DEFINITION of Ask

The ask price is the lowest price a prospective seller is willing to accept in exchange for a specific security.

WHAT IT IS IN ESSENCE

It refers to the price at which you can buy an asset or security from a seller. It can be variously named as ask or asking price.

Usually, the asking price for specific security displayed in most services is the lowest price in the market. But investors don’t have to buy or sell securities at these prices. Investors can specify their bid price when telling their broker to execute a trade.

The trade may not be executed immediately, but the seller can rest assured that he didn’t make less than he intended.

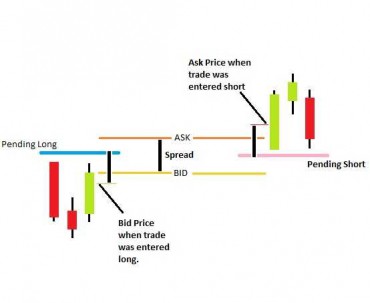

With an option, you usually sell at the bid price, which is generally less than the ask price. So if you buy at the ask price and immediately sell at the bid, you’ll experience a loss.

HOW TO USE

The ”ask price” is the lowest price a prospective seller is willing to accept. But the bid price is the highest price that a buyer is willing to pay for the security. The highest bid and lowest ask are quoted on most major exchanges. The difference between the two prices is called the bid-ask spread.

When an investor decides he wants to sell a security he owns, he doesn’t have to offer it at market price. Instead, he can use a “limit order” to specify to his broker that he wants to sell the security, as long as it’s above a certain price.

For example, the investor owns shares of company XYZ, and he is interested in selling them. Shares of XYZ have been trading between $30 and $35 throughout the day, but this investor would prefer not to sell for any price under $34. Because such investor indicated a “sell price,” broker will only execute the trade at (or above) that price.