How to read this report

Every report will start with a short “Market News” section. In this section, we scraped the latest financial news regarding the financial markets. This is a more macro vision of the market. Interest rates, unemployment reports, inflation, oil and energy, earning season, etc.

After the news report section we head to the trading idea section. Every idea is divided into 4 important parts:

-

-

-

- The company and its sector and description

- Recent news about the company

- Chart and its boundary lines

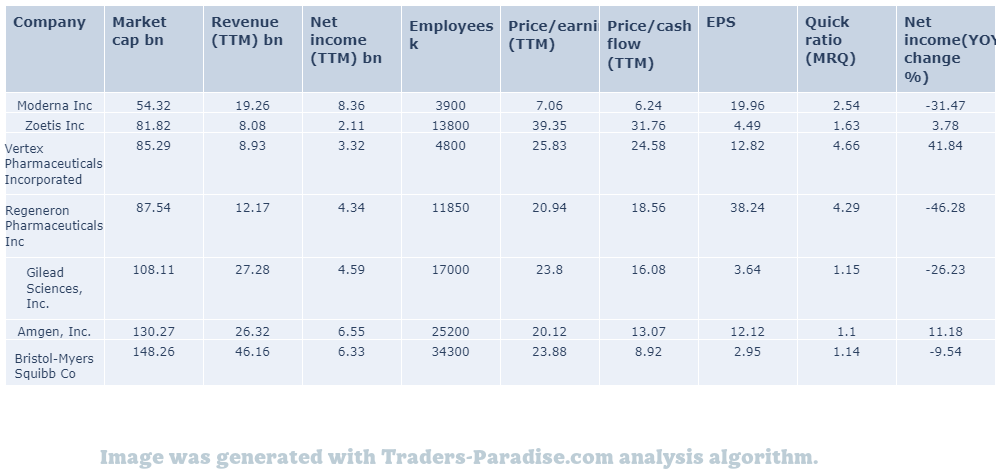

- A table with the company peers and competitors, including their financial and fundamentals.

-

-

A new report will be generated on a daily basis.

Does it work?

In short, yes.

you can read here how we use these methods for our real life trades.

Short declaimer

This report, including all content, is made for educational purposes only. Use on your own risk!

Most recent news about the financial markets

- New index to track volatility in S&P 500 option contracts.

Cboe is rolling out a new index to track volatility in S&P 500-linked option contracts with one day or less until expiration. The index will be available to stock-market investors on Cboe’s website on Monday. It will be called the “Fear Gauge”.

- JPMorgan U.S. Equity ETF (JPUS) may be a good long-term play.

JPMorgan Diversified Return U.S. Equity ETF (JPUS) should be on your Investing Radar? Style Box ETF report for JPUS is available on the website of the fund provider. For more information, go to: www.jpmorgandiversifiedreturnu.com.

- Invesco Dow Jones Industrial Average Dividend ETF (DJD) is a strong ETF.

Invesco Dow Jones Industrial Average Dividend ETF (DJD) is a strong ETF right now. Smart Beta ETF report for DJD is available here. . for more information, visit: http://www.invesco.com/investor/index.shtml.

- Is it the best way to invest in junk bonds?

The 14% Yield Fund is Anything But Junk, but it’s still a good idea to invest in it. It’s a low-yielding, high-yield fund with a good risk profile. It offers a good return on invested capital.

- Stocks to watch this week as gold prices continue to rise.

There’s an opportunity in gold stocks that most people won’t take advantage of, according to some analysts. . in Gold Stocks that most will miss. In this article, we look at some of those stocks.

- Is Asset Managers Still Short?

According to Sentiment Update, Asset Managers are still short on cash. For more information, go to: http://www.sentiment.com/news/sentiment-overview/investment-managers-still-short-on-cash.

- More than 70% of respondents cited inflation as the biggest risk. Geopolitical risk cited as second-biggest worry in poll

70% of respondents in Central Banking Publications’ survey of 83 central banks cited above-target inflation as the biggest risk this year. Geopolitical risk was cited as the second-biggest worry. However, markets and other indicators point towards a fall in inflation expectations going ahead in the U.S.

- This fund has an allocation strategy that can work to its advantage.

Using a real-assets strategy for some of your money can provide all-weather protection through inflation cycles and protect your spending power. This fund has an allocation strategy that can work to your advantage. It has an all-time allocation strategy for real assets.

- S&P 500 has been trading in a narrow range for most of the year.

4200. Decline below 3950 would be negative and probably bring in some serious selling, writes Lawrence McMillan on S&P 500 at 4200 at 4,200. 4,000 at 4.200 at 3950 at 4100. 4200, 4200 and below 4200 soon.

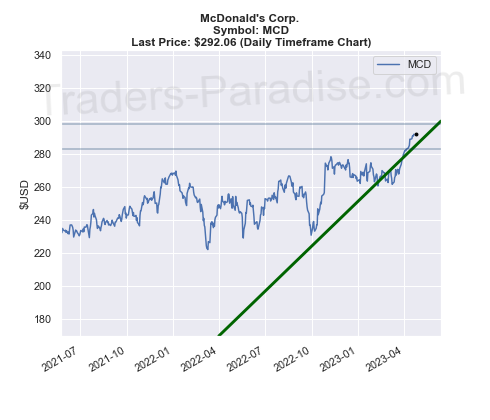

#1 Trading idea on MCD

Company Name: McDonald’s Corp.

Symbol: MCD

Sector: Services

Company Description: Richard and Maurice McDonald started a hamburger stand in San Bernardino, California in 1940. They later turned the business into a franchise. The Golden Arches logo was introduced in 1953 at a location in Phoenix, Arizona. McDonald’s Corporation is an American fast food company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MCD — Strategist says stocks need to drop 15% to recover.

Even without an earnings apocalypse, stocks still need to drop 15% this week, according to strategist. – MarketWatch.com’s call of the day is that investors will not be out of the woods even if earnings news is not a disaster this week.

- News story for MCD — Amazon, Meta, Alphabet and Microsoft lead a packed week of earnings.

Amazon.com, Meta Platforms Inc., Alphabet Inc., and Microsoft Corp. lead a packed week of first-quarter earnings. Big Tech determines the course of Wall Street. Here is why Amazon will hold the most sway over the stock market this week.

- News story for MCD — 1 Stock to Buy, 1 Stock to Sell This Week: McDonald’s, Intel

McDonald’s and Intel are the stocks to buy and sell this week. McDonald’’s is the one stock to buy. Intel is the stock to sell. Â . For confidential support call the Samaritans on 08457 90 90 90 or visit a local Samaritans branch or click here.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

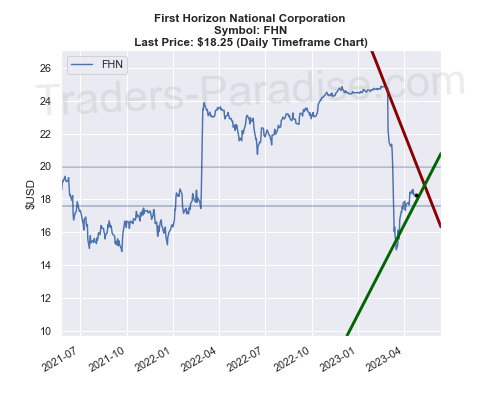

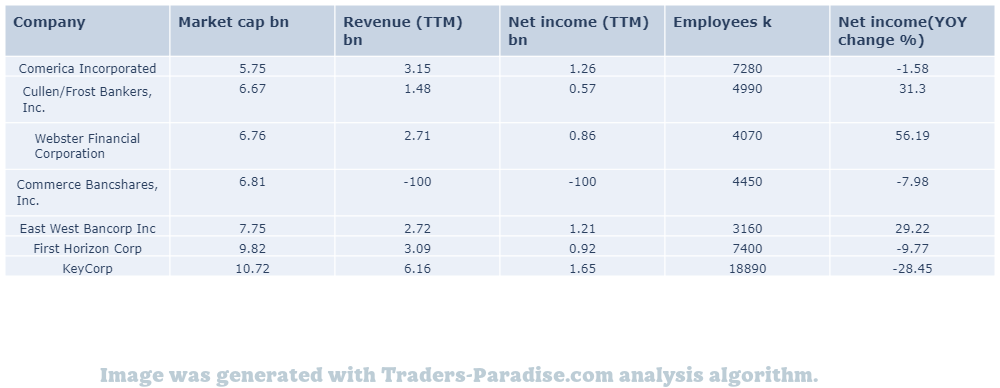

#2 Trading idea on FHN

Company Name: First Horizon National Corporation

Symbol: FHN

Sector: Financial

Company Description: First Horizon Corporation is the banking holding company for First Horizon Bank providing various financial services. The company is headquartered in Memphis, Tennessee and is the bank’s parent company. It is a publicly traded company with a market capitalization of $1.2 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for FHN — Lower non-interest income, deteriorating credit quality weigh on earnings.

First Horizon’s Q1 earnings meet estimates, NII rises. However, deteriorating credit quality and a fall in non-interest income act as headwinds for the company’s results. – FHN’s shares are down 1.5%.

- News story for FHN — Earnings and revenue missed estimates by 0% and 0.58%, respectively.

