In the Q3 earnings report, Tiffany posted net income decreased by 17%

In the Q3 earnings report, Tiffany posted net income decreased by 17%

The earnings report comes a week after the French LVMH made a deal to acquire Tiffany for $16.2 billion.

By Guy Avtalyon

For more than 180 years, the first thoughts about Tiffany are luxury jewelry but the one that takes your breath away. Tiffany, elegant, great and original design, one-word perfection.

In on1886, it created the eponymous diamond ring as a permanent symbol of promise showing that Tiffany vote for love. Tiffany diamonds are keeping by many generations and showing to the world on extraordinary occasions as refine feeling for luxury.

Recently, Tiffany and Moët Hennessy – Louis Vuitton SE and simply is known as LVMH, announced that LVMH acquires Tiffany. The official announcement state it is: “for $135 per share in cash, in a transaction with an equity value of approximately €14.7 billion or $16.2 billion.”

This deal could help the famous jeweler to launch more affordable jewelry. But what happened?

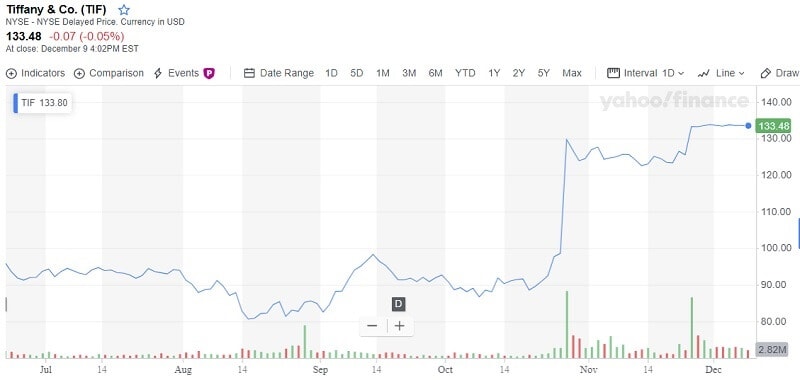

Just a week after, the company posted worse-than-expected Q3 results for this year and Tiffany’s stock price fell.

The analysts expected that Tiffany could earn 85 cents per share. It was the opposite, Tiffany & Co. had reduced net income by 17%. During the previous period, the price per share was 77 cents and after the Q3 report, it fell to 65 cents per share.

How did Tiffany work in 2019?

The company’s revenue was the same, $1.015 billion as last year but lower than the foreseen $1.037 billion. The analysts expected a 1.4% growth but it didn’t happen.

Company’s CEO Alessandro Bogliolo said in an official statement: “Our underlying business remains healthy with sales attributed to local customers on a global basis growing in the third quarter, led by strong double-digit growth in the Chinese Mainland offset in part by softness in domestic sales in the Americas.”

On December, 9 TIF was traded at $133.48.

Tiffany’s market cap was $16 billion at Monday’s close.

Exit strategy for TIffany’s stock

We checked it out by using our app how TIF stock will perform and we set a stop-loss level at -4.75% from the current price and take-profit level at 5.25% form the same price. Our tool showed a return of $186.94 in the next 10 days with the position of $10.000. Since the position isn’t closed, the possibility that our exit strategy is good is shown from the historical performances. According to the historical data for 3 months this strategy was good at 74% trades and for one year in 55%.

Of course, you might have some other exit strategy and it is best if you check it by yourself.

Should you invest in TIF stock?

Today is December 10, Tuesday. The current price of TIF stock is $133.50 and our historical data shows that the stock price has an overall rising tendency for the past 12 months.

Traders Paradise uses its own app to determine if TIF is a good portfolio addition. And we saw that this stock has a chance to rise for around 23% after 12 months and could easily hit the price around $165 at the end of that period. According to our given position at $10.000, this means that after one year our potential profit will grow and we will have $12.300 in total with a profit of $2.300.

So, we think Tiffany (TIF) is a good addition to any portfolio. Hold this stock, it is a good long-term investment.

Leave a Reply