Bitcoin price prediction can be a very tricky job. The market is volatile and Bitcoin itself is a real roller coaster.

By Guy Avtalyon

What is the Bitcoin price prediction for 2019? What can we expect? Can we expect a new bull run? Will the BTC price stabilize? Are we in for another bear year? Will Bitcoin crash or rise?

So many questions. Many experts and influencers have shared their price predictions for Bitcoin in 2019.

Most of you know of the famous Bitcoin price prediction of John McAfee. He said he will eat his dick on national television if BTC not hits $1 million by the end of 2020.

Now, McAfee didn’t give a price target for 2019, but based on his 2020 prediction Bitcoin needs to be worth just over $170,000 on December 31, 2019, to be on track to hit the $1 million mark a year later.

Well, it’s time to be serious.

Seriously, how far can Bitcoin price actually go? No one knows where the price is going to go. These sorts of price movements are common in the volatile world of cryptocurrencies.

But, 2019 is what the crypto fans are looking forward to. The NASDAQ has also vowed to launch Bitcoin futures in the first half of 2019.

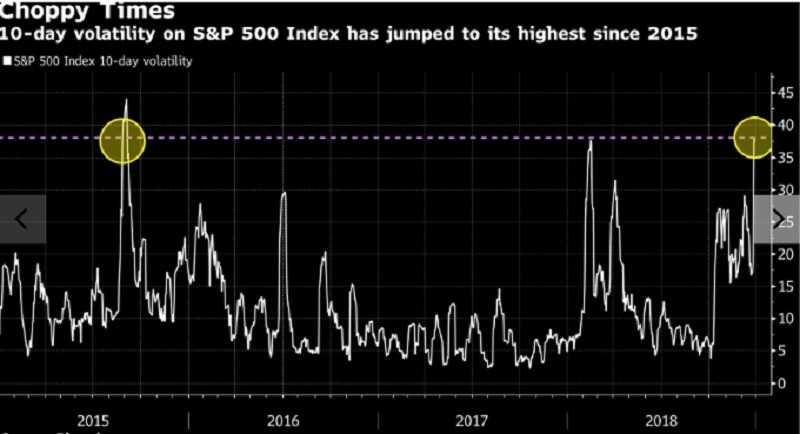

One of Bloomberg’s column stated that there is a probability that FUD(Fear, Uncertainty, and Doubt) might loom over crypto space in 2019.

Also, analysts and enthusiasts kept their hopes high. Mike Novogratz said explicitly that he believes there is going to be big adaption in 2019, 2020 as he thinks there will be more contributions from people in the blockchain world.

After the state government of Ohio has announced that it is going to accept tax payments in BTC it sounds possible. The government has partnered with Bitpay to make this happen conveniently. So it is possible now the bitcoins can be converted into dollars on behalf of the tax office. The adoption rate going higher and higher.

Market Prediction For Bitcoin Price

The market is experiencing volatile conditions. Let’s take a look at the prediction with the market experts. They have been the mind of the cryptocurrency market. Let’s take a look at the famous Bitcoin predictions:

John McAfee, the founder of the popular McAfee software and a bright Bitcoin follower predicted that Bitcoin will hit $1 million by 2020.

Sam Doctor and Tom Lee Bitcoin Price Prediction

Tom Lee, ex-Chief Equity Strategist JP Morgan, and Co-founder and head of research of Fundstrat, believes BTC would grow.

He is counting on more institutional investors taking on Bitcoin and a steady increase in the Bitcoin user base. Lee explained the current fall in the price of bitcoin by referring to the recent plunge in the price of tech stocks, like Amazon, Apple, and Facebook. He thinks that increased institutional fortunes would help turn BTC’s future around very soon.

Tom Lee said that the BTC fair value is much higher than the current price. The current fair value is somewhere between $13,800 and $14,800 which he believes might increase and reach $150,000 per coin. As soon as bitcoin wallets account for seven percent of 4.5 billion Visa holders.

Sam Doctor, an analyst from Fundstrat along with Lee predicted that by 2019, BTC might reach nothing less than $36,000, with the probability of $64,000 at the maximum and $20,000 at its lowest.

Sonny Singh Bitcoin price prediction

In a recent interview for Bloomberg, Sonny Singh, the chief commercial officer at Bitpay commented on why it is okay not to panic looking at the current market condition.

Singh, who is a Bitcoin maximalist, called Bitcoin an “800-pound gorilla, as it has access to the most notable “network effect” of all decentralized networks. He is assertive of the fact that there is a high possibility that BTC might reach $15,000- $20,000 by Thanksgiving, 2019. He was explaining that the probability of a crypto ETF and an influx of funding for startups is high on the cards.

Ronnie Moas Bitcoin price prediction

Ronnie Moas is a cryptocurrency analyst. He predicted that BTC might reach $28,000 by 2019. Also, he believes the demand for BTC would increase with its decreasing supply. And he claims that by 2019, the adoption rate would increase. Hence, people would demand more of it. But remember, BTC is not unlimited in supply.

Anthony Pompliano Bitcoin price prediction

Anthony Pompliano, founder of Morgan Creek said that “Bitcoin isn’t going anywhere:”

Pomp tweeted that BTC might go as low as $3000, after which it will continue being bullish starting from 2019. He declared that there is no reason to freak out on the declining price as Bitcoin’s fundamentals are becoming stronger.

Traders Paradise Bitcoin price prediction

Bitcoin has been experiencing fluctuations over time. But Traders Paradise strongly believes that Bitcoin will soar up. We have to remind you that Bitcoin’s price falls when Bitcoins being used for illegal purposes. And Bitcoin experienced so many troubles like hacking and stealings. Also, you have to know that Bitcoin is still the market leader.

NASDAQ is launching BTC’s future, that too at the very beginning of 2019. So, Bitcoin’s price might reach greatly increase by the end of 2019. Hence, this year could have a good prospect and development for Bitcoin.

This year will be bullish for Bitcoin. More people will start believing in the technology behind Bitcoin. It is very possible for Bitcoin to tripled price by the middle of 2019.

There is some logical explanation, the more the trading, the more the price.

We all know there can be only 21 million Bitcoins mined, out of which 17 million has been mined already. That means only 4 million to be mine. That will make its value more. Besides that, more and more countries have shown willingness to integrate Bitcoin and other cryptocurrencies into their financial systems. The governments and the central banks will embrace the digital currencies. Hence, the demand should be more.

Truth is that regulated markets can function freely and securely.

Bitcoin prices in 2019 will be marked by volatility which has made bitcoin price prediction in short-term a bit of a challenge, even for experienced analysts. So far, 2018 has presented its own surprises though not a dramatic as the rollercoaster it was in 2017.

By the end of the year 2019, the Bitcoin price could reach five-digits value. That means that the 2018 bearish trend ends and shifts to the bullish trend.

Traders Paradise’s prediction is that the cryptocurrency market will experience a certain optimism in 2020. Not only Bitcoin, but all the major cryptocurrencies will also experience an upward shift.

By 2023, Bitcoin will be used more often by more people. The real-time use case will be increased. That will make it even more powerful.

Image from shutterstock.com

Image from shutterstock.com Source: Bloomberg

Source: Bloomberg