DEFINITION of Acceptance

The agreement was written on a draft and signed by the drawee – who becomes the acceptor – to pay the specified amount on the due date. The term is also applied to the accepted time draft itself.

WHAT IT IS IN ESSENCE

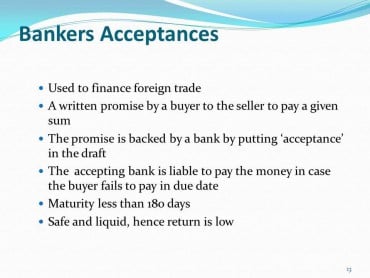

Acceptance is a type of time draft used particularly in international trade. If it is drawn directly by the seller of goods on the buyer, it is called a trade acc or trade bill. It can also be issued by finance companies or banks and used as a means of financing trade. A banker’s acceptance (BA), also called bank bill, is an acc drawn on and accepted by a bank.

Such bills are sold by banks at a discount. They can be redeemed with the same or other accepting banks at face value within a short timeframe. As such, the paper is effectively a bank-backed, short-term, non-interest bearing note and qualifies as a money market instrument.

HOW TO USE

A banker’s acceptance is a promised future payment. It is accepted and guaranteed by a bank and drawn on a deposit at the bank. It specifies the amount of money, the date, and the person to whom the payment is due.

A banker promises to pay the exporting firm a specific amount on a specific date. A banker’s acceptance is simply an order for a bank to pay a specified party at a later date.