4 min read

Call options are an investment contract in which a fee is paid for the right to buy or sell shares at a future date. When we are talking about writing a put or call option we are speaking about an investment contract in which a fee is paid for the right to buy or sell shares at a future date.

Put and call options for stocks are typically sold in lots of 100 shares.

A little review of history.

The origins of writing an option date back to ancient times. Don’t think it is something new. Aristotle, the Greek philosopher, recorded an early example of options trading in his ”Politics”.

The philosopher and mathematician Thales of Miletus studied astronomy as a way to predict olive harvests for his region. Thales believed there would be a coming bountiful olive harvest. But did not have the money to buy his own olive presses. So instead paid a fee for the right to access the olive presses of others.

Do you see? This was the first options contract.

So, writing a call option means that you are selling a call option. If you sell a call (also known as a “short call”) then you are obliged to sell stock at the strike price.

Typically, a call is sold against long stock.

When you buy some option $400 call option that you have the right to buy 100 shares of some company at $400.

And maybe you asked yourself the question “who exactly am I buying it from?”

To have the right to buy the stock at the strike price, somebody has had to take the other side of that transaction and agreed to give you the right to buy it.

The ones that take the opposite side of the call option buyer are the “call option sellers.” And sometimes they are known as “call option writers”.

When you BUY call options, you bought it from someone.

That means that someone is giving you the rights to buy the underlying stock at the strike price by selling you that option.

The act of CREATING and SELLING that call options contract to you by that person is the act of WRITING a call option.

In execution, this means opening a call options position using the SELL TO OPEN order.

When you do that, you create a new call options contract for trading in the options market and that is known as “Write” a call options contract because you are exactly “writing it up”.

Selling options, whether Calls or Puts, is a popular trading technique to increase the returns on the portfolio.

Selling Premium can prove successful when performed on a selective basis. But, if you don’t follow some specific guidelines, your long-term prospect of profitability is doubtful.

Selling options for Income can be debatable because you don’t know are you making money with your options trading. When you take a look in your overall portfolio it can be difficult to measure each transaction success.

But in this environment is yield-seeking, and selling options is a strategy designed to generate current income.

Selling options is a bit more complex than buying options.

That can involve extra risk. If sold options expire worthlessly, the seller gets to keep the money received for selling them.

To be clear with more details.

There are two types of call option selling.

If you bought a call option and the price has gone up you can always just sell the call on the open market. This type of transaction is called a “Sell to Close” transaction because you are selling a position that you currently have.

If you do not currently own the call option, but rather you are creating a new option contract and selling someone the right to buy the stock from you, then this is called “Sell to Open“, “Writing an Option“, or sometimes just “Selling an Option.”

Writing or selling a call option is when you give the buyer of the call option the right to buy a stock from you at a certain price by a certain date. Simpler, the seller (also known as the writer) of the call option can be forced to sell a stock at the strike price. The seller of the call receives the premium that the buyer of the call option pays. If the seller of the call owns the underlying stock, then it is called “writing a covered call.” If the seller of the call does NOT own the underlying stock, then it is called “writing a naked call.” A covered call enables you to own a stock with unlimited downside risk and collect a premium for the call you sold.

Writing or selling a call option is when you give the buyer of the call option the right to buy a stock from you at a certain price by a certain date. Simpler, the seller (also known as the writer) of the call option can be forced to sell a stock at the strike price. The seller of the call receives the premium that the buyer of the call option pays. If the seller of the call owns the underlying stock, then it is called “writing a covered call.” If the seller of the call does NOT own the underlying stock, then it is called “writing a naked call.” A covered call enables you to own a stock with unlimited downside risk and collect a premium for the call you sold.

When you sell a covered call you are actually selling a synthetic put.

If you are not comfy selling naked puts, then you should not be comfy selling a covered call. It is exactly the same as selling a put.

If you are comfortable with the covered call, then there are numerous factors to analyze when entering any options position.

Now, it is convenient to look at what factors can make a trade more likely to be profitable than another.

