Most recent news about the financial markets

- S&P 500 shows stronger support at 3970, says McMillan.

The stock market is pushing back as investors look for a confidence boost. S&P 500 shows stronger support at 3970. A close below 3950 would be bearish for the market, writes Lawrence McMillan. The market is up 1.5% today.

- S&P 500 ETF Trust snaps three-week winning streak. U.S. economy added 236,000 new jobs in March

U.S. economy added 236,000 new jobs in March. Wages grew 4.2% year-over-year and the unemployment rate ticked lower from 3.6% to 3.5%. World Wrestling Entertainment, Inc. (NYSE: WWE) announced it will be merging with UFC to form a new public company.

- The S&P 500 ETF Trust traded lower for the first time in four weeks.

The U.S. added 236,000 jobs in March, missing economist estimates of 240,000. The unemployment rate fell 0.1% to 3.5%. Wages were up 4.2% year-over-year and increased 0.3% from February.

- U.S. adds 236,000 jobs in March, missing expectations. Unemployment rate remains at 3.5%, unchanged from February

The U.S. added 236,000 jobs last month, below the average economist estimate of 240,000. The unemployment rate is at 3.5%, below economist estimates of 3.6%. The labor participation rate continued to rise to 62.6%, compared to the 63.4% pre-COVID-19 pandemic rate in February 2020. Wages were up 4.2% year-over-year and increased 0.3% from February.

- Bond funds saw record inflows in first quarter. Investors showed ‘a lot of restraint’ in the first quarter

Bonds have been the hot spot for money flowing into exchange-traded funds this year. In the first quarter, investors showed restraint and chose bonds over other investment options. iReport.com will let you know if you want to invest in bonds.

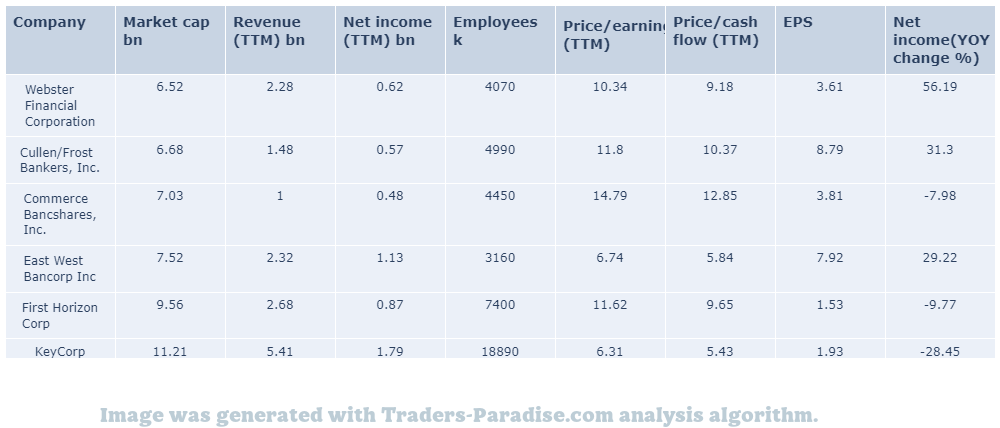

#1 Trading idea on FHN

Company Name: First Horizon National Corporation

Symbol: FHN

Sector: Financial

Company Description: First Horizon Corporation is the banking holding company for First Horizon Bank providing various financial services. The company is headquartered in Memphis, Tennessee and is the bank’s parent company. It is a publicly traded company with a market capitalization of $1.2 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for FHN — IVOV is a mid-cap value ETF.

Vanguard S&P Mid-Cap 400 Value ETF (IVOV) should be on your investing radar? Style Box ETF report for IVOV is available on the website of Vanguard’s investment advisor, who recommends IVOV as a suitable investment for investors.

- News story for FHN — KRE is a strong ETF for regional banking.

SPDR S&P Regional Banking ETF (KRE) is a strong ETF right now. Smart Beta ETF report for KRE has been published. It is based on the Smart Beta report for the KRE’s Smart Beta exchange traded fund (ETF).

- News story for FHN — Strong fundamentals, good growth prospects make BlackRock an attractive investment option.

There are 4 reasons to add BlackRock (BLK) stock to your portfolio now. BlackRock is driven by strong fundamentals and good growth prospects and seems to be an attractive investment option now. It has a good chance to grow in the long term.

