level that will be triggered when your position is totally wrong.

We are referring to stop orders going forward, plain vanilla stop order, opposed to a stop limit order.

For example, the price is going up. You are waiting for some reversal signal. But, the price changes its direction and makes a reversal trade setup. And then starts going down. You take a short position. So the last high that the price has made before it goes down is a resistance level.

But what if you realized that taking a short position has been a wrong decision and the price will keep on going up again?

If the price goes up and breaks above the resistance level, it means you were wrong and the uptrend was not reversed. Therefore, you have to be out. That is why professional traders say: You are either right, or you should be out.

So where should you place the stop loss in this example?

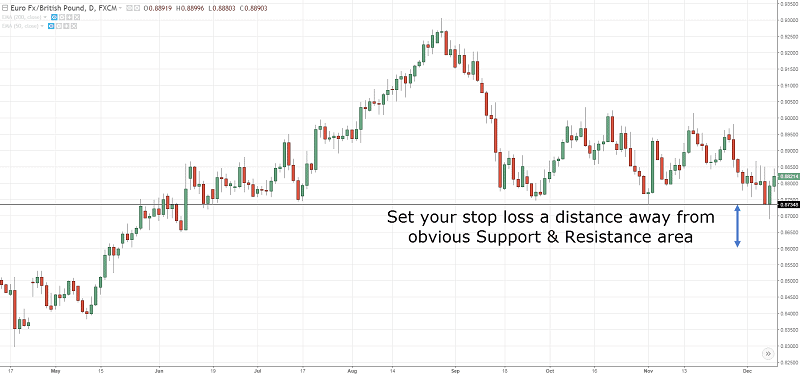

image source: tradingwithrayner.com

A few pips above the last high (resistance level) plus the spread.

When price moves to your preferred direction and you are making the profit, you can move the stop loss further to lock some part of the profit you have made. At least, you can move the stop loss to breakeven, entry price, when you are in a reasonable profit. So, if the market turns around, you will get out with zero loss.

First of all, what is stop loss hunting?

Do you know that forex brokers make money when you take a position? Yes. They charge you some pips when you buy a currency pair. This number of pips that brokers charge when you buy currency pairs is called spread. Brokers offer different spreads for different currency pairs.

But, the spread is not the only way that forex brokers make money. It is one of the ways. They also make money through the swap. Market brokers make money through commission as well. However, the commission is the only legal way of making money for the true ECN/STP brokers. They can make money through other ways, but they are not allowed to.

Short note: STP refers to Straight Through Processing and it is just a name given to dealing desk brokers that have automated the dealing process. Traditionally in the spot forex market, when you place a trade, you are being filled by your forex broker is also known as an RFED.

ECN refers to Electronic Communication Network. ECN can best be described as a bridge linking smaller market participants with its liquidity providers through a FOREX ECN Broker.

However, whatever you pay as the spread goes to the market maker broker pocket. Also, the money you lose is the market maker broker profit. Say that, when you trade Forex through a market maker broker, in fact, you are trading with the broker, not the real currency market.

So it makes sense that the market maker brokers like you to lose.

Your loss is their profit. Similar, it is expected they don’t want you to win because your profit is their loss. Market make brokers make a lot of money. The statistic shows that 99% of the trader lose on their own and nobody needs to push them to lose. However, some market maker brokers get greedier and want to make more money faster.

YOU WOULD LIKE TO READ Automatic Trading – What Is It

Stop loss hunting is one of the ways they use to do that. They have some special robots or train some employees who monitor the clients’ trades.

How does it work?

The trader takes a short position and sets a stop loss. The market goes against the position and becomes so close to the stop loss. And the robot or the stop loss hunter employee increases the spread manually to help the price hit the stop loss earlier.

But, most regulated brokers are not hunting your stop loss because it’s not worth the risk.

The word gets out that some broker hunts their client stops loss. What? It’s a matter of time before clients pull out of their account and join a new broker.

Would you want to risk doing that over a few tiny pips?

We guess not.

Most brokers don’t hunt your stops as the risk is greater than the reward.

But, your broker widens the spread and stops you out of your trade.

There is a reason for this.

A broker widens their spreads during major news release. The market has low liquidity during this period.

YOU WOULD LIKE TO READ Stop Loss Order and How to Use It

Take a look at the depth of the market. The bids and offers are low just before the major news release. The participants in the market are pulling out their orders ahead of the news release.

The liquidity during such period is thin and that results in a wider spread.

Because of this, the spreads in forex is widener. If it isn’t, there will be opportunities for arbitrage.

So, you can see that widening is not there for fun their spread for fun. Your broker is doing it to protect themselves.

Most brokers don’t hunt your stop loss because it’s bad for business.

How to avoid stop loss hunting by setting a proper stop loss

Let’s say, you find such broker.

You can still protect yourself and beat the sharks who are hunting your stops.

What can you do?

Here are 3 techniques you can use:

- Don’t place your stop loss just below Support (or above Resistance)

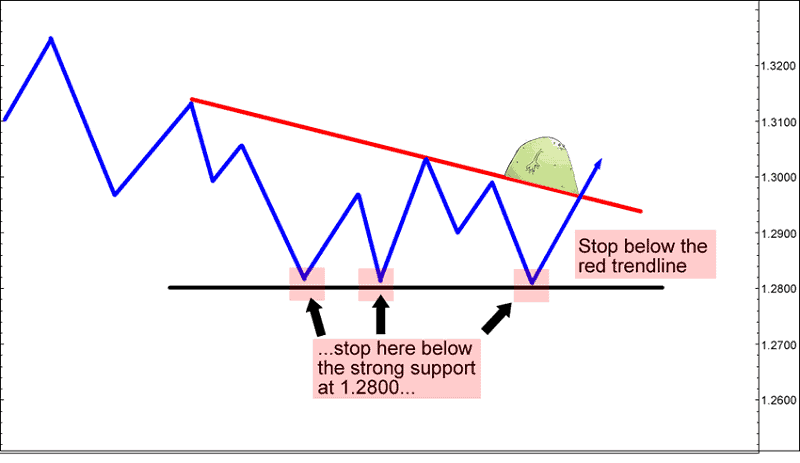

image source: bpcdn.co

- Don’t place your stop loss at an arbitrary level

- Set your stop loss at a level where it invalidates your trading setup

The bottom line

The one way to stay away from the stop loss hunting is trading through a bank account.

Trading the longer time frames is another way of staying away from stop loss hunting. Well, nothing can 100% prevent a scam broker from cheating the clients. But trading the longer time frames is a good way to lower the risk. On that way, you will have wide stop loss orders that are harder to get hunt unless the broker increases the spread for hundreds of pips.

In general, you will finally have to close your account and leave when you trade with a scam broker that hunts your stop losses and cheats because nothing that fully stops them from cheating you.

Therefore, you’d better choose a good broker from the first day or trade through a bank account.

Leave a Reply