First Horizon National delivered earnings and revenue surprises of 0% and 0.58%, respectively, for the quarter ended March 2023. First Horizon National’s Q1 Earnings Matches Q1 Revenue Estimates. For confidential support call the Samaritans on 08457 90 90 90, visit a local Samaritans branch or click here for details.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

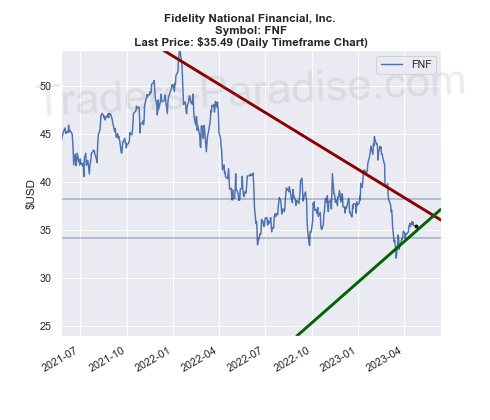

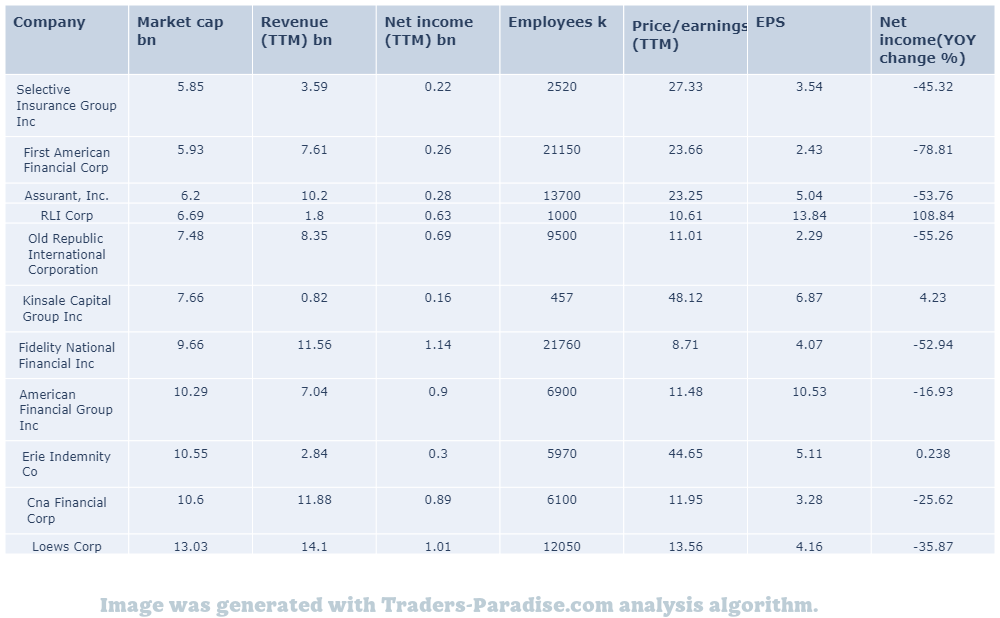

#3 Trading idea on FNF

Company Name: Fidelity National Financial, Inc.

Symbol: FNF

Sector: Financial

Company Description: Fidelity National Financial offers various insurance products in the United States. The company is headquartered in Jacksonville, Florida and offers insurance products. It offers different types of insurance products, including life insurance and annuities. It’s a private company with a primary focus on Florida.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for FNF — SEC chief wants retail orders to be auctioned off. Questions remain on ultimate impact of reforms

Gensler’s meme-stock reforms are meant to help retail traders, but some investor protection advocates aren’t so sure. SEC chief wants retail stock orders to be auctioned off to market makers and exchanges, but questions remain as to the ultimate impact of these reforms.

- News story for FNF — Financial stocks with RSI near or below 30 are considered oversold.

The most oversold stocks in the financial sector presents an opportunity to buy into undervalued companies. First Guaranty Bancshares Inc (NASDAQ: FGBI) is one of the most undervalued stocks in this sector with an RSI near or below 30.

- News story for FNF — Q4 earnings miss on title volume decline, higher average fee per file.

Fidelity National’s Q4 results reflect significant decline in volume, partially offset by a higher average fee per file. FNF missed Q4 earnings expectations. The company reported a decline in title volume, but a rise in the average fee for files.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

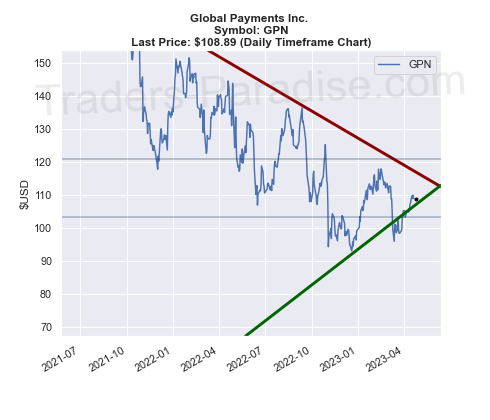

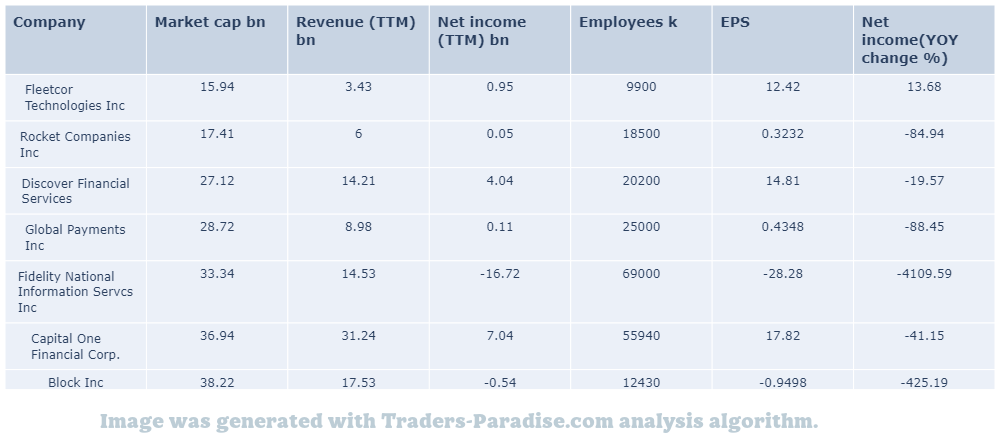

#4 Trading idea on GPN

Company Name: Global Payments Inc.

Symbol: GPN

Sector: Services

Company Description: Global Payments Inc. is an American company providing financial technology services globally headquartered in Atlanta, Georgia. Global Payments is a provider of payment technology services. . for more information, visit globalpaymentsinc.com or call 1-800-273-8255.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

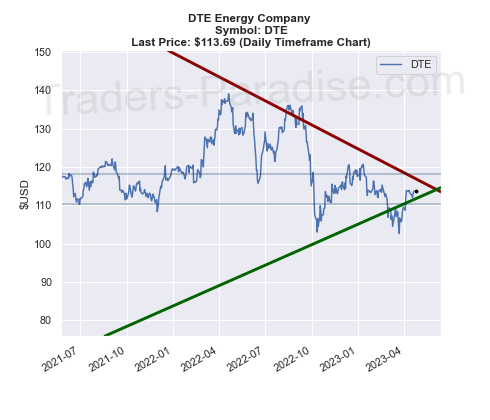

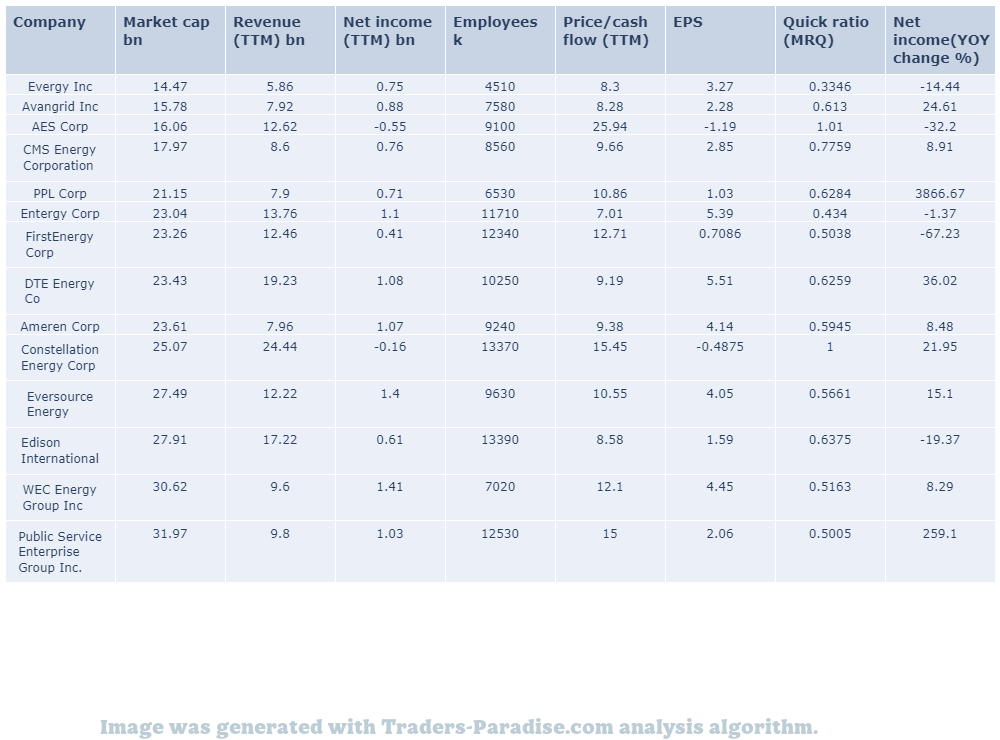

#5 Trading idea on DTE

Company Name: DTE Energy Company

Symbol: DTE

Sector: Utilities

Company Description: DTE Energy is a diversified energy company based in Detroit. It was formerly known as Detroit Edison until 1996. It is involved in the development and management of energy-related businesses and services in the U.S. and Canada. DTE Energy has operations in the following countries:

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for DTE — DTE Energy has an impressive earnings surprise history.

