(Updated October 2021)

DEFINITION of Advance Payment Guarantee/Bond

The Advance payment guarantee/bond represents a guarantee that advance payments will be returned. Only if the party has received such payments does not perform its part of the contract.

In essence, it provides a purchaser the security of a guarantee. In case of a failure by the seller fails to meet its contractual obligation.

WHAT IT IS IN ESSENCE

An advance payment guarantee/bond will normally be an on-demand bond. Meaning that the bondsman pays the amount of money set out in the bond. Immediately on demand. And without any preconditions having to be met. This is as opposed to a conditional bond or default bond. There the bondsman is only liable if it has been established that there has been a breach of contract.

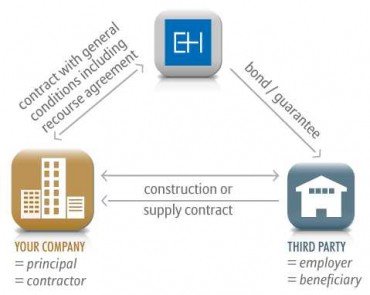

It is the contract under which the issuer undertakes to be responsible for the fulfillment of a contractual obligation. That owed by one person to another. If the first person defaults. The issuer’s obligation may be primary or secondary.

An advance payment guarantee /bond is in the scene to guarantee the performance of a commercial contract. For example, as a contract for the sale of goods or a construction contract.

Anyone who drafts advance payment bonds must be very careful. In order to set out the circumstances for payment. And to make clear that they are on-demand bonds.

HOW TO USE

Advance payment guarantee/bonds will provide protection. To the buyer after an advance payment. To the seller prior to completion of the contract.

So, the bonds undertake that the seller will refund any advance payments. Any that have been made to the buyer. Of course, in the event that the product is unsatisfactory.

The advance payment guarantee/bonds will protect in the event of failure. It will fulfill its contractual obligations due to insolvency. They will usually be on-demand bonds. Meaning that the value set out in the bond will immediately pay on a demand. And without the need to meet preconditions.