TECHNICAL ANALYSIS

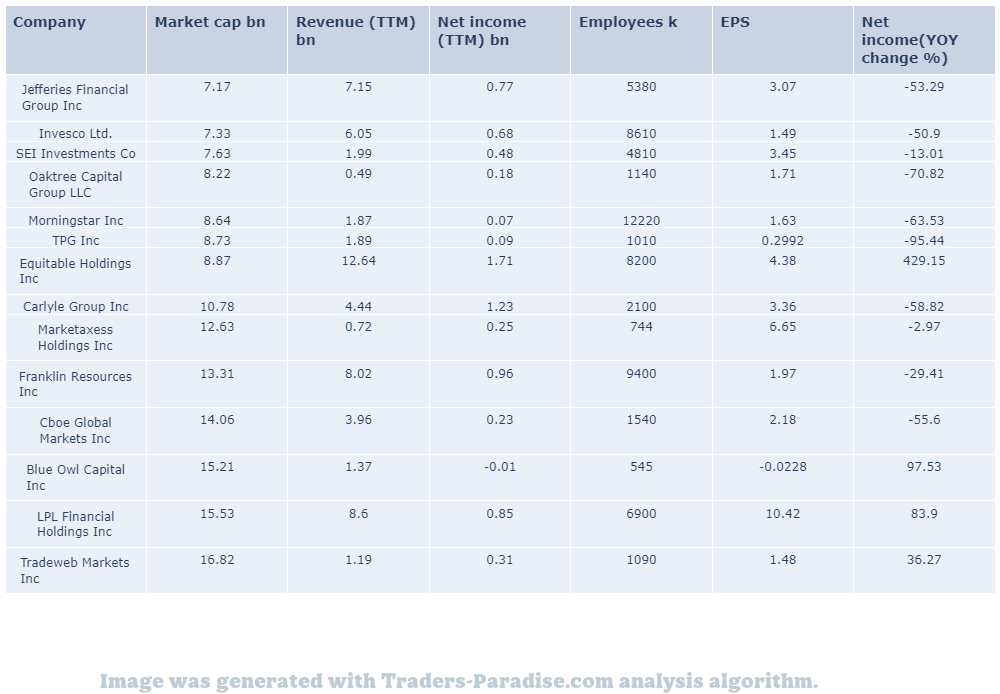

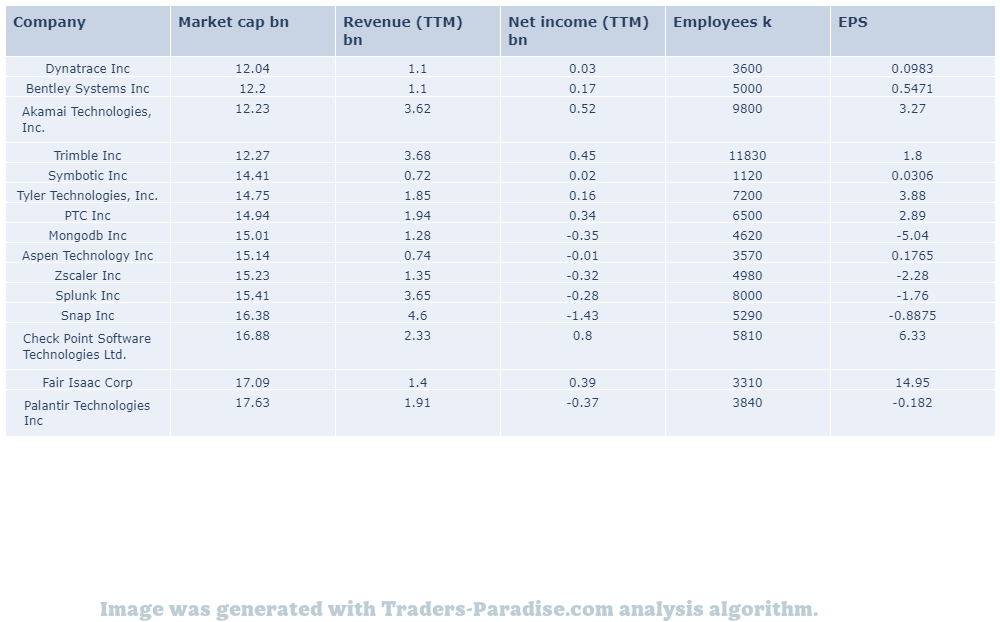

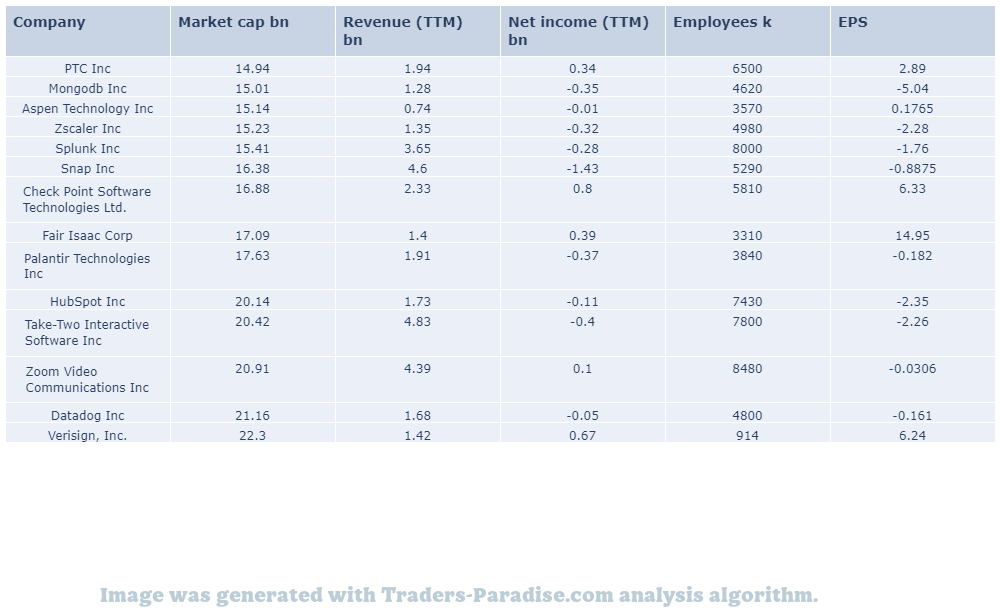

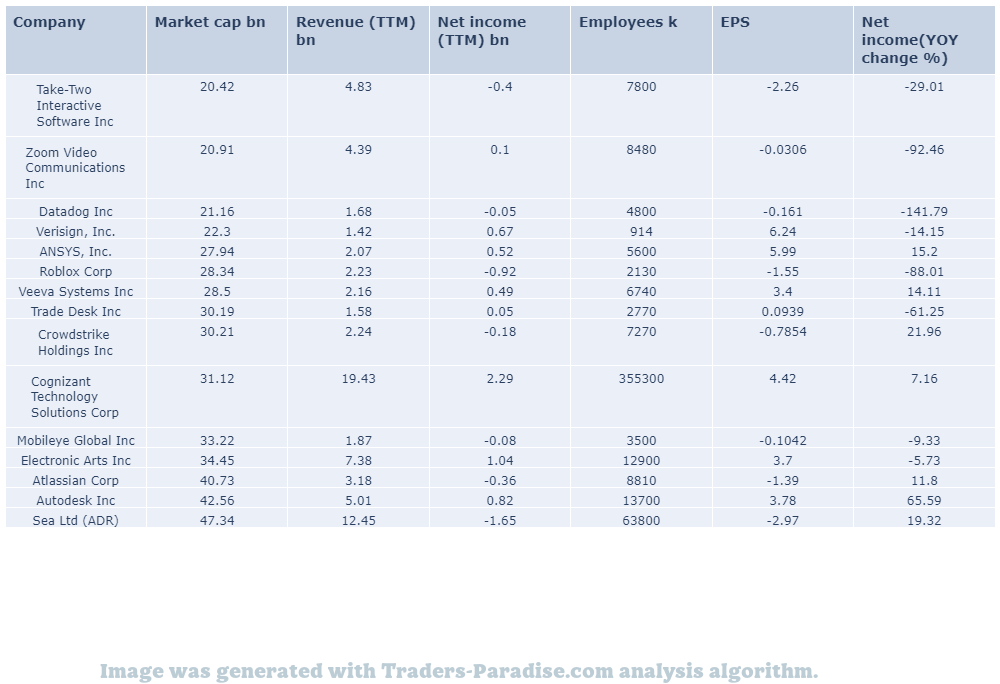

PEERS AND FUNDAMENTALS

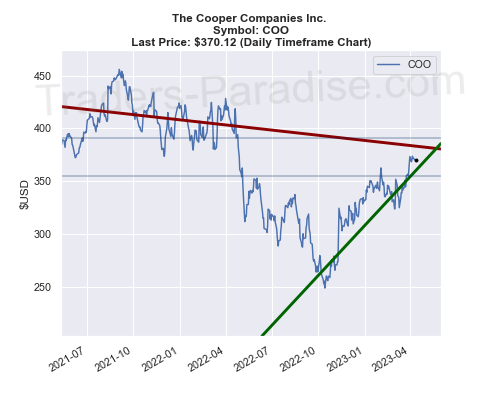

#2 Trading idea on COO

Company Name: The Cooper Companies Inc.

Symbol: COO

Sector: Healthcare

Company Description: The Cooper Companies, Inc. is a global medical device company headquartered in San Ramon, California. The company is branded as CooperCompanies. CooperCompanies.com is a brand of CooperCompanies, Inc., a medical device manufacturer.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for COO — Pricing pressure weighs on the company.

Stryker (SYK) continues to benefit from strength in the robotic arm-assisted surgery platform, Mako, and its broad product portfolio. However, pricing pressure weighs on the company. Here’s why you should add Stryker stock to your portfolio.

- News story for COO — Surmodics (SRDX)

Surmodics (SRDX) has good prospects in the thrombectomy business. Here’s why you should keep the stock for now, as it’s a good investment choice for now. – for investors who are optimistic about Surmodics’ prospects.

- News story for COO — Inari Medical (NARI) is a medical technology company.

Inari Medical (NARI) continues to benefit from its commitment to understand the venous system. However, its dependency on the adoption of products is concerning. Here’s why you should retain Inari Medical’s stock now. Â

TECHNICAL ANALYSIS

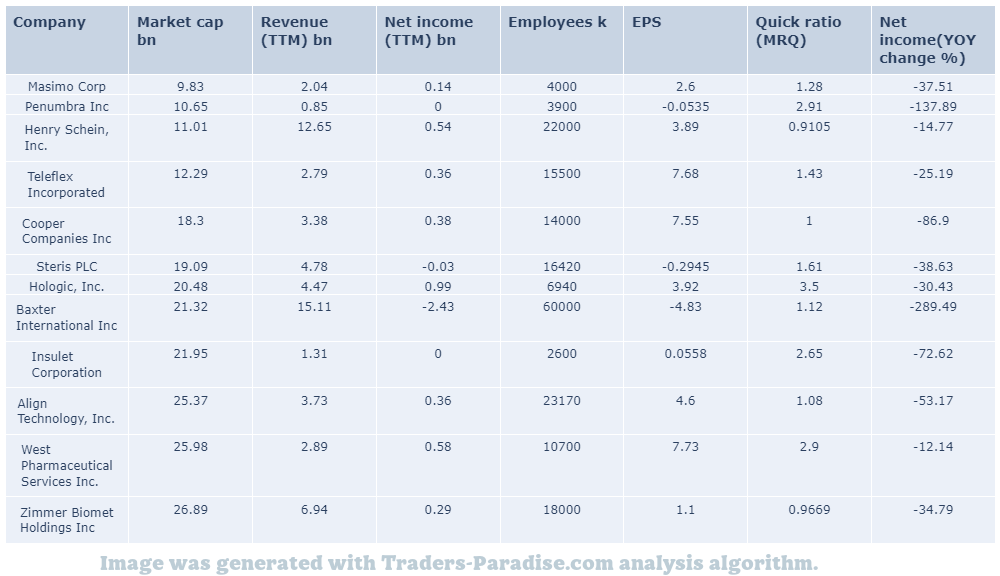

PEERS AND FUNDAMENTALS

#3 Trading idea on CME

Company Name: CME Group Inc.