DTE Energy (DTE) has an impressive earnings surprise history. DTE Energy possesses the right combination of the two key ingredients for a likely beat in its next quarterly report. Dte Energy is expected to beat earnings estimates again. for the quarter ending March 31st.

- News story for DTE — Utility giant DTE Energy is set to report its first-quarter results on Oct. 26.

DTE Energy (DTE) is expected to beat earnings estimates. DTE Energy possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for DTE’s upcoming report and follow this link for more information.

- News story for DTE — First quarter 2023 earnings release, conference call scheduled for Thursday, April 27, 2023.

DTE Energy schedules first quarter 2023 earnings release and conference call for April 13, 2023. The company will announce before the market opens on Thursday, April 27th 2023 and release the results before the public on April 13th, 20th.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

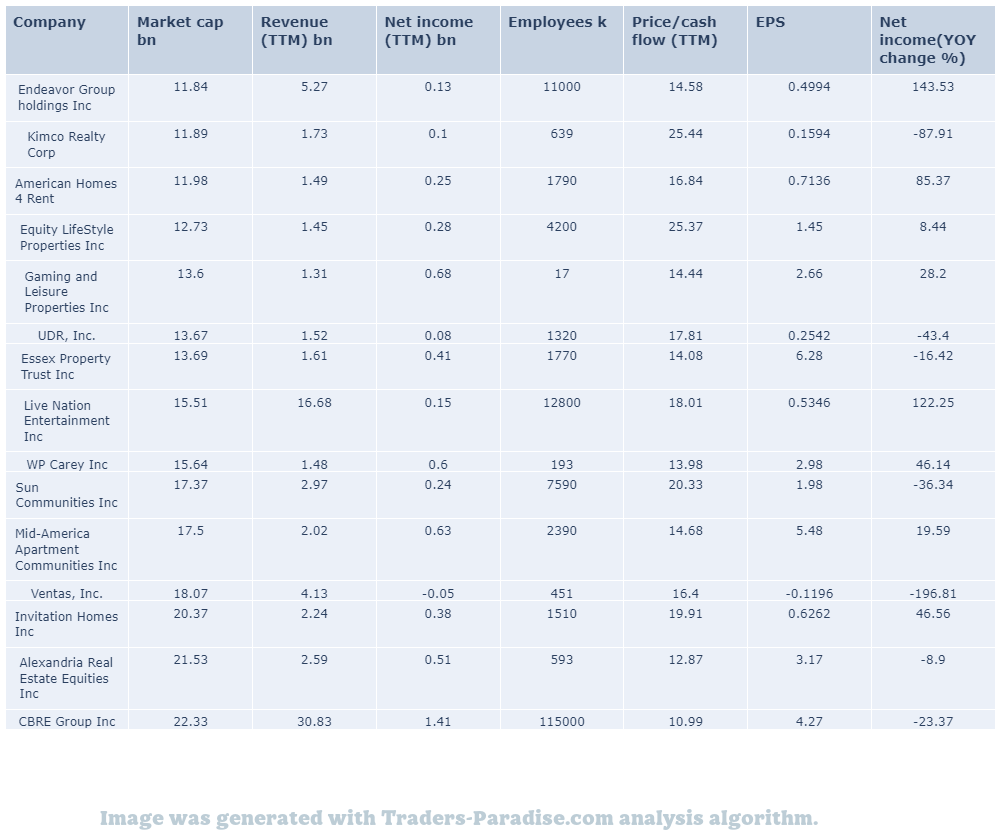

#6 Trading idea on SUI

Company Name: Sun Communities Inc.

Symbol: SUI

Sector: Financial

Company Description: There are no photos of the event. None of the participants took part in it. None of them were involved in any of the events that took place. None were present at the event itself. None took part. None was present in the event that happened.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SUI — 4 analysts have rated the stock recently.

Sun Communities (NYSE:SUI) has observed the following analyst ratings in the last quarter: Bullish, Somewhat Bullish and Bearish. The company has an average price target of $160.5 with a high of $168.00 and a low of $151.00.

- News story for SUI — Shares of real estate investment trust (Reit) have slumped in recent months.

In recent months, REITs have sold off heavily, which has led to some historic buying opportunities. Click here to see our two top REIT picks: Buy The Dip and Buy The Dip. . Â

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

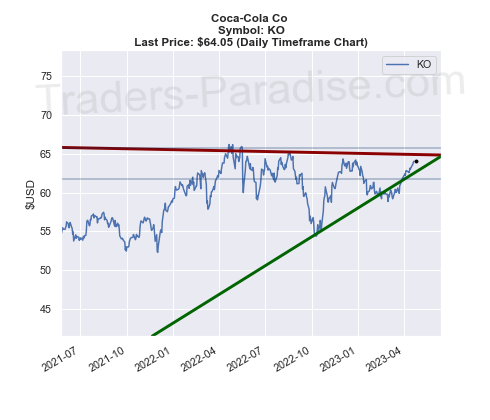

#7 Trading idea on KO

Company Name: Coca-Cola Co

Symbol: KO

Sector: Industrial Goods

Company Description: The Coca-Cola Company is an American multinational beverage corporation incorporated under Delaware’s General Corporation Law and headquartered in Atlanta, Georgia. It has interests in the manufacturing, retailing, and marketing of nonalcoholic beverage concentrates and syrups, and in the production of sodas.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KO — Strategist says stocks need to drop 15% to recover.

Even without an earnings apocalypse, stocks still need to drop 15% this week, according to strategist. – MarketWatch.com’s call of the day is that investors will not be out of the woods even if earnings news is not a disaster this week.

- News story for KO — Amazon, Meta, Alphabet and Microsoft lead a packed week of earnings.

Amazon.com, Meta Platforms Inc., Alphabet Inc., and Microsoft Corp. lead a packed week of first-quarter earnings. Big Tech determines the course of Wall Street. Here is why Amazon will hold the most sway over the stock market this week.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

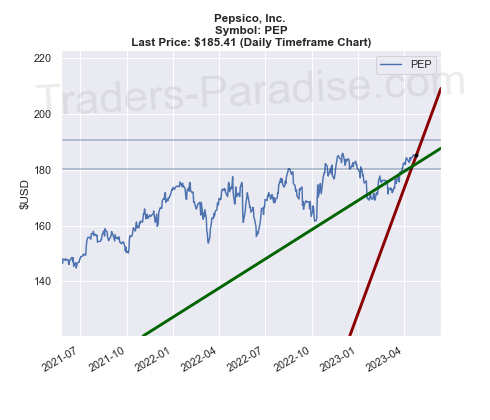

#8 Trading idea on PEP

Company Name: Pepsico, Inc.

Symbol: PEP

Sector: Consumer Goods

Company Description: PepsiCo, Inc. is an American based multinational food, snack, and beverage corporation headquartered in Harrison, New York, in the hamlet of Purchase. It oversees the manufacturing, distribution, and marketing of its products. Its business encompasses all aspects of the food and beverage market.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PEP — Amazon, Meta, Alphabet and Microsoft lead a packed week of earnings.

Amazon.com, Meta Platforms Inc., Alphabet Inc., and Microsoft Corp. lead a packed week of first-quarter earnings. Big Tech determines the course of Wall Street. Here is why Amazon will hold the most sway over the stock market this week.

- News story for PEP — Shares of McDonaldTMs, Intel rise on optimism over China deal.

This week McDonald’s and Intel are the stocks to buy and sell this week. McDonald’s is the one stock to buy. Intel is the stock to sell this time. Â . in this week’s stock market report.

- News story for PEP — Safe dividend stocks to beat inflation

Dividends from these companies have more than 100 years of annual payout raises between them. They are safe dividend stocks that can’t be bought and sold at a higher rate of interest than inflation. They have a good track record of beating inflation.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

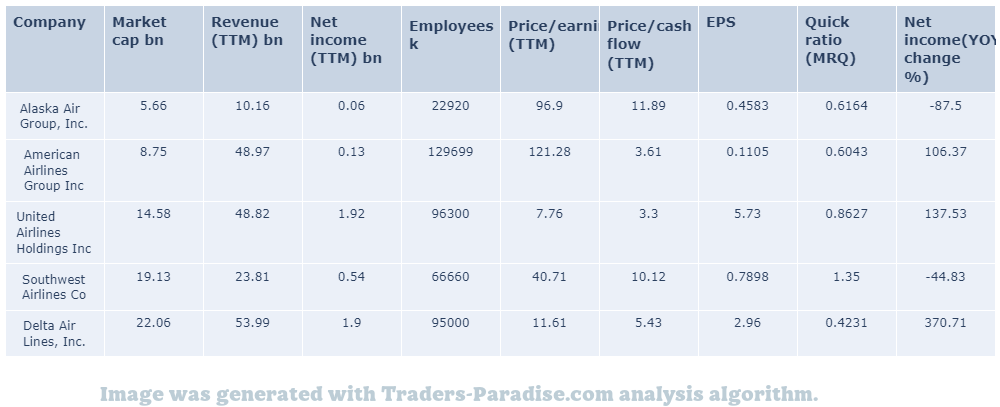

#9 Trading idea on LUV

Company Name: Southwest Airlines Co.

