2 min read

Investing in foreign markets may sound intriguing or intimidating.

Yes, international investing can be a difficult attempt. There are communication hurdles. Also, there are problems with money transfers to foreign exchanges. And regulations can be tricky. On the other hand, financial advisors suggest holding at least some foreign stocks in a diversified portfolio.

Luckily, there are easy ways for Investing in foreign markets. That excludes picking up a new language or exchanging your local money for euros or dollars or something like that.

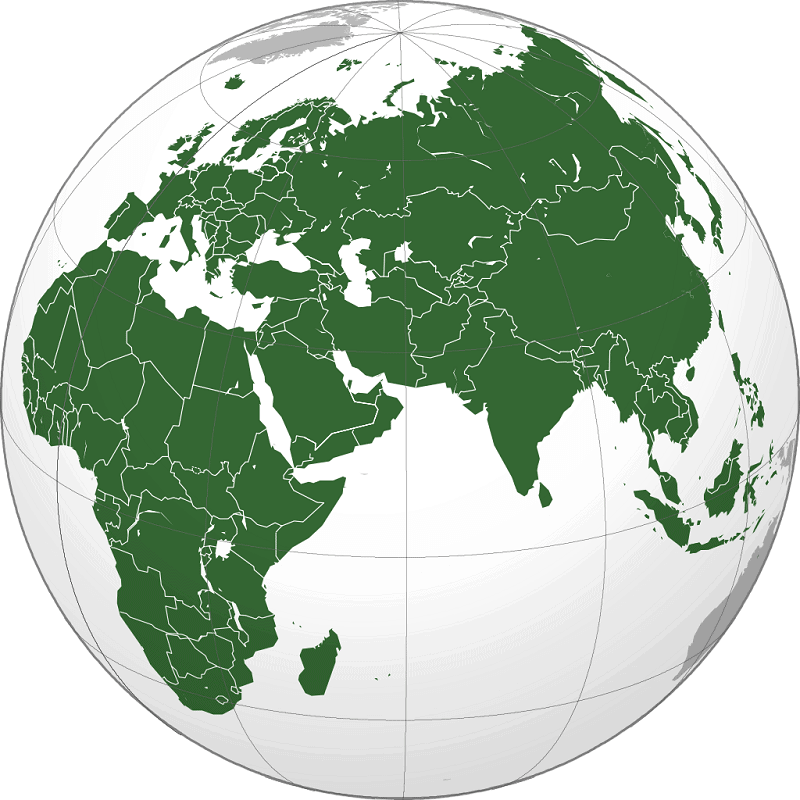

One of the best ways to diversify your portfolio is to put some of your money in global investments. Foreign markets may react differently to economic conditions than, for example, U.S. markets. It is possible that strong performance abroad helps to compensate for weak performance at home.

Foreign stocks can diversify your portfolio as we said, but they may open up chances for growth and success. In general, there are three ways you can use to make your portfolio more international in its exposure.

Having an international stock appearance in your investments is a smart move that can improve your overall returns.

International stocks add diversification

You know the idiom: Don’t put all your eggs in one basket.

This saying is particularly relevant when investing. Diversification or holding a mixture of stocks across different countries, industries, and areas of companies is a simple way to increase long-term investment returns while decreasing risk.

An easy way to invest internationally is through a mutual fund that holds foreign securities. You get the privilege to choose from stock, bond or money market funds in several categories.

The easiest way to invest in foreign markets is by buying exchange-traded funds (ETFs) or mutual funds that hold a basket of international stocks and bonds. The foreign holdings over multiple industries and countries, provide investors with the highly-diversified foreign component to their portfolio in just one easy purchase.

In general, there are three ways you can invest internationally.

Investing directly in foreign stocks.

Using internationally focused exchange-traded funds to gain foreign exposure.

Buying shares of multinational corporations that are based in the U.S. but do almost all of their business internationally.

Let’s break down each of them.

Buying foreign stocks directly

The most reasonable way for Investing in foreign markets is to buy shares of foreign companies. You can find many foreign companies that list their stock on major U.S. exchanges. Moreover, investing in those companies is identical to buying shares of any U.S. company.

For stocks that aren’t listed on major U.S. exchanges, investing gets complex. Some foreign companies trade on an over-the-counter basis. That makes them available with many brokerage accounts. But, at the same time, makes them subject to less liquid trading conditions.

Still, other foreign stocks have no U.S. availability at all, so investors have to buy shares directly on foreign stock exchanges. There are limited numbers of brokers offer direct purchase and sale of foreign stocks on exchanges outside the U.S. This means, for example, you can count on finding the exact stock you’re looking for with a great deal of work.

Try your hand at paper trading with foreign investments you find intriguing. This virtual-trading practice, offered by many online brokers, will allow you to learn to invest in new markets without risking any money.

Buying international stocks through an ETF

Many exchange-traded funds have a focus on foreign stocks. They offer a more diversified entrance at international investing. Also, they have a wide variety of different funds to choose from.

Some international ETFs endeavor to offer stocks of the entire global market. Others focus in on particular regions, countries, industries, or other classifications of international stocks. One of the most common characteristics involves ETFs that focus on stocks in developed markets. That is versus those that concentrate on emerging market stocks. Many ETFs have limitation to one or the other of these groups.

The benefit of international ETFs is that they’re listed on U.S. stock exchanges and are easy to trade. Fees can be higher than with domestic stock ETFs, so you have to look carefully at costs.

Buying U.S. stocks that concentrate abroad

Many U.S. companies have increased their presence to international markets.

For example, Philip Morris International only sells cigarettes and other tobacco products outside the U.S. Some other companies keep a minimal U.S. presence. But they are available internationally.

American companies win reputation abroad, especially in the consumer sector. So, the investors have to consider not only U.S. economic and industry conditions but also what companies face in their abroad markets.

Risks of investing internationally

Investing internationally carries the same risk associated with all investing. The market conditions can change, causing your investments to lose value.

Political risk – Changes to government and political systems can cause devastation on a nation’s investment markets.

Currency risk – Exchange-rate fluctuations can boost or limit investment returns.

Market risk – Many abroad markets are characterized by wide price oscillations.

The bottom line

Investing in foreign markets are a great way to build international exposure in any portfolio. And you don’t have to worry about foreign stocks or regulations. Moreover, investors can achieve proper diversification for their portfolios by Investing in foreign markets.

Leave a Reply