3 min read

Take Profit order or shorter TP is extremely essential element in all tradings. How to place the Take profit order? The question of how to place stop-loss order is one and those two are related and connected.

So we have to make some distinctions.

Stop-loss order linked to the risk when you take a position.

Take profit is related to the gain for your open position.

Both of these elements form what we call – money management. We told you about Stop-Loss in the prior posts. In case you missed it, you can read it HERE or HERE.

But let’s stay awhile with the definition of “Take Profit” order.

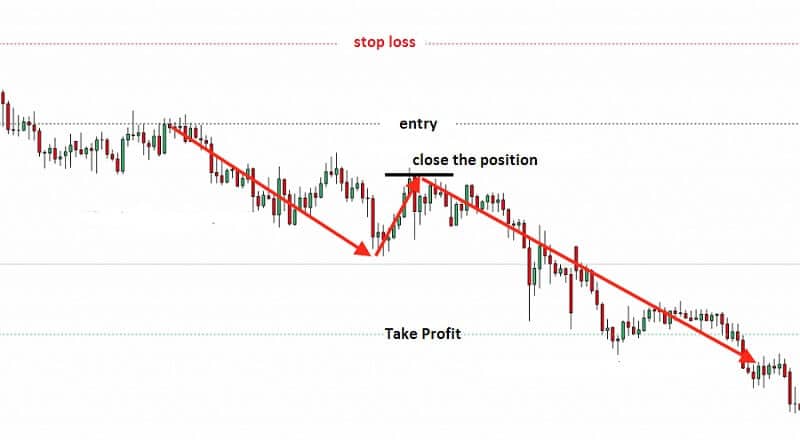

Take Profit order is a limit order. Traders use it to close a position when the market touches a specific price level. To be more clear. Take profit represents the reward that a trader planned before taking a position. Take Profit order has to follow, must go in the same direction as the market. The trader is free to define the level of reward depending on his/her feeling of how much risk is taken to obtain adequate profit.

Take Profit order is similar to Stop Loss order, meaning, it is an exit order. Yet, Stop Loss order will limit your loss on a trade, but Take Profit means a price at which a successful trade will be automatically closed. To make this simpler – Take Profit is your profit target. That is the reason why you always have to set Take Profit order at the level you are expecting the price will catch. When you buy, for example, a stock, your Take Profit order must be higher than the current price. But if you are selling a stock, your Take Profit order should be below the current price.

Yes, we know you have an excellent idea.

But do you know how to place a Take Profit order?

If you do it wrong, you will not make a sufficient profit.

Levels of resistance and support will help you to place a proper TP. This strategy is the most successful and we will show you why.

First, locate a resistance level in your chart. Then place a Take Profit order a bit below the resistance. In this way, when you place TP under the resistance level, you will increase your chances to match the level that the price will hit. The next step is simple, just close your position and make a profit. This profit will always be higher.

This is in case you notice an upward trend. But if you notice a downward trend, you have to determine a support level.

In that case, TP has to be a bit over the support.

Contrary to the situation with resistance, a TP level should be a bit over the support.

Experienced traders have some TP tips. One of them is that the TP must be 2 or 3 times of the SL value. But this advice is doubtful. You have to consider more indicators, not just one. If you are trading Forex, this strategy will work for you.

But if you are trading stocks some other rules are more convenient.

You will make the most gains in the 20%-25% range.

If you see a notable increase of 20% to 25% – sell.

Why this 20%-25% range?

Stocks tend to rise 20% to 25% after breaking out the support, then fail and set up new support. Sometimes this game resumes their progress.

In Traders-Paradise’s Full Trading & Investing Course – Secrets Revealed

(don’t forget to subscribe while it is free of charge, the time is limited) you find a fantastic lesson about the rules and among them an explanation of the Rule of 72.

Following Rule 72 you can easily calculate why the 20% to 25% is adequate Profit take range.

How to calculate?

Divide 72 by the percentage gain you have in stock. The result will show you how many times you have to compound that gain to double your capital. Let’s say you get 3. Re-invest your capital plus gains 3 times. You will double your money easier than to make 100% profit from one stock. The net profit will be greater. But as we mentioned, you have this all and detailed explained in Traders-Paradise’s Full Trading & Investing Course – Secrets Revealed

Why place a Profit Target?

Determining where to exit before trade begins allows you to calculate the risk/reward ratio.

The stop-loss defines the possible loss on a trade. But the profit target defines the possible profit. Logically, the possible reward should exceed the risk.

By trading with a profit target, it is possible to estimate whether a trade is worth taking. If the profit potential doesn’t exceed the risk, don’t take a trade. By establishing a profit target you can eliminate weak trades.

Leave a Reply