Symbol: LUV

Sector: Services

Company Description: Southwest Airlines is one of the major airlines of the United States and the world’s largest low-cost carrier airline. It is headquartered in Dallas, Texas. It’s also known as Southwest Airlines Co., typically referred to as Southwest Airline Co., or simply Southwest.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for LUV — 1 Stock to Buy, 1 Stock to Sell This Week: McDonald’s, Intel

McDonald’s and Intel are the stocks to buy and sell this week. McDonald’’s is the one stock to buy. Intel is the stock to sell. Â . For confidential support call the Samaritans on 08457 90 90 90 or visit a local Samaritans branch or click here.

- News story for LUV — Analysts are expecting lower-than-expected earnings.

Southwest Airlines (LUV) is expected to report negative earnings next week. Get prepared with the key expectations for the upcoming report. For confidential support call the National Suicide Prevention Lifeline at 1-800-273-8255 or visit http://www.suicidepreventionlifeline.org/.

- News story for LUV — Shares of Southwest Airlines closed at $32.45 in recent trading session

. Southwest Airlines (LUV) closed the most recent trading day at $32.45, moving +1.22% from the previous trading session. LUV shares are up 1.22%. LUV is down 1.3%. LVI shares are down 2.5%.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

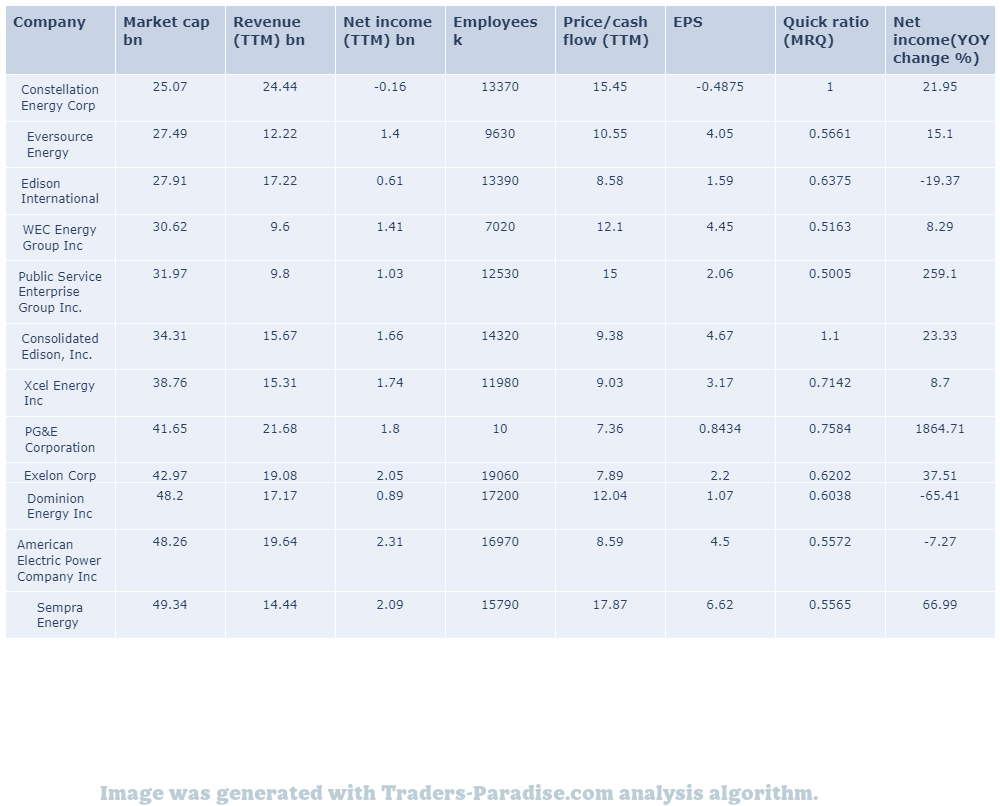

#10 Trading idea on D

Company Name: Dominion Resources, Inc.

Symbol: D

Sector: Utilities

Company Description: Dominion Energy supplies electricity in Virginia, North Carolina, and South Carolina and natural gas to parts of Utah, West Virginia, Ohio, Pennsylvania and North Carolina. Dominion also has generation facilities in Indiana, Illinois, Connecticut and Rhode Island. Dominion Energy is headquartered in Richmond, Virginia.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for D — Shares of Dominion Energy closed at $57.43 in recent trading session

the previous day. Dominion Energy (D) closed at $57.43, marking a +0.12% move from the previous trading session, and +1.3% gain from previous day, and -1.5% gain on previous trading day.

- News story for D — Wall Street’s most accurate analysts rate these stocks.

Dominion Energy, Dominion Energy and Dominion Resources are high-yielding utilities stocks with over 4% dividend yields. The most accurate Wall Street analysts recommend them to investors. Benzinga readers can review the latest analyst takes on their favorite stocks by visiting the Analyst Stock Ratings page.

- News story for D — 14 analysts have a positive view on the stock.

14 analysts have an average price target of $63.07 for Dominion Energy. The current price of Dominion Energy is $57.905. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the upside potential of the stock.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

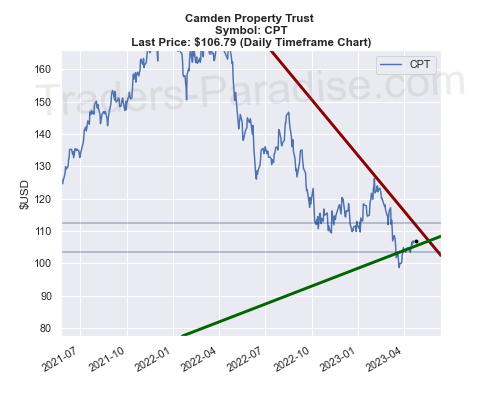

#11 Trading idea on CPT

Company Name: Camden Property Trust

Symbol: CPT

Sector: Financial

Company Description: Camden Property Trust is an S&P 400 company. It is engaged in the ownership, management, development, remodeling, acquisition, and construction of multi-family apartment communities. It’s a real estate company primarily engaged in owning, managing, developing and renovating apartments.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CPT — Check out these low-risk ways to invest $1,000.

There are 3 very low-risk ways to invest $1,000 right now. These companies have durable businesses and elite financial profiles and are well-known. Â . i in the U.S.

- News story for CPT — Check here for live updates from the Super Bowl in Atlanta.

Some REITs are crashing and it’s a good idea to buy them now. Â . – The Wall Street Journal. For more information, go to: http://www.wsj.com/news/investor-gives/reits-crisis/

- News story for CPT — How to invest $1,000 (or less) into rental properties and collect stressless passive income.

How to Invest $1,000 into Rental Properties and Collect Stressless Passive Income. The relaxing way to become a landlord is to invest in rental properties and collect stressless passive income. For more information, go to: http://www.realtor.com/rental-properties.