Symbol: CME

Sector: Financial

Company Description: CME Group Inc. is an American global markets company. It is the world’s largest financial derivatives exchange. It trades in asset classes that include agricultural products, currencies, energy, interest rates, metals, stock indexes and cryptocurrencies futures. It also operates Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantil Exchange and The Commodity Exchange.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CME — CME has an impressive earnings surprise history and currently possesses the right combination of the two.

CME (CME) has an impressive earnings surprise history. CME has the right combination of the two key ingredients for a likely beat in its next quarterly report. C ME is expected to beat the estimates again. C MIe is a small company with a small market cap.

- News story for CME — Cboe Global rallies on strong market position, global reach, higher logical port fees.

Cboe Global (CBOE) stock is up 16.5% in a year. Cboe has strong market position, global reach, higher logical port fees and physical port fees, favorable growth estimates and solid capital position. CBOE’s stock rallies on the back of strong market positions and global reach.

- News story for CME — The company has been upgraded to a Rank #2 (Buy).

CME (CME) has been upgraded to a Zacks Rank #2 (Buy). This reflects growing optimism about the company’s earnings prospects. This might drive the stock higher in the near term. CME is a new buy stock according to the Zacks analysts.

TECHNICAL ANALYSIS

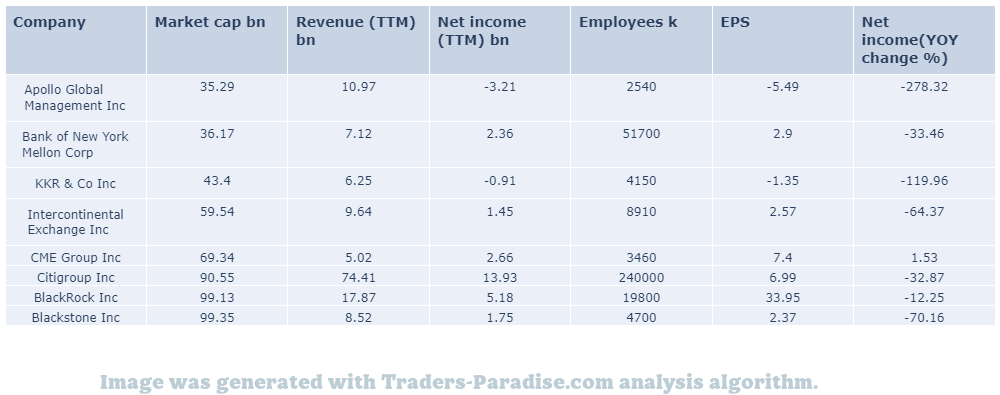

PEERS AND FUNDAMENTALS

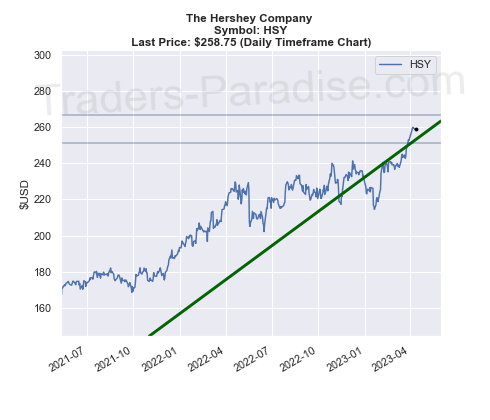

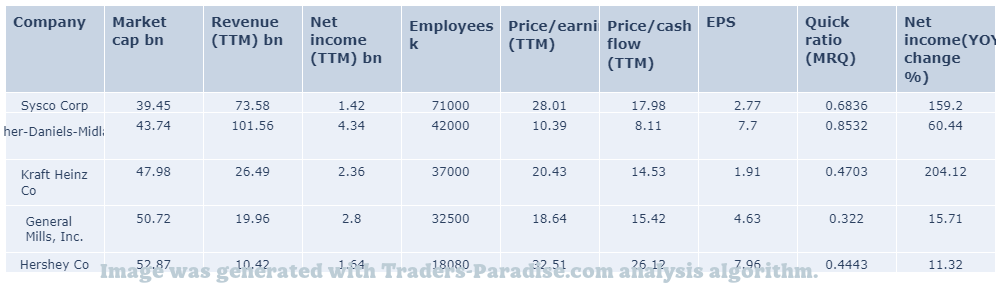

#4 Trading idea on HSY

Company Name: The Hershey Company

Symbol: HSY

Sector: Consumer Goods

Company Description: Hershey’s is one of the largest chocolate manufacturers in the world. It also manufactures baked products, such as cookies and cakes, and sells beverages like milkshakes. Its headquarters are in Hershey, Pennsylvania, and the company is based in the United States.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HSY — Time-tested methodologies helped investors navigate the market well last week.

Zacks’ time-tested methodologies helped investors navigate the market well last week. Here are some of the key performance data from the past three months. Take the Zacks Approach to Beat the Market: NVIDIA, Novo Nordisk, Magenta in Focus.

- News story for HSY — Passive income grew by 22.63% in February and 46.87% in March.

Nicholas Ward’s passive income stream grew by 22.63% in February and by 46.87% in March. Read more as I review my February and March results in this piece. Nicholas Ward’s Dividend Growth Portfolio: Special Fixed Income Edition.

- News story for HSY — Nike joins other brands supporting trans rights.

Nike teams up with trans activist Dylan Mulvaney. Kid Rock and Travis Tritt called for boycotting Anheuser-Busch for partnering with the trans actress. More brands are still supporting trans rights. Â

