1 min read

Hey, millennials! What are you trying to do? Are you saving for retirement?

You have really upped your game when it comes to saving for retirement: only 1 in 6 millennials reportedly have $100,000 socked away.

In fact, most millennials are not on track when it comes to saving for retirement. Statistics show that 66% of people between the ages of 21 and 32 have absolutely nothing saved for retirement.

I know, you are not surprised. I’m not either. Young people do not have leftovers for savings. Many have started to work at a time of stagnant salaries and high unemployment.

Pensions are disappearing, the future of social security is uncertain.

It’s likely we’ll live forever.

Millions of millennials have little or no savings.

In the first place, they believe they’d be better off by putting their money elsewhere. Some have to pay off student loans.

Some are trying to build up their own business.

Many started to work at low-wage jobs for a few years and then went back to school to improve their employment chances. And some have more immediate costs like childcare and rent.

We can recognize the ruthless pressure to save more for a distant future.

And it is completely disconnected from your reality.

We each face different circumstances and desire different things in life.

But supposed experts continue to implore this entire generation to save in retirement accounts.

Do they know that only focusing on saving for the future means the possibility to neglect more pressing financial issues?

Such common sense rule about savings disregards life cycle priorities that differ from those of the generations past.

Instead of cashing out after working at the same job for 40 years, many of millennials would rather enjoy a more entrepreneurial career while earning well beyond typical retirement age.

Let me be clear!

There’s nothing wrong with saving for the future and using the tax advantages of retirement plans. It’s mathematically true that starting to save early in the life improves our odds of having enough later.

But, it’s necessary to recognize the cost of missed opportunities. Saving reflects the safest choice, that’s true.

But doing as experts try to advise, might hold back millennials from taking any financial risk to pursue more entrepreneurial efforts now.

Many young people have finance-related fears of an uncertain future and how to make their career choices.

This is not to say everyone should avoid stable jobs or great retirement plans.

No, that means that millennials avoid sacrificing but they are taking risks.

And that makes sense.

Taking a risk by investing in yourself to build a business could not only lead to greater wealth but could provide a far more fulfilled life along the way.

Their different needs and preferences should define their financial plans, not any of the many generalized “rules” we often hear. But they shouldn’t completely abandon long-term savings, they should think about how best to use their extra dollars, both to establish their financial security and to find more fulfilling careers and happier lives.

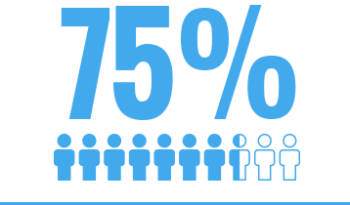

About 25% of millennials said they were not eligible to participate in an employer-sponsored retirement plan because of their part-time employment status.

In terms of preparing for retirement, millennials have three strikes against them from the get-go.

First, because of limited access to retirement plans at work, millennials will struggle to build retirement savings.

Second, they are less likely to have bought a home, and home equity is a valuable retirement asset.

And third, they are more likely to be burdened by student loans.

That’s why a lot of millennials take chance in trading and investing with low fees.

As a generation which is forced to plan from day to day, it is not a problem for them to trade on a daily basis. Or to put their extra incomes in some stock investment.

That’s good work, guys!

Your job in this world is not to solve the problems that baby-boomers left to you, but to take care of yourselves and make your life better and easier.

In that way, the whole world will be better placed.

But before you start your adventure try some free demo account and learn and test your skills.

And you have to be very cautious when you have to decide which brokerage to choose.

You have a plenty of them to choose from, and for the good start.

We recommend you to read some of our recommendations and predictions.

Good luck to all of you, millennials!

Risk Disclosure (read carefully!)

Leave a Reply