TECHNICAL ANALYSIS

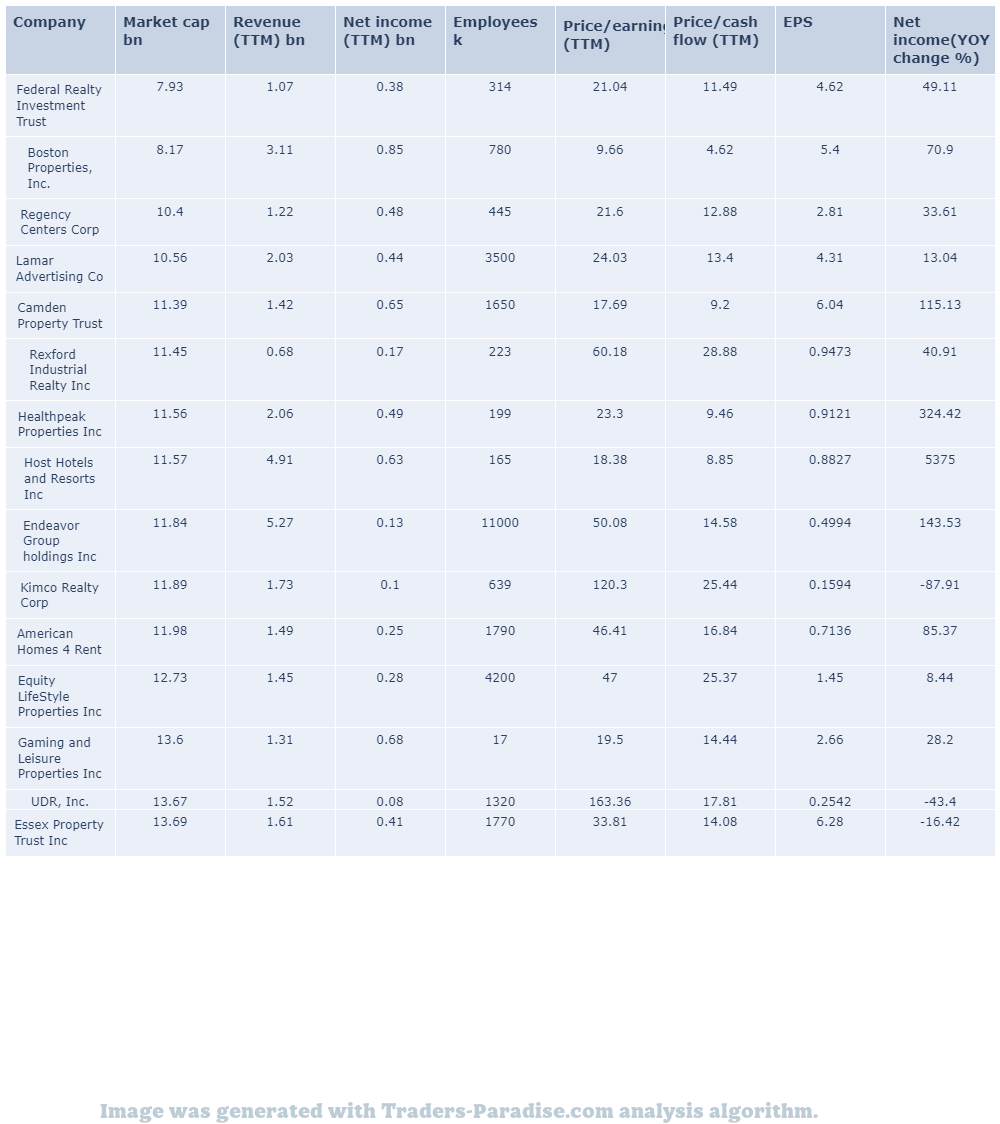

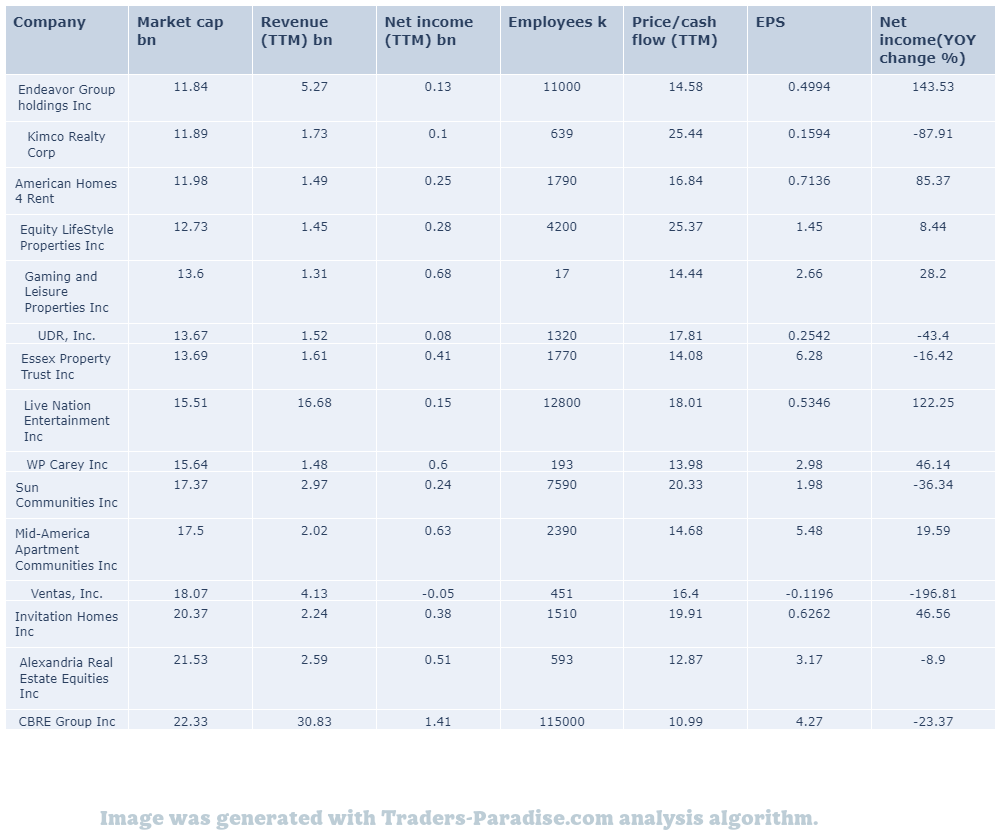

PEERS AND FUNDAMENTALS

#12 Trading idea on MAA

Company Name: Mid-America Apartment Communities Inc.

Symbol: MAA

Sector: Financial

Company Description: Mid-America Apartment Communities is a publicly traded real estate investment trust based in Memphis, Tennessee. It invests in apartments in the Southeastern United States and the Southwestern United States. It’s a real estate company with a public market value of $1.2 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MAA — .

The Dividend Champion, Contender, and Challenger Highlights are from the week of April 23. The highlights are from this week’s Business Insider magazine, published on April 23rd and April 24th, and cover the week’s top stories.

- News story for MAA — Shares of Mid-America Apartment are trading higher on expectations of strong earnings.

. Mid-America Apartment’s (MAA) Q1 results are likely to reflect the healthy demand for apartment units in its markets. MAA’s Q2 results are expected to be released later this month. M AA’s Q3 results will be announced later this quarter.

- News story for MAA — Is a Beat in Store for Equity Residential in Q1 Earnings?

Equity Residential’s Q1 results are likely to benefit from its portfolio diversification efforts and technology investments amid a rebound in demand in the quarter. Equity Residential is expected to report a beat in its Q1 earnings. for Equity Residential in the first quarter.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

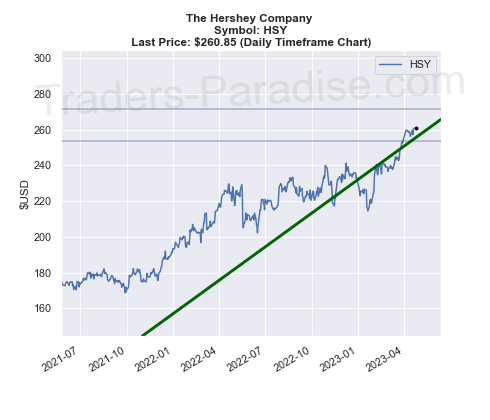

#13 Trading idea on HSY

Company Name: The Hershey Company

Symbol: HSY

Sector: Consumer Goods

Company Description: Hershey’s is one of the largest chocolate manufacturers in the world. It also manufactures baked products, such as cookies and cakes, and sells beverages like milkshakes. Its headquarters are in Hershey, Pennsylvania, and the company is based in the United States.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HSY — Family-run business has been in business for more than 200 years.

The business began in the late 1800s and remains essentially the same today. It has turned $10,000 into $6.1 million in just a few years. It is still going strong today. It was founded by a man who had a simple business idea.

- News story for HSY — Mondelez, Hershey, Kraft Heinz, Kellogg likely to top earnings estimates.

Mondelez, Hershey, Kraft Heinz, and Kellogg are likely to top earnings estimates this season. Food companies have been benefiting from favorable demand and solid pricing amid cost inflation, as shown by their recent results. – Kompakt.

- News story for HSY — The company is expected to report better-than-expected earnings next week.

Hershey’s earnings are expected to grow next week. The company has the right combination of the two key ingredients for a likely earnings beat. Get prepared with the key expectations ahead of next week’s release and follow the links below to learn more about the company.

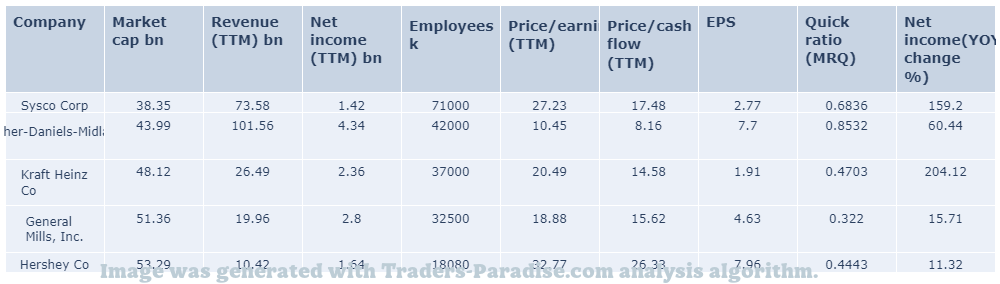

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

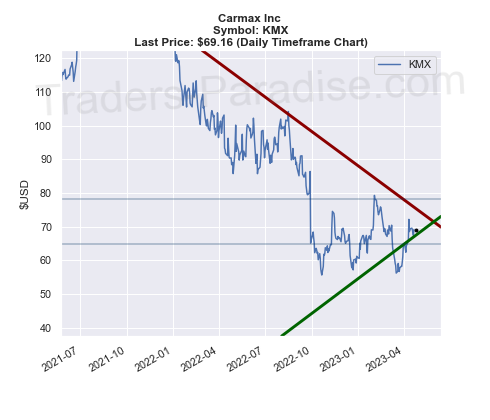

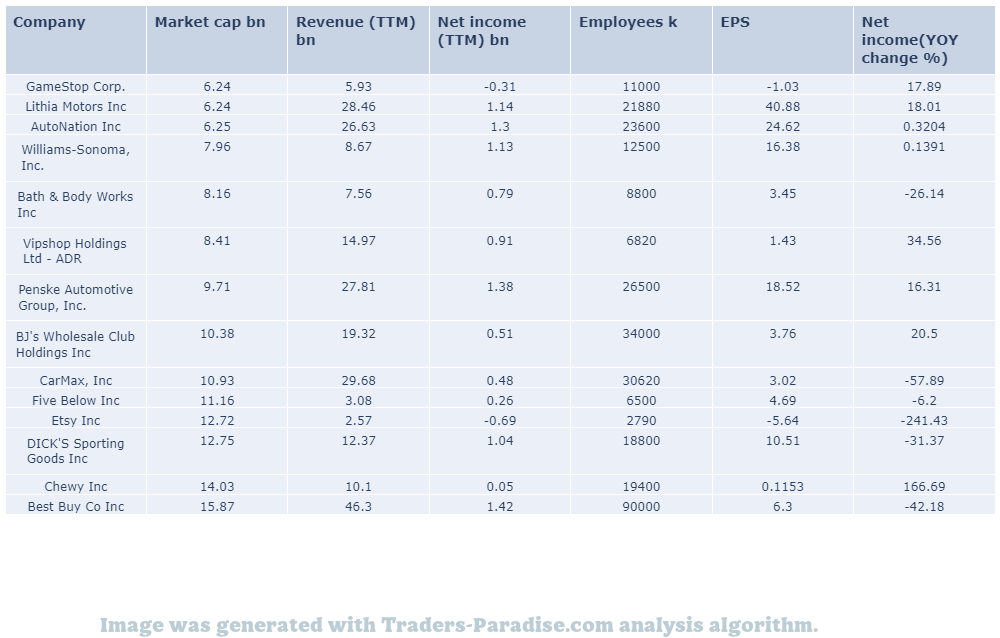

#14 Trading idea on KMX

Company Name: Carmax Inc

Symbol: KMX

Sector: Consumer Discretionary

Company Description: CarMax is a used vehicle retailer based in the United States. It operates two business segments: CarMax Sales Operations and CarMax Auto Finance. It has a fleet of more than 100,000 vehicles in its fleet. It sells vehicles through its own stores and online.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KMX — CarMax, Ford, Blink Charging and XPeng are part of top Analyst Blog.