TECHNICAL ANALYSIS

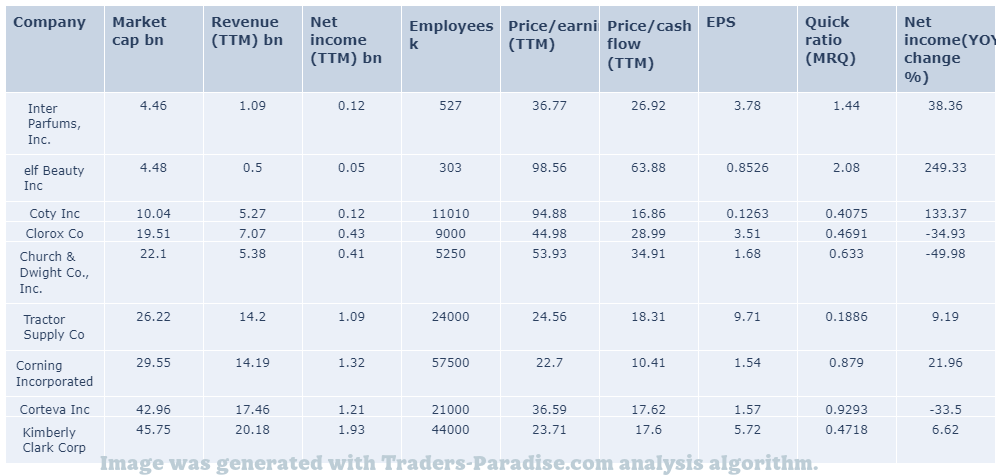

PEERS AND FUNDAMENTALS

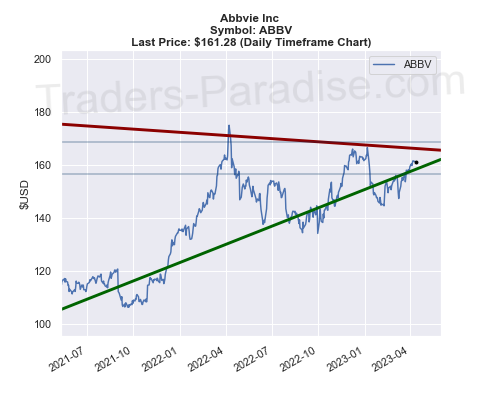

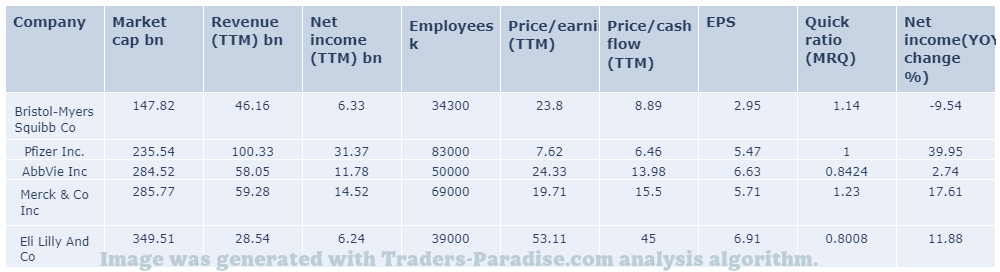

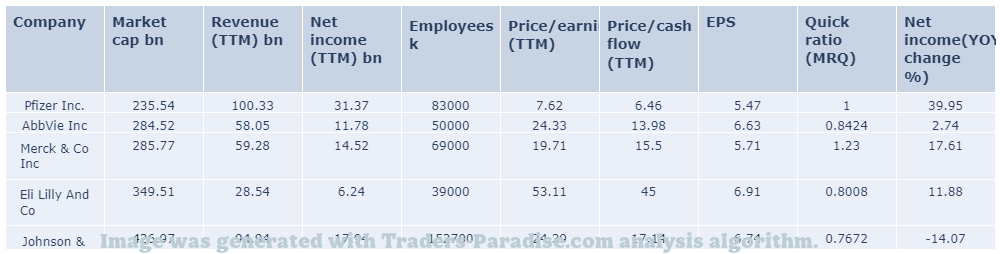

#5 Trading idea on ABBV

Company Name: Abbvie Inc

Symbol: ABBV

Sector: Healthcare

Company Description: AbbVie is an American publicly traded biopharmaceutical company. It originated as a spin-off of Abbott Laboratories. It was founded in 2013. It’s a publicly traded company that was created as a result of a merger between Abbott and Abbvie.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ABBV — Approval based on confirmatory studies not supported.

AbbVie and J&J withdraw the FDA’s accelerated approval for Imbruvica in two blood cancer treatments. Confirmatory studies data do not support full approval, according to the company’s announcement. i.e. the data does not support the full approval.

- News story for ABBV — Invesco Dynamic Pharmaceuticals ETF (PJP) is a strong ETF.

Is Invesco Dynamic Pharmaceuticals ETF (PJPJ) a strong ETF right now? Smart Beta ETF report for PJP is available here. Â – for the PJP. For more information, visit Smart Beta’s website.

- News story for ABBV — Five stocks with high dividend yields are in Warren Buffett’s secret portfolio.

There are five high-yield stocks in Warren Buffett’s Secret Portfolio you can buy right now. The dividend yields for these stocks range from 3.7% to 10.6% and they are all high-Yield stocks.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#6 Trading idea on CLX

Company Name: The Clorox Company

Symbol: CLX

Sector: Consumer Goods

Company Description: The Clorox Company is an American global manufacturer and marketer of consumer and professional products. It is based in Oakland, California. It’s a global manufacturer of consumer products and a marketer in the field of professional products, including cleaners and disinfectants.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CLX — Time-tested methodologies helped investors navigate the market well last week.

Zacks’ time-tested methodologies helped investors navigate the market well last week. Here are some of the key performance data from the past three months. Take the Zacks Approach to Beat the Market: NVIDIA, Novo Nordisk, Magenta in Focus.

- News story for CLX — Wall Street analysts have a negative outlook for Clorox.

Clorox (NYSE:CLX) has observed the following analyst ratings: Bullish, Somewhat Bullish and Bearish. 7 analysts have an average price target of $141.86. The current price of Clorox is $157.69. The greater the number of bullish ratings, the more positive analysts are.

- News story for CLX — Pricing actions, revenue management initiatives, brand strength and digital growth position Colgate for growth

Pricing actions, revenue management initiatives, innovation, brand strength and digital growth position Colgate (CL) for growth amid higher costs and currency headwinds. Here’s why investors should hold Colgate stock for now. – Colgate’s stock is up 2% this morning.

TECHNICAL ANALYSIS

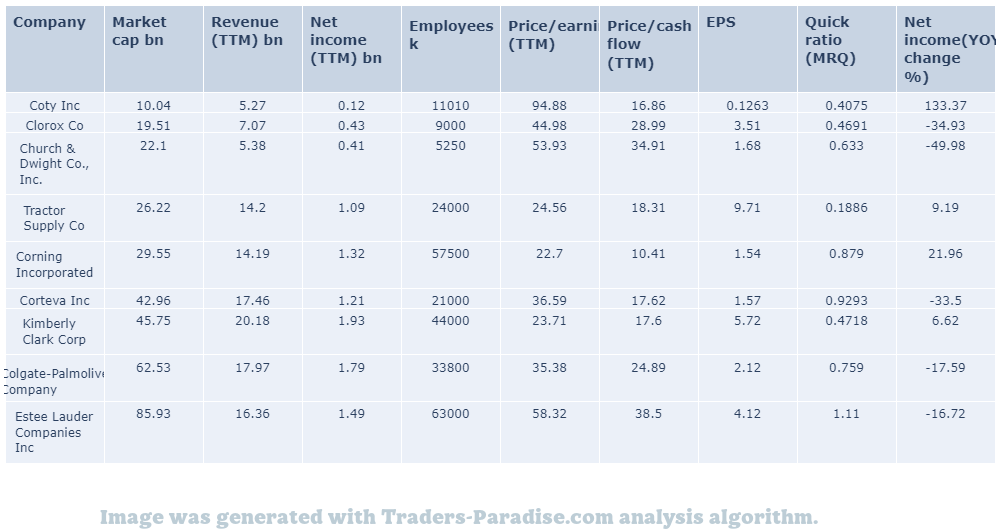

PEERS AND FUNDAMENTALS

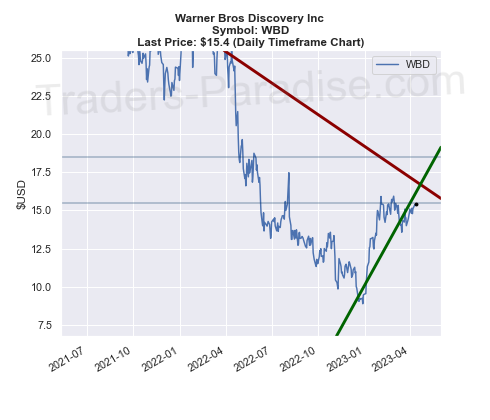

#7 Trading idea on WBD

Company Name: Warner Bros Discovery Inc

Symbol: WBD

Sector: Technology

Company Description: Warner Bros. is headquartered in New York, New York and is owned by Warner Bros. Pictures. The company is a division of Warner Bros., which is based in Los Angeles. It’s worth $2.5 billion in annual revenue.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WBD — Warner Bros. Discovery (WBD)

Warner Bros. Discovery (WBD) closed the most recent trading day at $15.40, moving +1.92% from the previous trading session. WBD outpaced stock market gains by 1.92%. WBD closed the previous session at $14.40.

- News story for WBD — Truist Securities sees potential for revenue growth of 26% over next five years.

Truist Securities initiated the coverage on Warner Bros. Discovery Inc (NASDAQ: WBD) with a price target of $19. The analyst Matthew Thorton writes that the company’s strategy to relaunch HBO Max with Discovery+ content should boost ARPU and subscription renewals. DC Studios is pursuing the Marvel playbook and opportunistically narrowing the significant IP exploitation.

TECHNICAL ANALYSIS

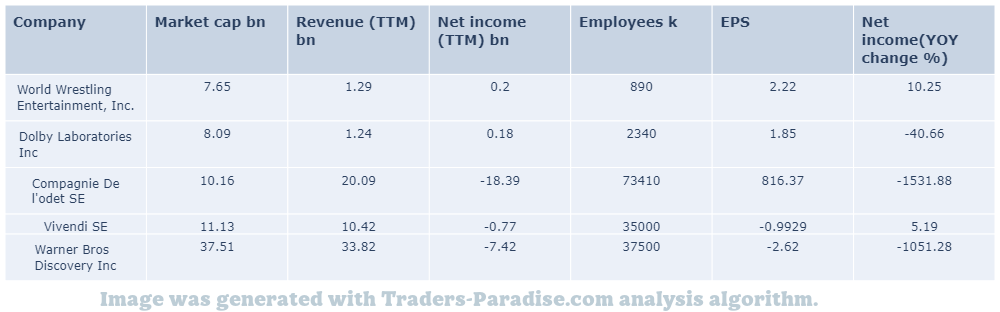

PEERS AND FUNDAMENTALS

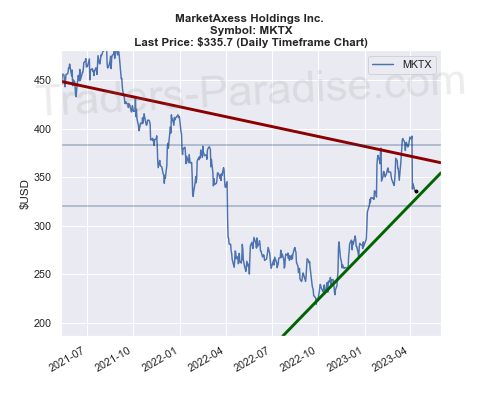

#8 Trading idea on MKTX

Company Name: MarketAxess Holdings Inc.

