2 min read

Reports find that women are better at investing than men.

Period!

The big investment firm Fidelity says that female investors outperformed males last year by 0.3%. In fact, Fidelity found that females outdid men in the past decade.

Women have had a pretty bad reputation in global financial markets. As investors, the perception is that they joined the game too late, they saved too little and they invested too conservatively.

Additionally, insults about women capacities and their mental abilities appeared from respectable figures. Larry Summers’ comment that innate differences between men and women may explain the relatively low number of women scholars in the physical sciences. Those words raised a lot of uproar in academic circles and at Harvard University, where at the time Summers was serving as president. Some are ready to claim that this controversy cost Summers his job. Lawrence Summers must be noted, served as U.S. Treasury Secretary during the Bill Clinton presidential years and became an economics professor at age 28 and has written 150 scholarly papers. He advised President Obama on what to do about the biggest banks and the auto industry during the Wall Street subprime debt meltdown of 2008.

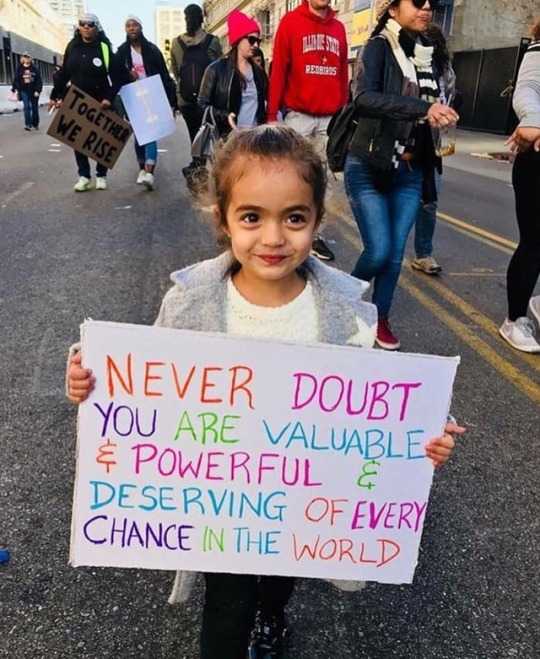

Have you seen the statue of the “fearless girl” facing the Wall Street bull?

State Street Global Advisors put up the statue to mark International Women’s Day and it’s getting a lot of attention.

What that statue try to tell us? The market is blind to your sex. The market is blind to your gender.

Try to type in some browser, “Are women investors better than men?” Google will list a stream of stories that argue such a case. I found AARP’s website began one article with these words: “Overall, women are better investors than men.”

And as an example, they cited research from professors at the University of California-Berkeley who concluded, after a study of stock trading patterns between the sexes, that men trade 45% more than women. The scholars argued that since frequent trading eats away at returns, women thus performed a full percentage point better than men.

C’mon! That is NOT the right reason.

The true fact is: In 2016 female investors earned higher returns and saved more of their pay to fund retirement accounts than men. The first thing that Fidelity said was that men were 35% more likely to make more trades, meaning that brokerage eats away at the portfolio. That is the first women’s advantage.

“It is a double whammy,” says Alexandra Taussig, Fidelity’s senior vice president for women investors. “The myth that men are better investors is just that – a myth.”

The second advantage is that women assume less risk, such as not loading up entirely on equities. They also invest more in vehicles like target-date funds, whose automatic allocations make for smarter diversification, Fidelity said.

Women are better at investing because women have more guts. Meredith Whitney became famous for making a bearish call on Citigroup (C) in late 2007, saying the big bank will be forced to suspend its dividend and she was right.

Over the years, women have made strides in the field of equity research and portfolio management. You can read about their adventures on Wall Street via books such as “Tiger Woman on Wall Street” by Junheng Li.

A study by academics Terrance Odean (University of California, Berkeley) and Brad Barber (University of California, Davis), also found that women outperform men, by roughly 1 percent a year.

Invest like a wonder woman, means shifting to a long-term focus, saving more up front and giving up on trying to time the market with brilliant trades.

As I said in the beginning, success in the market does not depend solely on gender affiliation.

The stock market doesn’t know who you are, it cannot know whether you’re male or female. Nor will it ever care, in the first place. But women are better at investing.

Do you know where to invest? FIND HERE

Risk Disclosure (read carefully!)

Leave a Reply