CarMax, Ford, Blink Charging and XPeng are part of the Zacks top Analyst Blog. Zacks Analyst Blog highlights CarMax and Ford as well as XPeng on the Analyst Blog’s list of high-ranked companies. Â

- News story for KMX — Stocks to avoid this week: What you need to know

3 Stocks to Avoid This Week: These investments seem pretty vulnerable right now and are not worth investing in at the present time. i.e. these stocks are not safe to invest in at this moment in time, and they are not financially viable.

- News story for KMX — CarMax posts mixed fiscal Q4 results. Ford to spend C$1.8 billion on high-volume EV manufacturing hub

CarMax reports mixed fiscal Q4 results. Ford announces plans to spend C$1.8 billion on its Oakville, ON, manufacturing site to transform it into a high-volume EV manufacturing hub. KMX’s Quarterly Show is held.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

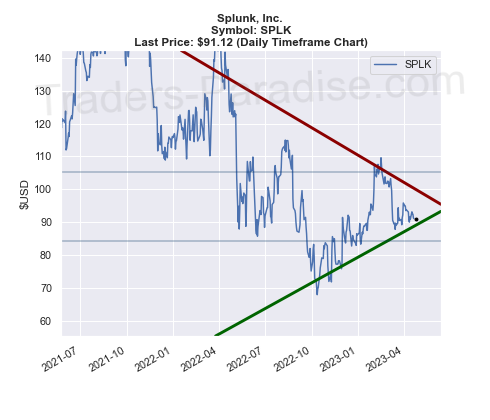

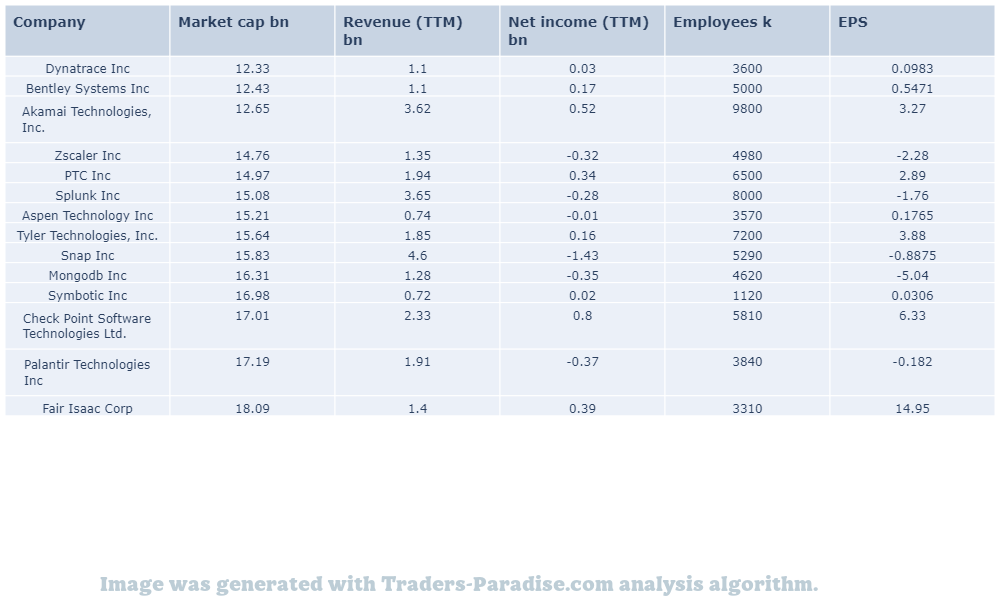

#15 Trading idea on SPLK

Company Name: Splunk, Inc.

Symbol: SPLK

Sector: Technology

Company Description: Splunk Inc. provides software and cloud solutions that deliver and operationalize insights from data generated by digital systems in the United States and internationally. The company is headquartered in San Francisco, California, and is a subsidiary of Splunk Inc., which is a software company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SPLK — Datadog is an Outstanding But Over-Priced Data Monitor.

adog is an outstanding but over-priced data monitoring device. . For confidential support call the Samaritans on 08457 90 90 90 or visit a local Samaritans branch, see www.samaritans.org for details.

- News story for SPLK — Shares of Splunk closed at $91.12 in recent trading session

unk (SPLK) closed at $91.12, marking a -0.23% move from the previous day. Splunk stock is down 0.23%. Splunk’s stock is up 0.3% from previous day to $91:00.

- News story for SPLK — Splunk and NIO have been highlighted as Bull and Bear of the Day.

Splunk and NIO have been highlighted as Zacks Bull and Bear of the Day in the Zacks article. They are part of the article about the Bull and the Bear from Zacks magazine. The article is titled, “The Bull and The Bear”.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

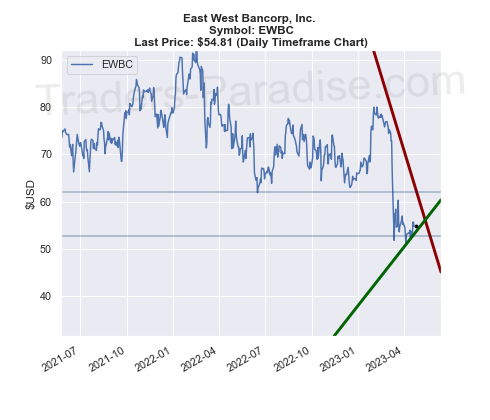

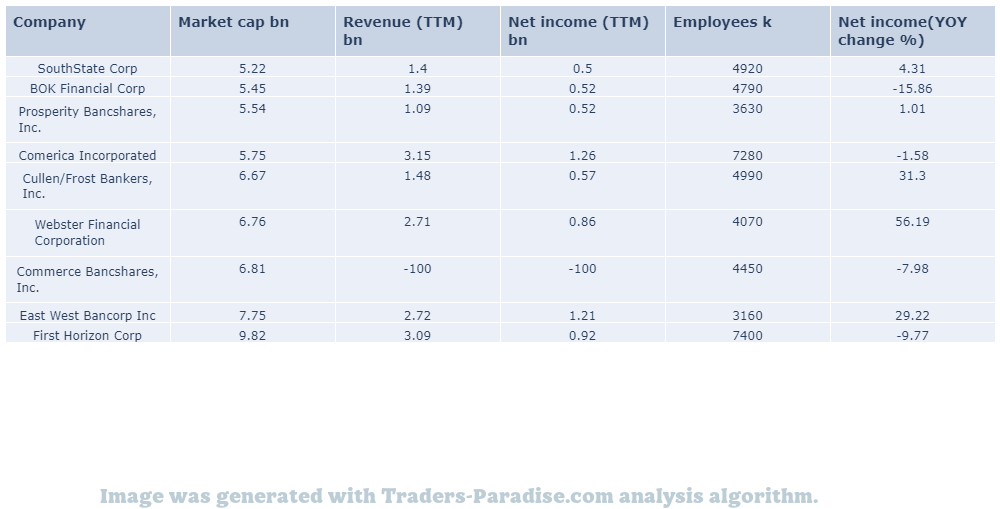

#16 Trading idea on EWBC

Company Name: East West Bancorp, Inc.

Symbol: EWBC

Sector: Financial

Company Description: East West Bancorp, Inc. provides a range of personal and commercial banking services to businesses and individuals in the United States and Greater China. The company is headquartered in Pasadena, California. It is the banking holding company for East West Bank.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for EWBC — .

The Dividend Champion, Contender, and Challenger Highlights are from the week of April 23. The highlights are from this week’s Business Insider magazine, published on April 23rd and April 24th, and cover the week’s top stories.

- News story for EWBC — East West reports higher NII net interest income, loan balances.

East West Bancorp’s Q1 earnings beat on higher net interest income and an increase in loan balances. However, a rise in provisions and expenses hurt the company’s profits. The company’s shares are up 1%. -EWBC.

- News story for EWBC — East West (EWBC) has an average price target of $75.0.