Symbol: MKTX

Sector: Financial

Company Description: MarketAxess Holdings Inc. operates an electronic trading platform for the institutional credit markets. It also provides market data and post-trade services. MarketAxess is an international financial technology company that operates an e-trading platform for institutional credit market.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MKTX — MarketAxess Holdings has an average price target of $338.7.

MarketAxess Holdings (NASDAQ:MKTX) has an average price target of $338.7 with a high of $415.00 and a low of $288.00. According to 10 analyst offering 12-month price targets in the last 3 months, the average target is $338,7.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

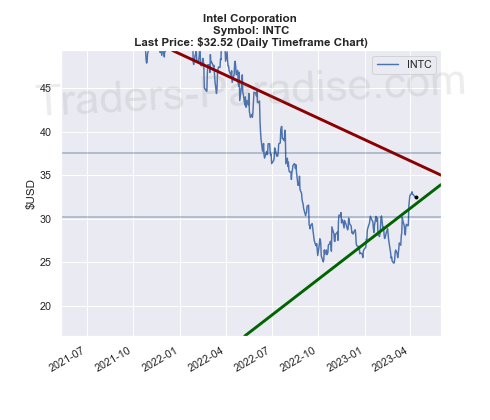

#9 Trading idea on INTC

Company Name: Intel Corporation

Symbol: INTC

Sector: Technology

Company Description: Intel is the world’s largest semiconductor chip manufacturer by revenue. It is the developer of the x86 series of microprocessors, the processors found in most personal computers (PCs). It is headquartered in Santa Clara, California, in Silicon Valley.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for INTC — Shares jumped 20% in March on strong data center sales.

Ngiant shares jumped 20% in March. The company has been making progress in the data center space. The stock rode optimism in the semiconductor industry, which is also good for Nvidia’s stock price. iReport.com: Here’s why Nvidia’s shares rose 20%.

- News story for INTC — Multi-chip prototypes support U.S. Department of Defense.

Intel developed advanced multi-chip prototypes to support the U.S. Department of Defense’s vision of modernization and enhance defense industrial base capabilities. Intel (INTC) Develops Advance Multi-Chip Prototypes for Defense. Intel delivered the prototypes to the Department of Defence.

- News story for INTC — AMD, Intel, and TSMC to benefit from recovery in notebooks.

Notebook shipments are still expected to be down year over year, but it seems the bottom has passed. Notebook Projections Signal Bullish Opportunities for AMD, Intel, and TSMC Stockholders, according to the research firm. iReport.com.

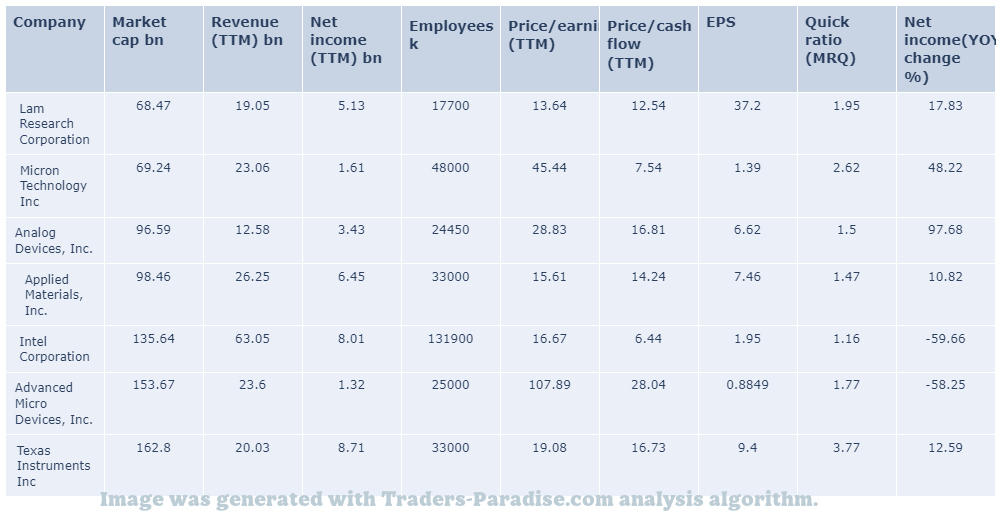

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

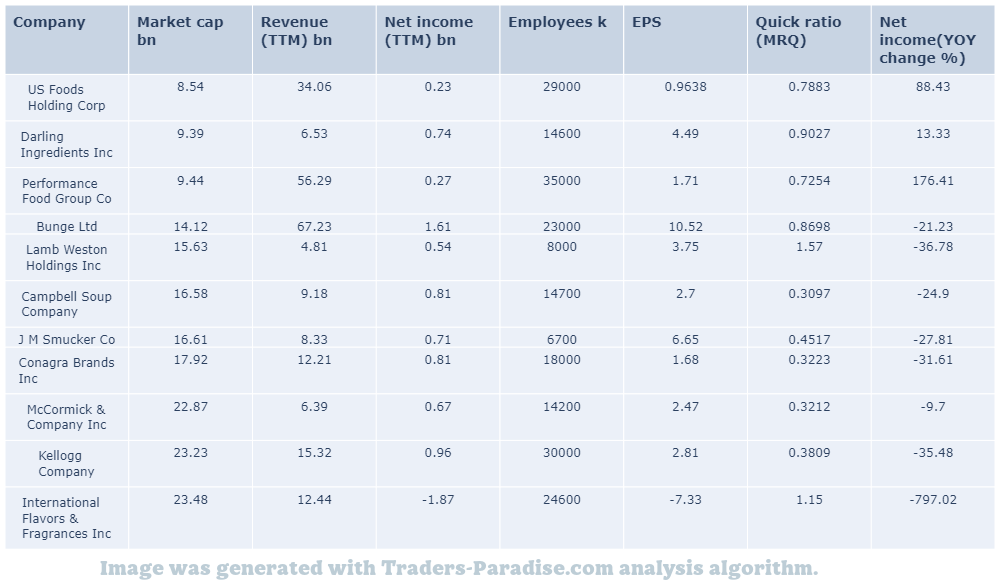

#10 Trading idea on SJM

Company Name: J M Smucker Co

Symbol: SJM

Sector: Industrial Goods

Company Description: The J. M. Smucker Company is an American manufacturer of jam, peanut butter, jelly, fruit syrups, beverages, shortening, ice cream toppings, and other products in North America. Its headquarters are located in Orrville, Ohio.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SJM — Negative net price realization seen in pet food, pet food segments.

The J. M. Smucker (SJM) benefits from its positive net price realization across all segments. The company is also progressing well by focusing on its core strategies. It is focusing on Pricing Efforts & Strategies. It’s also focusing on core business strategies.

- News story for SJM — Goals, current holdings, allocation, sales, and buys of Q1 2023.

Q1 2023 saw S&P 500 up 4% and gave investors a decent start for the year. Click here to read the goals, current holdings, allocation, sales, and buys of my Dividend Growth Portfolio for Q1 202023.

- News story for SJM — McCormick’s P/E ratio is higher than most of its peers

stock soared on Tuesday. McCormick stock doesn’t have a high P/E ratio, but it’s not a reason to avoid the stock either. i in the share price on Tuesday soared by 10% to $8.50.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

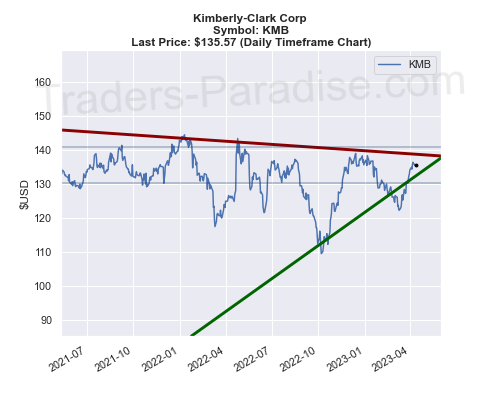

#11 Trading idea on KMB

Company Name: Kimberly-Clark Corp

Symbol: KMB

Sector: Industrial Goods

Company Description: Kimberly-Clark Corporation is an American multinational personal care corporation that produces mostly paper-based consumer products. The company manufactures sanitary paper products and surgical & medical instruments. Its brand name products include Kleenex facial tissue, Kotex feminine hygiene products, Cottonelle, Scott and Andrex toilet paper, Wypall utility wipes, KimWipes scientific cleaning wipes and Huggies disposable diapers and baby wipes.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KMB — Negative net price realization seen in pet food, pet food segments.