At the top of any list is liquidity or the percentage of the difference between the bid and ask.

If you are giving away too great a percentage to the market-makers or algorithms, then the costs of entering the transaction are too high.

You should look to trade an options contract that has a bid/ask spread of less than 1.5%. Always consider that the more you give away to the bid/ask spread, not only entering but exiting the transaction.

Well, this may prove difficult at times, but it isn’t easy to make money.

Besides this, all trade evaluations must consider the cost of commissions. While all of these costs make profitable trading that much more difficult, they must be included in your analysis.

You should consider the relative strength index of the underlying, extreme conditions tend to provide more interesting trading opportunities.

A seller is obligated to buy or sell an underlying security at a specified strike price if the buyer chooses to exercise the option.

There must be a seller for every option buyer.

There are several resolutions that must be made before selling options:

1) What security to sell options on

2) The type of option (call or put)

3) The type of order (market, limit, stop-loss, stop-limit, trailing-stop-loss, or trailing-stop-limit)

4) Trade amount that can be supported

5) The number of options to sell

6) The expiration month

When all this information is collected, a trader goes into the brokerage account, select security and go to an options chain. Once an option has been selected, the trader goes to the options trade ticket. Then enter a sell to open order to sell options and makes the appropriate selections to place the order.

Here are the key things you should remember with respect to buying and selling call options.

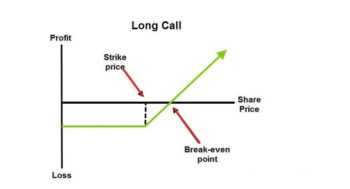

You buy a call option only when you are bullish about the underlying asset.

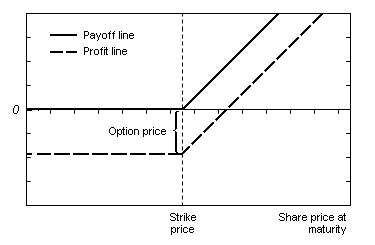

Upon expiry, the call option will be profitable only if the underlying has moved over and above the strike price. Buying a call option is also referred to as ‘Long on a Call Option’ or simply ‘Long Call’. To buy a call option you need to pay a premium to the option writer.

The call option buyer has a limited risk (to the extent of the premium paid) and a potential to make an unlimited profit. The breakeven point is the point at which the call option buyer neither makes money nor experiences a loss.

P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid

P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid

Breakeven point = Strike Price + Premium Paid

When you sell a call option (also called option writing) only when you believe that upon expiry, the underlying asset will not increase beyond the strike price.

Selling a call option is also called ‘Shorting a call option’ or simply ‘Short Call’.

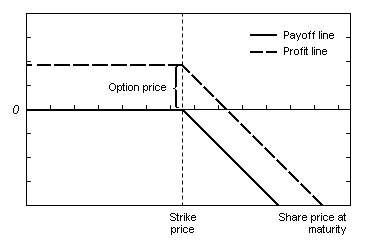

When you sell a call option you receive the premium amount. The profit of an option seller is restricted to the premium he receives, however his loss is potentially unlimited.

The breakdown point is the point at which the call option seller gives up all the premium he has made, which means he is neither making money nor is losing money.

Since short option position carries unlimited risk, he is required to deposit margin. Margins in case of short options are similar to futures margin.

P&L = Premium – Max [0, (Spot Price – Strike Price)]

Breakdown point = Strike Price + Premium Received

When you are bullish on a stock you can either buy the stock in the spot, buy its futures, or buy a call option.

When you are bearish on a stock you can either sell the stock in the spot (although on an intraday basis), short futures, or short a call option.

The calculation of the intrinsic value for the call option is standard, it does not change based on whether you are an option buyer/ seller.

You sell a call option when you are bearish on a stock.

When you sell a call option you receive a premium.

Selling a call option requires you to deposit a margin.

When you sell a call option your profit is limited to the extent of the premium you receive and your loss can potentially be unlimited.

Nothing more, nothing less.

Risk Disclosure (read carefully!)

Leave a Reply