7 analysts have published their opinion on East West Bancorp (NASDAQ:EWBC) stock in the last 3 months. The company has an average price target of $75.0 with a high of $80.0. The analysts are typically employed by large Wall Street banks.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

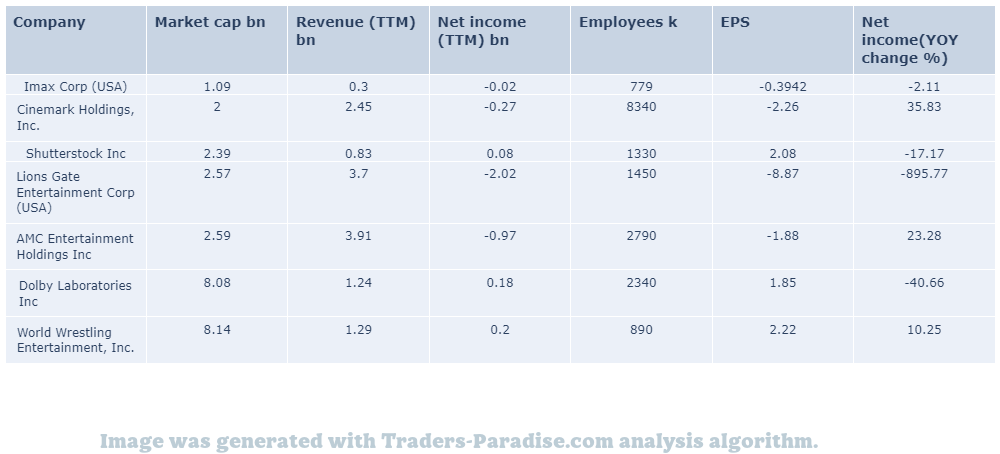

#17 Trading idea on AMC

Company Name: AMC Entertainment Holdings Inc

Symbol: AMC

Sector: Consumer Discretionary

Company Description: AMC Entertainment Holdings, Inc. is involved in the theatrical business. The company is headquartered in Leawood, Kansas and has a film production division. “The Dark Knight Rises” is scheduled to be released on October 25th.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for AMC — Strategist says stocks need to drop 15% to recover.

Even without an earnings apocalypse, stocks still need to drop 15% this week, according to strategist. – MarketWatch.com’s call of the day is that investors will not be out of the woods even if earnings news is not a disaster this week.

- News story for AMC — Shares of the company closed at $4.99 on Tuesday

AMC Entertainment (AMC) closed at $4.99 in the latest trading session, marking a +0.4% move from the prior day. The stock market gains outpaced the AMC Entertainment’s share price gain.

- News story for AMC — Benchmark raises fiscal first-quarter box-office growth estimates.

AMC reports its fiscal first-quarter results before market open on May 5th. AMC growth estimates raised by Benchmark, citing box-office performance of “The Hobbit” and “The Dark Knight Rises” among other films that boosted the company’s performance.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

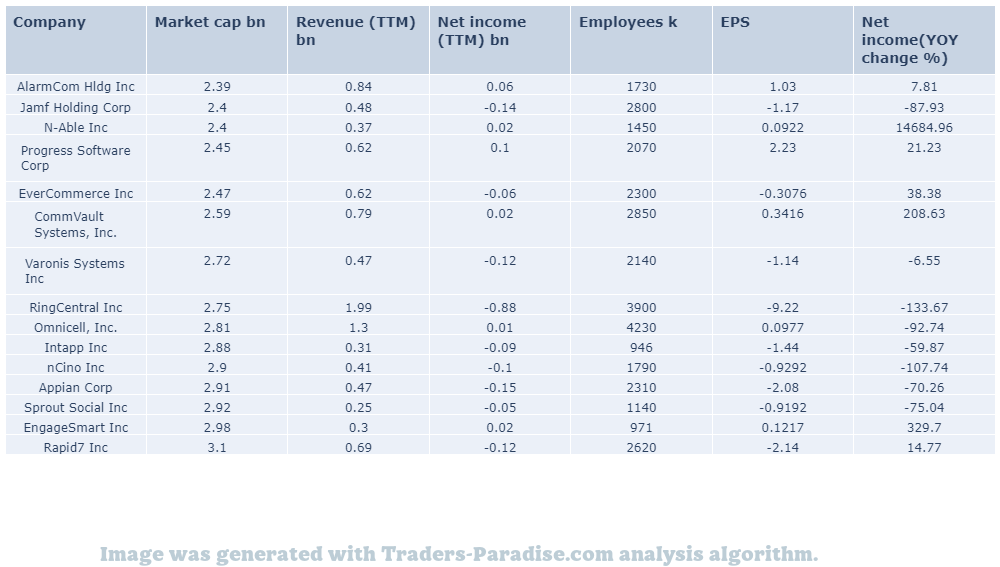

#18 Trading idea on RNG

Company Name: RingCentral Inc

Symbol: RNG

Sector: Technology

Company Description: RingCentral, Inc. offers software-as-a-service solutions that enable businesses to communicate, collaborate and connect in North America. The company is headquartered in Belmont, California and offers its services in English and in Spanish. for more information, visit ringcentral.com.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for RNG — Bullish Somewhat Bullish Indifferent Somewhat Bearish Total Ratings 5 2 3 0 0 Last 30D 1 0 0 0 1M Ago 1 0 0

In the last 3 months, 10 analysts have offered 12-month price targets for RingCentral. The company has an average price target of $46.9 with a high of $62.00 and a low of $35.00. The greater the number of bullish ratings, the more positive analysts are on the stock.

- News story for RNG — RNG has posted better-than-expected results in three of the last four quarters.

RingCentral (RNGR) has an impressive earnings surprise history. RingCentral’s next quarterly report is expected to beat estimates again. RNGR currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly earnings report.

- News story for RNG — Surge in AI hiring is a ‘beacon of light’ for tech world.

AI has been a ‘beacon of light for the tech world’ after months of layoffs, high interest rates and the collapse of Silicon Valley Bank, says one tech exec. Startups are hiring for the next big thing and AI is a good fit.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

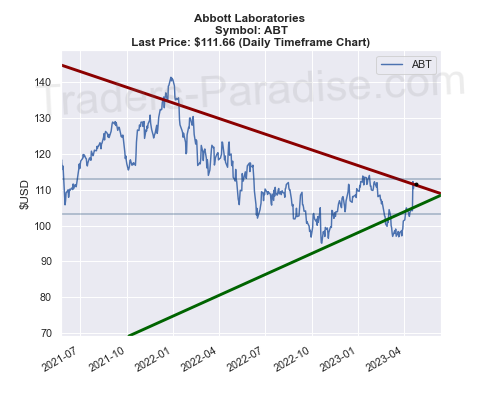

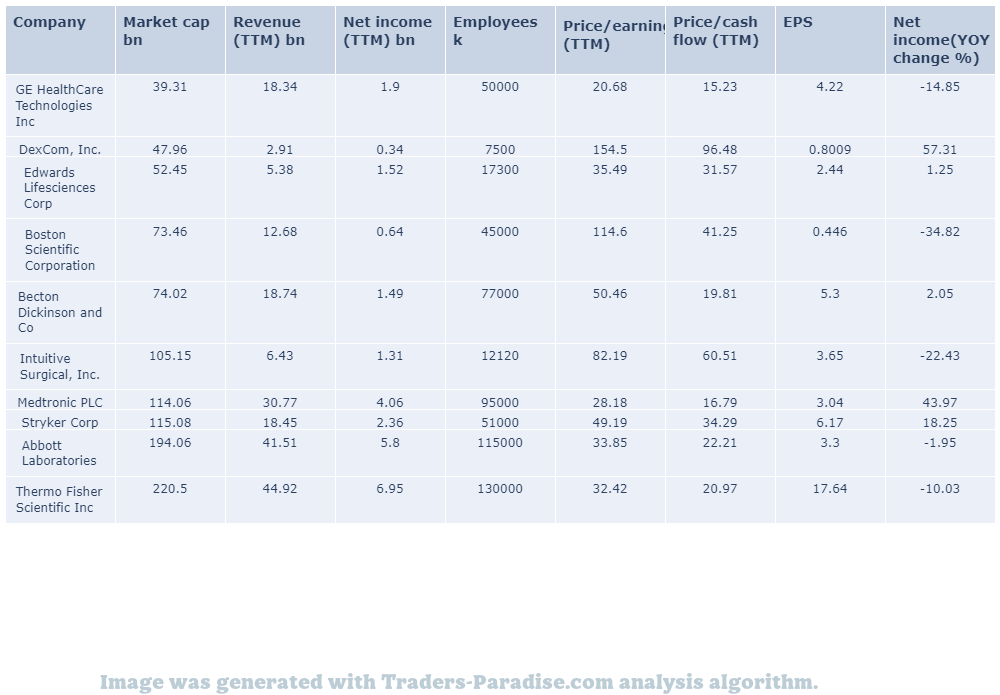

#19 Trading idea on ABT, might be reaching some kind of top

Company Name: Abbott Laboratories

Symbol: ABT

Sector: Healthcare

Company Description: Abbott Laboratories was founded by Chicago physician Wallace Calvin Abbott in 1888. It sells medical devices, diagnostics, branded generic medicines and nutritional products. It split off its research-based pharmaceuticals business into AbbVie in 2013. It has its headquarters in Abbott Park, Illinois.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ABT — Is Abbott Laboratories still a good dividend stock to buy?

a better-than-expected first-quarter report pushed it much higher. Abbott Laboratories is still a good dividend stock to buy. in this situation in my opinion. In my opinion in Abbott Laboratories in the current situation to buy it.

- News story for ABT — Management raises full-year EPS view on increased patient admissions.

HCA Healthcare’s first-quarter results gain from increased patient admissions. Management expects EPS within the $17.25-$18.55 band this year, higher than the previous view of $16.40-$17.60. HCA beats on Q1 earnings.

- News story for ABT — Morgan Stanley cuts Charter Communications price target, BMO Capital cuts Morgan Stanley.