The J. M. Smucker (SJM) benefits from its positive net price realization across all segments. The company is also progressing well by focusing on its core strategies. It is focusing on Pricing Efforts & Strategies. It’s also focusing on core business strategies.

- News story for KMB — P&G to report first-quarter results on Thursday. Investors are looking for clarity on growth trends.

Investors are about to get a lot more clarity about P&G’s growth trends. Procter & Gamble stock will be in a different place in a year’s time than it was a year ago. P&P’s growth trend will be more visible.

- News story for KMB — Wall Street’s most accurate analysts rate these stocks.

Medifast, Inc. (NYSE: MED) is one of three high-yielding stocks in the consumer staples sector with a dividend yield of 6.85%. The company has high free cash flows and a high dividend payout. The most accurate Wall Street analysts’ ratings for Medifast are based on Benzinga’s database.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

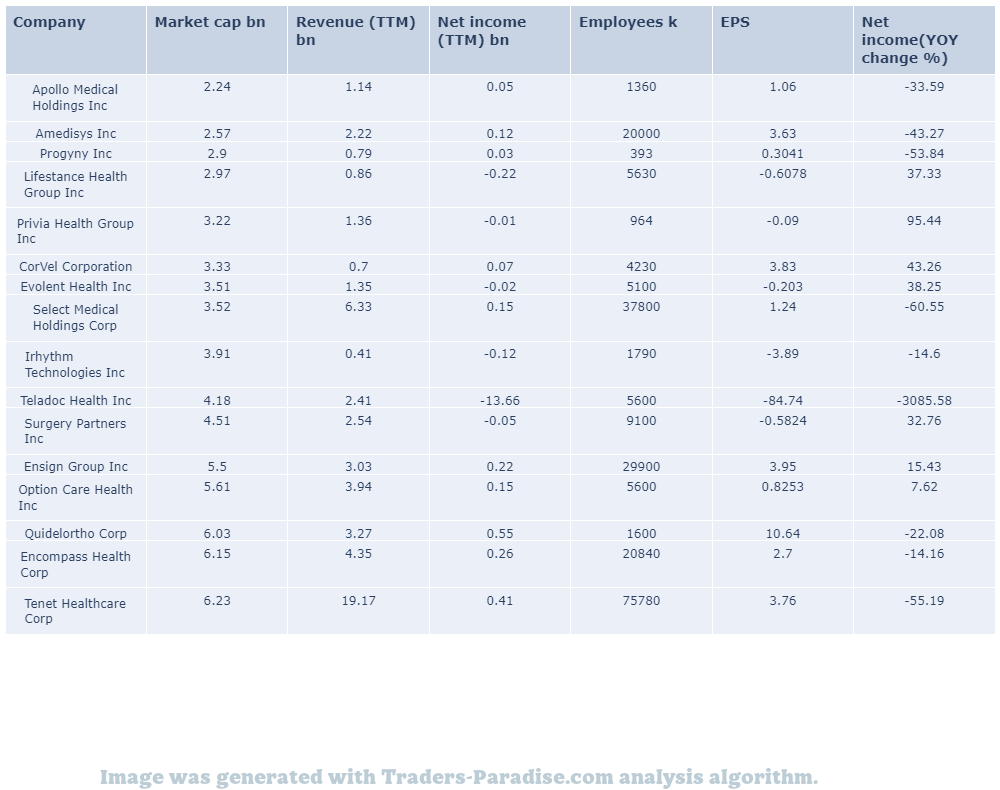

#12 Trading idea on TDOC

Company Name: Teladoc Health Inc

Symbol: TDOC

Sector: Healthcare

Company Description: Teladoc Health provides business-to-business virtual health care services in the United States and internationally. The company is headquartered in Purchase, New York and provides services in both the U.S. and abroad. Teladoc is a privately-owned company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TDOC — How much do you want to invest in stocks?

Even another bear market doesn’t deter investors with the appropriate buy-and-hold horizon. Where to invest $2,500 right now is where to find the best place to do it. . for more information visit: http://www.cnn.com/investing/

- News story for TDOC — Top 5 growth stocks to buy before the next bull market.

It’s the time to prepare your portfolio for better days ahead. 5 Top Growth Stocks to Buy Before the Next Bull Market are listed below. – for more information on these stocks, visit: http://www.cnn.com/investor/top-growth-stocks-to-buy/

- News story for TDOC — Shares of Teladoc closed at $25.61 in recent trading session

oc (TDOC) closed at $25.61, marking a -1.12% move from the previous day. Teladoc stock (TDoc) is down 1.12%. It’s up 1.3% from previous day, down 1%.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

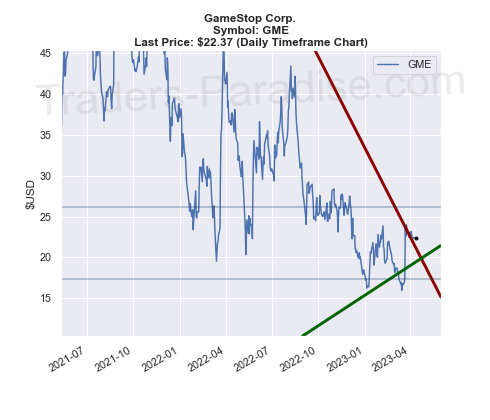

#13 Trading idea on GME, might be reaching some kind of top

Company Name: GameStop Corp.

Symbol: GME

Sector: Services

Company Description: GameStop Corp. is headquartered in Grapevine, Texas, and the company is a subsidiary of GameStop Inc., which is based in New York City. The company is valued at more than $20 billion, according to the company’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GME — Shares of the largest US video game retailer plunged on Tuesday.

GameStop is going out of business. Who will be the next big retailer to go bankrupt? Check out the Meme Stocks page for more information on this topic. It will probably be some time before we see a short squeeze the size of GameStop again.

- News story for GME — MCS, GME, AMK, HUM, ICFI among stocks with low leverage.

Investors seem to be encouraged by the March jobs report. MCS, GME, AMK, HUM, and ICFI are good low-leverage stocks to buy as the U.S. releases the report. The report reflects a resilient economy and moderate inflation.

- News story for GME — SEC chief wants retail orders to be auctioned off. Questions remain on ultimate impact of reforms

Gensler’s meme-stock reforms are meant to help retail traders, but some investor protection advocates aren’t so sure. SEC chief wants retail stock orders to be auctioned off to market makers and exchanges, but questions remain as to the ultimate impact of these reforms.

