by G. Gligorijevic

Trading penny stocks is one of the most hazardous investments in the market. They are extremely cheap, and this makes them volatile.

Do you want to make money with these cheap stocks? Well, you have to know the basics. And one of the basics is to know how long to hold penny stocks. Like with many other assets in the market, you have to know when is the right time to buy penny stocks and when it is to sell.

But why the penny stocks are so special?

As a difference from most blue-chip stocks, penny stocks ordinarily don’t match cyclical trends in the market. It may be more challenging to recognize how long to hold penny stocks. In reality, penny stocks will follow the general market trends in the sector they belong to.

If a positive event happens, most stocks in the given sector will follow the trend.

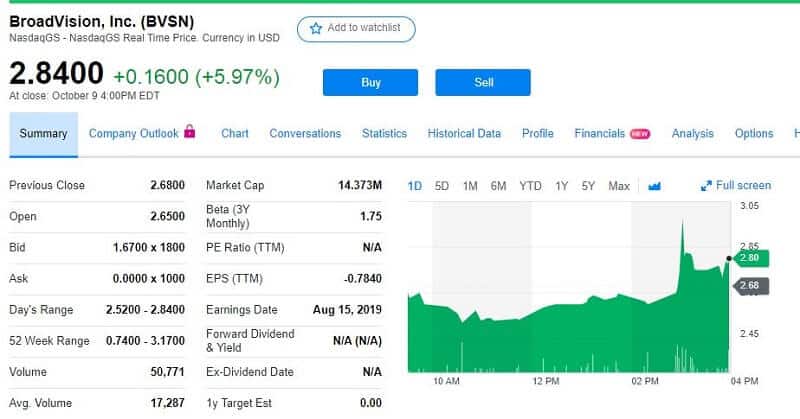

When we are talking about penny stocks, as you can guess, a minimum change in price will cause a great gain in percentages. To understand this, take a look at this company’s stock chart.

BroadVision, Inc. is an international software vendor of self-service web apps for business social software, automated commerce, business portals, etc.

The stock price of BVSN was yesterday $2.84 which is $0.16 up or +5.97% from the previous trading day.

But here is the tricky part. Penny stocks, no matter which company you are looking at, will always hit the peak. But what is following after the peak is what matters. Apps are booming nowadays. And typically for the penny stocks is that when the whole sector is rising most sector stocks will jump. When it comes to high-tech penny stocks, the volatility joined with positive feelings has produced some serious breakouts. What happens after those breakouts is more important. The stocks may collapse or to consolidate.

The consolidation can be difficult

The stock will surely pull back but to a level lower than the peak and almost every time, that new level will be above previous highs.

What you as an investor or trader has to do is watch the indicators. Pay attention to indicators that display overbought or oversold. Use the RSI indicator. Yes, it is a simple tool but can help you to determine what to do with your penny stocks.

Never expect from penny stocks to give you a huge gain by holding them for a long time. Holding them too long is an extremely risky strategy. It is always better to set small goals. For example, 20-25% profit. Also, you can use some other stock-trading indicators or combine them. But you have to know that indicators will not show you everything.

Some traders don’t even use them, they believe they have a good hunch.

When it gets to buying penny stocks or selling them it is all up to you. Of course, there are plenty of tools you can use to be surer if it is time to buy or sell. But even they are not sure-fire. This is particularly true when it comes to how long to hold penny stocks. The problem with the period of holding penny stocks is that despite all indicators and your confidence some bad news like the company’s annual report may ruin everything. So, watch your penny stocks carefully, and when you see they are rising, and indicators show they could rise more, don’t wait too long. Take profit. That is what matters at the end of the day.

You can hold penny stocks 5 minutes or 5 months but never more than 6 months. That’s the answer.

Leave a Reply