Charter Communications shares fell 1.6% to $338.33 on Thursday. Truist Securities raised the price target for Airbnb from $120 to $130. Argus Research cut U.S. Bancorp’s price target from $63 to $63.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

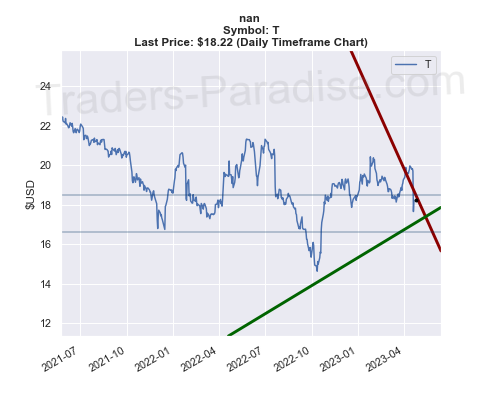

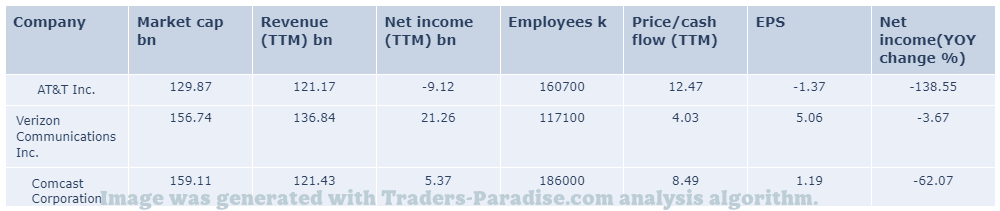

#20 Trading idea on T, might be reaching some kind of top

Company Name: nan

Symbol: T

Sector: Technology

Company Description: AT&T Inc. is the world’s second largest provider of mobile telephone services. It is headquartered at Whitacre Tower in Downtown Dallas, Texas. It’s a Delaware-registered but is headquartered in a building that is Delaware registered but is located in Texas.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for T — AT&T: Mr. Market’s Big Gift To The Bulls.

AT&T is Mr. Market’s big gift to the Bulls. AT&T will give the Bulls a big gift. AT&Ts will give a gift to the Bulls by giving them a big market share increase. iReport.com:

- News story for T — Wall Street is baffled by plunge in AT&T shares. Telecom giant reported better-than-expected earnings

AT&T bulls are out to defend the telecommunications stock Friday in the wake of a historic post-earnings selloff. AT&T stock’s “historic” plunge baffles Wall Street: “There is no fundamental explanation” for the drop.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

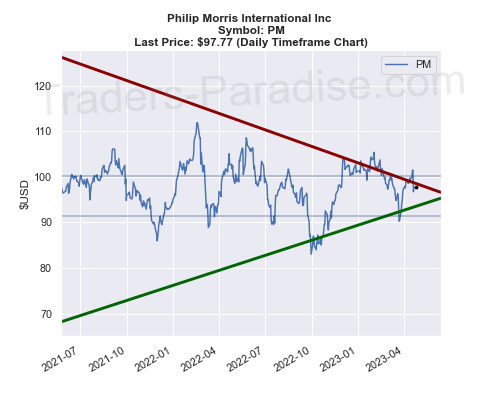

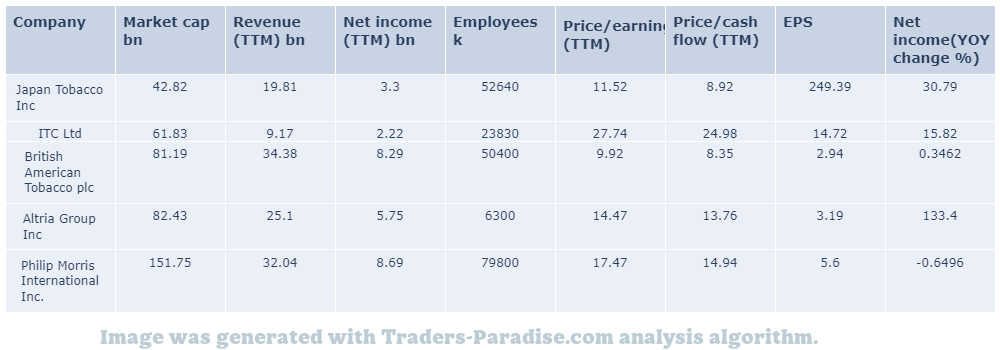

#21 Trading idea on PM, might be reaching some kind of top

Company Name: Philip Morris International Inc

Symbol: PM

Sector: Industrial Goods

Company Description: Philip Morris International Inc. is a Swiss-American multinational cigarette and tobacco manufacturing company with products sold in over 180 countries. The most recognized and best selling product of the company is Marlboro. PMI’s products are sold in all the world’s major markets.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PM — 10 dividend stocks with rising payouts.

10 dividend stocks with at least 4.5% yield are rated ‘buy’ by most analysts. They are expected to raise their payouts by as much as 15% through 2025, according to some estimates. Â –

- News story for PM — All images are copyrighted.

12 Dividend Aristocrats That Should Leave You Swimming In Cash: Shareholders should be happy with their current share price and their current dividend. Shareholders can buy shares of these companies on the NYSE and the S&P 500. Shareholder shares can also be bought on the CAC.

- News story for PM — Tobacco, discount retailer look to be solid long-term picks.

Tobacco company and discount retailer look to be solid long-term picks for dividend investors. A tobacco company and a discount retailer are the 2 top dividend stocks to buy now, according to Morningstar’s list of the top 10 dividend stocks in the United States.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

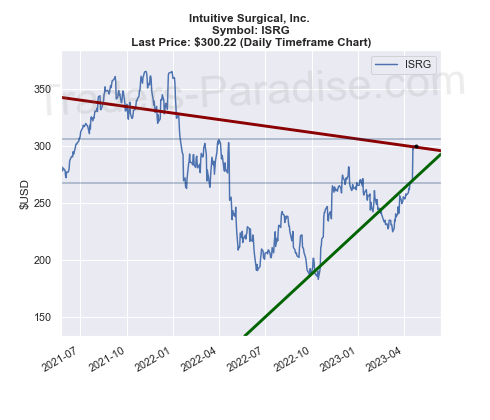

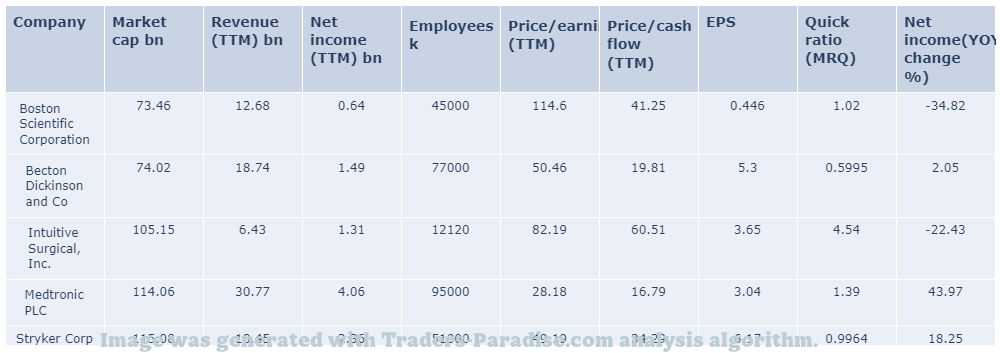

#22 Trading idea on ISRG, might be reaching some kind of top

Company Name: Intuitive Surgical, Inc.

Symbol: ISRG

Sector: Healthcare

Company Description: Intuitive Surgical, Inc. is an American corporation that develops, manufactures, and markets robotic products designed to improve clinical outcomes of patients through minimally invasive surgery. The da Vinci Surgical System is a robotic system developed by Intuitive Surgic.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ISRG — Top stocks to invest $20,000 in right now.

The best stocks to invest $20,000 in right now are these top stocks. You’ll want to hold on to these stocks for the long-term. – The Best Stocks to Invest $20k in Right Now are these stocks.

- News story for ISRG — Shares of e-commerce firm Amazon are up more than 20% this year.

Investing $5,000 in this stock 20 years ago would have made you a millionaire today. There’s still plenty of growth ahead for the business and it’s still worth investing in. for the future. For more information, go to: http://www.cnn.com/investorprofiles/investing-in-this-stock/

- News story for ISRG — Investment Ideas feature highlights: Nvidia, First Solar, Intuitive Surgical, Dexcom and Asure Software.

Nigro, First Solar, Intuitive Surgical, Dexcom, and Asure Software are featured in the Zacks Investment Ideas article. Â . in the article are: Nvidia, First solar, IntraSurgical and Dexcom.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#23 Trading idea on GILD, might be reaching some kind of top

Company Name: Gilead Sciences Inc.

Symbol: GILD

Sector: Healthcare

Company Description: Gilead Sciences, Inc. is a biopharmaceutical company based in Foster City, California. It focuses on developing antiviral drugs used in the treatment of HIV, hepatitis B, hepatitis C, and influenza. Its products include Harvoni and Sovaldi.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GILD — Investors are likely to focus on HIV franchise performance and oncology sales.

HIV franchise performance and oncology sales will be the focus when Gilead reports its first-quarter 2023 results. Gileads is expected to report its results on January 1st, 2023, and focus will be on HIV and Oncology.

- News story for GILD — Gilead Sciences has a 3.6% dividend yield.

Bryn Talkington of Requisite Capital Management named Gilead Sciences, Inc. (NASDAQ: GILD) as a good stock to own this year. GILD has 7% free cash flow yield and a 3.6% dividend yield. Morgan Stanley recently maintained the company with an Equal-Weight rating and raised the dividend.

- News story for GILD — The company is expected to report better-than-expected earnings.

Gilead Sciences (GILD) is expected to beat earnings estimates for the first quarter of this year. Gilead possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations ahead of the Q1 release.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.

Leave a Reply