TECHNICAL ANALYSIS

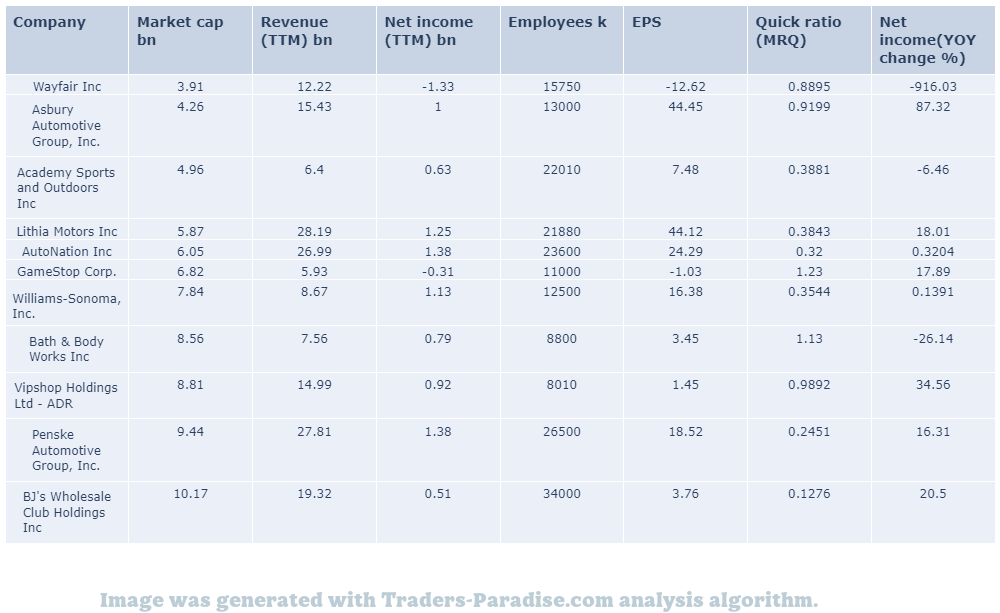

PEERS AND FUNDAMENTALS

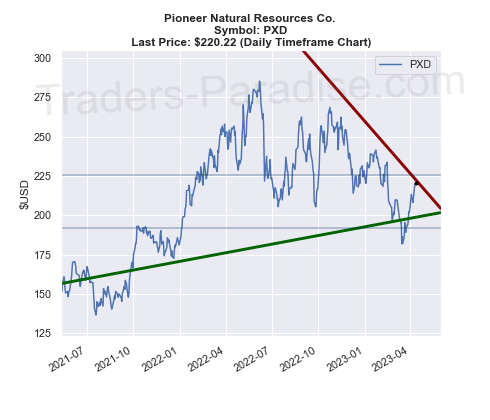

#14 Trading idea on PXD, might be reaching some kind of top

Company Name: Pioneer Natural Resources Co.

Symbol: PXD

Sector: Basic Materials

Company Description: Pioneer Natural Resources Company is a company engaged in hydrocarbon exploration headquartered in Irving, Texas. It operates in the Cline Shale, which is part of the Spraberry Trend of the Permian Basin. The company is the largest acreage holder in the area.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PXD — Markets flat (Russell +1%) with Econ data pending.

Russell +1%, with Econ Data Pending. Market participants biding their time before the next potential market catalyst, as they wait for the next catalyst. – Russell +1%. – Market participants are waiting for a catalyst. – Russell is up 1%.

TECHNICAL ANALYSIS

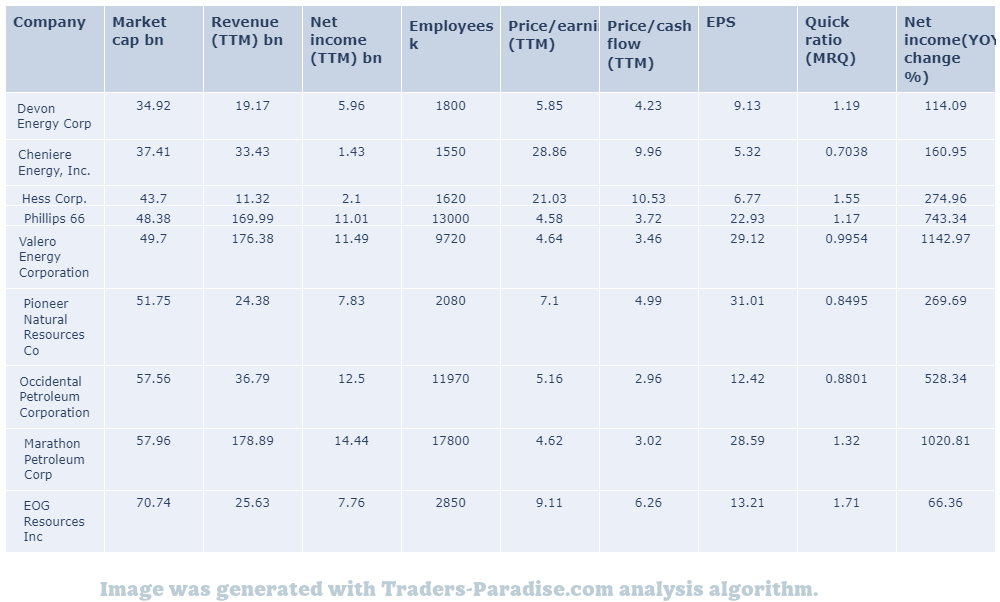

PEERS AND FUNDAMENTALS

#15 Trading idea on MOH, might be reaching some kind of top

Company Name: Molina Healthcare, Inc.

Symbol: MOH

Sector: Healthcare

Company Description: Molina Healthcare, Inc. provides managed care services to low-income individuals and families under the Medicaid and Medicare programs and through the state insurance marketplaces. The company is headquartered in Long Beach, California and provides care to people on Medicaid and through state insurance markets.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MOH — inorganic growth activities, cost-cutting initiatives

Molina’s inorganic growth activities, financial flexibility and cost-cutting initiatives position it well for growth. Here’s why you should retain Molina in your portfolio. . Â moh-investors.com.

- News story for MOH — Health insurer and flooring retailer each have growth potential.

A health insurer and a hard-surface flooring retailer have market-beating potential. They are growth stocks with potential to grow and create wealth for the long-term. They can be bought and tuck away to grow their wealth.

- News story for MOH — 8 analysts have a positive view on the stock.

8 analysts have an average price target of $344.25 for Molina Healthcare. The current price of the stock is $265.12. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the upside potential.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

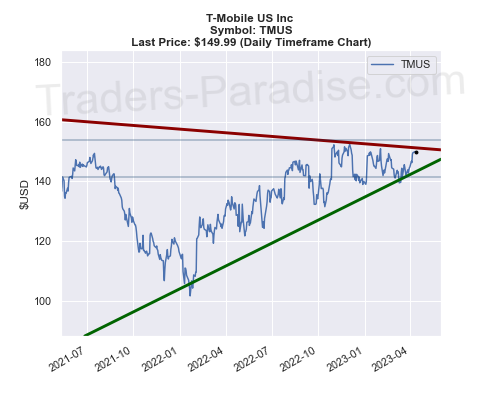

#16 Trading idea on TMUS, might be reaching some kind of top

Company Name: T-Mobile US Inc

Symbol: TMUS

Sector: Technology

Company Description: T-Mobile US, Inc. is an American wireless network operator. Its headquarters are in Bellevue, Washington, in the Seattle metropolitan area and in Overland Park, Kansas, in Kansas City metropolitan area. It does business under the global brand name T-Mobile.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TMUS — T-Mobile US has an average price target of $183.17, with a high of $19 and a low of $16.

According to 6 analysts offering 12-month price targets in the last 3 months, T-Mobile US has an average price target of $183.17 with a high of $199.00 and a low of $163.00. The greater the rating of an analyst, the higher the price target.

- News story for TMUS — KeyBanc says Comcast is a better cable play than Charter.

KeyBanc analyst says Comcast Corp. looks like a better cable play than Charter Communications Inc., according to KeyBanc’s analyst. Comcast’s stock stands out in the cable sector, according to one analyst. Charter’s stock also stands out.

- News story for TMUS — Read the full analyst blog on T-Mobile, Abbott, Advanced Micro Devices, Intuit and Cintas.

Zacks Analyst Blog highlights T-Mobile US, Abbott Laboratories, Advanced Micro Devices, Intuit and Cintas. T-mobile US, Abott Labs, AMD and Intuit are included in this Analyst Blog. Zacks has a Blog with Analyst Blogs from:

