3 min read

Trading Forex at the weekend gaps is a growing field of investment. Forex weekend trading hours have extended away the traditional trading week.

Forex trading the weekend gaps are becoming popular because of trader’s expecting Sunday’s opening price to return to Friday’s closing price.

There is a mistake that you can’t trade over the weekends.

So, you surely can trade online at the weekend. To be honest, weekend trading in currency, stocks, CFDs, and futures is increasing fast.

Actually, the forex market is opened during the weekend.

How Trading Forex at the weekend gaps is possible if we know that the forex market is working 24/5?

Well, it is decentralized. And technically the forex market is open 24/7. It is true that the majority of dealers close transactions on the weekend. For retail traders close at around 5 p.m. EST on Friday and open around 5 p.m. EST on Sunday.

And we can see a gap during the forex open time only when the price movement is great because of some news.

But gaps are quite obvious in the forex market when the market is closed over weekends.

The market prices are moving over the weekend. You can not stop the currency transaction. For retail traders, the price isn’t the same on Friday when the market closes trades and on a Sunday afternoon when it opens.

If the price is higher on Sunday, we have a gap up. But we will have a gap down if it opens lower than the Friday afternoon price.

Trading Forex at the weekend gaps is very familiar to forex traders. It is a very often use strategy. Why is that?

Well, the Forex market is, in fact, open 24/7. Yes, trading ends on Friday and can be opened on Sunday evening.

But so many things can influence the currency price movement over the weekend. So, when traders are trading at weekend gaps, they are expecting the opening price will hit the closing price.

The gap traders believe that the price will continually fulfill the gap. Really? In fact, it constantly does. But it isn’t feasible always.

That’s why some traders make losses. Some gaps are tradable some are not.

For example, we recognize four varieties of gaps.

Breakaway gap

The breakaway gap regularly rises a new trend.

The price frequently develops out of the consolidation phase. Moves up or down with powerful momentum. What leave behind is the gap.

Some crucial, breaking events may cause movement. That new trend isn’t always tradable. Breakaway gaps happen at the end of the price pattern. They indicate that the new trend is starting.

The breakaway gap

The breakaway gap

Exhaustion gap

Exhaustion gap occurs close to the end of a price pattern. It indicates a definitive try to reach new highs or lows. Usually, it comes after a sudden move. It has an unnatural rise in volume and then turns strongly. Also, you have to know that it comes after some news or reports. For example, after the earnings announcement. That is the period when trading activity increase. Traders are closing their big positions. That causes an obvious reversal. You can find the exhaustion gaps no matter if it is an up or down trend.

The exhaustion gap

The exhaustion gap

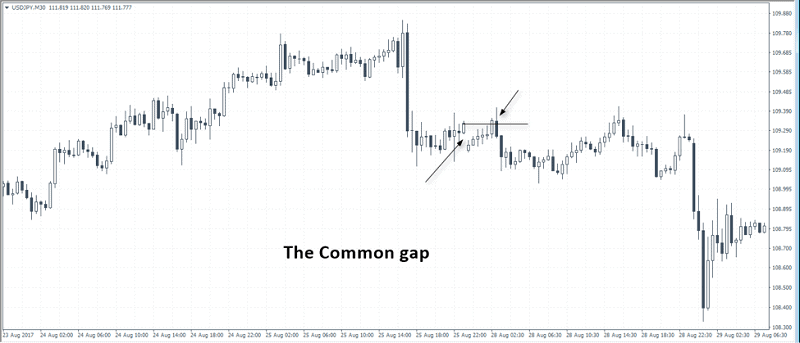

Common gap

It simply represents a space where the price shows a gap.

They are gaps seen on a price chart and they are very common and the most generally traded.

Also, they regularly arrive late Sunday and early Monday market openings.

They are suitable for short-term intra-day trading. You should look for a common gap around Sunday midnight and trade those Forex gaps at that time.

The Common gap

The Common gap

Runaway gap

Runaway gaps mark trend continuing. A runaway gap is fairly one of the most secure ways to trade. Particularly if you combine them with other price tools.

A runaway gap happens when the price is gapping into the course of the trend. When the trend is strong you may see them.

Runaway gaps regularly work inside a trend.

Traders need to recognize the gap before they find the potential increase in price. This means that runaway gaps are traded after the action.

The bottom line

The gaps can give a lot of news about market moving.

Trading at the weekend gaps is risky.

But you can use the information produced by a price gap to develop a complex trading plan. It can be helpful with other trading ideas.

Leave a Reply