TECHNICAL ANALYSIS

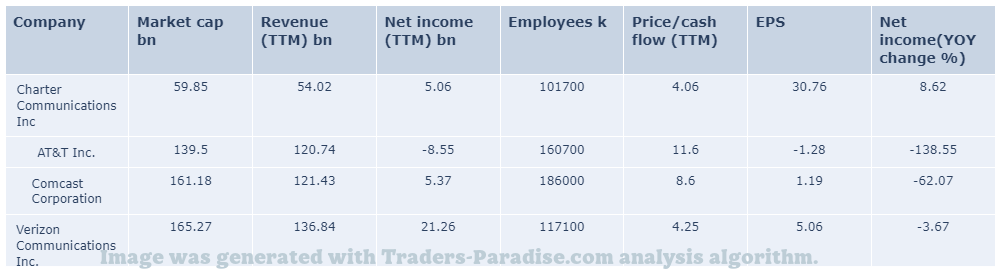

PEERS AND FUNDAMENTALS

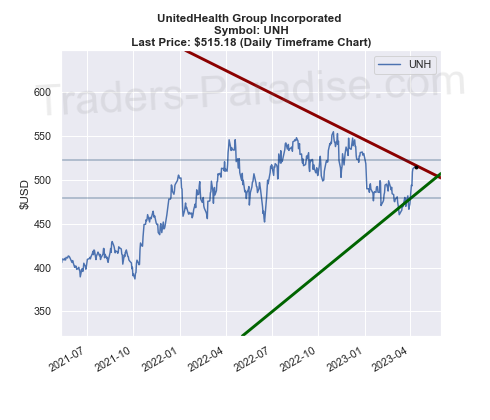

#17 Trading idea on UNH, might be reaching some kind of top

Company Name: UnitedHealth Group Incorporated

Symbol: UNH

Sector: Healthcare

Company Description: UnitedHealth Group Incorporated is an American for-profit multinational managed healthcare and insurance company based in Minnetonka, Minnesota. In 2020, it was the second-largest healthcare company (behind CVS Health) by revenue with $257.1 billion and the largest insurance company by net premiums. UnitedHealthcare revenues comprise 80% of the Group’s overall revenue.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for UNH — UnitedHealth Group (UNH)

UnitedHealth Group (UNH) closed at $515.18 in the latest trading session, marking a +0.46% move from the prior day. UnitedHealth Group outpaced stock market gains by 0.46%. UNH is a health insurance company.

- News story for UNH — First-quarter earnings are likely to reflect growth in premiums and memberships.

UnitedHealth’s first-quarter results are likely to reflect growing premiums and memberships. UnitedHealth is expected to report its results on April 25th. Unitedhealth is a major U.S. health insurance provider. It has a market value of $486 billion.

- News story for UNH — Stocks in the Dow Jones Industrial Average are outperforming this month.

Dow Jones’ best-performing April stocks are benefiting from recent good news and a theme-based tailwind that could last a while. The stock market is moving in the direction of the theme-related tailwinds, which is good for the stock market.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

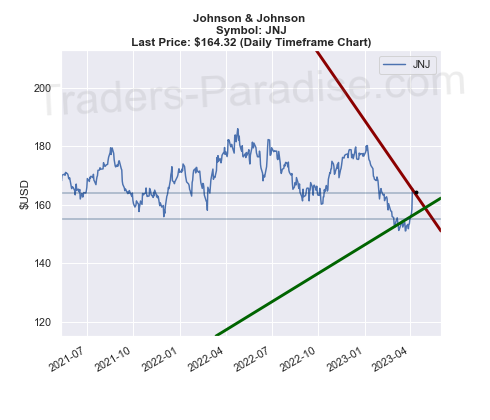

#18 Trading idea on JNJ, might be reaching some kind of top

Company Name: Johnson & Johnson

Symbol: JNJ

Sector: Healthcare

Company Description: Johnson & Johnson was founded in 1886. Its common stock is a component of the Dow Jones Industrial Average. The company is ranked No. 36 on the 2021 Fortune 500 list of the largest U.S. corporations by total revenue. J&J has a prime credit rating of AAA.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for JNJ — Johnson & Johnson (JNJ) closed at $164.32 in latest trading session

of Johnson & Johnson (JNJ) closed at $164.32, marking a -0.5% move from the previous day. JNJ’s stock price is down 0.5%. JNJ stock is up 0.4% from the day.

- News story for JNJ — J&J says it will pay out $1 billion to settle talcum powder claims.

Investor’s view of Johnson & Johnson’s Talc settlement and Chewy’s growth initiatives are discussed in this article. – for Investor’s View of Talc Settlement and Chewys’ Growth Initiatives. For Chewy, take a look at its growth initiatives.

- News story for JNJ — Morgan Stanley has decided to maintain its Equal-Weight rating of Johnson & Johnson.

Morgan Stanley has maintained its Equal-Weight rating of Johnson & Johnson (NYSE:JNJ) and lower its price target from $180.00 to $179.00. The shares are trading down 0.56% over the last 24 hours at $164.22 per share.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#19 Trading idea on AZPN, might be reaching some kind of top

Company Name: Aspen Technology, Inc.

Symbol: AZPN

Sector: Technology

Company Description: Aspen Technology, Inc. provides asset optimization solutions in North America, Europe, Asia Pacific, Latin America, and the Middle East. The company is headquartered in Bedford, Massachusetts and provides services in various regions. Â in

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for AZPN — These companies have a track record of increasing payouts.

These companies have a track record of increasing their payouts regardless of the market cycle and they are good passive income investors. They are: “Dividend Kings”, “Pioneer Dividend Company” and “Aims to Grow Dividends”.

- News story for AZPN — F5 launches new AI-powered app and API security tools.

F5 (FFIV) launches new AI-powered app and API security tools. They are designed to provide customers with comprehensive and better protection and control in managing apps and APIs across on-premises, cloud and edge locations. F5’s new tools are available now.

- News story for AZPN — Tyler (TYL) has completed its second integration of its CAVU e system.

Tyler completed the second integration of Tyler’s CAVU eLicense system between OSBC and NMLS. It saves several hours of manual work and reduces tedious data entry for OSBC staff. Tyler (TYL) Completes eLicense Integration Between OSBC & NMLs.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#20 Trading idea on ZM, might be reaching some kind of top

Company Name: Zoom Video Communications Inc

Symbol: ZM

Sector: Technology

Company Description: Zoom Video Communications, Inc. provides a premier video communications platform in the Americas, Asia Pacific, Europe, the Middle East, and Africa. The company is headquartered in San Jose, California, and provides services in the following regions: Asia Pacific and Europe.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ZM — U.S. economy added 236,000 jobs in March, just shy of economists’ expectations.

The U.S. economy added 236,000 jobs in March, just shy of economists’ expectations. The unemployment rate is now 3.5%. Is this the last chance for job switchers to jump ship? iReport.com:

- News story for ZM — Shares of Facebook, Alphabet and Amazon are up this year.

For now, these three tech stocks don’t need AI to deliver market-beating returns, but they are worth a look. for now, steer clear of the AI hype for now and focus on the real-world business opportunities. iReport.com will let you know.

- News story for ZM — More than 168,000 tech employees have lost their jobs since 2023.

More than 168,000 tech-sector employees have lost their jobs since the start of 2023 2023 has surpassed 2022 for global tech redundancies, according to data compiled by the website Layoffs.fyi. The number is expected to rise further in the coming years.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

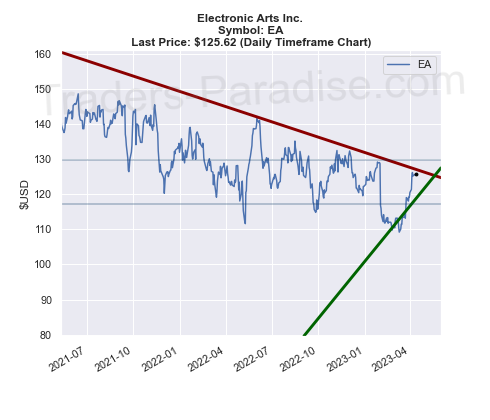

#21 Trading idea on EA, might be reaching some kind of top

Company Name: Electronic Arts Inc.

Symbol: EA

Sector: Technology

Company Description: Electronic Arts Inc. is the second-largest gaming company in the Americas and Europe by revenue and market capitalization after Activision Blizzard and ahead of Take-Two Interactive, and Ubisoft as of May 2020. It is headquartered in Redwood City, California.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for EA — Electronic Arts (EA) is set to launch EA Sports PGA Tour worldwide.

Electronic Arts is launching EA Sports PGA Tour worldwide. It includes all four majors in men’s golf, including all the majors in the major golf tournaments. EA Sports is a video game developed by Electronic Arts and published by EA Canada. for PC.

- News story for EA — RSI is at 73.89 in the communication services sector.

The most overbought stocks in the communication services sector presents an opportunity to go short on these overvalued companies. Electronic Arts Inc. (NASDAQ: EA) has a 52-week high of $142.79 and a RSI value of 73.89.

- News story for EA — Stocks to watch on Wall Street this week: Morgan Stanley, Goldman Sachs

The latest from RH and other market news. Bank Stocks Worth Buying, and the latest on RH and RH’s stock market news are included in this article. Â iReport.com: Share your thoughts on bank stocks worth buying.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.

Leave a Reply